Economist Henrik Zeberg says that the altcoin market is establishing for a parabolic run to new highs earlier than the worldwide economic system witnesses a recession.

Zeberg tells his 143,000 followers on the social media platform X that he’s trying on the TOTAL-ETH-BTC chart, which measures the complete market cap of crypto property in addition to Bitcoin (BTC) and Ethereum (ETH).

Zeberg sees TOTAL-ETH-BTC skyrocketing into “euphoria” close to the $1.83 trillion degree.

“BLOW-OFF TOP removed from performed but!

US Equities and Crypto will soar into the ultimate – and most speculative section – of this Enterprise Cycle. Altseason will ship Alts flying.

Euphoria will develop!”

At time of writing TOTAL-ETH-BTC is valued at $662.75 billion.

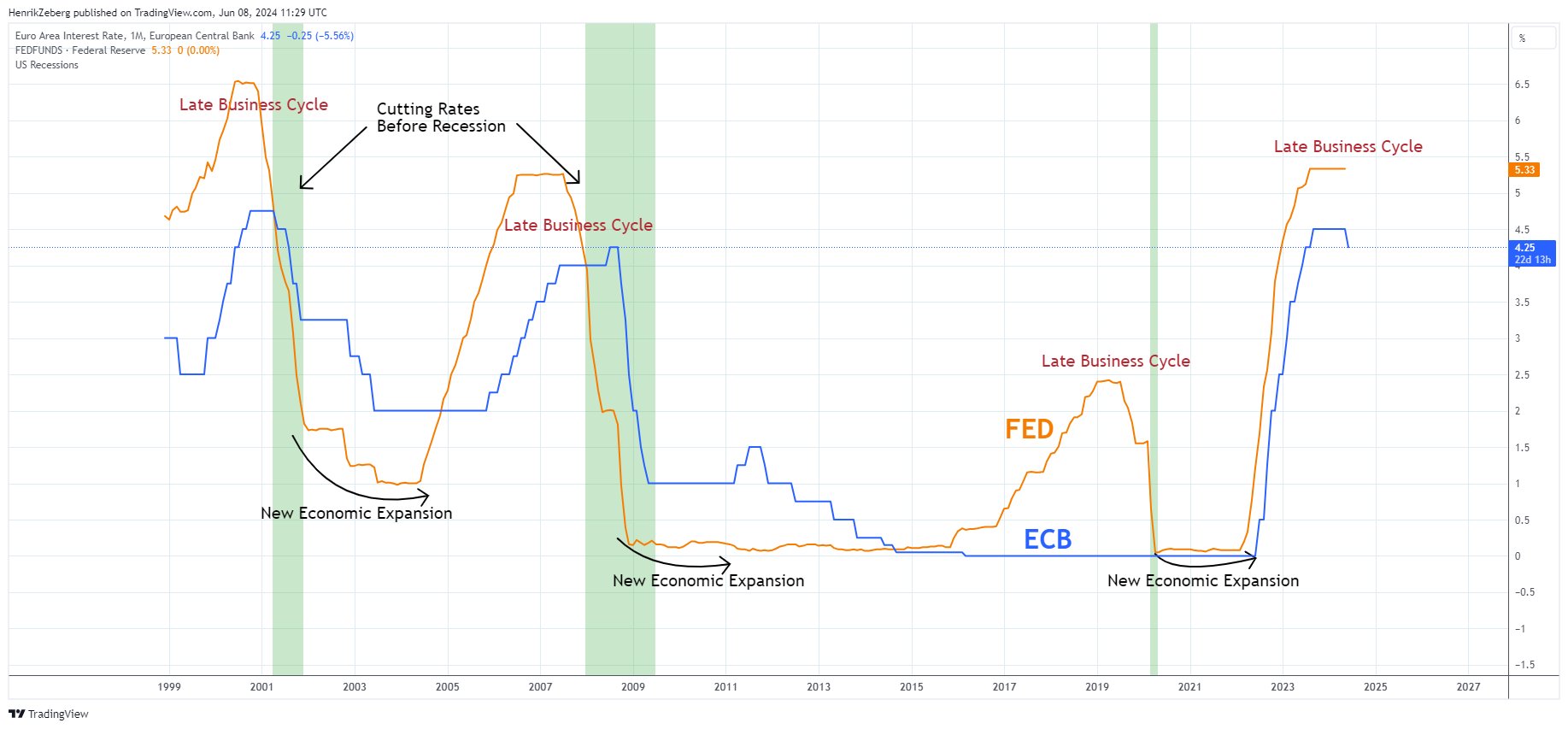

Zeberg shares one other chart suggesting that central banks just like the Federal Reserve within the US and the European Central Financial institution (ECB) have a tendency to chop charges shortly earlier than a recession.

“Financial Growth forward – or Late Cycle and therefore Recession forward?

Let me make it straightforward for individuals who discover it obscure the place we’re within the Enterprise Cycle.

On Thursday, ECB selected to chop its Fund Charges.

ECB and FED all the time will attempt to lower charges late cycle to hinder economic system from falling into recession.

Now have a look at the chart.

Are we ‘Late Cycle’ – or standing in entrance of ‘New Financial Growth’?

THINK!”

This month, each the Financial institution of Canada (BOC) and the ECB lowered rates of interest.

The Federal Reserve’s subsequent assertion on the Federal Funds Fee is anticipated on the June twelfth Federal Open Market Committee (FOMC) assembly. The central financial institution is anticipated to maintain charges unchanged.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/svetabelaya/WindAwake