In a current thread on X (previously Twitter), famend on-chain analyst Checkmate supplied an evaluation relating to the long run trajectory of Bitcoin. At the moment, the premier cryptocurrency hovers across the $60,000 mark, a pivotal second that echoes historic patterns throughout the Bitcoin market cycle.

What Will The Subsequent 6 Months Deliver For Bitcoin?

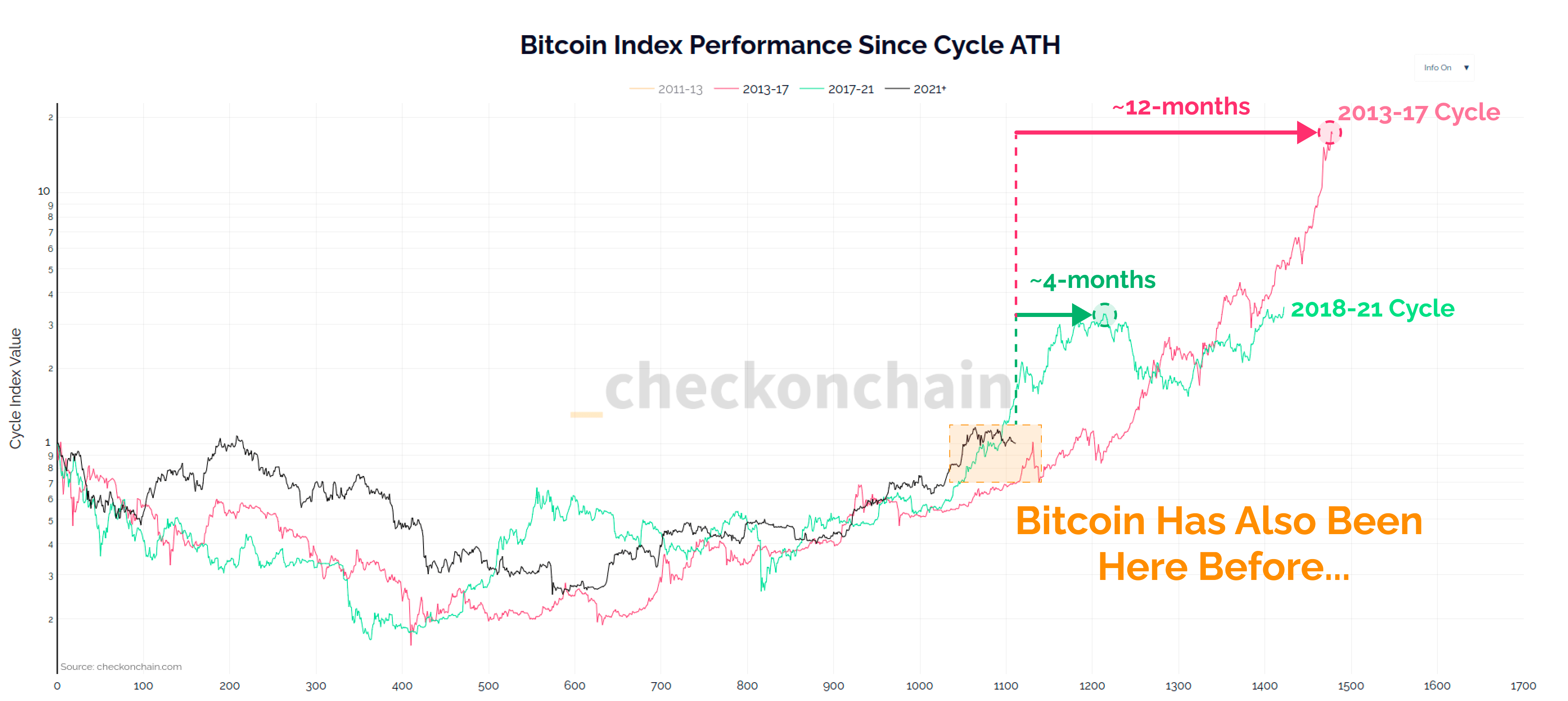

Checkmate argues that Bitcoin is positioned in a “chopsolidation” section—a time period coined to explain a stagnant but unstable interval. He means that this might final roughly six months, based mostly on earlier cycles, and doubtlessly usher in a interval of parabolic progress that might final between six to 12 months. “Bitcoin historical past tends to rhyme, and up to now, this cycle is not any totally different,” Checkmate famous. “The tune sung over the past two cycles paints round 6-months of chopsolidation forward of us, adopted by 6-12 months of parabolic advance.”

