The

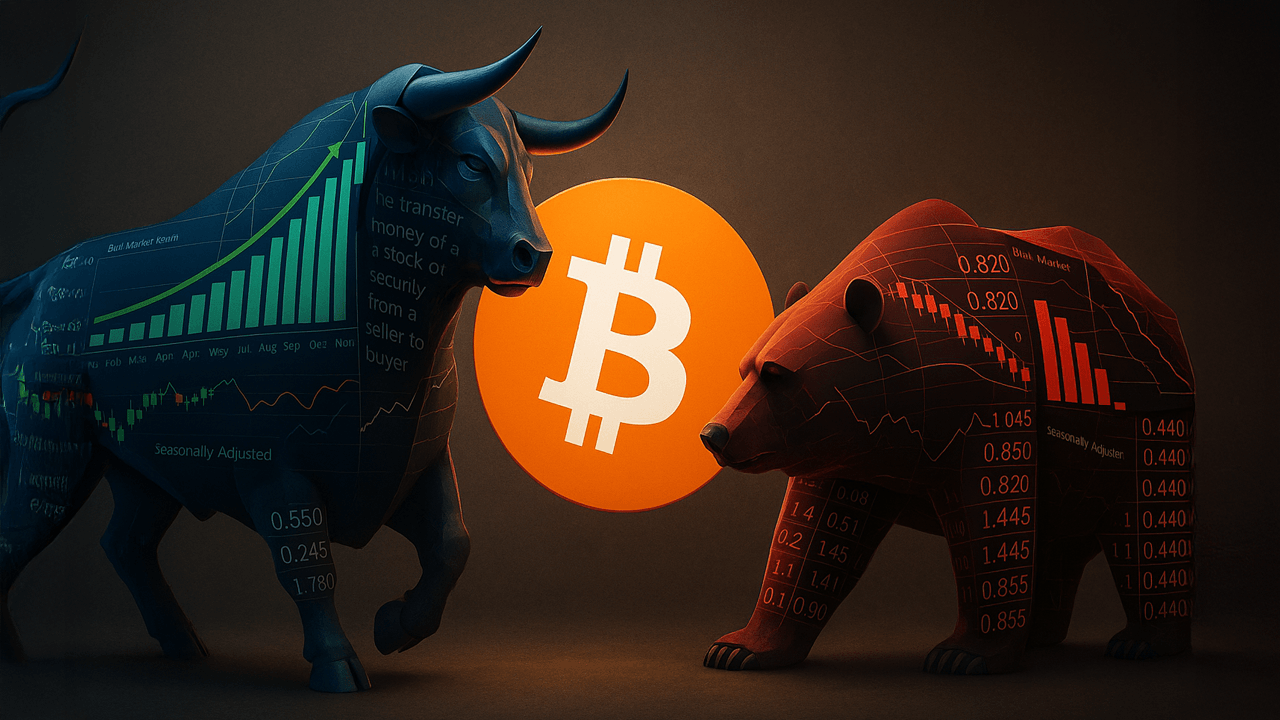

cryptocurrency market is experiencing one in all its strongest sell-offs in months

at present (Monday), testing ranges not seen for the reason that starting of 2024. Bitcoin

(BTC) has shed 25% of its whole worth in simply 4 days, shrinking by $320

billion. The remainder of the cryptocurrency market misplaced virtually the identical quantity.

Bitcoin and

Cryptocurrencies Face Strongest Promote-Off in a 12 months

Bitcoin’s

value is falling by practically 14% throughout Monday’s session, testing ranges beneath

the psychological help of $50,000. That is BTC’s lowest value level since

February and marks the fourth day of very sturdy promoting strain.

In whole,

the worth has contracted by 25%, or about $16,000. In greenback phrases, $320

billion has evaporated from the Bitcoin market since final Friday, erasing the

worth stubbornly constructed by crypto bulls at the start of the 12 months.

BREAKING: #Bitcoin falls beneath $50,000 pic.twitter.com/11og9GoSyi

— Bitcoin Journal (@BitcoinMagazine) August 5, 2024

The BTC

sell-off wave has precipitated altcoins to lose massively as nicely, with the whole

scale of the sell-off now reaching $600 billion. That is the strongest bleeding

of digital belongings in over a 12 months.

In response to consultants

and analysts, the principle motive for the sudden change in sentiment on

Bitcoin, Ethereum, and main altcoins is the deteriorating situation of the

inventory market, with which digital belongings are strongly correlated.

A current 10x Analysis report suggests #Bitcoin’s value may drop beneath $50,000 as a consequence of #US financial uncertainties, impacting the broader #crypto market. The #ISM Manufacturing Index downturn indicators potential sharp corrections for Bitcoin and a 20% decline within the S&P 500. The… pic.twitter.com/xWk8e04mPG

— TOBTC (@_TOBTC) August 5, 2024

For

instance, the S&P 500 index misplaced practically 2% final Friday and fell to two-month

lows at 5,346 factors. The tech-heavy Nasdaq slid much more sharply, testing

ranges final noticed in Could.

“The broader digital token area is following steep losses in world inventory markets

amid fears of a slowdown within the US financial system that’s spurring hypothesis of an

emergency price lower by the Federal Reserve,” commented Arthur Firstov, Chief Enterprise Officer at Mercuryo, the fee infrastructure providder for crypto. “Panic has swept

throughout cryptocurrency markets as contributors witness waves of promoting strain.”

The sturdy

depreciation of the US inventory market was triggered not solely by native financial

knowledge and considerations concerning the Federal Reserve’s (Fed) future financial coverage however

additionally by a crash in world inventory markets. World considerations had been sparked by the

Japanese market, the place the Nikkei index misplaced 20% over three days. Monday’s

declines exceeded 10%, pushing the Tokyo inventory alternate benchmark to its lowest

ranges since November 2023.

$1 Billion in Leveraged

Longs Vanishes from the Market

The size

of losses within the cryptocurrency market and the cash really misplaced by traders

can also be proven by knowledge on the worth of liquidations of lengthy leveraged positions.

CoinGlass knowledge exhibits that liquidations of

lengthy positions over the previous 24 hours reached practically $1 billion. $406 million

in longs disappeared from Bitcoin derivatives, and one other $370 million from

lengthy positions on Ethereum.

Concerning #Bitcoin, this factor is a magnificence. Its a ghost city in longs, due to nuclear liquidation occasion. Shorts are piling up and eventualy they’ll have the identical religion. #cryptocrash #crypto #bitcoin pic.twitter.com/JUm8rKZU3V

— Kackbyll (@Kackbyll1) August 5, 2024

Firms

related to digital belongings, together with publicly traded Bitcoin miners on

Wall Avenue, are additionally dropping on the dynamic slide of cryptocurrencies. Shares

of Marathon Digital Holdings, the biggest BTC producer on Nasdaq, fell by over

5% on Friday and examined ranges from Could. The depreciation exceeded 20% in only one week. Beforehand, the corporate’s shares had been

harm by information of a $138 million advantageous imposed on it.

This text was written by Damian Chmiel at www.financemagnates.com.

Source link

_id_fc3595c9-3c98-44b3-96c5-d35e861666a9_size900.jpg)