Initially revealed on Unchained.com.Unchained is the official US Collaborative Custody companion of Bitcoin Journal and an integral sponsor of associated content material revealed via Bitcoin Journal. For extra info on companies supplied, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.

You don’t typically see the time period “Roth IRA” trending on-line, however in 2021, tech investor Peter Thiel made headlines for his $5 billion tax-free Roth IRA piggy financial institution. How did he do it? The reply is different investments. He used a self-directed IRA to spend money on early-stage tech firms a number of instances over. Is it a loophole? Presumably. Nevertheless it occurred, it obtained consideration, and the IRA construction in query might come beneath additional scrutiny.

“Thiel has taken a retirement account price lower than $2,000 in 1999 and spun it right into a $5 billion windfall.” – ProPublica (2021)

Let’s have a look at six widespread dangers related to self-directed and checkbook IRAs, how they could apply within the context of bitcoin, and why there could also be elevated regulation coming sooner or later. However first, we have to outline our phrases and differentiate between IRA constructions.

The completely different IRA constructions

The completely different IRA constructions can behave in an “each sq. is a rectangle, however not all rectangles are squares” type of method. IRAs will be Conventional (pre-tax) or Roth (post-tax) no matter custodial relationship/construction. All IRAs are custodial. A custodian, within the context of IRAs, is a licensed monetary establishment overseeing and administering the IRA.

Brokerage and Financial institution IRAs

Brokerage and financial institution IRAs are probably the most acquainted and customary sorts. Brokerage and Financial institution IRAs enable traders to spend money on shares, bonds, ETFs, mutual funds, and different securities, in addition to banking merchandise (CDs, deposit accounts, and many others.). Examples embody your typical Constancy, TD Ameritrade, or Charles Schwab IRA. The Unchained IRA is closest to this construction on this hierarchy.

Self-directed IRA (SDIRA)