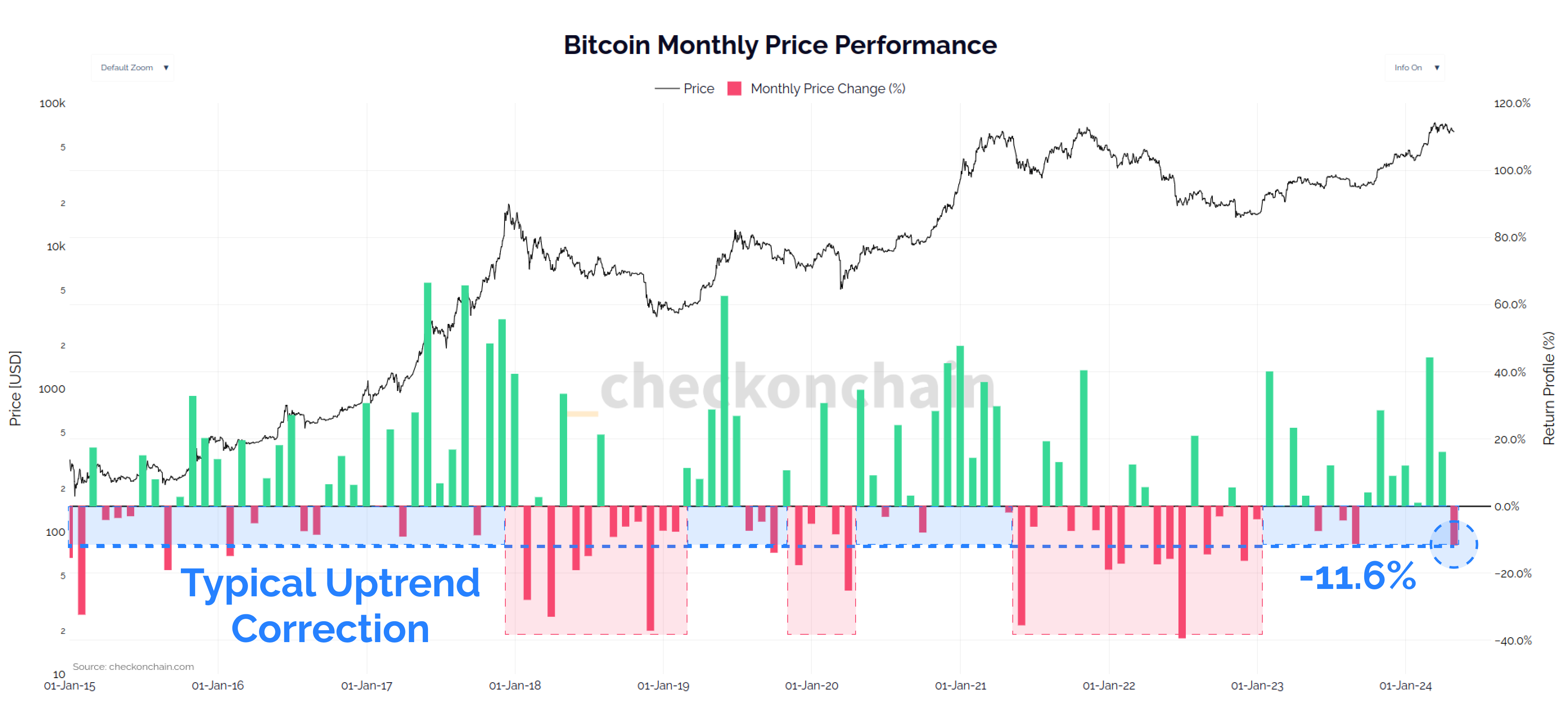

Supporting his evaluation, Checkmate refers to April 2021 as a major excessive level for Bitcoin for “many good causes,” noting that regardless of a substantial month-to-month drop of over $8,250 in April, such actions are typical and sometimes signify wholesome market corrections. “It’s an -11.2% month-to-month pullback, and is extraordinarily widespread throughout uptrends, and corrections are wholesome and vital,” he said, reinforcing his confidence in Bitcoin’s resilience and potential for restoration.

Additional statistical backing comes from historic information targeted solely on Bitcoin halving years (2012, 2016, 2020, and 2024), which Checkmate used as an example that such month-over-month corrections usually are not outliers however moderately widespread occurrences throughout the digital asset’s cyclical developments. The tip of every 12 months post-halving has traditionally proven robust efficiency, supporting the notion that the present worth level could possibly be a precursor to vital beneficial properties.

Promote In Might And Go Away?

Checkmate additionally retweeted a put up from Charles Edwards. The founding father of Capriole Investments commented in the marketplace’s unprecedented bullishness, implying {that a} deeper correction is to be anticipated.

