Bitcoin’s current value volatility has led many to surprise if large-scale bitcoin hodlers are making the most of value dips to build up extra bitcoin. Whereas some metrics might initially counsel a rise in long-term holdings, a more in-depth examination reveals a extra nuanced story, particularly after the present extended interval of uneven consolidation.

Are Lengthy-Time period Holders Accumulating?

Upon preliminary remark, long-term Bitcoin holders are seemingly growing their holdings. In accordance with the Lengthy Time period Holder Provide, since July thirtieth, the quantity of BTC held by long-term holders has elevated from 14.86 million to fifteen.36 million BTC. This surge of round 500,000 BTC has led some to consider that long-term holders are aggressively shopping for the dip, probably setting the stage for the subsequent important value rally.

Nonetheless, this interpretation may be deceptive. Lengthy-term holders are outlined as wallets which have held BTC for 155 days or extra. This week we’ve simply surpassed 155 days since our most up-to-date all-time excessive. Subsequently, it’s seemingly that many short-term holders from that interval have merely transitioned into the long-term class with none new accumulation occurring. These buyers are actually holding onto their BTC, hoping for increased costs. So in isolation, this chart doesn’t essentially point out new shopping for exercise from established market contributors.

Coin Days Destroyed: A Contradictory Indicator

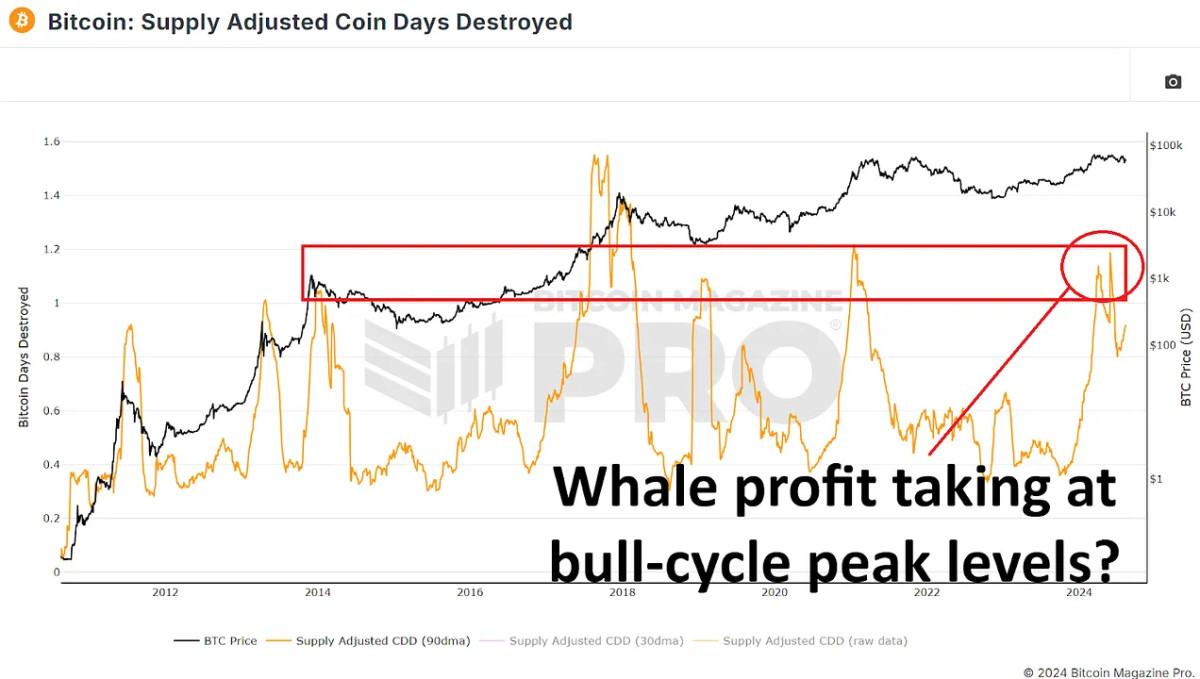

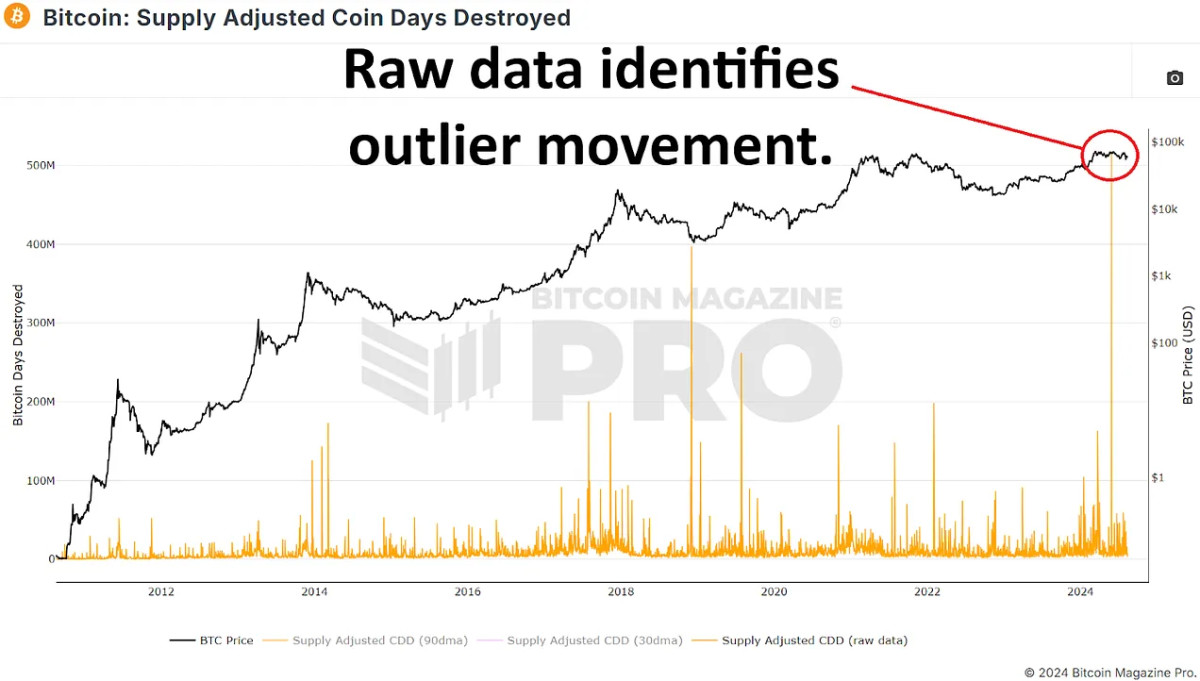

To additional discover the habits of long-term holders, we will look at the Provide Adjusted Coin Days Destroyed metric over the current 155-day interval. This metric measures the rate of coin motion, giving extra weight to cash which have been held for prolonged durations. A spike on this metric might point out that long-term holders possessing a considerable quantity of bitcoin are shifting their cash, seemingly indicating extra promoting versus accumulating.

Just lately, we now have seen a major improve on this information, suggesting that long-term holders may be distributing somewhat than accumulating BTC. Nonetheless, this spike is primarily skewed by a single huge transaction of round 140,000 BTC from a recognized Mt. Gox pockets on Could 28, 2024. Once we exclude this outlier, the info seems way more typical for this stage out there cycle, corresponding to durations in late 2016 and early 2017 or mid-2019 to early 2020.

