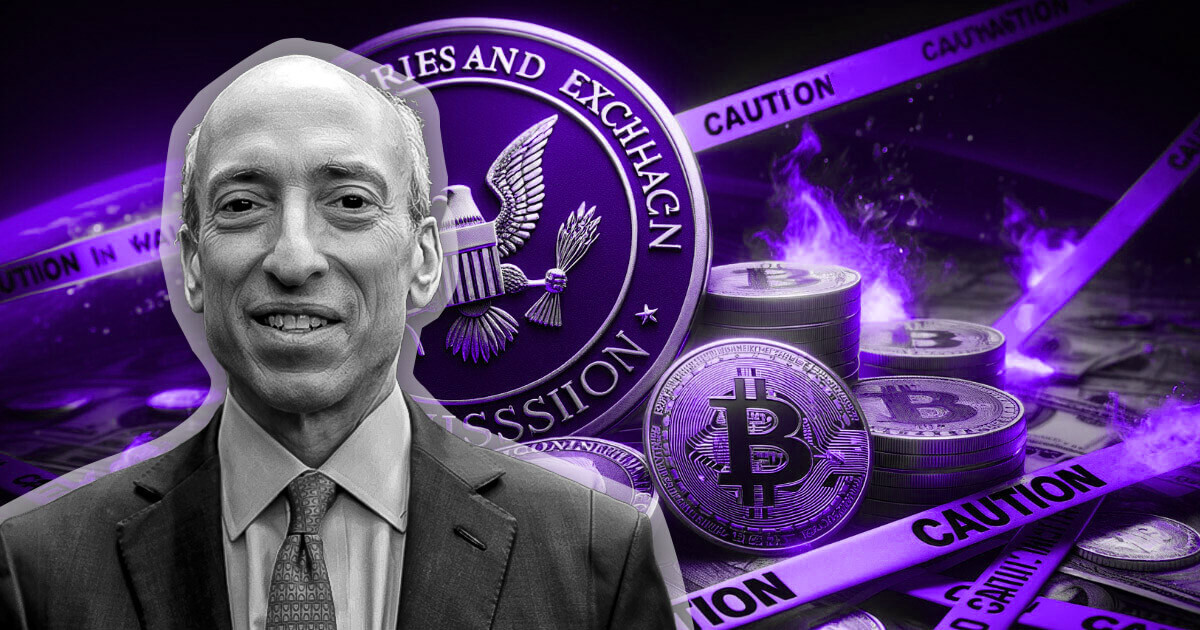

US SEC Chair Gensler reaffirms Bitcoin (BTC) shouldn’t be a safety underneath present rules.

SEC plans new rules for DeFi and buying and selling techniques to guard buyers.

Crypto companies, together with Coinbase, push again in opposition to increasing regulatory scope.

In latest statements, SEC Chairman Gary Gensler has firmly reiterated that Bitcoin is assessed as a non-security underneath current SEC rules. His feedback got here throughout an interview on CNBC’s “Squawk Field.”

Gensler emphasised the significance of regulatory readability, insisting that whereas many companies have benefitted from the general public’s rising curiosity in cryptocurrencies, they typically resist the rules designed to make sure market integrity.

Within the interview, Gensler famous that the SEC’s function is to foster belief out there, stating, “Improvements don’t develop in the long run until in addition they construct belief.” He referenced the numerous losses and bankruptcies which have occurred within the crypto area, underscoring the need of getting rules in place to guard buyers.

Regardless of Gensler’s reaffirmation concerning Bitcoin, he acknowledged the discontent amongst crypto companies regarding regulatory frameworks. He highlighted that many business stakeholders argue in opposition to the existence of such rules, which he attributes to their discomfort with the enforcement actions taken by the SEC.

Notably, Gensler’s remarks observe the latest eToro settlement, which confirmed that Bitcoin (BTC), together with Bitcoin Money (BCH) and Ethereum (ETH), usually are not thought of securities.

SEC’s buying and selling techniques proposal

Earlier Gary Gensler whereas testifying earlier than the US Home Monetary Companies Committee mentioned the SEC’s proposal to mandate different buying and selling techniques to decide on whether or not to register as nationwide securities exchanges or to register as broker-dealers and adjust to extra necessities underneath proposed Regulation ATS relying on their actions and buying and selling quantity. This proposal goals to shut regulatory gaps amongst buying and selling platforms, making certain compliance with guidelines supposed to stop unfair buying and selling practices.

Nonetheless, the proposed rules have met vital push-back from digital-asset companies, together with Coinbase, which argue that the definition of an alternate may inadvertently embrace DeFi platforms, complicating their compliance.

Because the SEC continues to navigate the advanced panorama of cryptocurrency regulation, Gensler reiterated the company’s dedication to fostering a clear market.

With no timeline set for ultimate selections on the buying and selling techniques proposal, the SEC stays open to contemplating functions from exchanges searching for to supply central clearing for the US Treasury market, which is projected to develop considerably underneath new guidelines.