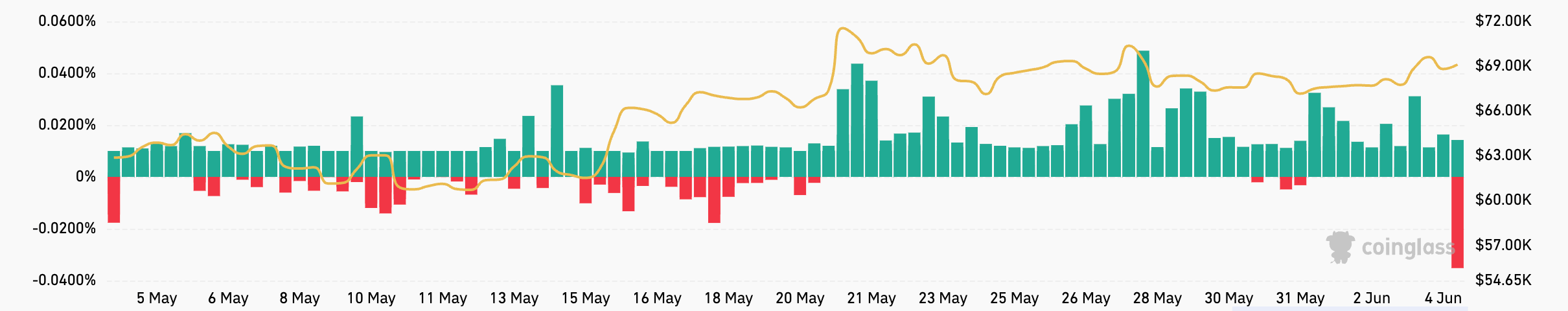

The funding price for perpetual futures serves as a proxy for market sentiment and exhibits the stability between lengthy and brief positions. Vital deviations from the typical funding price throughout exchanges can sign potential imbalances in positioning. A spike within the funding price on a selected alternate exhibits a lot of lengthy positions, which might result in a possible squeeze or lengthy liquidations if the market turns.

One other remark that may be produced from the adjustments in funding charges is arbitrage alternatives. A big divergence between exchanges or contract varieties allows merchants to capitalize on non permanent market inefficiencies. For this reason even the slightest adjustments in funding charges might be necessary, as they’ll act as early warning indicators of potential market shifts or adjustments in sentiment.

The funding price for USDT and USD-margined perpetual futures has been comparatively steady all through Could. That is indicative of a comparatively steady market that’s leaning bullish. This stability was briefly damaged on Could 27, when the funding price for USDT and USD-margined perpetual futures on dYdX spiked to 0.0889%. This was a pointy deviation from the typical price of round 0.0120% throughout different exchanges, indicating a big imbalance between lengthy and brief positions. Extra merchants taking over lengthy positions might have resulted from Bitcoin’s transient value spike to over $70,000. Nevertheless, as different exchanges noticed much less volatility of their funding price, there might have been a selected inefficiency that dYdX merchants have been speeding to use.

The funding price for token-margined perpetual futures has skilled comparable stability prior to now 30 days, hovering between 0.0100% and 0.0140% all through Could. Within the early hours of June 4, Bitmex noticed a big drop in funding price for token-margined perpetual futures from a steady 0.0100% to -0.0352%. Such a pointy drop in 24 hours confirmed a sturdy bearish sentiment amongst merchants. Nevertheless, with different exchanges seeing their charges steady at 0.0100%, the bearish sentiment appears to be concentrated amongst Bitmex customers alone. Bitmex’s morning funding price was near the decrease restrict of -0.0375% set by many exchanges, which confirmed excessive positioning in these contracts in comparison with USDT or USD-margined contracts.

All through the day, the funding price managed to consolidate at round -0.0150%, additional displaying the volatility’s short-lived nature.

A few of this volatility might be attributed to the speculative nature of token-margined contracts. Exchanges providing token-margined perpetual futures typically present increased leverage than USDT or USD-margined contracts. Whereas increased leverage can amplify potential features, it additionally magnifies losses, making token-margined contracts riskier and extra appropriate for speculative buying and selling methods.

Token-margined perpetual futures have a tendency to draw a better proportion of retail merchants and speculators who’re extra risk-tolerant and should search increased returns. Institutional buyers {and professional} merchants, who usually prioritize danger administration and capital preservation, usually tend to gravitate in the direction of USDT or USD-margined contracts, that are perceived as extra steady.

One other necessary issue that would have led to such a pointy drop within the funding price on Bitmex is market depth. Token-margined perpetual futures normally have decrease liquidity than their USDT or USD-margined counterparts. Decrease liquidity results in wider bid-ask spreads, making these markets extra prone to hypothesis and volatility.

The steady charges throughout most exchanges over the previous 30 days, mixed with Bitcoin’s comparatively range-bound value motion, point out a interval of market uncertainty and indecision. Due to this fact, the remoted drops and spikes in funding charges on particular exchanges prior to now weeks point out inside tendencies and adjustments greater than market-wide ones.

The submit Funding price volatility exhibits localized buying and selling imbalances regardless of market stability appeared first on CryptoSlate.