The Conduct of Whale Wallets

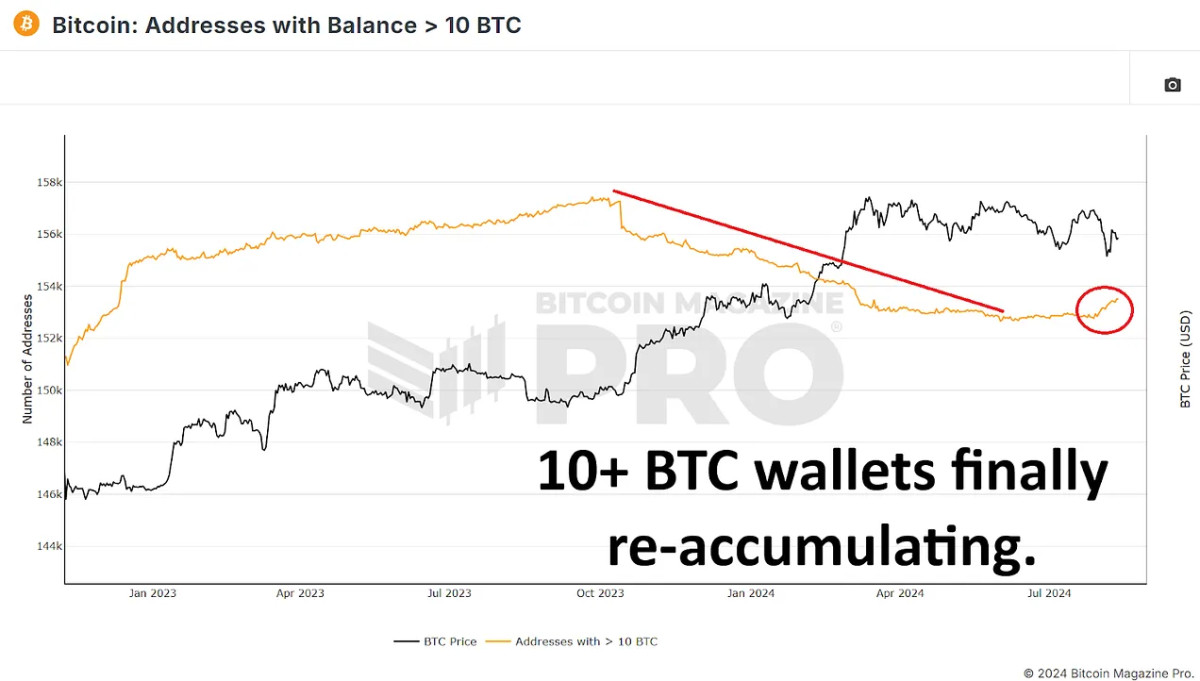

To find out whether or not whales are shopping for or promoting bitcoin, analyzing wallets holding substantial quantities of cash is essential. By analyzing wallets with at the very least 10 BTC (minimal of ~$600,000 at present costs), we will gauge the actions of great market contributors.

Since Bitcoin’s peak earlier this yr, the variety of wallets holding at the very least 10 BTC has barely elevated. Equally, the variety of wallets holding 100 BTC or extra has additionally seen a modest rise. Contemplating the minimal threshold to be included in these charts, the quantity of bitcoin accrued by wallets holding between 10 and 999 BTC might account for tens of hundreds of cash purchased since our most up-to-date all-time excessive.

