It doesn’t matter what your buying and selling technique is, a bull run is sort of all the time a welcome sight — particularly in crypto buying and selling. Bull runs are extra than simply durations when costs shoot up: rising buying and selling volumes, investor curiosity, and new initiatives all seem throughout bull markets to create a more healthy ecosystem and a greater buying and selling setting. And once they finish, it’s all the time an opportunity for short-sellers to generate revenue. Attributable to them being so influential, you will need to be capable to inform when a bull is over — and in the present day, I’ll discuss a number of the finest to take action.

Is the 2024 Bitcoin Bull Run Over? Bitcoin’s Bull and Bear Run Cycle

Bitcoin’s bull and bear run cycles are an necessary dynamic that shapes the crypto market panorama. Usually, Bitcoin’s bull runs are triggered by main occasions comparable to halvings, which traditionally happen each 4 years and cut back the reward for mining new blocks, successfully lowering the brand new provide of Bitcoin. This shortage tends to drive costs up because of the elevated demand towards a restricted provide, aided by constructive investor sentiment and broader crypto adoption. These bull phases typically finish when the market turns into overly saturated, euphoria peaks, and macroeconomic components like regulatory modifications or international financial shifts immediate a sell-off.

On the flip facet, Bitcoin bear markets start when the sustained downward worth actions take maintain, typically made worse by dangerous information or shifts in market sentiment. These durations are a pure a part of the monetary cycle, serving to appropriate the excesses of the earlier bull run. For traders, the start of a bear market could be a possibility to reassess and plan for long-term holdings, whereas the tip of a bear market is likely to be the appropriate time to speculate earlier than the subsequent bull run begins, as new cycles of progress are sometimes on the horizon after vital corrections.

Bitcoin worth remained comparatively secure following the April 2024 Bitcoin halving, recording a short decline beneath $60K however rapidly bouncing again up and difficult the $64K resistance degree as soon as once more. On the time of writing, Bitcoin was nonetheless trying to maintain rising, with some specialists anticipating the second half of the bull run to be even higher than the earlier one, which noticed BTC document a brand new ATH of $73,750.07.

Try our Bitcoin worth prediction right here.

What Is a Bull Run?

A bull run in monetary markets refers to a interval of persistently rising costs marked by widespread optimism, investor confidence, and constructive market dynamics. This time period is ceaselessly utilized to varied asset lessons, together with shares, commodities, and, notably, digital currencies. Within the context of the cryptocurrency market, a crypto bull run entails a major and sustained enhance within the worth of crypto property like Bitcoin, Ethereum, and others.

Throughout such durations, cryptocurrency market contributors typically expertise heightened exercise and elevated funding flows pushed by expectations of continued upward developments. Components just like the launch of a Bitcoin ETF can additional bolster investor confidence by offering extra conventional publicity to digital currencies via regulated avenues.

7 Indicators That Present When a Bull Run Is Over

Listed below are seven key indicators that may sign the transition from bullish to bearish market circumstances.

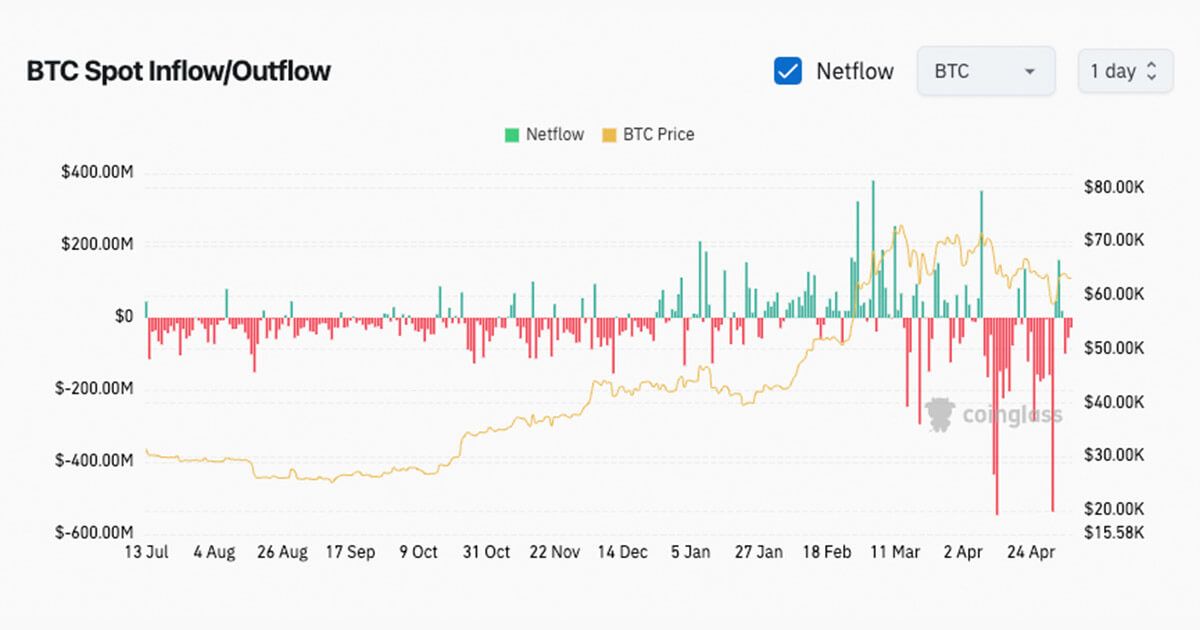

1. Decline in Buying and selling Quantity

A noticeable decline in buying and selling quantity could be a sturdy indicator {that a} bull run is dropping momentum. Throughout a bull market, excessive buying and selling volumes sometimes help rising costs as investor enthusiasm grows. When these volumes begin to drop off considerably, it may possibly counsel that fewer merchants are shopping for into the asset at greater costs, indicating a potential reversal or slowdown in market progress.

2. Elevated Market Volatility

Elevated volatility could be a precursor to a market peak. As uncertainty grows, worth fluctuations turn into extra pronounced, with property experiencing sharp rises and falls inside quick durations. This sort of erratic motion typically indicators that traders have gotten nervous, which may result in speedy sell-offs, ending the bull run. Within the crypto market, for instance, such volatility is just not unusual and might swiftly impression sentiment.

3. Bearish Divergence in Technical Indicators

Technical indicators just like the Relative Energy Index (RSI) and Shifting Common Convergence Divergence (MACD) can present bearish divergences as a bull run begins to wane. A bearish divergence happens when the worth of an asset makes a brand new excessive, however the indicator fails to achieve a brand new excessive. This discrepancy typically suggests weakening momentum and could be a warning signal of a possible reversal.

4. Curiosity Charges and Financial Shifts

Rates of interest set by central banks can affect market sentiment and asset costs. Rising rates of interest sometimes enhance the price of borrowing, which may dampen financial progress and cut back speculative buying and selling exercise. For traders, shifts in financial coverage are essential to watch, as they’ll precipitate the tip of bull markets throughout a variety of asset lessons, together with shares and, not directly, cryptocurrencies.

5. Adjustments in Market Management

A shift wherein sectors or property are main the market also can point out {that a} bull run is ending. As an example, if extra defensive sectors, comparable to utilities and client staples, start to outperform extra cyclical sectors, like expertise or client discretionary, it may sign that traders are transferring their cash into safer property, anticipating a downturn.

6. Regulatory Information and Geopolitical Dangers

Regulatory modifications or elevated geopolitical tensions can abruptly alter market dynamics. For instance, regulatory crackdowns within the cryptocurrency area can result in sudden and extreme worth drops, affecting broader market sentiment. Equally, geopolitical dangers like commerce wars or political instability in key economies can deter funding and set off a shift from a bull to a bear market.

7. Revenue-Taking by Institutional Buyers

Massive institutional traders typically begin to take income after substantial beneficial properties, which may result in a cascading impact the place smaller traders additionally start to promote, fearing a downturn. Monitoring the actions of those massive gamers can present early indications of a market high. In fairness markets, this is likely to be noticed via the disclosure filings of huge asset managers, whereas, in crypto, market evaluation platforms may point out massive pockets actions and exchanges.

What Is the Distinction Between a Bull and a Bear Run?

The distinction between a bull and a bear market primarily lies out there’s path and the final sentiment surrounding its future. A bull market is characterised by a sustained enhance in market costs, sometimes by 20% or extra from latest lows, throughout many securities or the index as an entire. This upward pattern is pushed by sturdy investor confidence and optimistic expectations about future financial and company efficiency. Throughout such instances, key components like charge cuts or constructive macroeconomic indicators can bolster investor confidence and additional stimulate funding in varied property, together with digital property.

In distinction, a bear market is outlined by a decline in asset costs, usually by 20% or extra from latest highs, throughout a broad spectrum of securities. This downward pattern is fueled by widespread pessimism, damaging investor sentiment, and sometimes a response to adversarial macroeconomic components. The present cycle of the market, indicators of market shifts, and reaching the bottom degree in key financial indicators can precipitate a bear market. Listed below are some potential advantages related to every market situation:

Bull Market Advantages:

Wealth Creation: Buyers can see substantial beneficial properties as the worth of shares, digital property, and different investments rises.

Financial Development: A rising market can result in elevated client spending and funding, boosting financial actions.

Elevated Funding Alternatives: New enterprises and preliminary public choices (IPOs) typically happen throughout bull markets, offering extra funding alternatives.

Constructive Sentiment: Common optimism makes it simpler to lift capital for companies and ventures.

Bear Market Advantages:

Shopping for Alternatives: Decrease asset costs can present shopping for alternatives for worth traders in search of underpriced shares or digital property.

Potential for Excessive Returns: Shopping for throughout a bear market can result in vital beneficial properties when the market finally rebounds.

Danger Administration Expertise: Buyers study to navigate via volatility and enhance their funding methods, specializing in long-term horizons and diversification.

In abstract, whereas bull markets are characterised by progress and optimism fueled by components like charge cuts and spot ETFs supporting crypto bull markets, bear markets are marked by decline and warning, typically instigated by damaging shifts in macroeconomic components. Each market circumstances provide distinctive alternatives and challenges to traders.

Conclusion: The best way to Inform if a Bull Run is Over

Figuring out the tip of a bull run entails deciphering a mix of technical knowledge, market sentiment, and broader financial indicators. Whereas no single indicator can present a definitive sign, a holistic strategy that features these components can provide substantial foresight, serving to to mitigate dangers and capitalize on potential alternatives. For each conventional and crypto markets, staying knowledgeable and responsive to those indicators is essential in navigating the complexities of buying and selling and investing.

FAQ

What’s a bull run in crypto?

A bull run in crypto is a interval characterised by sustained upward worth actions and considerably elevated market volumes. This part is commonly pushed by a surge in crypto adoption, constructive retail market sentiment, and, typically, favorable basic components comparable to technological developments or regulatory readability.

When is the subsequent crypto bull run?

Crypto bull runs are notoriously onerous to foretell because of the market’s excessive volatility and sensitivity to a variety of stimuli, from macroeconomic components to rumors of recent market entrants. Traditionally, components comparable to a discount in provide on exchanges, widespread adoption information, and vital international monetary shifts can trace on the onset of a brand new bull part. Nevertheless, predicting the precise timing could be as tough as hitting a curveball in baseball.

What’s a bear market?

A bear market is characterised by sustained downward worth actions and a common decline in market sentiment. Within the crypto world, bear markets are sometimes triggered by dangerous information, comparable to regulatory crackdowns or main hacks, coupled with damaging retail market sentiment. A bear market can result in pessimism and withdrawal, typically exacerbating the downward pattern as extra holders search to liquidate their positions.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.