Tony Kim

Jul 30, 2024 17:55

A research by Uniswap (UNI) Labs, Circle, and Copenhagen Enterprise Faculty uncovers how conventional monetary components affect crypto costs.

A latest research performed by researchers from Uniswap (UNI) Labs, Circle Web Monetary, and the Copenhagen Enterprise Faculty has make clear the impression of conventional monetary components on the value actions of crypto belongings, in line with Uniswap Protocol.

Key Insights from the Analysis

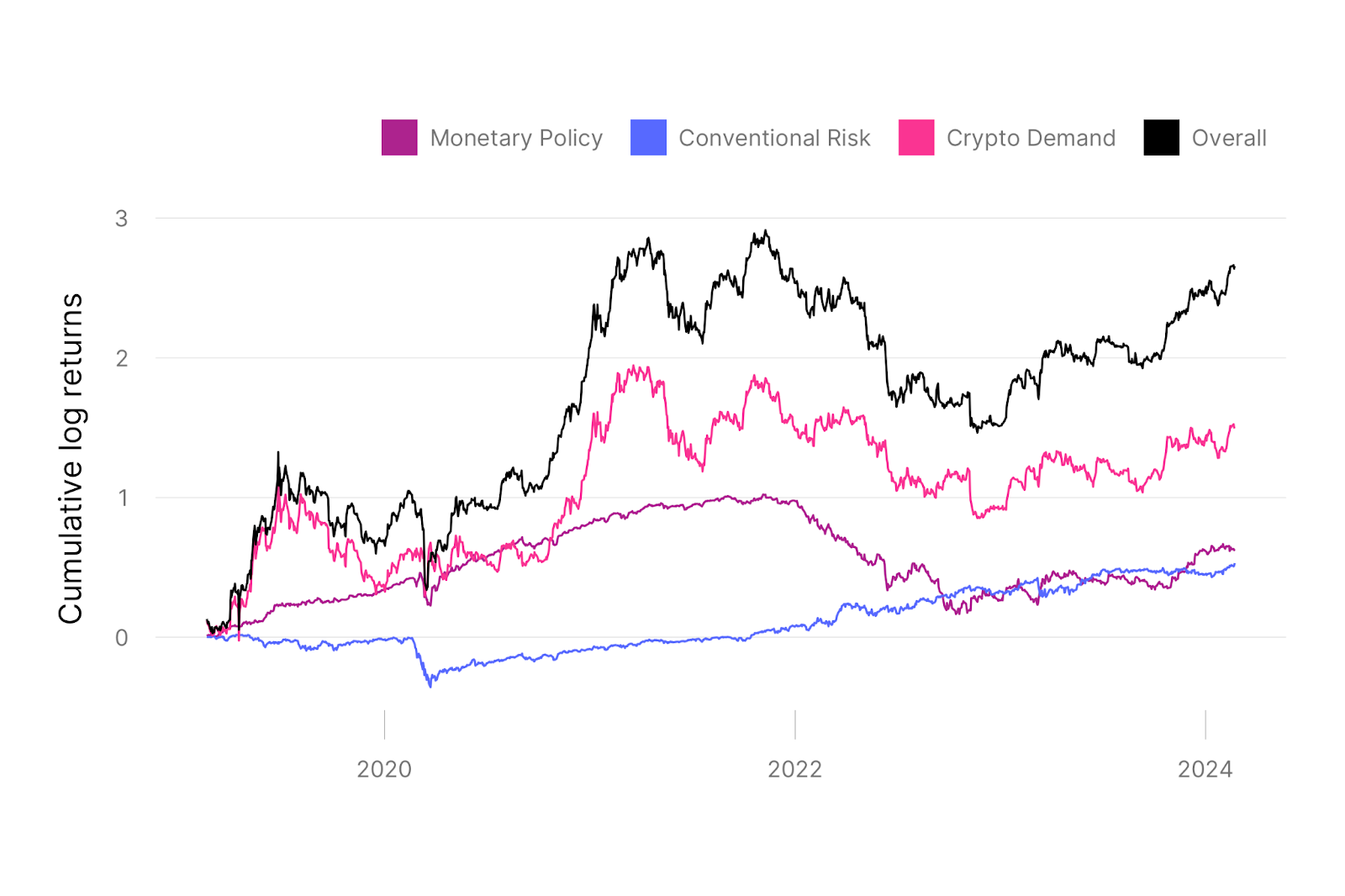

The paper delves into how components comparable to U.S. financial coverage affect the crypto market. The researchers discovered that digital belongings exhibit behaviors just like conventional asset courses throughout the world monetary markets. This analysis is a part of Uniswap Labs’ ongoing efforts to grasp market dynamics and the components driving crypto costs.

The research breaks down asset costs into three essential elements: financial coverage, broad market threat premium, and crypto-specific demand. It highlights that contractionary financial coverage was chargeable for greater than two-thirds of Bitcoin’s (BTC) sharp decline in 2022. Moreover, the analysis examines important market occasions such because the FTX chapter, Bitcoin ETF bulletins, and the monetary turmoil brought on by the COVID-19 pandemic.

Bitcoin’s Response to Monetary Shocks

Notably, the analysis contains an evaluation of Bitcoin’s return by shock since early 2019. This evaluation supplies a deeper understanding of how varied monetary shocks have impacted Bitcoin costs through the years.

Implications for Crypto Market Perceptions

The findings recommend that crypto costs could also be extra rational and predictable than beforehand thought. This might have important implications for traders and analysts who’ve historically considered the crypto market as extremely risky and unpredictable.

For these all for a extra complete understanding of the research, the total paper is offered on SSRN.

Picture supply: Shutterstock