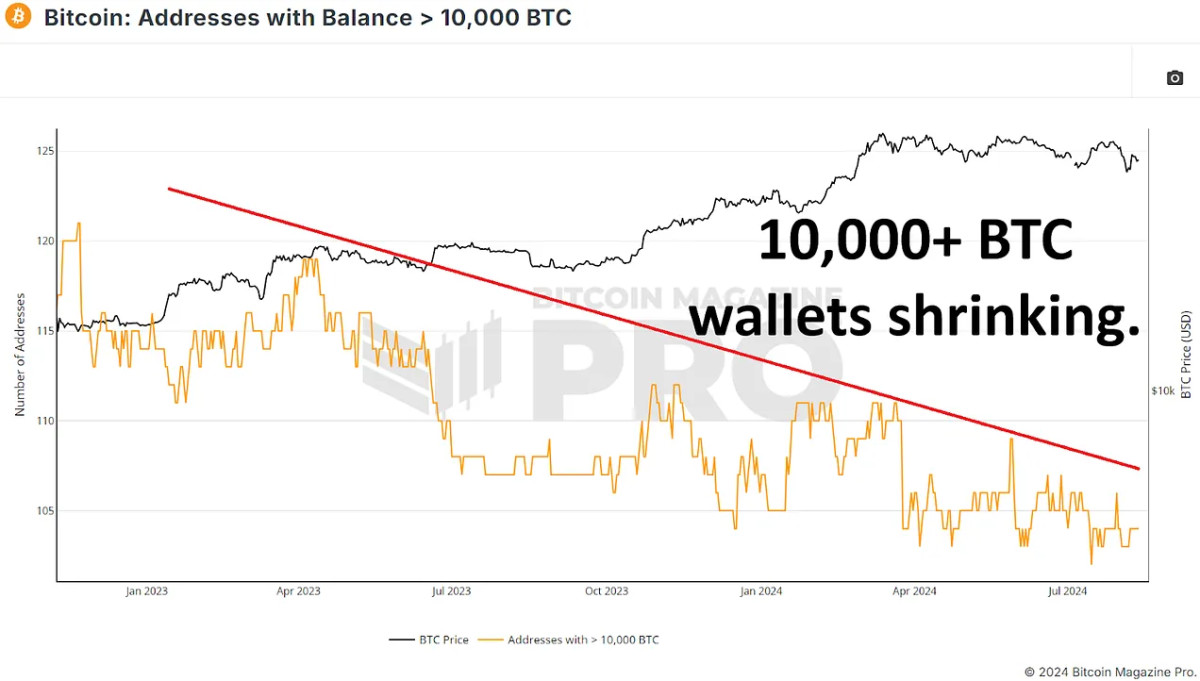

Nonetheless, the development reverses after we take a look at bigger wallets holding 1,000 BTC or extra. The variety of these giant wallets has decreased barely, indicating that some main holders may be distributing their BTC. Probably the most notable change is in wallets holding 10,000 BTC or extra, which have decreased from 109 to 104 previously months. This implies that among the largest bitcoin holders are seemingly taking some revenue or redistributing their holdings throughout smaller wallets. Nonetheless, contemplating most of those extraordinarily giant wallets will usually be exchanges or different centralized wallets it’s extra seemingly these are a set of dealer and investor cash versus anybody particular person or group.

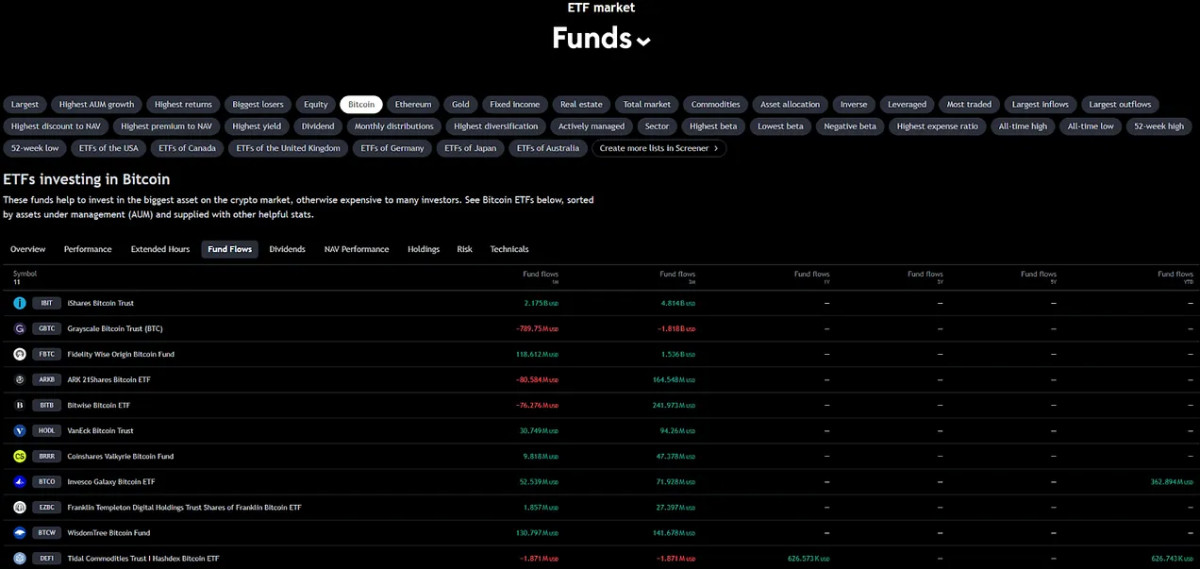

The Function of ETFs and Institutional Inflows

Since reaching a peak of $60.8 billion in belongings beneath administration (AUM) on March 14th, the BTC ETFs have seen an AUM lower of round $6 billion, nevertheless when making an allowance for the value lower of bitcoin since our all-time excessive, this roughly equates to a rise of roughly 85,000 BTC. Whereas that is constructive, the rise has solely negated the quantity of newly mined Bitcoin throughout the identical interval, additionally 85,000 BTC. ETFs have helped scale back promoting stress from miners and probably from giant holders however have not considerably accrued sufficient to affect the value positively.

