Fast Take

Because the digital belongings market continues to evolve, two outstanding US-based corporations have taken vastly totally different approaches to their Bitcoin investments, with starkly diverging outcomes.

MicroStrategy, a enterprise intelligence agency, made its first Bitcoin buy in August 2020 when the asset was buying and selling at round $10,000. Since then, the corporate has steadily amassed Bitcoin, now holding over 1% of the entire provide. In distinction, electrical car maker Tesla entered the market barely later, shopping for Bitcoin in January 2021, close to the 2021 market frenzy.

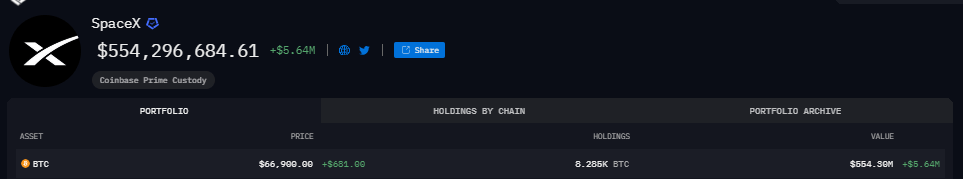

Based mostly on information from Arkham Intelligence, Tesla at the moment possesses roughly 11,509 Bitcoin valued at roughly $767.6 million, whereas SpaceX holds round 8,285 Bitcoin valued at roughly $554.3 million. Collectively, their mixed Bitcoin holdings complete practically 19,794 cash, with an approximate market worth of round $1.3 billion based mostly on present market costs.

In 2021, Tesla purchased $1.5 billion price of Bitcoin, more likely to be round 38,900 BTC, however offered a considerable portion in 2022. Had Musk held till now it might have been price round $2.6 billion.

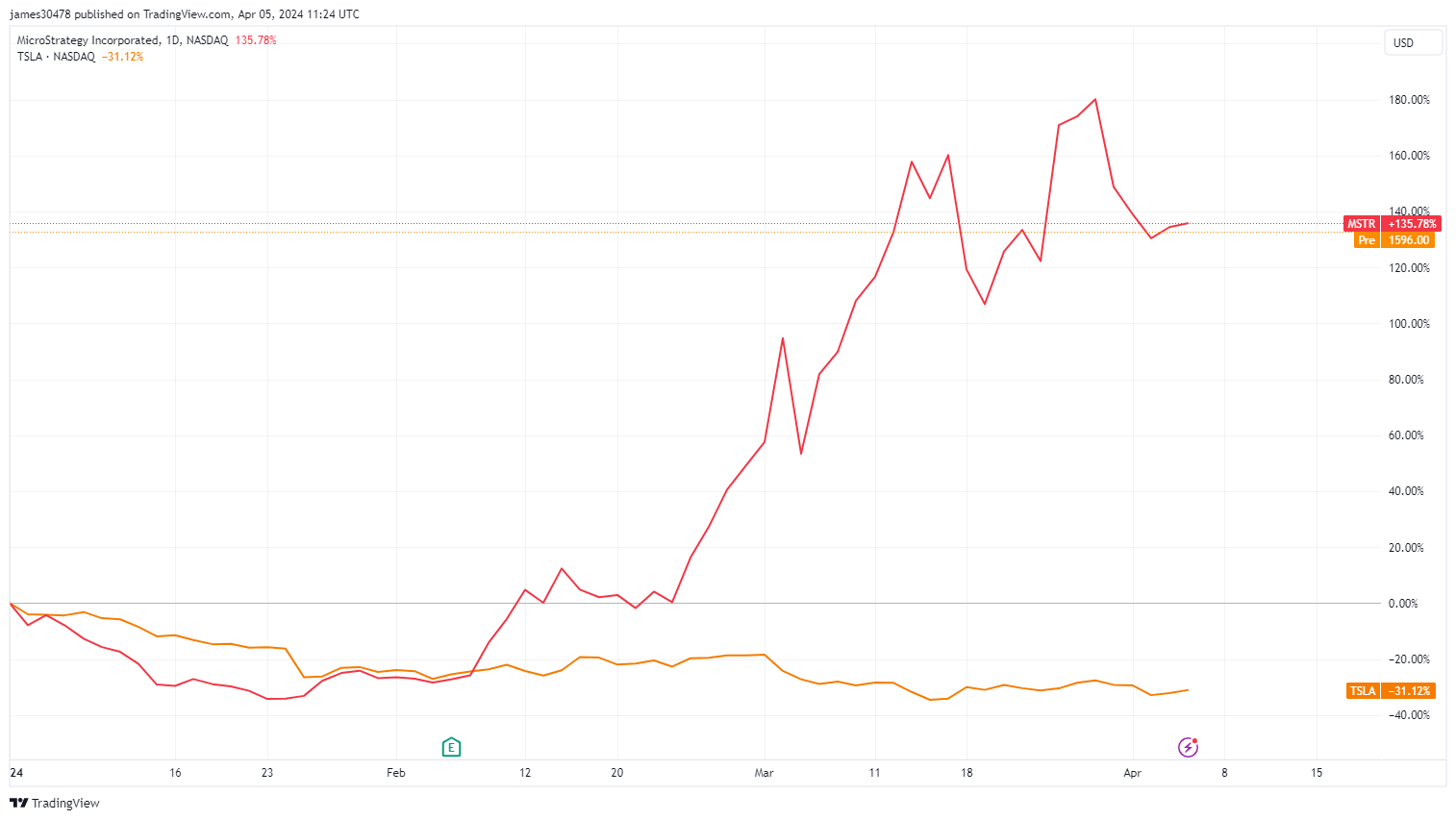

The diverging trajectories of those two corporations are mirrored of their inventory efficiency. MicroStrategy has seen a exceptional surge of over 1200% since its preliminary Bitcoin funding, whereas Tesla’s shares have faltered, declining by 31% year-to-date. Consequently, MicroStrategy has ascended the market capitalization leaderboard, whereas Tesla has descended to the 18th largest asset by market capitalization.

The publish MicroStrategy thrives on Bitcoin technique whereas Tesla left over $1 billion on desk as inventory slips appeared first on CryptoSlate.