What Does “Bitcoin Halving” imply?

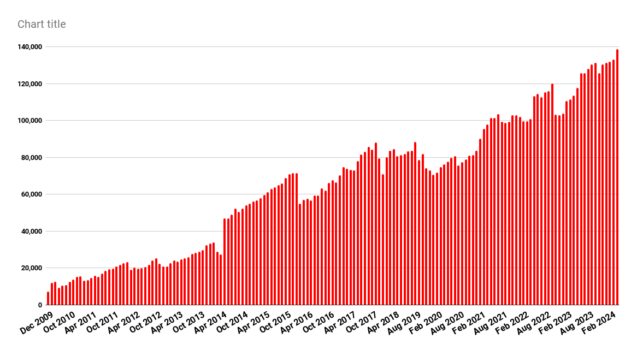

Bitcoin halving is a pre-programmed occasion that reduces the reward for mining new Bitcoin blocks by half. It’s a elementary facet of Bitcoin’s design, aimed toward sustaining its shortage and controlling the availability of recent Bitcoins over time. This occasion happens roughly each 4 years, with the newest halving occurring in Could 2020 and one other one set to happen in April 2024.

Bitcoin halving was instituted by Satoshi Nakamoto, the pseudonymous creator of Bitcoin, as a part of the unique Bitcoin protocol. Nakamoto’s imaginative and prescient was to create a decentralized, peer-to-peer digital foreign money that may function independently of central banks and governments. The halving mechanism was designed to imitate the shortage of valuable metals like gold and make sure that the overall provide of Bitcoins would by no means exceed its hard-coded restrict of 21 million.

How Does Bitcoin Halving Happen?

The halving occasion is instantly associated to bitcoin mining—the course of by which new Bitcoin transactions are verified and added to the blockchain ledger. Miners use specialised pc {hardware} to resolve advanced mathematical issues, and the primary miner to resolve the issue is rewarded with newly minted Bitcoins. This course of is named Proof-of-Work (PoW), and it serves as a consensus mechanism to make sure the integrity and safety of the Bitcoin community.

The halving course of is automated, deterministic, and constructed instantly into the Bitcoin protocol’s code to implement scheduled reductions in new coin issuance with none centralized management or oversight. It’s triggered when a selected situation is met—when 210,000 blocks are mined. The interval between attaining this equates to roughly each 4 years.

The next set of actions should occur for the it mentioned that Bitcoin halving course of has happen:

Block Reward Discount: The reward for efficiently mining a brand new block and including it to the Bitcoin blockchain is robotically lowered by 50%. For instance, if the present block reward is 12.5 newly minted Bitcoins, will probably be lowered to six.25 Bitcoins after the halving.

Code Execution: The discount in block reward is executed robotically by the Bitcoin protocol’s code throughout the complete community. No human intervention or centralized management is required.

Community Consensus: For the halving to achieve success, the vast majority of miners and nodes on the Bitcoin community should replace their software program to the most recent model that enforces the brand new, lowered block reward.

Affirmation: The halving is confirmed as soon as the following block is mined after the 210,000th block, and the brand new lowered block reward is paid to the miner who found that block.

Continued Operation: After the profitable halving, the Bitcoin community continues working as regular, with miners receiving the brand new lowered block reward for every block they mine going ahead.

When Bitcoin was first launched in 2009, the reward for mining a brand new block was 50 Bitcoins. The primary halving occasion, which occurred on November 28, 2012, lowered it to 25 Bitcoins per block. Subsequent halvings occurred in 2016 (12.5 Bitcoins per block) and 2020 (6.25 Bitcoins per block). The subsequent halving, which is anticipated to occur in 2024, will see the mining reward lowered to three.125 Bitcoins per block.

What Are The Impacts of Bitcoin Halving?

Bitcoin halving is a vital occasion within the cryptocurrency’s life cycle, with far-reaching implications for numerous contributors within the Bitcoin community. Its affect is multifaceted, affecting buyers, miners, and the general well being of the Bitcoin ecosystem.

Miners and Community Safety

For miners, Bitcoin halving presents each challenges and alternatives. Because the block reward is lowered by half, miners face a lower in income, which might result in some miners leaving the community attributable to diminished profitability. This exodus of miners can doubtlessly affect the community’s safety and processing energy, as fewer miners contribute to validating transactions and securing the blockchain.

Conversely, if Bitcoin’s worth will increase considerably after the halving occasion, it will possibly offset the lowered mining rewards and incentivize extra miners to hitch the community, in the end strengthening its safety and decentralization.

Moreover, halving occasions can catalyze a shift within the mining trade, favouring bigger, extra environment friendly mining operations with entry to cheaper vitality sources and specialised {hardware}. Smaller mining operations and particular person miners could discover it more and more difficult to compete and stay worthwhile in a post-halving atmosphere.

Community Well being and Dangers

Whereas Bitcoin halving is designed to take care of the cryptocurrency’s shortage and long-term worth, it’s not with out dangers. One potential concern is the danger of a 51% assault, the place a single entity or group good points management of greater than 50% of the community’s computing energy, permitting them to control the blockchain and doubtlessly double-spend cash.

After a halving occasion, if a major variety of miners go away the community attributable to lowered profitability, it might quickly lower the community’s general hash charge and make it extra weak to such assaults. Nonetheless, the Bitcoin community has confirmed resilient to those threats, and the inducement construction is designed to discourage such malicious behaviour.

Buyers and Market Dynamics

For buyers, Bitcoin halving is mostly perceived as a bullish occasion, because it reduces the availability of recent Bitcoins coming into the market whereas demand stays fixed or will increase. This supply-demand dynamic usually results in upward stress on Bitcoin’s worth, making it a gorgeous funding alternative.

Traditionally, Bitcoin’s worth has exhibited important volatility and hypothesis round halving occasions as buyers try to anticipate and capitalize on potential worth actions. Whereas previous efficiency shouldn’t be a assure of future outcomes, Bitcoin has usually skilled substantial worth rallies within the months main as much as and following halving occasions.

Is Bitcoin Worth Really Affected by Halving?

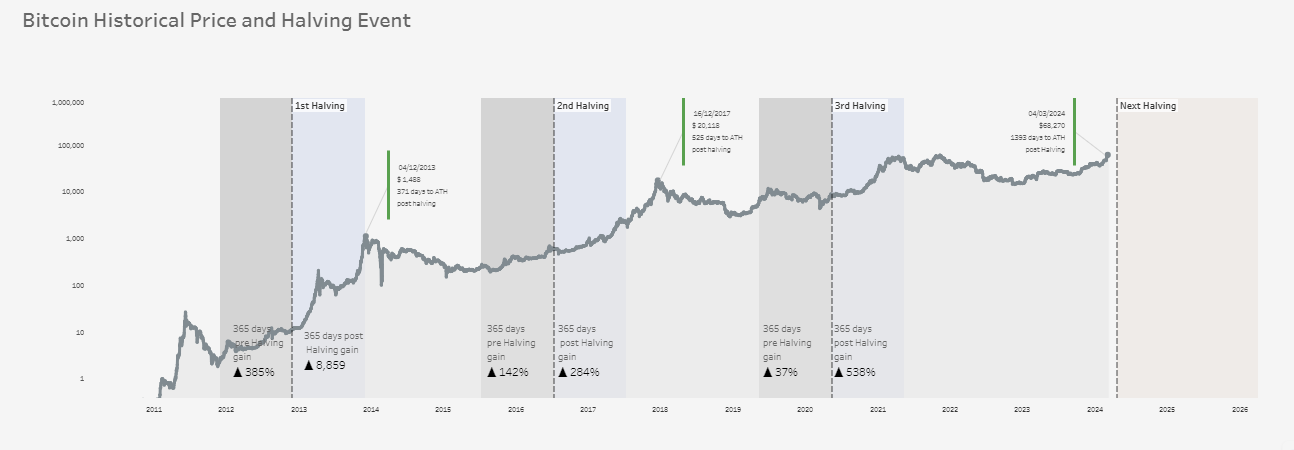

The connection between Bitcoin halving occasions and subsequent worth actions has been a topic of intense debate and evaluation throughout the cryptocurrency neighborhood. Whereas historic information suggests a sample of bull markets following halvings, establishing a direct causal hyperlink between the 2 stays contentious.

Bitcoin Worth and Halving Occasion Relationships

Every of the three halving occasions which have occurred up to now in Bitcoin’s historical past has been adopted by a major worth rally. The primary halving in 2012 noticed Bitcoin’s worth surge from round $13 on the time of the occasion to a peak of $1,152 a 12 months later. Equally, the 2016 halving preceded a rally that took Bitcoin’s worth from $664 to a excessive of $17,760 inside a 12 months. The newest halving in 2020 was adopted by a bull run that propelled Bitcoin’s worth from $9,734 to a peak of $67,549 in November 2021.

Whereas these worth actions are simple, it’s important to notice that correlation doesn’t essentially suggest causation. Varied different components, akin to elevated institutional adoption, regulatory developments, and general market sentiment, might have contributed to those worth rallies.

