Bitcoin is weaving by a consolidation part since marking a brand new all-time excessive of $73,777 in mid-March. Since then, Bitcoin’s every day closing costs have exhibited important restraint, by no means sealing above $71,500 and sustaining a ground above $54,000, although it has seen a serious intraday low touching $49,000. This consolidation part has nudged the Worry and Greed Index in the direction of a cautious “worry” rating of 30, revealing an environment of apprehension amongst merchants who discover themselves often whipsawed by the risky market dynamics.

Is $60,000 The New $10,000 For Bitcoin Worth?

Regardless of the prevailing market nerves, some market consultants consider that it is a potential shopping for alternative, paying homage to related market situations seen in 2019. Bloomberg ETF skilled James Seyffart remarked by way of X: “Bitcoin proper now round $50k-$70k during the last 6 months kinda sorta reminds of BTC buying and selling round $7k – $10k from mid 2019 by early to mid 2020.”

Associated Studying

He acknowledges the complexities of evaluating historic and present charts, emphasizing that whereas historic patterns mustn’t dictate future outcomes, the comparative dynamics provide insightful parallels. “I clearly know to not equate historic charts with present charts. i do know all of the variations of the present worth dynamics and many others. $10k was manner additional off the $20k+ ATH that 60K is. However go forward — make enjoyable of me. I can take it,” Seyffart added.

James “Checkmate” Verify, a number one on-chain analyst and co-founder of Checkonchain, concurred with Seyffart’s commentary. “The similarities between the 2024 chop-consolidation, and the one we skilled again in 2019 are unusual, and uncanny.”

In 2019, the market notably surged from $4,000 to $14,000 inside three months, considerably pushed by the PlusToken Ponzi scheme in China, which absorbed roughly 2% of Bitcoin’s complete circulating provide on the time. This was adopted by a mass sell-off of those acquired cash on Huobi by the Chinese language CCP, contributing to extended market choppiness till the sharp downturn in March 2020.

Drawing a parallel, Verify famous {that a} related sequence unfolded in 2024 when the market climbed from $40,000 to $73,777, catalyzed by a considerable uptake in spot bids from US spot ETFs, absorbing round 5% of the Bitcoin provide. This was succeeded by substantial promoting actions from the US and German governments, involving roughly 70,000 BTC, which contributed to sustained market chop till the 5-August Yen Carry Commerce unwind.

“Significantly, it’s actually weird how related these occasions are, and that is simply primarily based on the headline occasions. There may be much more proof under the floor,” Verify concluded. He shared a number of on-chain metrics which spotlight the sturdy similarities.

