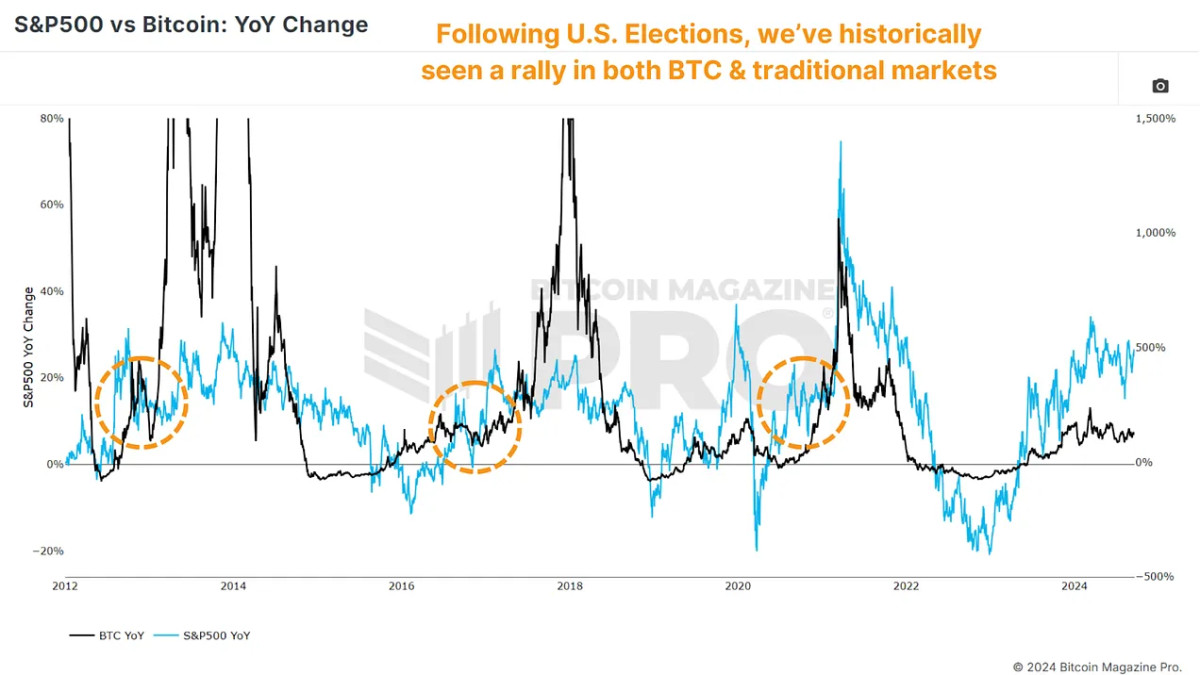

Because the U.S. presidential election approaches, it’s value inspecting how previous elections have influenced Bitcoin’s worth. Traditionally, the U.S. inventory market has proven notable traits round election intervals. Given Bitcoin’s correlation with equities and, most notably, the S&P 500, these traits may supply insights into what would possibly occur subsequent.

S&P 500 Correlation

Bitcoin and the S&P 500 have traditionally held a powerful correlation, notably throughout BTC’s bull cycles and intervals of a risk-on sentiment all through conventional markets. This might phenomenon may probably come to an finish as Bitcoin matures and ‘decouples’ from equities and it’s narrative as a speculative asset. Nevertheless there’s no proof but that that is the case.

Publish Election Outperformance

The S&P 500 has usually reacted positively following U.S. presidential elections. This sample has been constant over the previous few many years, with the inventory market usually experiencing vital good points within the 12 months following an election. Within the S&P500 vs Bitcoin YoY Change chart we will see when elections happen (orange circles), and the worth motion of BTC (black line) and the S&P 500 (blue line) within the months that observe.

2012 Election: In November 2012, the S&P 500 noticed 11% year-on-year development. A 12 months later, this development surged to round 32%, reflecting a powerful post-election market rally.

2016 Election: In November 2016, the S&P 500 was up by about 7% year-on-year. A 12 months later, it had elevated by roughly 22%, once more displaying a considerable post-election enhance.

2020 Election: The sample continued in 2020. The S&P 500’s development was round 17-18% in November 2020; by the next 12 months, it had climbed to almost 29%.

A Current Phenomenon?

