The crypto market continues to be influenced primarily by broader macroeconomic situations, with the most recent US Shopper Worth Index (CPI) report offering a glimmer of optimism for threat property, together with cryptocurrencies.

Crypto Awaits Fed’s Transfer

In line with a current Coinbase report, the marginally softer-than-expected July CPI print of two.9% year-over-year – the bottom stage in three years – has “calmed market considerations and bolstered expectations of impending Fed charge cuts on the September 17-18 Federal Open Market Committee (FOMC).

Per the report, this has been seen as optimistic information for threat sentiment, as it might assist dispel fears of a possible US recession, which Coinbase believes is extra vital than the entire dimension of Fed cuts this yr.

Associated Studying

Nonetheless, the crypto market has remained range-bound, with Bitcoin (BTC) unable to interrupt via the $61,000 stage. Sentiment has slowed on account of an absence of crypto-specific catalysts, and perpetual futures funding charges in BTC have turned destructive this week, probably indicating decrease dealer exercise.

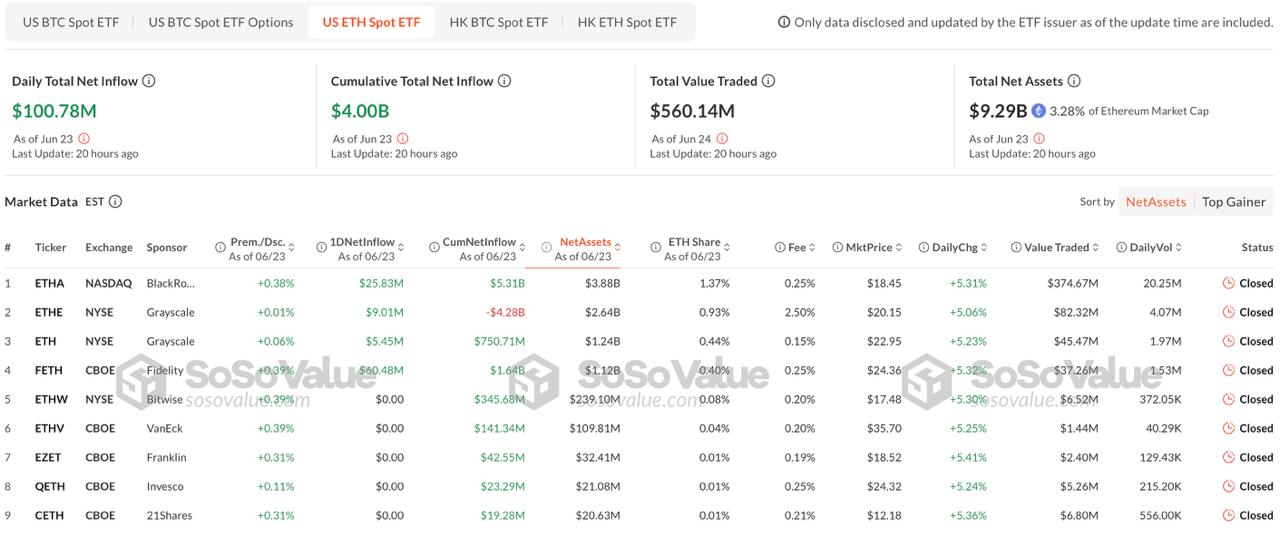

Within the Ethereum (ETH) ecosystem, gasoline costs have slumped, which may sign a decline in community exercise. On a extra optimistic be aware, spot Ethereum ETFs within the US have seen inflows this week.

ETF Inflows Sign Sturdy Institutional Curiosity

The report additionally highlighted the rising institutional adoption of crypto, as evidenced by the most recent 13-F filings for US spot Bitcoin ETFs. The information, which captures the state of institutional possession as of June 30, 2024, reveals notable new holders comparable to Goldman Sachs ($412 million) and Morgan Stanley ($188 million).

The ETF advanced noticed web inflows of $2.4 billion throughout this era, regardless of a drop in whole property underneath administration (AUM) from $59.3 billion to $51.8 billion, on account of Bitcoin’s worth decline from $70,700 to $60,300.

Nonetheless, Coinbase analysts imagine the continued ETF inflows throughout Bitcoin’s underperformance could also be a “promising indicator of sustained curiosity in crypto from the brand new swimming pools of capital that the ETFs give entry to.”

In addition they count on the proportion of funding advisor holdings to extend as extra brokerage homes full their due diligence on these funds.

Associated Studying

Trying forward, the report notes that the stage is about for market dynamics to be examined on the upcoming Jackson Gap Financial Symposium, a pivotal occasion that would sway sentiments and form the trajectory of crypto markets.

Whereas short-term fluctuations and market slowdowns could dampen quick enthusiasm, Coinbase highlights the underlying currents of institutional curiosity and the evolving panorama of ETF inflows that paint a promising image for crypto costs for the remainder of the yr.

On the time of writing, BTC is buying and selling at $59,679, regaining the top quality seen in current days between $57,000 and $60,000.

Featured picture from DALL-E, chart from TradingView.com