Potential Causes for Worth Will increase

One of many main arguments for why halving occasions might drive Bitcoin’s worth larger is the supply-demand dynamic. By lowering the speed at which new Bitcoins are launched into circulation, halving occasions successfully constrict the availability of the cryptocurrency. If demand stays fixed or will increase, fundamental financial ideas recommend that the value ought to rise to take care of equilibrium.

Moreover, halving occasions can improve the price of mining for Bitcoin miners, as their block rewards are lowered by half. To take care of profitability, miners could have to promote their Bitcoin holdings at larger costs, contributing to upward worth stress.

Moreover, halving occasions are likely to generate important media consideration and hypothesis throughout the crypto neighborhood, doubtlessly driving elevated demand and funding from each retail and institutional buyers.

Counterarguments and Issues

Critics of the halving-price correlation argue that the halving occasions are broadly anticipated and, due to this fact, already priced into the market properly upfront. They contend that rational market contributors would have already factored within the upcoming provide discount, rendering the precise halving occasion much less impactful on costs.

Some analysts recommend that the value rallies noticed after halving occasions could also be extra attributable to speculative mania and the self-fulfilling prophecy of buyers anticipating worth will increase, relatively than any elementary modifications in provide and demand dynamics.

Nonetheless, it’s necessary to notice that the affect of halving on Bitcoin’s worth shouldn’t be all the time rapid or easy. Market sentiment, regulatory developments, and general adoption charges additionally play a major function in figuring out the cryptocurrency’s worth.

What Subsequent After Issuing the Most Variety of Bitcoin?

The Bitcoin protocol is designed such that there’s a hard-coded restrict of 21 million Bitcoins that may ever be created. This finite provide is a elementary facet of Bitcoin’s shortage and worth proposition; it differentiates the token from conventional fiat currencies that may be printed indefinitely by central banks.

Whereas it might look like a distant prospect, it’s essential to know what is going to occur as soon as the final Bitcoin is mined, an occasion anticipated to happen across the 12 months 2140. By this time, all scheduled halving occasions could have taken place, and the block reward for miners can be zero.

Transition to Transaction Charge-based Incentive Mannequin

As soon as the ultimate Bitcoin has been mined and the block reward turns into zero, the inducement construction for miners will transition totally to a transaction fee-based mannequin. On this mannequin, community customers (these shopping for, promoting, or transferring Bitcoins) can pay charges to miners for processing and validating their transactions on the blockchain.

These transaction charges will function the first incentive for miners to proceed contributing their computing energy to safe the community and preserve the integrity of the Bitcoin blockchain. The charges can be collected and distributed to miners proportionally primarily based on the quantity of labor they contribute to the community.

Dynamic Charge Adjustment

To make sure a easy transition and preserve incentives for miners, the Bitcoin protocol contains mechanisms for dynamic price adjustment. Because the block reward diminishes and ultimately reaches zero, the community will robotically modify the price construction to incentivize miners adequately.

This adjustment course of will probably contain miners collectively setting price ranges that cowl their operational prices and supply an inexpensive revenue margin, guaranteeing the continued viability of mining operations and the safety of the community.

Community Safety and Decentralization

One of many potential considerations surrounding the transition to a fee-based incentive mannequin is the affect on community safety and decentralization. With out the block reward as an incentive, there’s a danger that mining might change into much less engaging, resulting in a possible centralization of mining energy or a lower within the general hash charge of the community.

Nonetheless, the Bitcoin protocol is designed to mitigate these dangers via numerous mechanisms, akin to issue changes and the inherent financial incentives for miners to take care of a safe and decentralized community. So long as there’s adequate demand for Bitcoin transactions and customers are keen to pay acceptable charges, the inducement construction ought to stay intact, guaranteeing the continued operation and safety of the community.

In the end, the utmost issuance of 21 million Bitcoins shouldn’t be an endpoint however relatively a transition to a brand new part within the cryptocurrency’s evolution. By design, Bitcoin is a self-sustaining and self-regulating system, and its skill to adapt and thrive past this milestone can be a testomony to the robustness of its underlying structure and the continued dedication of its world neighborhood.

Conclusion

The affect of Bitcoin halving shouldn’t be all the time easy. Whereas it’s designed to extend shortage and doubtlessly drive up the value of Bitcoin, different components akin to market sentiment, adoption charges, and regulatory developments additionally play a major function in figuring out the cryptocurrency’s worth.

Furthermore, as Bitcoin continues to realize mainstream adoption and institutional curiosity, the affect of halving occasions on worth dynamics could evolve. As extra subtle buyers and market contributors enter the house, the potential for environment friendly pricing and a extra rational response to those occasions might emerge.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, and Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”