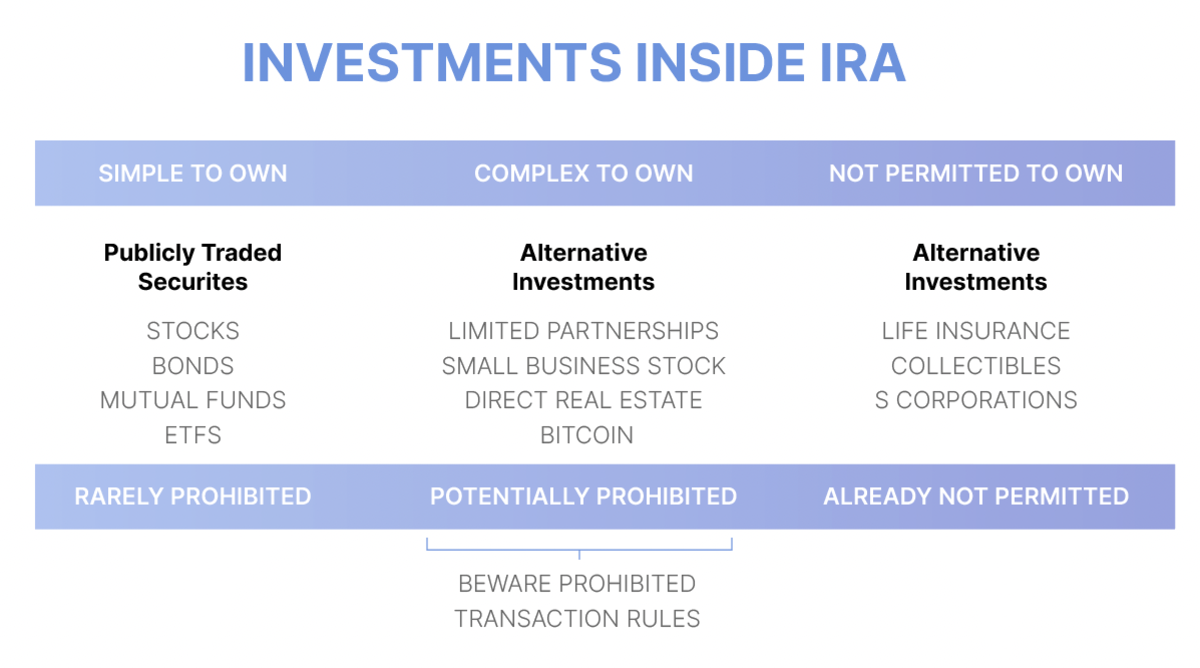

A self-directed IRA is a custodial IRA the place the custodian permits for expanded funding choices outdoors of or along with typical brokerage and financial institution belongings (shares, bonds, CDs, and many others.). House owners of self-directed IRAs can spend money on non-traditional belongings like actual property, companies, non-public loans, tax liens, valuable metals, and digital belongings. Though the IRS doesn’t have a definitive record of allowed investments, it actually has a couple of that aren’t allowed (collectibles, life insurance coverage, sure derivatives, S-Corps, and many others.).

Checkbook IRA

Checkbook IRAs are a subset of self-directed IRAs. The time period “checkbook IRA” will not be customary, nevertheless it often refers to a self-directed IRA that offers an account proprietor management of investments via a checking account, often via an LLC conduit. The account holder can then make investments with IRA funds just by writing a test (“checkbook management”). With the added freedom of further funding selections comes added duty of administration, in addition to authorized ambiguity as as to whether the construction nonetheless qualifies as a tax-exempt IRA.

Non-checkbook self-directed IRA

A subset of self-directed IRA the place the custodian approves transactions earlier than investments are made. Buyers should look forward to the custodian to evaluate every potential funding and formally settle for title to the underlying asset. These had been generally used for actual property and personal fairness investments and commenced regaining recognition as soon as further authorized uncertainties arose concerning checkbook IRAs in late 2021 (mentioned in part 4 under).

Dangers to observe for when utilizing a self-directed or checkbook IRA

1. Liquidity

Sadly, many self-directed belongings lack liquidity, making them tough to promote shortly. Examples embody actual property, privately held companies, valuable metals, and many others. If money is ever wanted for a distribution or inside expense, promoting an asset quick may very well be an issue (which compounds into different issues, i.e., by accident commingling funds). Self-directed IRA homeowners ought to conduct thorough due diligence on asset liquidity earlier than committing to an funding technique.

2. Formation and authorized construction

When forming a checkbook IRA, a self-directed IRA LLC is established first. Then, the LLC establishes a checking account similar to another enterprise entity. Subsequent, the LLC is funded by sending the IRA funds to the checking account.

With the right authorized construction, the IRA proprietor can develop into the only managing member of the LLC and have signing authority over the checking account. Nonetheless, improper authorized construction, registration, or titling might all trigger severe issues for the tax-advantaged standing of the IRA. Many checkbook IRA facilitators are competent, however errors might at all times result in points and attainable disqualification/lack of the whole IRA.

3. Misreporting transactions

Inside a checkbook IRA, homeowners can fund investments shortly and freely, however this comes with the duty of correctly following guidelines and self-reporting transactions.

On the finish of every 12 months, the proprietor of the LLC might want to present full transaction particulars to its IRA custodian and submit truthful market valuation (FMV) info. With out oversight into every transaction you make, a custodian is extra more likely to misreport revenue in your investments. All the time make sure the custodian has correct info to keep away from by accident breaking the regulation.

4. “Deemed distribution” remedy

Shoppers seeking to purchase valuable metals, actual property, or digital belongings ought to know the danger of “deemed distributions” remedy. A latest United States tax court docket case, McNulty v. Commissioner, illustrates the appreciable dangers of sustaining a checkbook IRA. Within the McNulty case, a taxpayer used her checkbook IRA LLC to buy gold from a valuable metals seller. She saved the LLC’s gold at house in her private secure. The court docket dominated that her “unfettered management” over the LLC’s gold with out third occasion supervision created a deemed taxable distribution from her IRA.