“That is beginning to get ridiculous. Bitcoin has not had a run like this since inception. We at the moment are 1 day in need of the report set in 2011 for days and not using a significant dip [more than 25%]. If you’re not ready to simply accept some draw back on this asset class, you shouldn’t be right here. Particularly now,” stated Edwards. His comment highlights the weird lack of extreme downturns available in the market, suggesting that buyers ought to be ready for potential volatility.

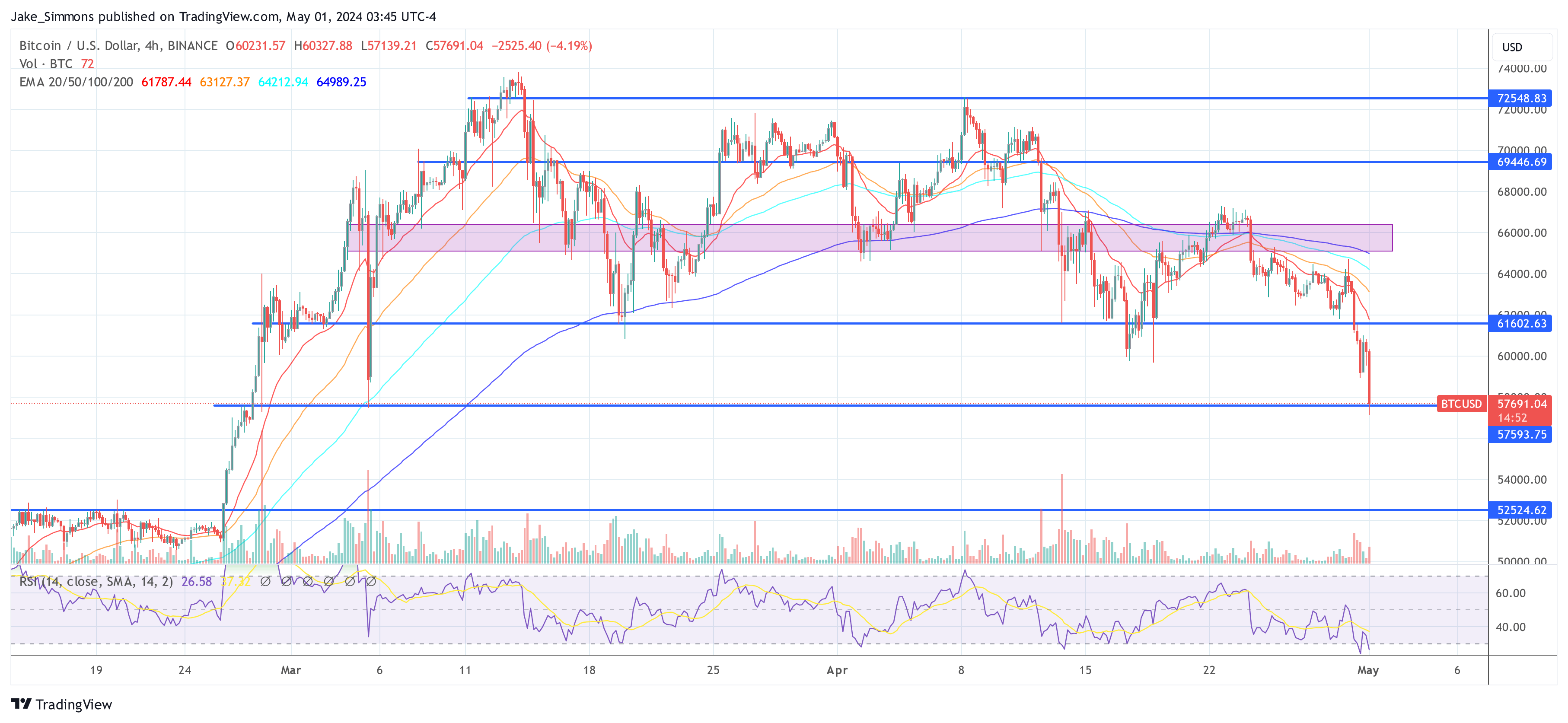

In one other put up on X, Edwards added a cautious observe to the in any other case optimistic outlook. He suggested, “Promote in Might and go away. This seems like distribution to me. So long as we commerce beneath $61.5K, situation (1) is technically extra probably. A powerful reclaim of $61.5K would give some hopes to the bulls for situation (2). A flush would even be good for the sustaining continuation of the bull market, the earlier we get one, the higher the lengthy alternatives are.”

This angle suggests a strategic withdrawal could also be sensible within the quick time period, implying that present market circumstances may be extra bearish than they seem and {that a} vital correction might doubtlessly strengthen the market’s long-term prospects.

At press time, the BTC plunged to $57,691.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.