Ever puzzled the right way to break away from the confines of typical and concentrated liquidity AMMs? I’ve gathered all of the ‘have to know’ a few true game-changer in onchain buying and selling; a platform engineered to empower merchants and liquidity suppliers such as you and me with capabilities that flip the tide in our favor, providing a stage of personalization and management beforehand unimaginable within the DeFi house.

Key Parts of Carbon DeFi by Bancor

Order Sorts and CapabilitiesAdjustability FeaturesBuilt in Execution BotBacktesting SimulatorAdvanced Exercise TrackerThe Expertise on the Core

Order Sorts and Capabilities

Previous to diving into Carbon DeFi’s particular person options, it’s essential to spotlight a very game-changing benefit:

Technique makers have interaction with the platform with out incurring fuel or buying and selling charges upon order execution.

It is a monumental shift from the norm. You solely pay for fuel when creating or modifying a technique, which means your technique can execute a number of trades with none further price burden.

Key Insights:

• Zero Value on Execution

In contrast to conventional platforms, executing trades on Carbon DeFi doesn’t bleed your pockets dry with charges.

• Inherent Good Contract Design

The structure of Carbon DeFi’s order sorts is ingeniously crafted.

By embedding performance immediately into good contracts, the platform sidesteps reliance on probably susceptible exterior events like oracles, hooks, and keepers.

This strategic selection not solely streamlines operations however considerably boosts safety by mitigating widespread DeFi dangers, corresponding to oracle manipulation.

• Strong Safety

Carbon DeFi underwent three complete audits earlier than its public launch, making certain a fortress-like safety posture.

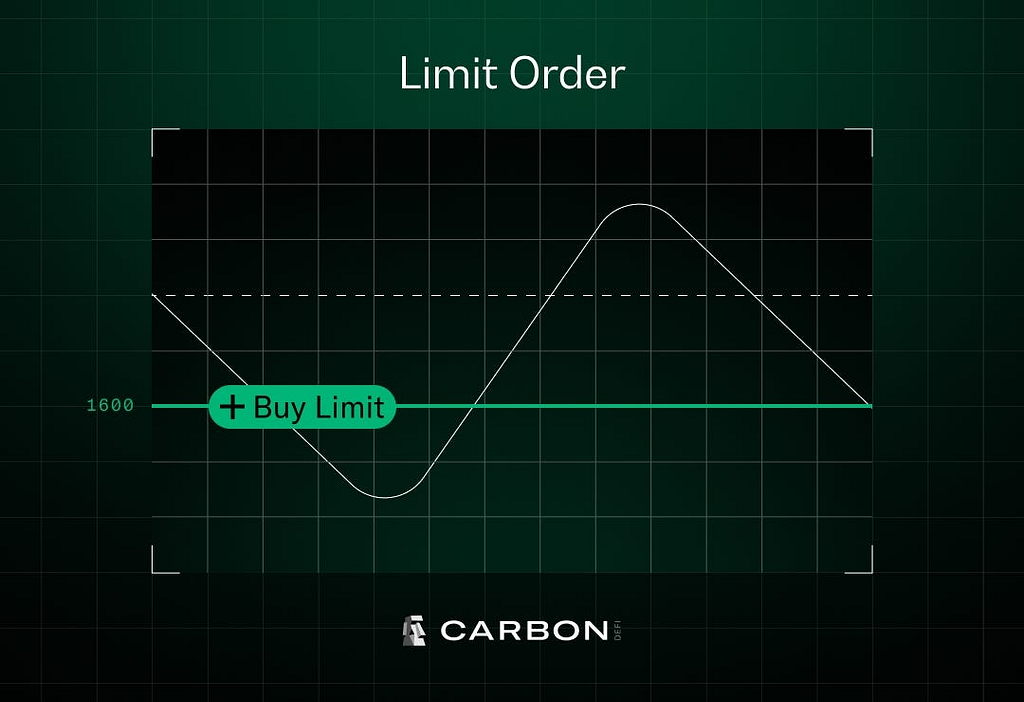

Peer-to-Peer Restrict Orders

Carbon DeFi reintroduces the strategic essence of conventional buying and selling with its native Restrict Orders.

This order kind permits you to set exact purchase or promote targets, akin to the subtle programs seen in centralized exchanges — but it stays firmly rooted within the ethos of decentralization.

Key Options:

• Precise Value Execution

Decide your ideally suited entry and exit factors with unparalleled accuracy. Whether or not shopping for or promoting, you management the value, making certain your technique unfolds precisely as deliberate.

• Zero Charges on Crammed Orders

A standout profit. When your restrict orders are executed, you’re not burdened by buying and selling or fuel charges. It’s a cost-efficient strategy that maximizes your funding potential, setting Carbon DeFi aside from the crowd.

• Intuitive Design

For these accustomed to restrict orders on centralized exchanges, the transition to Carbon DeFi is seamless. The interface is designed to really feel intuitive, marrying conventional performance with the modern fringe of DeFi.

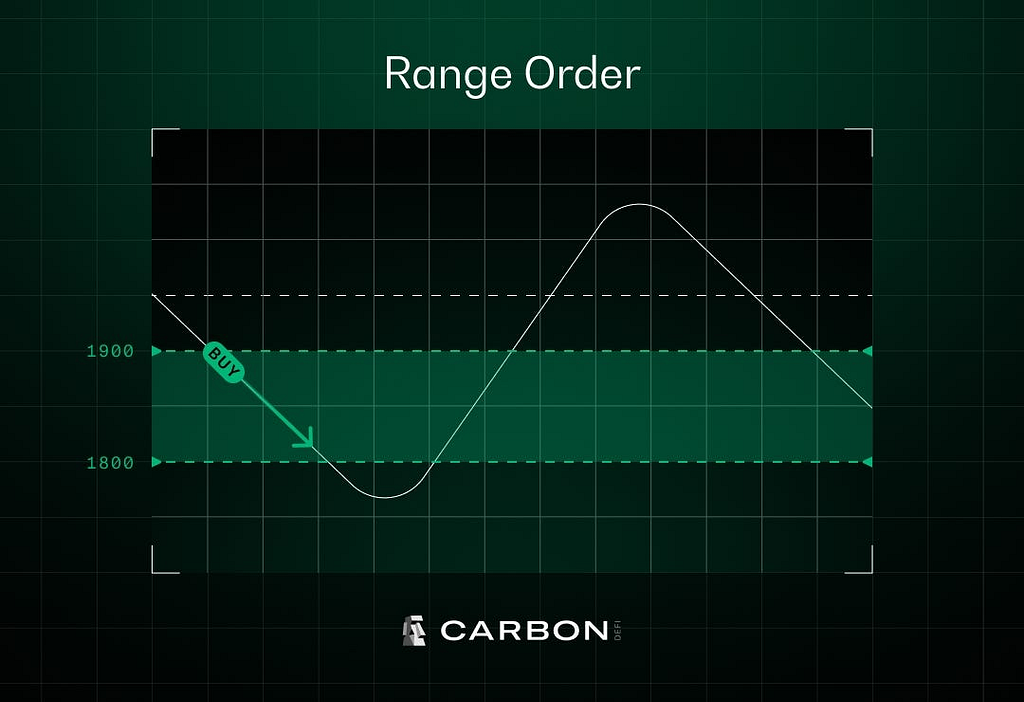

Vary Orders: Scaling In/Out Onchain

Innovating Past Conventional Limits

Carbon DeFi stands out with its Vary Orders characteristic, a real differentiator within the panorama of digital buying and selling. This performance empowers merchants to simply outline a worth vary to commerce inside, with Carbon DeFi mapping out an in depth sequence of restrict orders throughout the desired worth vary.

How It Works:

• Granular Management

Think about setting a single order to promote Ethereum (ETH) as the value will increase from $6,500 to $7,000. With Vary Orders, that is now an onchain actuality.

Behind the scenes, Carbon DeFi interprets a variety order into an intricate set of discrete restrict orders, akin to putting a myriad of pinpointed bets throughout a spectrum of values in a standard order e book.

• Market Fluctuation Mastery

This structural element makes Vary Orders a really perfect instrument for navigating the usually unpredictable waves of market volatility. It permits for a nuanced, dynamic strategy to buying and selling that may adapt to sudden adjustments, providing a stage of precision and adaptableness that conventional order sorts merely can not match.

Why It’s a Recreation-Changer:

Vary Orders redefine what’s potential in onchain buying and selling. They supply a complicated mechanism for executing a technique that’s each broad in its imaginative and prescient and exact in its execution.

This characteristic caters to the wants of merchants seeking to optimize their entry and exit factors, leveraging market fluctuations to their benefit in methods beforehand deemed unattainable.

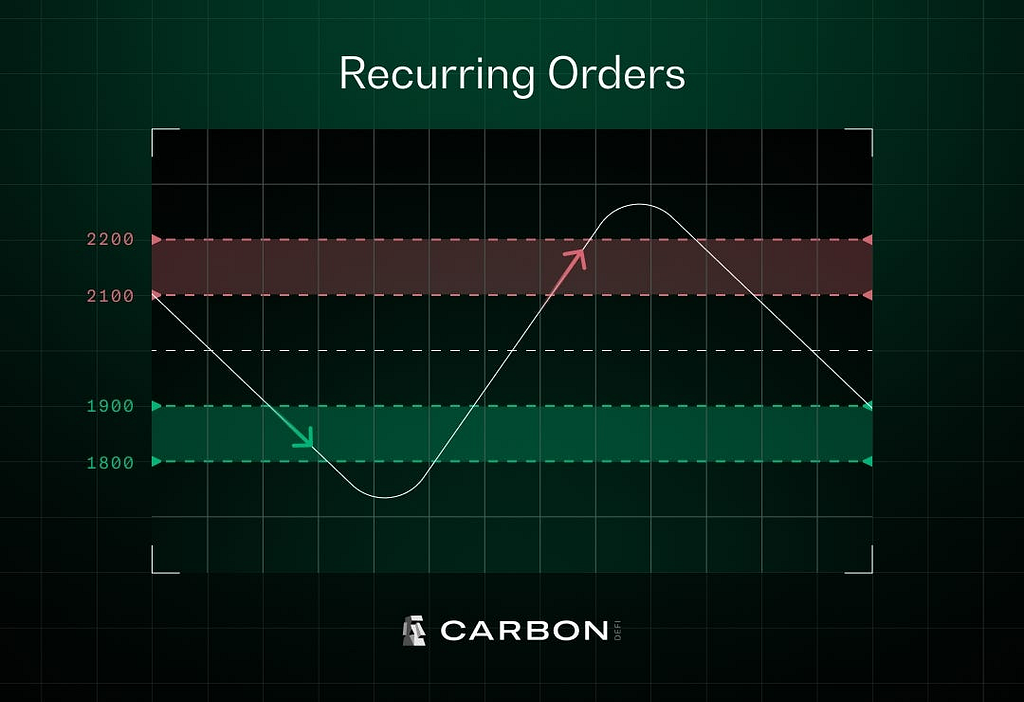

Recurring Orders: Automated Fading Methods

Automation Meets Precision

Carbon DeFi introduces Recurring Orders, a characteristic on the forefront of buying and selling automation.

This technique kind was designed to harness market volatility by intelligently linking purchase and promote orders. As one order is fulfilled, it mechanically units the stage for the following, making a self-sustaining cycle that capitalizes on the precept of “shopping for low and promoting excessive.”

How It Elevates Buying and selling:

• Perpetual Buying and selling Cycle

As soon as an order is accomplished, the acquired tokens mechanically finance the following reverse order, setting in movement a steady loop of strategic transactions.

This cycle is akin to having a private buying and selling bot or grid system, meticulously executing buys and sells at predefined ranges.

• Token Accumulation and Revenue Compounding

Via this cyclic course of, not solely do you accumulate tokens by capitalizing on favorable market circumstances, however you additionally compound your income over time, streamlining what would in any other case be a demanding and sophisticated guide buying and selling technique.

• Customizable Linked Orders

Carbon DeFi provides unparalleled flexibility, permitting you to hyperlink varied order sorts corresponding to limit-limit, range-limit, limit-range, or range-range. This customization ensures that your buying and selling technique aligns completely together with your market expectations and funding objectives.

• Provoke a Restrict Order With Sources You Don’t But Possess:

You’re not required to fund either side of the technique upfront. This implies you’ll be able to successfully leverage future features to gas your present buying and selling technique, a singular aggressive edge for technique makers.

Recurring Orders by Carbon DeFi not solely simplifies the buying and selling course of however democratizes entry to superior buying and selling ways beforehand reserved for less than probably the most subtle buying and selling programs.

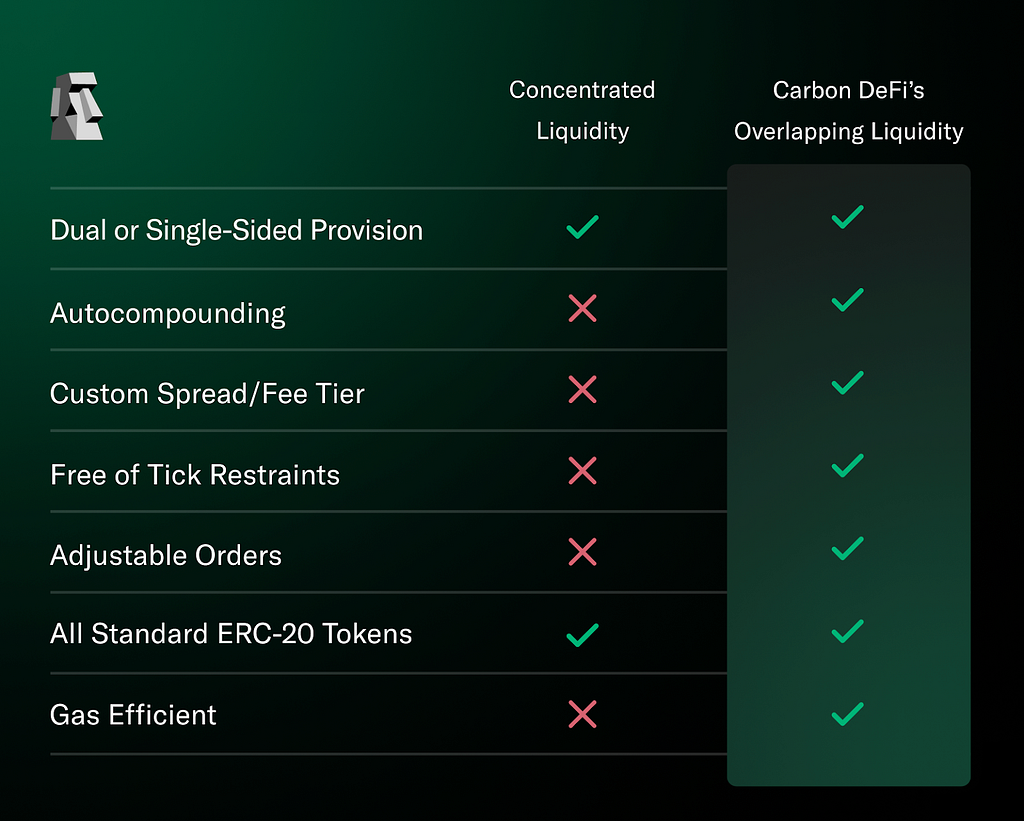

Overlapping Liquidity: Subsequent-Era Concentrated Liquidity

Mastering the Quick-Straddle (or Quick-Gamma) Place in DeFi Buying and selling

A Leap in Buying and selling Effectivity

At its core, Overlapping Liquidity represents a particular association of linked vary orders. It’s not simply an addition to the platform’s sturdy order sorts; it’s a leap in direction of a brand new period of concentrated liquidity positions tailor-made for the person dealer, providing:

• Customizable Unfold AKA Price Tiers

Break away from the constraints of typical concentrated liquidity fashions.

With Carbon DeFi, you’re now not tied to pre-defined payment tiers. As an alternative, you will have the facility to set your personal spreads, opening the door to customized buying and selling methods that match your distinctive threat and reward profile.

• Gasoline-Environment friendly Methods

Carbon DeFi stands out by permitting merchants to determine overlapping liquidity methods inside any worth vary in a gas-efficient method. This ensures that your buying and selling actions should not solely strategic but in addition cost-effective, maximizing your potential returns.

This forward-thinking strategy offers a big benefit, empowering you to craft methods that leverage concentrated AMM positions with out the normal limitations.

By enabling merchants to decide on their payment tiers and effectively handle liquidity inside any worth vary, Carbon DeFi is not only accommodating the wants of in the present day’s merchants — it’s anticipating the calls for of tomorrow’s markets.

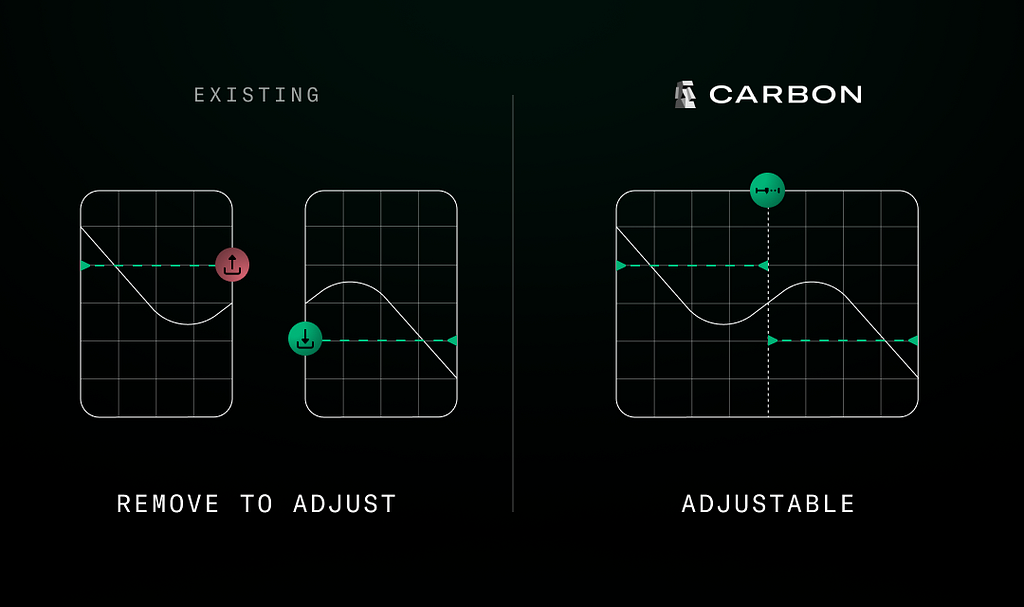

Flexibility at Your Fingertips

The flexibility to swiftly adapt to market adjustments is not only a bonus; it’s a necessity.

Carbon DeFi rises to this problem, revolutionizing onchain buying and selling with unmatched adaptability. Via a mix of superior applied sciences, an intuitive interface, and a collection of versatile order sorts, Carbon DeFi empowers merchants to fine-tune their methods with unprecedented ease and effectivity.

• Modify Pricing

Seamlessly modify the purchase and promote costs of your tokens on the fly.

With Carbon DeFi, there’s no have to cancel orders, withdraw, redeposit funds, or arrange new methods.

Modifying pricing permits for fast changes, permitting you to place your self precisely the place you wish to be within the market.

• Modify Place Dimension: Add and Withdraw Funds

Improve or cut back your stake in a technique at any second, with out dropping the essence of your strategic strategy embedded within the good contract. Whether or not it’s a partial withdrawal or an entire exit, your technique stays intact, prepared for reactivation everytime you select.

• Pause and Unpause

Take management of your buying and selling with the power to pause and unpause buying and selling actions.

Pausing ensures your tokens are quickly off-limits for buying and selling, permitting for strategic recalibrations.

Unpausing swiftly reengages your positions at your newly outlined parameters.

This flexibility is invaluable in a market identified for its speedy shifts and turns, providing merchants a big edge. Whether or not tweaking costs, adjusting positions, or taking a second to reassess technique with out dropping floor, Carbon DeFi positions its customers for potential success amidst the volatility of the DeFi panorama.

Environment friendly Order Execution: A Inbuilt Arbitrage Bot

The Final DEX/Bot Hybrid

Within the quest for unparalleled effectivity in DeFi, the modern minds at Bancor unveiled a groundbreaking resolution: the Arb Quick Lane. This open-sourced, permissionless arbitrage framework is seamlessly built-in into Carbon DeFi’s ecosystem, distinguishing itself with a singular proposition.

In a panorama craving effectivity and innovation, the DEX/Bot Hybrid design of Carbon DeFi and the Arb Quick Lane set a brand new benchmark, mixing the normal prowess of buying and selling bots with the clear, decentralized nature of DEXes.

• Bridging Markets with Precision

The Arb Quick Lane is not only an addition; it’s a conduit connecting Carbon DeFi’s markets with the huge liquidity swimming pools throughout the blockchain. Its deployment signifies a monumental leap in direction of making certain swift and well timed order execution for merchants, embodying a bridge that spans throughout your entire liquidity base of the deployed chain.

• Passive Mining Operations

Via the Arb Quick Lane, market members discover a distinctive pathway to DeFi engagement, paying homage to passive mining operations.

It provides a mix of energetic buying and selling advantages with the passive earnings attract, enriching the DeFi expertise.

• Hybrid Market Making Methods

The synergy between Carbon DeFi and the Arb Quick Lane Protocol illustrates a hybrid strategy that marries the very best of each worlds. What emerges is a system that mirrors the performance and effectivity of a conventional buying and selling bot, but is deeply rooted in DeFi rules.

Carbon DeFi, bolstered by the Arb Quick Lane, emerges as a powerhouse within the DeFi house. It combines the power to craft customized buying and selling methods with the introduction of novel order sorts, enhanced order execution, and an automatic strategy to market arbitrage.

Sharpening Your Edge: The Energy of the Carbon DeFi Simulator

A Beacon for Strategic Readability

https://medium.com/media/ac9ebd44347134c8bac249f9ff6890d6/href

The Carbon DeFi Simulator stands as a lighthouse, guiding merchants via the turbulent waters of the market.

It’s not only a instrument; it’s your strategic companion, providing neutral insights into buying and selling alternatives that span throughout any normal ERC20 token pairs, together with, and particularly unique token pairs.

Past Conventional Evaluation

The Simulator breaks free from the standard confines of USD, ETH, and BTC denominations, permitting for a broader spectrum of research with any token because the numeraire.

This characteristic is a game-changer, enabling customers to delve into historic market knowledge and worth charts with unparalleled depth and suppleness.

Whether or not you’re assessing Carbon DeFi’s technique choices or exploring uncharted token pairs, the Simulator equips you with the means to develop a eager instinct for the platform’s capabilities.

From Testing to Triumph

• Intuitive Studying

The core mission of the Simulator is to remodel customers from observers to strategists.

By providing a hands-on strategy to studying via historic knowledge evaluation, it bridges the hole between theoretical information and sensible execution.

• Seamless Technique Integration

With its flawless incorporation into Carbon DeFi’s interface, transitioning from technique testing to stay execution is as clean because it will get, making certain a cohesive and environment friendly buying and selling journey.

• Customization at Your Fingertips

Tailor your simulation with an array of choices, from selecting “Recurring Orders” to experimenting with “Overlapping Liquidity.” Set your worth targets and handle your funds with ease, crafting methods that align completely together with your buying and selling type and targets.

• Insightful Analytics for Knowledgeable Choices

Upon concluding a simulation, you’re not simply left with hypothetical outcomes. The Simulator provides a treasure trove of analytics:

Dynamic ChartsPerformance SummariesComprehensive Commerce Historical past Log and extra

By offering detailed analytics and versatile simulation choices, it ensures merchants are well-equipped to navigate the DeFi panorama and perceive Carbon DeFi’s market mechanics, making it an indispensable asset for anybody seeking to harness the total potential of Carbon DeFi’s modern buying and selling platform.

https://medium.com/media/7fcfc4ed63029092ec6890715186805c/href

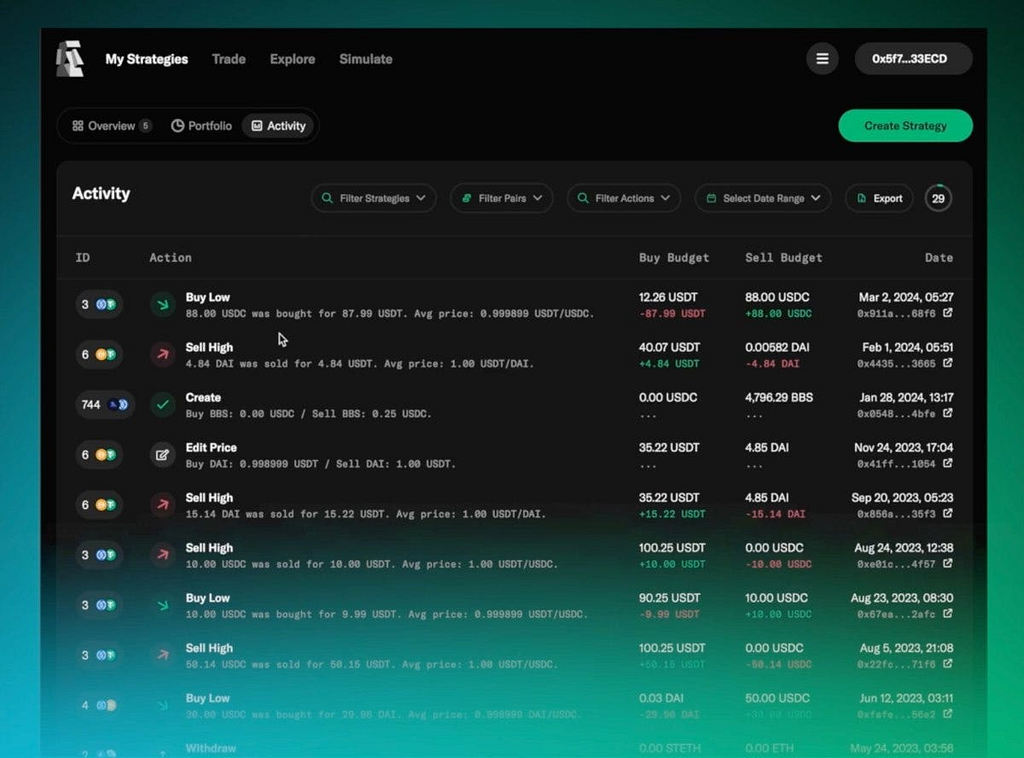

A New Period of Transparency and Effectivity

With the introduction of the Exercise Tracker, Carbon DeFi has shattered earlier limitations to knowledge accessibility. Up to date each 30 seconds, this dynamic instrument offers an unparalleled depth of perception into:

• A Particular Technique: Zoom in on the nuances and efficiency metrics of particular person methods, understanding each transfer and its impression.

• All Your Methods: Get a holistic view of your buying and selling endeavors, aggregating the info throughout all methods you’ve deployed.

• System-Huge Methods: Broaden your perspective with a chicken’s eye view of the ecosystem’s general buying and selling actions, capturing tendencies and actions throughout the board.

Past Conventional Boundaries

Earlier than the appearance of this characteristic, merchants waded via the murky waters of good contract analytics or leaned on exterior knowledge queries for insights — a cumbersome course of nonetheless plaguing customers of different DEX platforms, particularly throughout the AMM panorama.

The Exercise Tracker by Carbon DeFi transcends these challenges, integrating technique exercise immediately into the consumer interface, making knowledge not simply accessible however effortlessly so.

Why This Adjustments Every part

By consolidating essential buying and selling knowledge into an intuitive, real-time dashboard, Carbon DeFi empowers its customers with the information to make knowledgeable selections swiftly. This instrument democratizes knowledge evaluation, remodeling it from a posh, time-consuming process into an integral, seamless a part of the buying and selling expertise.

The Technological Evolution Reshaping DeFi

A Legacy of DeFi Breakthroughs

Carbon DeFi isn’t simply one other platform within the decentralized finance (DeFi) ecosystem; it’s the end result of years of pioneering work by Bancor, a reputation synonymous with innovation within the DeFi house.

From the inception of bonding curves and AMMs to the event of pool tokens, Bancor has persistently led the cost in shaping the panorama of DeFi expertise.

2017: The Daybreak of AMMs

Bancor set the DeFi world alight by introducing the primary Automated Market Maker (AMM) based mostly on its Fixed Product expertise. This breakthrough allowed liquidity suppliers to make sure market liquidity throughout all worth ranges, a boon for rising tokens seeking to acquire traction.

2020: Concentrated Liquidity

Advancing their imaginative and prescient, Bancor unveiled Concentrated Liquidity expertise, then referred to as Amplified Liquidity. This iteration refined the canonical AMM mannequin by mitigating worth slippage and focusing liquidity inside particular worth ranges, enhancing commerce effectivity and market stability.

2022: From AMMs to Uneven Liquidity

Persevering with on its path of innovation, Bancor launched Carbon DeFi, armed with a Novel Invariant Perform and Uneven Liquidity Swimming pools — known as Uneven Liquidity and Adjustable Bonding Curves. This improvement launched twin adjustable curves for getting and promoting, reshaping the DeFi panorama as soon as once more.

2023: Revolutionizing Arbitrage

The introduction of the Arb Quick Lane Protocol in March 2023 marked a brand new frontier for DeFi arbitrage. This permissionless arbitrage bot, built-in throughout the Bancor ecosystem, incentivizes customers to bridge worth disparities throughout exchanges, with almost 50% of the commerce awarded to profitable merchants. This not solely enhanced order execution inside Carbon DeFi but in addition fortified its place as a number one DeFi platform.

Bancor’s relentless pursuit of innovation has not solely formed the inspiration upon which Carbon DeFi stands however has additionally pushed the boundaries of what’s potential in DeFi.

Every technological milestone — be it the evolution from Fixed Product AMMs to Concentrated Liquidity to Uneven Liquidity and the groundbreaking Arb Quick Lane Buying and selling Bot — illustrates Bancor’s unwavering dedication to advancing the DeFi ecosystem.

Your Singular Answer for Onchain Buying and selling

Revolutionizing the DeFi Ecosystem with Unmatched Sophistication

Carbon DeFi emerges not simply as a beacon of innovation however because the very embodiment of buying and selling sophistication.

With its wealthy arsenal of superior order sorts, pioneering hybrid DEX/Bot structure, cutting-edge Backtesting Simulator, and Superior Exercise Tracker, Carbon DeFi redefines what merchants can count on from the DeFi house.

Unleashing the Energy of Superior Buying and selling

• Precision and Technique with Restrict Orders

Carbon DeFi takes precision to the following stage, permitting merchants to set actual entry and exit factors with Restrict Orders, making certain trades are executed on the most opportune moments.

• Adaptability via Vary and Recurring Orders

The platform’s Vary and Recurring Orders supply unmatched strategic flexibility, enabling merchants to adapt their methods in real-time to the ever-changing market circumstances.

• Commanding Management with Overlapping Liquidity

Overlapping Liquidity methods supply a stage of management beforehand unseen, permitting merchants to finely tune their market positions to seize the very best buying and selling alternatives.

Past a Platform: A Gateway to Buying and selling Excellence

Carbon DeFi transcends the normal boundaries of a buying and selling platform and stands as a gateway to unleashing buying and selling potential, providing a collection of instruments designed not only for navigating however for mastering the unstable crypto markets.

For the subtle dealer seeking to forge forward within the quickly evolving world of decentralized finance, Carbon DeFi provides the final word toolkit for success.

Trying Forward

As 2024 unfolds, Bancor units the tempo for the DeFi world, pushed by its strategic enlargement throughout an array of blockchain networks, together with:

Bancor Deployments of the Arb Quick Lane Protocol

BaseFantomMantleLinea

Licensed Third Occasion Deployments of Carbon DeFi’s Good Contracts

Mantle by VelocimeterBase by VelocimeterFantom by Velocimeter

Charting the Future: A Horizon Broadening with Each Step

The street forward for Bancor and its flagship improvements, Carbon DeFi and the Arb Quick Lane buying and selling bot, is something however static.

With a sequence of strategic deployments poised to unfold throughout a spectrum of blockchain ecosystems — together with Arbitrum, Linea, Blast, Sei, Canto, Scroll, Metis, Motion, Shardeum, and BSC — Bancor is getting ready to ushering in a brand new period for decentralized finance.

A Testomony to Innovation and Development

This formidable enlargement plan is a transparent testomony to Bancor’s dedication to pushing the boundaries of what’s potential in DeFi. Every new launch not solely broadens the attain of Bancor’s pioneering applied sciences but in addition integrates them into the material of the DeFi ecosystem, marking the beginning of a transformative journey for merchants worldwide.

Boundless Potential on the Horizon

As we glance to the long run, the chances for reshaping the onchain buying and selling panorama seem limitless.

Each integration, each deployment brings with it a wave of innovation, arming merchants with more and more subtle instruments and unlocking entry to untapped markets.

That is just the start of a journey marked by steady development and groundbreaking developments. Keep tuned, for the very best is certainly but to come.

Carbon DeFi is a product of Bancor and ruled by the Bancor DAO.

For extra on Carbon DeFi

Web site | X/Twitter | Telegram | YouTube

For extra on Bancor and its newest improvements

Web site | Weblog | X/Twitter | Arb Quick Lane Bot | YouTube | Governance

The Newest Breakthrough in Onchain Buying and selling– All You Have to Know was initially revealed in Bancor on Medium, the place individuals are persevering with the dialog by highlighting and responding to this story.