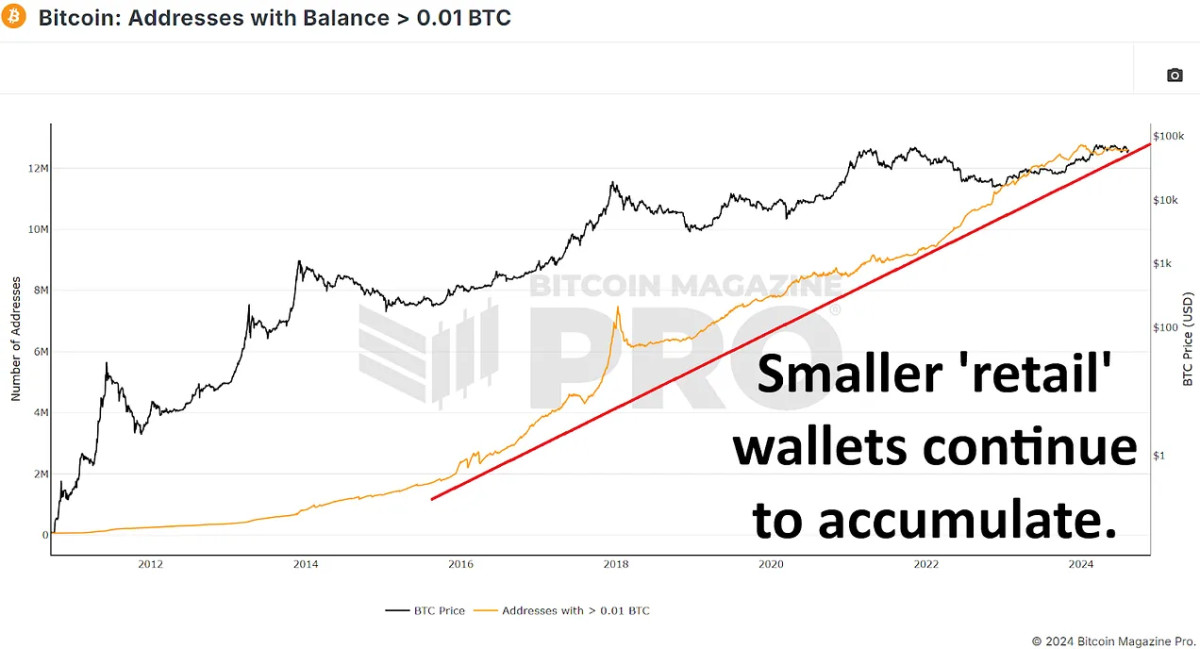

Retail Curiosity on the Rise

Apparently, whereas huge holders look like promoting BTC, there was a major improve in smaller wallets – these holding between 0.01 and 10 BTC. These smaller wallets have added tens of hundreds of BTC, exhibiting elevated curiosity from retail buyers. There’s been a web change of round 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This will likely appear alarming, however contemplating we usually see tens of millions of bitcoin swap from giant and long-term holders to new market contributors all through a whole bull cycle, this isn’t presently any trigger for concern.

Conclusion

The narrative that whales have been accumulating bitcoin on dips and all through this era of chopsolidation doesn’t appear to be the case. Whereas long-term holder provide metrics initially seem bullish, they largely mirror the transition of short-term holders into the long-term class somewhat than new accumulation.

The rise in retail holdings and the stabilizing affect of ETFs might present a powerful basis for future value appreciation, particularly if we see renewed institutional curiosity and continued retail inflows publish halving, however is presently contributing little to any Bitcoin value appreciation.

The true query is whether or not the present distribution section seizes and units the stage for a brand new spherical of accumulation, which might propel Bitcoin to new highs within the coming months, or if this movement of previous cash to newer contributors continues and sure suppresses the potential upside for the rest of our bull cycle.

🎥 For a extra in-depth look into this subject, take a look at our current YouTube video right here: Are Bitcoin Whales Nonetheless Shopping for?

And don’t neglect to take a look at our different most up-to-date YouTube video right here, discussing how we will probably enhance among the best bitcoin metrics: