The latest actions of the US Division of Justice (DOJ) have ignited a fierce debate on the way forward for monetary privateness.

The crackdown on Wasabi Pockets’s service has raised vital issues amongst privateness advocates and crypto customers alike, spotlighting the strain between regulatory actions and the appropriate to personal digital transactions.

A Blow To Privateness: DOJ Targets Wasabi Pockets

Wasabi Pockets, identified for its privacy-focused options, not too long ago introduced the shutdown of its Coinjoin coordination service. This service was integral to enhancing consumer anonymity by mixing particulars of a number of transactions to obscure the path again to the fund’s unique supply.

The choice got here after heightened scrutiny from the DOJ, which has more and more targeted on privateness instruments underneath the guise of stopping illicit monetary actions. This motion has not solely disrupted service operations but additionally sparked a broader dialog about privateness rights within the digital realm.

Naomi Brockwell, a vocal cryptocurrency advocate, expressed her dismay on X, emphasizing that monetary privateness is key to a free society. Her sentiments echo a rising discomfort amongst digital customers and privateness proponents who view such regulatory measures as “overly intrusive” and “detrimental” to private freedoms.

This week the DOJ criminalized the devs of an app that restores monetary privateness. Monetary privateness is important for a free society.I had a short chat again in 2020 with @Snowden in regards to the want for privateness in bitcoin.https://t.co/FBDSqqpvXJ pic.twitter.com/X2nNPJYSgc

— Naomi Brockwell (@naomibrockwell) Might 3, 2024

The Response From The Crypto Neighborhood

The response from the crypto group was swift and pointed, with notable figures like Edward Snowden weighing in on the implications for Bitcoin’s future. Snowden, a long-time advocate for privateness rights, criticized the sluggish progress on enhancing privateness options throughout the Bitcoin community.

His feedback replicate a frustration with the continuing vulnerability of cryptocurrencies to potential authorities oversight and interference.

Snowden additionally underscored the urgency for builders to innovate and implement robust privateness options that might face up to governmental pressures.

He identified that the technological functionality exists however the implementation has lagged, leaving customers uncovered and the promise of decentralized monetary techniques unfulfilled. Snowden famous in a publish on X:

I’ve been warning Bitcoin builders for ten years that privateness must be offered for on the protocol stage. That is the ultimate warning. The clock is ticking.

In the meantime, the implications of the DOJ’s actions lengthen past Wasabi Pockets. To this point, the US DOJ seems to be on a development of elevated regulatory interventions within the cryptocurrency area.

Not too long ago, following the enforcement measures towards Twister Money and Binance, the DOJ not too long ago initiated a lawsuit towards KuCoin, a number one cryptocurrency change, for a number of regulatory violations, together with breaches of anti-money laundering legal guidelines in america.

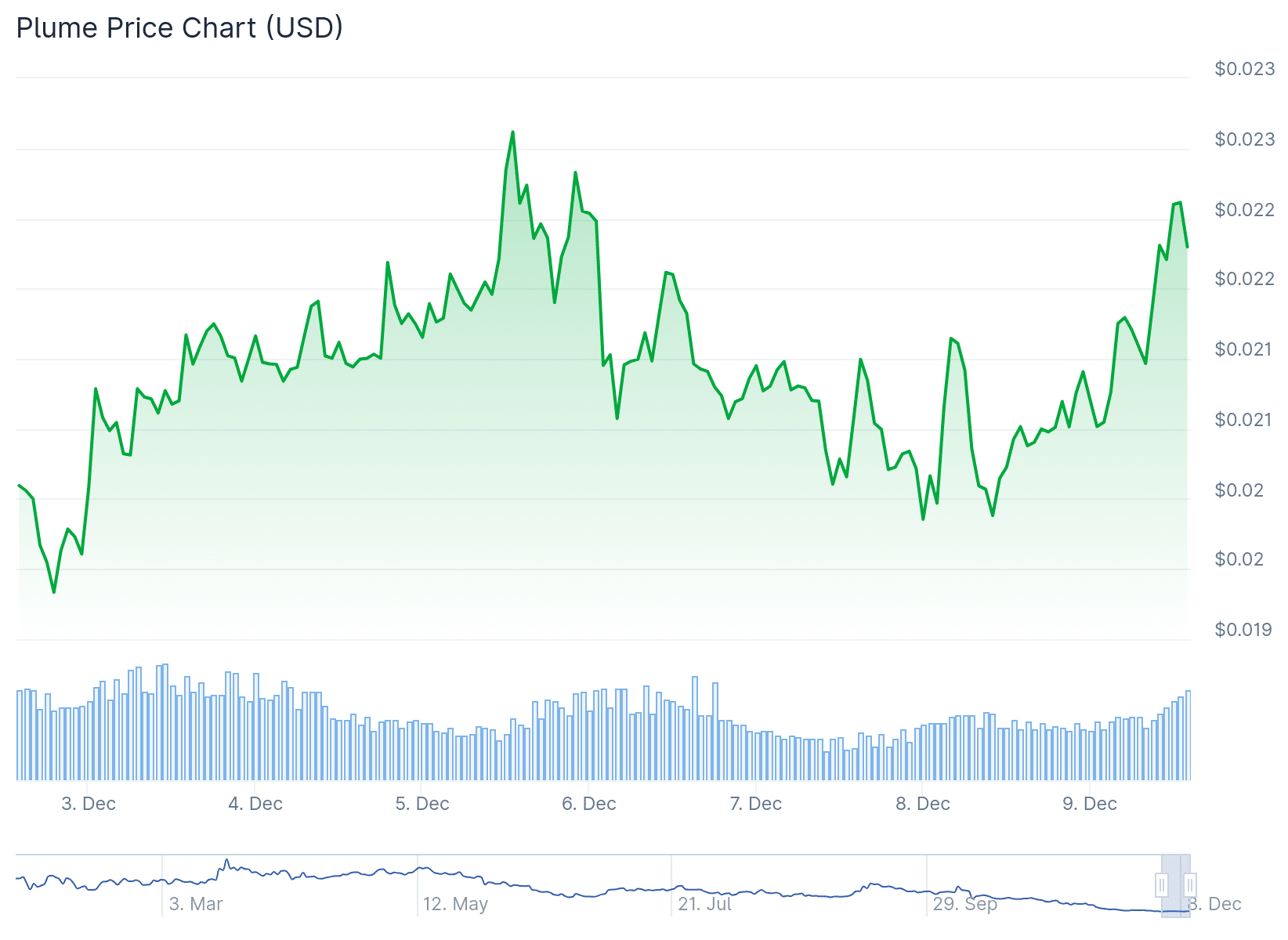

Featured picture from Unsplash, Chart from TradingView