Following the latest value spike that introduced Ethereum (ETH) near the $4,000 mark, the second-largest cryptocurrency has skilled inflows and renewed market enthusiasm. This is available in response to the US Securities and Trade Fee’s (SEC) approval of Ethereum ETF purposes by main asset managers.

Finest Week For Ethereum Since March

Based on a report by CoinShares, digital asset funding merchandise have witnessed a complete of $2 billion inflows, contributing to a five-week consecutive run of inflows amounting to $4.3 billion.

Moreover, buying and selling volumes in exchange-traded merchandise (ETPs) have risen to $12.8 billion for the week, a 55% enhance from the earlier week.

Notably, inflows have been noticed throughout numerous suppliers, indicating a turnaround in sentiment. Incumbent suppliers have additionally skilled a slowdown in outflows, reinforcing the constructive market sentiment.

Associated Studying

As seen within the picture above, Bitcoin (BTC) continues to dominate the market, with inflows totaling $1.97 billion for the week. Alternatively, quick Bitcoin merchandise noticed outflows of $5.3 million for the third consecutive week.

Equally, Ethereum has additionally seen a notable surge in inflows, recording its finest week since March with a complete of $69 million, which for CoinShares is probably going a response to the sudden SEC resolution to permit spot-based ETFs on Ethereum.

Differing Views On ETH’s Value

Regardless of the constructive developments, Ethereum’s value has struggled to keep up bullish momentum, failing to retest its yearly excessive of $4,100 reached in March. On Friday, the value dropped as little as $3,577.

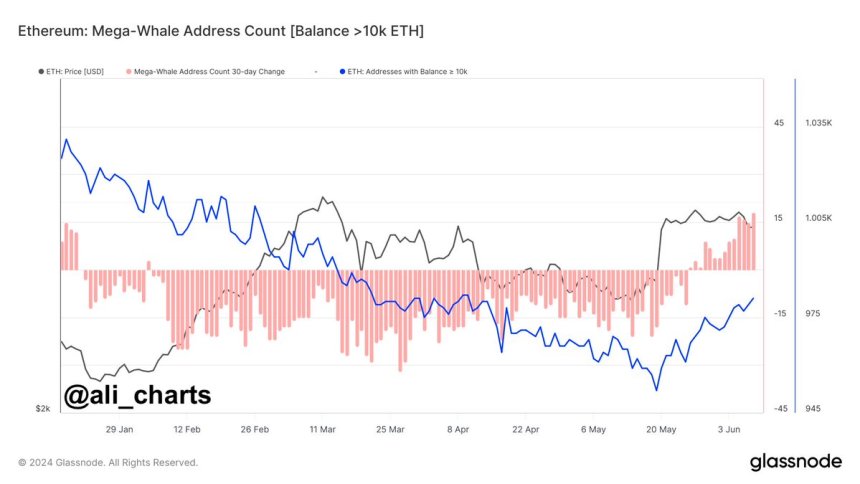

Nevertheless, Ethereum addresses holding greater than 10,000 ETH have elevated by 3% prior to now three weeks, indicating a big spike in shopping for strain.

Associated Studying

Market analysts have offered differing views on Ethereum’s future value motion. “Dealer Tank” predicts that ETH might drop to $3,500 whereas acknowledging the potential for a bullish reversal upon reclaiming the $3,700 stage.

Alternatively, crypto analyst Lark Davis highlights that Ethereum’s provide on exchanges is at an eight-year low, suggesting that the upcoming ETFs may trigger a “large provide shock” and probably result in a considerable enhance in ETH’s value.

In the end, as Ethereum’s value stays unsure, market individuals eagerly await the following actions within the cryptocurrency. As traders and analysts carefully monitor the market dynamics, the query of whether or not a breakout above $4,000 or a retest of decrease help ranges at $3,500 awaits a solution.

The second-largest cryptocurrency in the marketplace is at the moment buying and selling at $3,690, down 6.5% prior to now two weeks.

Featured picture from DALL-E, chart from TradingView.com