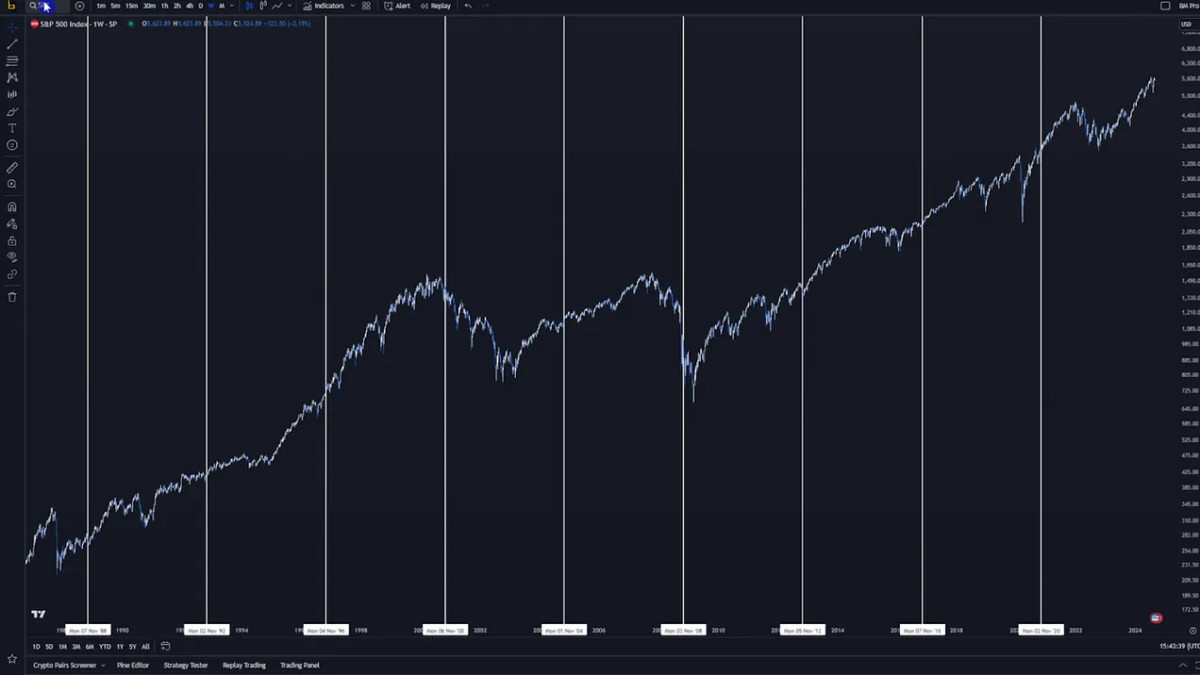

This isn’t restricted to the earlier three elections whereas Bitcoin existed. To get a bigger knowledge set, we will take a look at the earlier 4 many years, or ten elections, of S&P 500 returns. Just one 12 months had unfavorable returns twelve months following election day (2000, because the dot-com bubble burst).

Historic knowledge means that whether or not Republican or Democrat, the successful occasion does not considerably impression these constructive market traits. As an alternative, the upward momentum is extra about resolving uncertainty and boosting investor confidence.

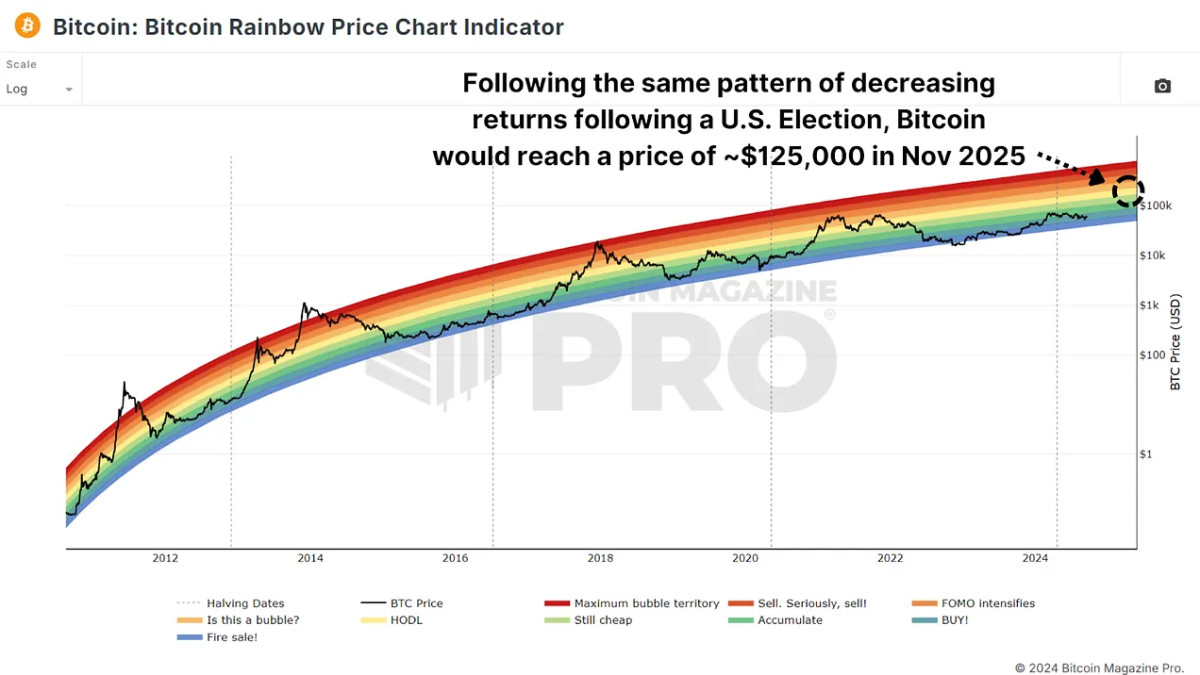

How Will Bitcoin React This Time

As we strategy the 2024 U.S. presidential election, it is tempting to invest on Bitcoin’s potential efficiency. If historic traits maintain, we may see vital worth will increase. For instance:

If we expertise the identical share good points within the twelve months following the election as we did in 2012, Bitcoin’s worth may rise to $1,000,000 or extra. If we expertise the identical because the 2016 election, we may climb to round $500,000, and one thing just like 2020 may see a $250,000 BTC.

It is fascinating to notice that every incidence has resulted in returns reducing by about 50% every time, so perhaps $125,000 is a sensible goal for November 2025, particularly as that worth and knowledge align with the center bands of the Rainbow Worth Chart. It’s additionally value noting that in all of these cycles, Bitcoin truly went on to expertise even increased cycle peak good points!

Conclusion

The information means that the interval after a U.S. presidential election is usually bullish for each the inventory market and Bitcoin. With lower than two months till the following election, Bitcoin traders could have motive to be optimistic in regards to the months forward.

For a extra in-depth look into this matter, try a latest YouTube video right here: Will The U.S. Election Be Bullish For Bitcoin?