Bitcoin is encouragingly agency at press time, discovering its footing above $58,000 and inches away from the important $60,000 psychological degree.

After a risky week, the steadiness is an enormous increase for bulls. Whereas there are pockets of power, sellers are nonetheless in management. For the uptrend to take form and consumers to construct momentum, bulls should reverse July 4 and 5 beneficial properties.

Is This The Proper Time To Purchase Bitcoin?

Amid this bullish optimism, one analyst on X mentioned BTC is on the excellent level if worth motion post-Halving through the years is something to go by. Within the submit, the analyst mentioned Bitcoin often tends to print greater highs, resuming the uptrend 80 days after Halving.

On April 20, the world’s most useful community Halved its miner rewards, lowering them from 6.25 to three.125 BTC. Nevertheless, despite the fact that merchants anticipated costs to broaden instantly, that wasn’t the case.

If something, the correction from March 2024 highs continued, with costs closing at round $56,500 in Could. The downtrend continued in June, with bears even additional within the first half of July, when BTC crashed to as little as $53,500.

It has been exactly 80 days between the Halving date in late April and July 9. Bulls are inclined to accumulate throughout this time in preparation for a parabolic bull run.

The re-accumulation part the analyst picks out can be strategic, particularly for clever BTC buyers. Following Halving and amid lowered rewards, weak miners are inclined to capitulate. As they exit, promoting their stash, costs fall in tandem.

Is The Bitcoin Miner Capitulation Over?

Information reveals that weak miners are inclined to shut down inside six to 10 weeks after Halving occasion. Their capitulation, as defined, coincides with sharp worth beneficial properties.

By the top of final week, it marked the top of the tenth week of miner capitulation, the longest for the reason that 2012 Halving occasion. If worth motion rhymes with historic performances, then the dumping part is probably going over, and Bitcoin is within the early phases of a parabolic surge.

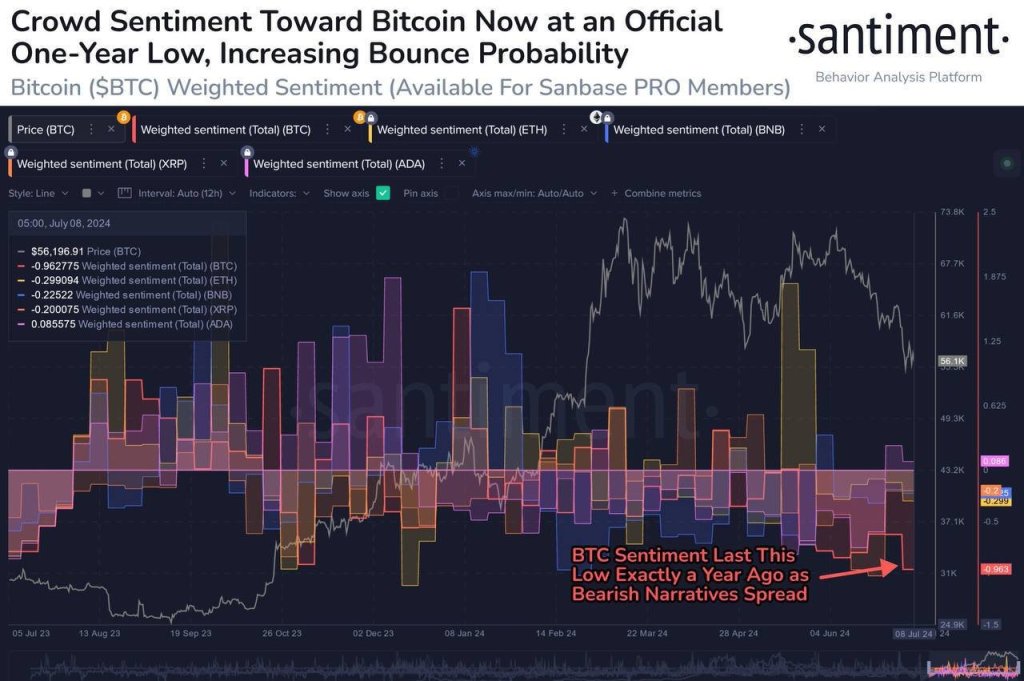

Santiment knowledge reveals that bearish sentiment amongst Bitcoin merchants throughout main social media platforms like X and Telegram is highest in over a 12 months. Aggressive merchants can take a contrarian place, loading on each dip at these excessive worry, uncertainty, and doubt (FUD) ranges.

Function picture from Canva, chart from TradingView