Associated Studying

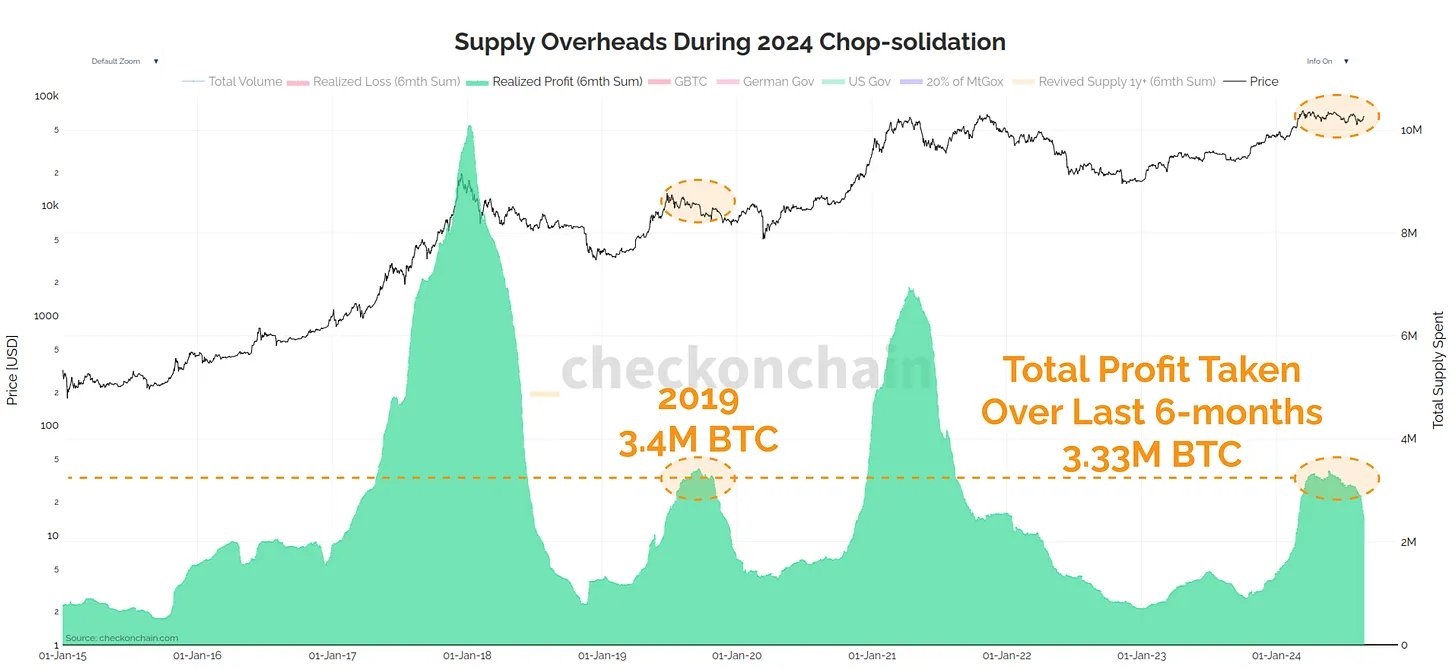

His “Provide Overheads Throughout 2024 Chop-consolidation” chart confirmed that the 6-month sum of spent cash older than 1 yr was fairly much like historic actions. In 2019, 1.75 million BTC was moved by this cohort; comparably, in 2024, as of at this time, 1.9 million BTC has been mobilized. Noteworthy, the massive entities, together with the Grayscale Bitcoin Belief (GBTC), German Authorities, and the US authorities, accounted for about 454,000 BTC of this motion.

Extra information from Verify’s evaluation highlighted the “Realized Income” throughout these durations. In 2019, 3.4 million BTC had been bought for revenue over six months. In 2024, this determine stands at 3.33 million BTC.

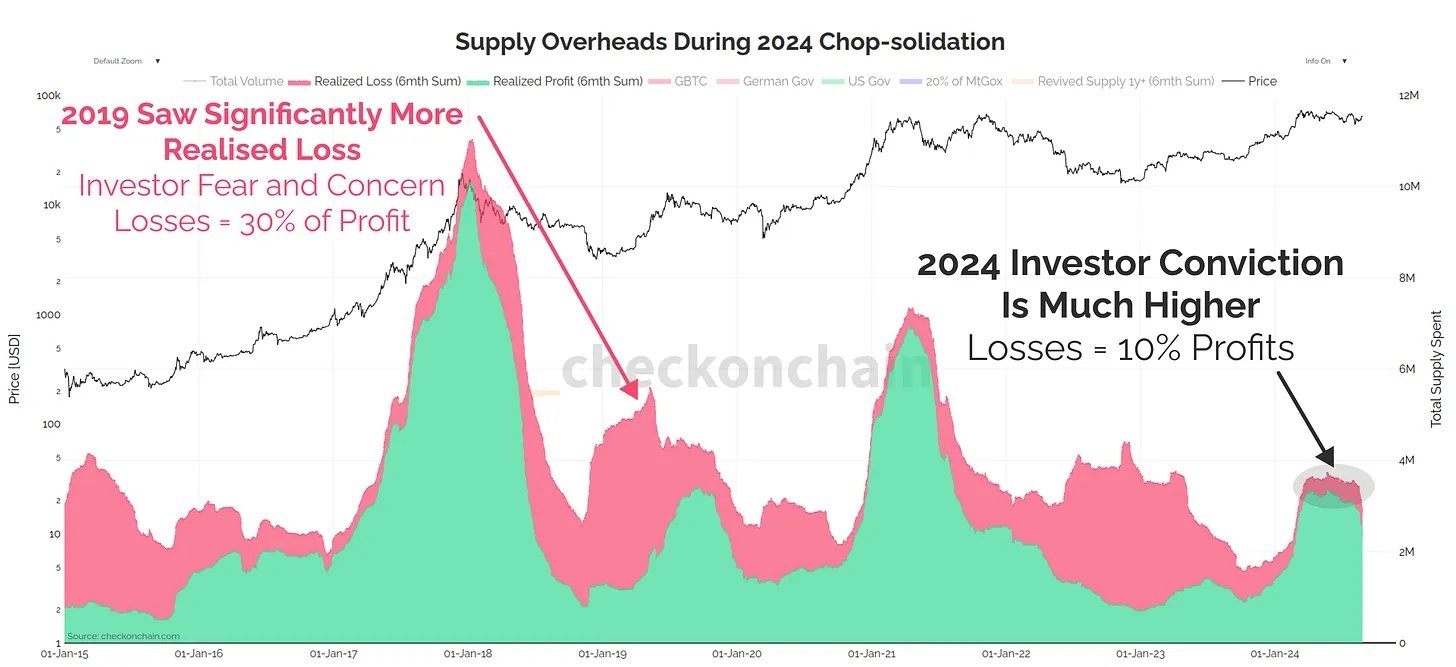

Nevertheless, the evaluation of realized losses gives a stark distinction between the 2 durations. In 2019, losses equaled 30% of the earnings, indicating a market fraught with investor worry and readiness to promote at losses. Conversely, in 2024, losses are solely 10% of the earnings. This comparability demonstrates how market sentiment has shifted from 2019 to 2024, with buyers in 2024 showing extra assured and fewer liable to panic promoting.

At press time, BTC traded at $59,689.

Featured picture created with DALL.E, chart from TradingView.com