Information reveals the Bitcoin Internet Taker Quantity has been largely at destructive ranges not too long ago. Right here’s what this might imply for the asset’s value.

Bitcoin Internet Taker Quantity Has Been Principally Destructive In The Previous Month

As CryptoQuant neighborhood supervisor Maartunn identified in a submit on X, the Internet Taker Quantity suggests an absence of sturdy taker purchase quantity previously month.

The “Internet Taker Quantity” is an indicator that retains observe of the distinction between the Bitcoin taker purchase and taker promote volumes. Naturally, the 2 volumes measure the purchase and promote orders stuffed by takers in perpetual swaps.

When the worth of this metric is constructive, it signifies that the taker purchase quantity is bigger than the taker promote quantity proper now. Such a pattern implies nearly all of the market shares a bullish sentiment.

Then again, the indicator beneath the zero mark suggests the dominance of a bearish mentality within the sector, because the quick quantity outweighs the lengthy quantity.

Now, here’s a chart that reveals the pattern within the Bitcoin Internet Taker Quantity over the previous month:

The worth of the metric seems to have been destructive in current days | Supply: @JA_Maartun on X

As displayed within the above graph, the Bitcoin Internet Taker Quantity has seen only a few spikes into constructive territory throughout this window, and the size of those spikes has additionally not been too nice.

The indicator has been contained in the purple area the remainder of the time, usually observing considerably destructive values. As such, it will seem that taker promote quantity has dominated the market within the final month.

The graph reveals that the one part on this interval the place constructive values reached a notable scale accompanied an increase within the cryptocurrency’s value. As such, the metric could have to flip inexperienced once more if BTC has to make some restoration.

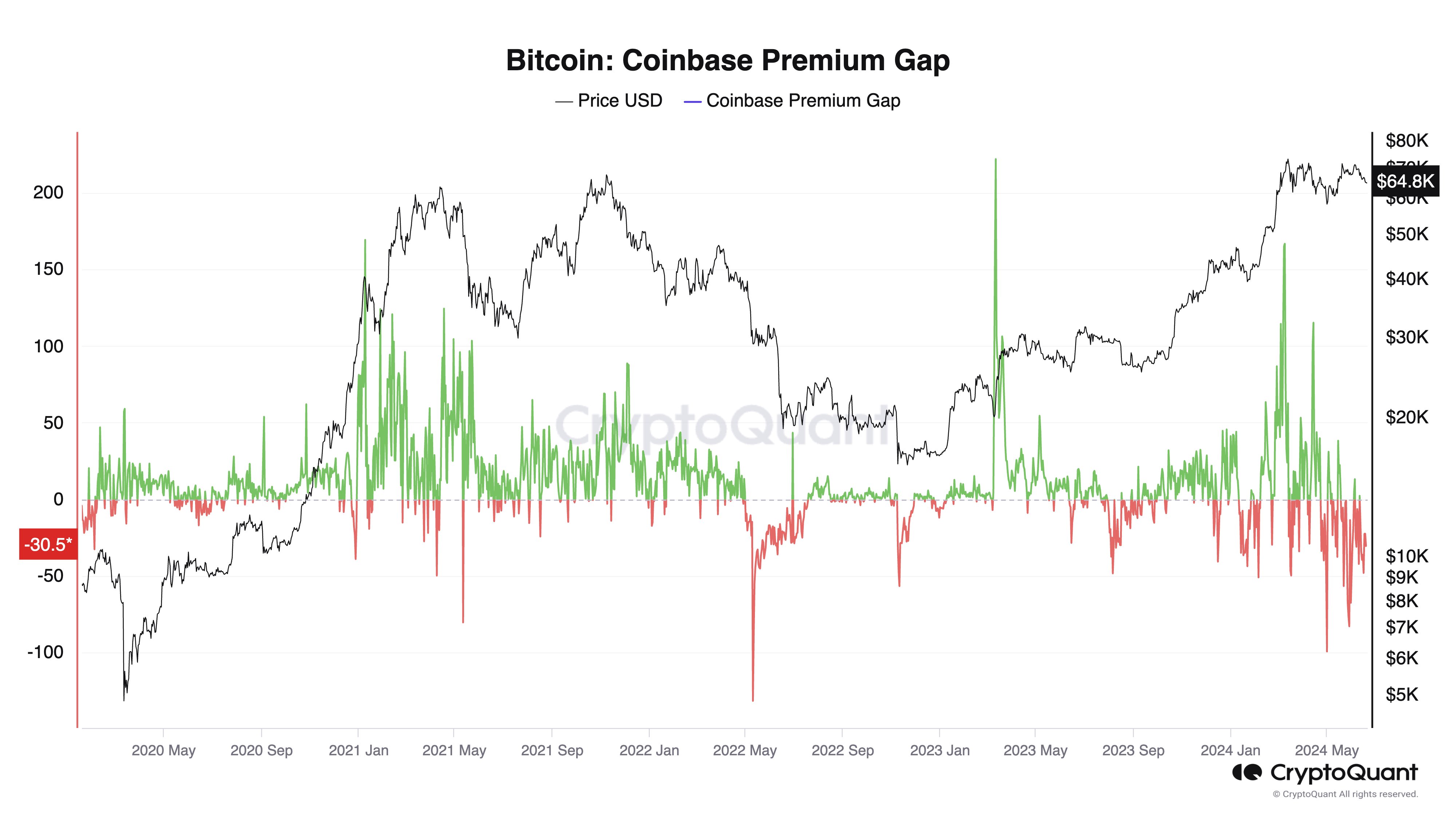

The online taker quantity hasn’t been the one indicator that has been bearish for Bitcoin not too long ago; it seems that the Coinbase Premium Hole has additionally been destructive, as CryptoQuant founder and CEO Ki Younger Ju shared in an X submit.

Appears to be like like the worth of the metric has been fairly purple in current weeks | Supply: @ki_young_ju on X

The Coinbase Premium Hole retains observe of the distinction between the Bitcoin costs listed on the cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair). The indicator’s worth displays how the investor habits on Coinbase differs from that on Binance.

Because the chart reveals, the Bitcoin Coinbase Premium Hole has been sitting in underwater territory not too long ago, suggesting that Coinbase has been seeing extra promoting stress than Binance. This promoting might be one of many the reason why the asset has been caught in consolidation recently.

BTC Value

Bitcoin is buying and selling round $64,800, which is throughout the vary the asset has been transferring sideways inside for some time now.

The value of the asset appears to have been taking place not too long ago | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com