The Mt. Gox chapter saga appears to finish because the long-awaited compensation course of lastly begins. On July 5, Mt. Gox, some collectors began receiving Bitcoin (BTC) and Bitcoin Money (BCH) of their accounts. Some crypto traders fear in regards to the influence it is going to have available on the market.

Repayments Move By means of, Japanese Collectors First In Line

Mt. Gox was the most important Bitcoin alternate on the planet ten years in the past, dealing with round 70% of all BTC transactions. In 2014, the alternate suffered an alleged safety breach that resulted within the lack of 850,000 BTC and the eventual chapter of the buying and selling platform.

A decade later, the affected Mt. Gox customers have begun receiving the long-awaited repayments. Mark Karpelès, the previous CEO of Mt. Gox, said in an X publish his pleasure that the payout course of lastly began:

MtGox prospects have lastly began receiving Bitcoins! After over 10 years I wasn’t positive anymore if it’d lastly occur, however right here we’re lastly!! This has been a protracted journey and I’m joyful to see we’re lastly getting there, solely a bit extra…

The Rehabilitation Trustee, Nobuaki Kobayashi, launched a discover on July 5 revealing it had made repayments in BTC and BCH to a number of the collectors. The payout was made by part of the Designated Cryptocurrency Exchanges following the Rehabilitation Plan.

Rehabilitation Trustee’s discover relating to the compensation of Mt. Gox Collectors: Supply: Alex Thorn on X

Some customers have reported that they’ve already been credited. As seen within the subreddit devoted to the alternate’s insolvency, Japanese collectors have acquired their Bitcoin and Bitcoin Money in full. One Reddit consumer reported being credited “precisely the quantity displayed within the Mt Gox desk” to their BitBank account.

Japanese creditor shares full compensation in BTC and BCH. Supply: Mikeplus20 on Reddit

Seemingly, solely customers from the Japanese crypto alternate have acquired their tokens thus far, which sparked concern in some crypto traders. The discover said that some collectors might need to “anticipate some time” to obtain their BTC and BCH payout, which may take as much as 90 days.

Traders Concern A Bitcoin Carnage

Crypto traders stay cautious of the market as Bitcoin’s worth has taken a success following the compensation information. A number of group members concern {that a} large sell-off from the collectors will comply with regardless of the peace of mind that many will maintain their Bitcoin.

Nonetheless, some collectors have expressed their want to make some income from their tokens. “At this stage, as quickly as I get them, I’m flogging them on Kraken,” one consumer stated, suggesting that the majority affected customers would possibly really feel they’ve recovered from their loss, so “It’s all bonus.”

Because of this, some consider that the payout must be disbursed in a number of installments to stop an extra market decline. Famend Journalist Tim Copeland weighed in on the state of affairs, expressing concern in regards to the benefit the early receivers might need on different collectors.

Seemingly, customers from exchanges like Kraken have an obstacle in opposition to Japanese collectors as they don’t have entry to their Bitcoin and Bitcoin Money tokens but. This enables Japanese customers to promote their BTC earlier than every other creditor, which may have an effect on late receivers if the worth continues bleeding.

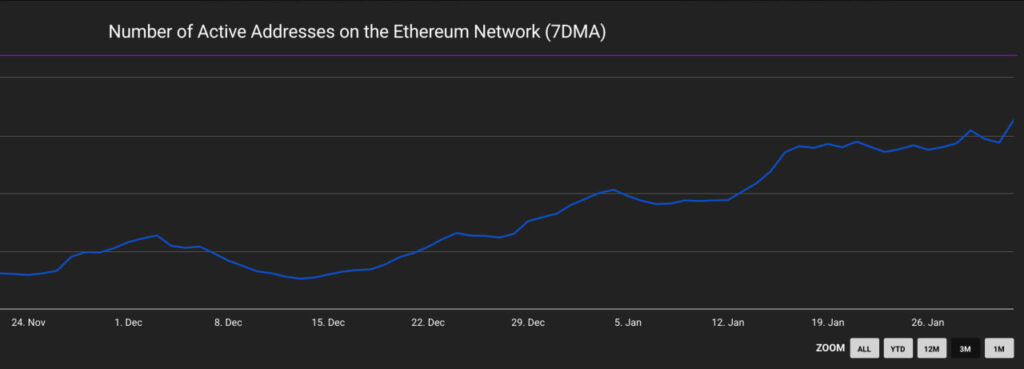

In the end, a sector of the crypto group seems to be bearish after BTC fell to $54,000 earlier in the present day. As of this writing, BTC is buying and selling at $55,520, a 2.5% drop within the final 24 hours.

Bitcoin’s efficiency within the weekly chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com