Bitcoin’s value has risen roughly 2% prior to now 24 hours, trending above $70,000, a psychological degree. As bulls put together for extra beneficial properties, Willy Woo, an on-chain analyst, believes the coin may soar even larger after breaking above the all-important resistance degree at $72,000.

Will Bitcoin Soar To $75,000 Due To A Brief Squeeze?

Even after the spike on Could 20 lifted the coin above $66,000 after days of decrease lows, taking Bitcoin to $56,500, bulls didn’t observe by means of. As issues stand now, Bitcoin is inside a broader vary, capped at $72,000, the primary native help, and $73,800, the all-time excessive.

Associated Studying

Nevertheless, a breach can be important contemplating the importance of $72,000, a degree that has solely been retested however not damaged in a number of weeks. One clarification for potential value growth is {that a} breakout, ideally with rising quantity, would possibly sign the beginning of one other leg up, drawing demand.

For Woo, closing $72,000 may see costs quick increase, even breaking $75,000 due to a brief squeeze. As soon as bulls pierce and shut above this degree of curiosity, there can be a wave of liquidations, the place many brief positions are pressured to shut, driving costs larger.

Based mostly on Woo’s evaluation, roughly $1.5 billion price of brief positions shall be liquidated “all the way in which as much as $75,000.” If this occurs, then it’s extremely possible that Bitcoin will register new all-time highs roughly seven weeks after Halving.

Influx To Spot BTC ETFs Rising, Demand Will Solely Proceed Rising

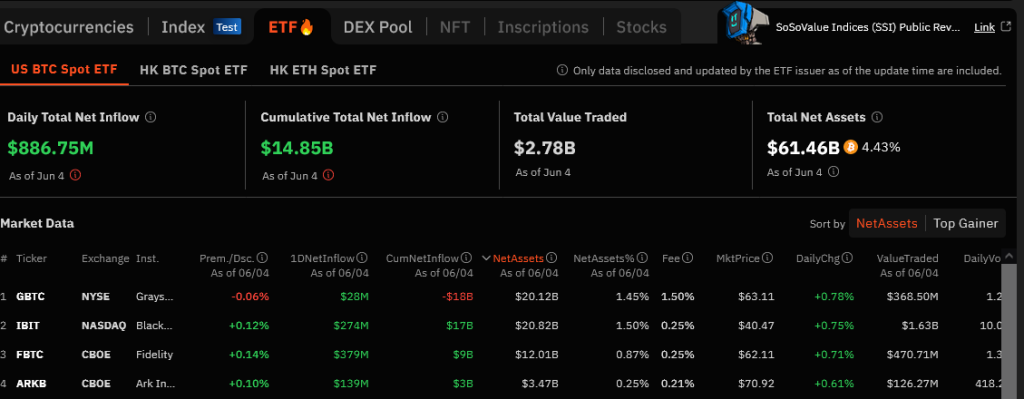

Underpinning this bullish sentiment is the spectacular surge in institutional inflows into spot Bitcoin exchange-traded funds (ETFs) on June 4. In response to sosovalue knowledge, spot Bitcoin ETF issuers purchased $886.6 million price of BTC yesterday.

Constancy purchased $378.7 million of BTC, whereas BlackRock, behind the most important spot BTC ETF, purchased $274.4 million of the coin. Bitwise additionally made a considerable demand, including $61 million of BTC.

Apparently, Grayscale additionally noticed inflows, including $28.2 million of BTC on behalf of its purchasers. This inflow was the second-highest day by day influx quantity for the reason that launch of spot Bitcoin ETFs in January 2024.

Associated Studying

With this wave of institutional demand, Bitcoin is above $71,500. Most significantly, costs stay above $70,000, confirming the bull spike from the center BB on June 3.

The demand for these complicated derivatives will solely improve. Yesterday, the Thailand Securities and Alternate Fee (SEC) accredited the nation’s first spot Bitcoin ETF. The product will solely be accessible to rich and institutional buyers. The inexperienced lighting comes after an analogous product went reside in Australia.

Function picture from DALLE, chart from TradingView