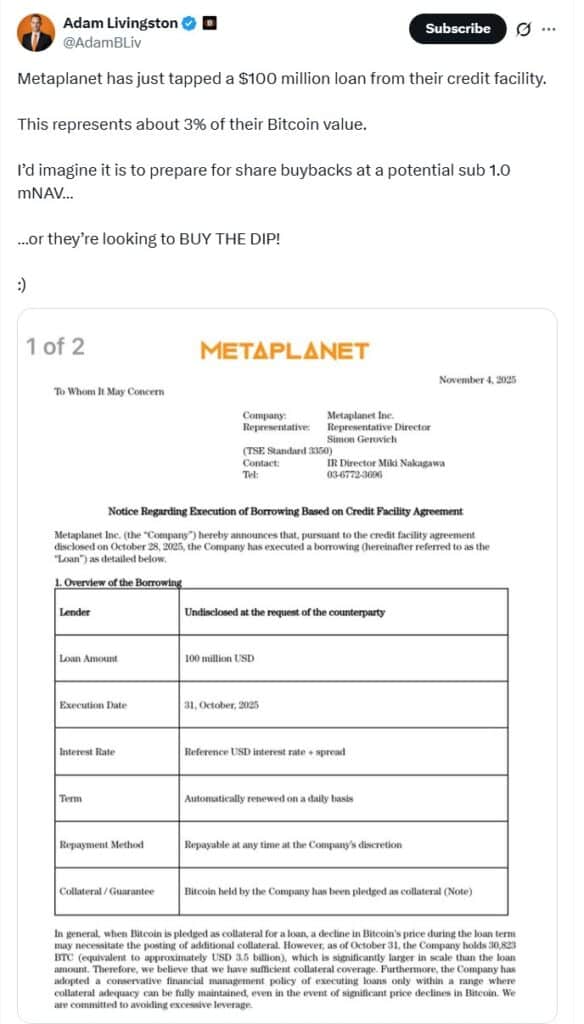

In a brand new disclosure, funding administration firm Millennium Administration has revealed holdings of virtually $2 billion in spot Bitcoin ETFs. This revealing was made by means of a SEC 13F-HR institutional funding supervisor holdings report filed at present, and underscores the rising curiosity and funding in Bitcoin ETFs by main institutional gamers.

JUST IN: 🇺🇸Millennium Administration discloses it holds $2 billion in spot #Bitcoin ETFs in new SEC submitting 👀 pic.twitter.com/hHzlWbHr9c

— Bitcoin Journal (@BitcoinMagazine) Could 15, 2024

The agency reported proudly owning for a mixed whole of $1,942,591,163:

– $844,181,820 of BlackRock’s iShares Bitcoin Belief

– $45,001,320 of ARK 21Shares Bitcoin ETF

– $44,737,805 of Bitwise Bitcoin ETF

– $202,029,915 of Grayscale Bitcoin Belief

– $806,640,303 of Constancy Sensible Origin Bitcoin Fund

Millennium Administration’s substantial funding comes only a day after the State of Wisconsin Funding Board (SWIB) disclosed its holdings of virtually $100 million in BlackRock’s spot Bitcoin ETF (IBIT) and $62 million in Grayscale’s GBTC. This wave of institutional curiosity highlights a rising development amongst main monetary entities to incorporate Bitcoin ETFs of their portfolios.

The latest surge in 13F filings has seen a wide range of establishments saying their Bitcoin ETF holdings. This contains not solely funding companies like Millennium and SWIB but additionally conventional monetary giants akin to JPMorgan Chase. JPMorgan, America’s largest financial institution, just lately disclosed its personal holdings in spot Bitcoin ETFs, noting its position as a market maker for these funding autos.

The development signifies a broader acceptance and integration of Bitcoin into mainstream monetary markets. Bitcoin ETFs, which give a regulated and accessible approach for establishments to achieve publicity to Bitcoin with out holding the asset instantly, have been gaining traction since their launch in america earlier this 12 months.

Millennium Administration’s almost $2 billion funding in spot Bitcoin ETFs marks one of many largest institutional commitments so far. The ripple impact of disclosures like this are more likely to be far-reaching.