It’s unimaginable to know the way far a tax court docket will go making use of “deemed distribution” remedy to any given transaction or funding inside a checkbook IRA. For checkbook IRA homeowners that maintain the keys to bitcoin in an unsupervised construction, there’s a threat that the McNulty ruling might trigger your total IRA to be topic to tax. Additional, since different investments had been pretty lately (2015) added to IRS Publication 590, it’s totally attainable that the IRS and Congress might apply extra scrutiny to checkbook IRAs going ahead. Learn extra in regards to the McNulty case and its implications.

5. Prohibited transactions

All self-directed IRA homeowners are at all times prohibited from commingling private and IRA belongings or utilizing any private funds to enhance IRA belongings. “Self-dealing” is among the most typical pitfalls for self-directed account holders. For instance, for those who use your IRA to buy actual property, you aren’t allowed to make use of the property your self—not even slightly bit. You can not reside there, keep there, or hire workplace house to your self there. You aren’t even allowed to make your individual repairs or present “sweat fairness.”

It’s not solely the IRA proprietor that may’t take part in any “self-dealing,” however spouses, kids, and grandchildren as properly. They’re thought of disqualified people, and penalties are stiff. These are stringent guidelines and can lead to large tax complications if breached. I don’t intend to crush any goals, however investing your 401k/IRA into your lakefront Airbnb trip house and having you or your loved ones keep there even as soon as is a nasty concept. No buying a rental house and renting it out to members of the family both. For additional enjoyable, see the IRS record of prohibited transactions right here.

Listed below are a couple of examples of how prohibited transactions guidelines may very well be utilized to digital asset traders:

Commingling private wallets with IRA walletsLeverage and not using a non-recourse loanInvesting in sure collectible NFTs1

6. Financing

Financing inside a self-directed IRA can be extra sophisticated for a number of causes:

Usually, a non-recourse mortgage and bigger down fee are wanted for any property purchases.Surprising prices and costs can add up shortly and eat into any income.IRA-owned lively companies might run into the problem of UBIT (Unrelated Enterprise Earnings Tax). This additionally impacts the overlap of bitcoin mining inside an IRA.Any revenue and bills should stay inside the IRA construction and by no means commingled with private funds. For instance, when the water heater goes out (actual property) or salaries should be paid (companies), the IRA itself should pay for these companies out of the IRA’s personal money. IRA homeowners may very well be tempted to co-mingle funds briefly as they search for short-term liquidity to resolve their money wants.

What does this imply for bitcoin IRAs?

The self-directed IRA house has many potential dangers if not correctly managed. The IRS and Congress have been paying particular consideration to how these constructions are used and abused. Mix this with their curiosity in regulating digital belongings, and the panorama seems ripe for additional scrutiny. With that, bitcoin IRAs want a novel method that mitigates these pitfalls.

Unchained IRA will not be a checkbook IRA

Should you’re seeking to maintain precise bitcoin in your IRA account, you must think about the Unchained IRA. It’s not a “checkbook IRA” the place transactions have to be self-reported, and Unchained makes use of its key within the collaborative custody setup to trace inflows and outflows of IRA vaults. That visibility mechanism permits the custodian to actively monitor the IRA and due to this fact permits customers to stay compliant with present IRA guidelines and rules.

There isn’t a self-reporting required, and the non-checkbook construction helps mitigate the danger of potential pitfalls (McNulty, misreporting transactions, and many others.). If bitcoin appreciates like many traders hope and anticipate, holding cash in an IRA construction correctly is of the utmost significance.

This text is supplied for instructional functions solely, and can’t be relied upon as tax recommendation. Unchained makes no representations concerning the tax penalties of any construction described herein, and all such questions ought to be directed to an legal professional or CPA of your alternative. Jessy Gilger was an Unchained worker on the time this put up was written, however he now works for Unchained’s affiliate firm, Sound Advisory.

1While not technically a part of the Prohibited Transaction Guidelines (part 4975 of the Inside Income Code), collectibles are individually prohibited from being held in an IRA beneath part 408(m).

Initially revealed on Unchained.com.Unchained is the official US Collaborative Custody companion of Bitcoin Journal and an integral sponsor of associated content material revealed via Bitcoin Journal. For extra info on companies supplied, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.