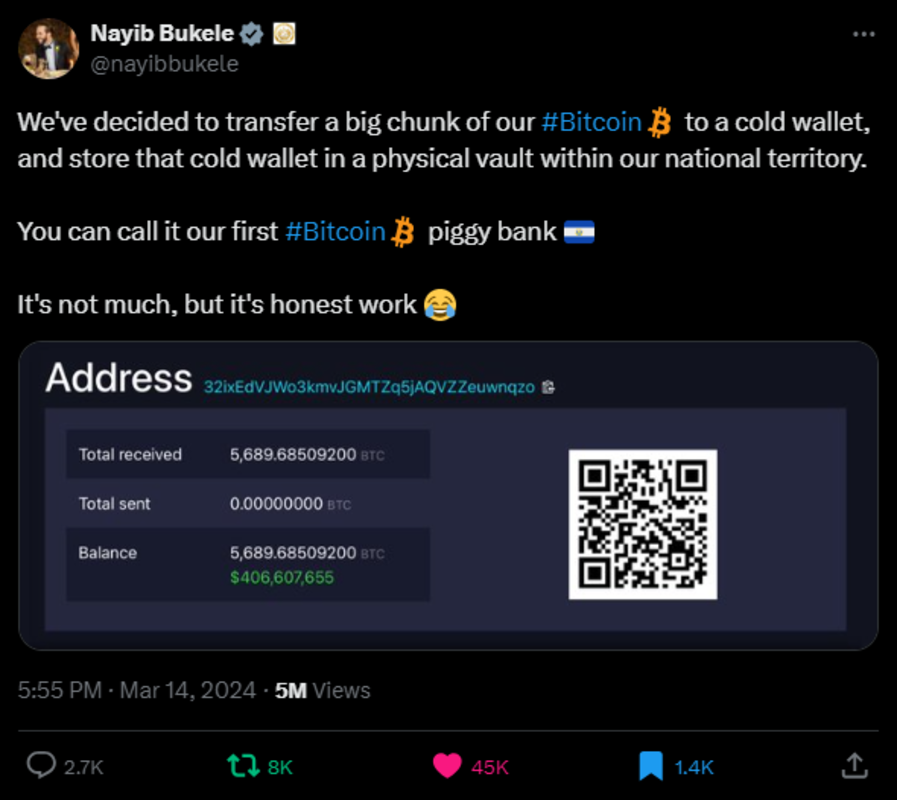

On March 14, 2024, El Salvador’s president-elect, Nayib Bukele, unveiled a historic daring maneuver that echoed throughout the Bitcoin world: El Salvador confirmed the switch of a considerable portion of its Bitcoin holdings into chilly storage, securely saved inside a vault in its nationwide borders. This strategic choice marks a pivotal juncture in El Salvador’s Bitcoin journey for the reason that introduction of the Bitcoin Regulation, which has drawn each admiration and skepticism worldwide.

Amidst a cacophony of critiques starting from allegations of human rights violations to insufficient trendy infrastructure, El Salvador has stood dedicated, weathering storms of disapproval from conventional finance stalwarts and even fervent Bitcoin maximalists on Twitter (X) Areas. The veil of ambiguity surrounding the dimensions of El Salvador’s Bitcoin reserves, some extent of competition and criticism for a lot of, has now been decisively lifted, ushering in a brand new period of transparency and confidence within the nation’s dedication to fostering a thriving Bitcoin-friendly ecosystem.

With this groundbreaking transfer, Salvadorans and Bitcoin fanatics worldwide have the power to audit El Salvador’s Bitcoin reserves and may see all inbound and outbound transactions. This audacious step wasn’t mandated however was taken willingly, embodying El Salvador’s dedication to its residents’ belief and the worldwide Bitcoin neighborhood’s ethos of openness. Unsurprisingly, shortly after Bukele introduced El Salvador’s Bitcoin deal with, Bitcoiners started to ship donations to the pockets, with practically 6 Million Sats in transactions as of this writing. To this point, plebs can monitor El Salvador’s day by day 1 bitcoin DCA purchases. On this historic second, El Salvador not solely charts a brand new course in monetary governance but additionally silences its critics by setting a precedent of main by instance in responsibly disclosing and managing its modest however trendy sovereign Bitcoin wealth reserves.

With 5,689 Bitcoins—valued at $385,111,456 USD as of this writing—El Salvador has secured its digital wealth and aptly navigated the treacherous waters of worldwide politics. The choice to shift its Bitcoin holdings from Bitgo, an American custodian, to a vault inside its sovereign borders wasn’t only a public relations masterstroke; it was a strategic crucial. Given the strained relations between the American authorities and El Salvador over the Bitcoin Regulation, the mounting holdings beneath Bitgo’s custody risked changing into entangled in potential sanctions and regulatory quagmires. This decisive motion safeguards El Salvador’s monetary autonomy and showcases a shrewd understanding of the intricacies of the American regulatory panorama.

Whereas the disclosure of the reserves has garnered widespread approval, there might have been compelling and strategic causes behind the nation’s preliminary reluctance to disclose its full holdings. Nayib Bukele’s affirmation that solely a “large chunk” of the entire Bitcoin reserves has been transferred to chilly storage underscores a nuanced understanding of the nation’s strategic monetary administration. Within the advanced realm of nation-states navigating the uncharted waters of a Bitcoin Customary, sustaining a level of opacity generally is a prudent technique. El Salvador, in its quest to carve a definite path on the planet, has tactically saved some playing cards near its chest, ready for the opportune second to unveil its Bitcoin wealth in a calculated transfer. This sensible strategy displays a cautious balancing act between transparency and strategic benefit within the dynamic panorama of geopolitics.

Bukele make clear El Salvador’s Bitcoin holdings in earlier tweets, surpassing their earlier acquisition methods and dollar-cost averaging efforts. Opposite to speculations circulating on social media, Bukele revealed a multifaceted strategy that had propelled the nation’s Bitcoin reserves. Past mere purchases, El Salvador’s revolutionary visa program, income from Bitcoin-to-dollar exchanges held in escrow, income from authorities providers, and mining endeavors have collectively contributed to a good-looking Bitcoin treasury. This revelation additional dispels misconceptions propagated by armchair quarterbacks and highlights El Salvador’s revolutionary braveness in leveraging various avenues to bolster its rising Bitcoin wealth.

Disclosing El Salvador’s Bitcoin reserves represents a major stride towards transparency and accountability for its residents. But, it is essential to acknowledge that there’ll all the time be a section of critics who demand extra and complain about each element in an try to seek out fault. Nonetheless, it is important to keep in mind that these measures usually are not solely geared toward appeasing detractors. As an alternative, they function a foundational step in making a optimistic enterprise atmosphere the place Bitcoiners can confidently set up their ventures, understanding that the nation is devoted to their success.

The final word aim for Bukele and El Salvador extends past merely silencing critics; it is about remodeling the nation right into a affluent hub of alternative for Salvadorans. In a stroke of genius, El Salvador has constructed its personal digital Fort Knox, with the distinctive characteristic that residents can confirm the existence of the funds. The Salvadoran authorities goals to nurture a tradition of belief and funding within the nation’s future by rewarding proof-of-work and low-time desire. This imaginative and prescient encompasses constructing a brand new El Salvador the place residents can thrive, seize alternatives at house, and contribute to the nation’s progress, reasonably than looking for elusive guarantees overseas. As El Salvador continues its journey towards financial empowerment and progress, these strategic strikes function foundational pillars for a brighter and extra affluent future.

This can be a visitor put up by Jaime Garcia. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.