Nigeria’s Securities and Alternate Fee has proposed to lift the registration charges for digital asset service suppliers (VASP) in search of an operational license. This improvement is accompanied by different modifications within the laws governing the important thing elements of the crypto business within the West African nation.

VASP Registration Charges In Nigeria To Rise By 400%

On March 15, the Nigerian SEC launched a set of proposed amendments to its Guidelines on Digital Belongings Issuance, Providing Platforms, Alternate, and Custody. In accordance with the securities regulator, the instructed modifications are aimed toward offering extra regulatory readability to a quickly creating crypto market in addition to implementing suggestions from business gamers following latest discussions with the Central Financial institution of Nigeria (CBN).

Of all of the up to date laws, a quintupling improve in VASP registration charges from 30 million ($18,841.75) to 150 million ($94,208.76) has been a serious speaking level as such insurance policies are normally considered as a way of discouraging enterprise participation, on this case, the emergence of latest crypto exchanges. In the meantime, it might additionally operate as a protecting mechanism, thus making certain that solely sturdy and well-funded events are in a position to function as VASPs.

Moreover, crypto exchanges and buying and selling platforms would now be anticipated to pay an utility payment and processing payment of 300,000 naira ($188.42) and 1,000,000 naira ($628.06) versus earlier values of 100,000 ($62.81) and 300,000 ($188.42) respectively.

As well as, the nation’s regulator has additionally raised the minimal paid-up capital for these companies to 1,000,000,000 naira ($628,058.40) which have to be set in financial institution balances, mounted property, or as an funding in sure securities. In the meantime, there will probably be a constancy bond masking as much as 25% of this minimal paid-up capital in keeping with the Fee’s current guidelines and laws.

The Nigerian Crypto Area And Its Troubles

These days, Nigeria has been amongst main crypto headlines attributable to an ongoing squabble with outstanding crypto trade Binance. The federal government of the West African nation has accused Binance of taking part in a major position within the devaluation of Nigerian Naira, demanding compensation to the tune of $10 billion.

This accusation has been accompanied by the Nigerian authorities making different calls for of Binance by way of consumer information and reportedly detaining two of the trade’s high executives. In response, Binance has shut down all Nigerian Naira (NGN) providers in addition to delisted Naira buying and selling pairs on its platform. Nevertheless, there are nonetheless no indications the trade will pull out of the African nation.

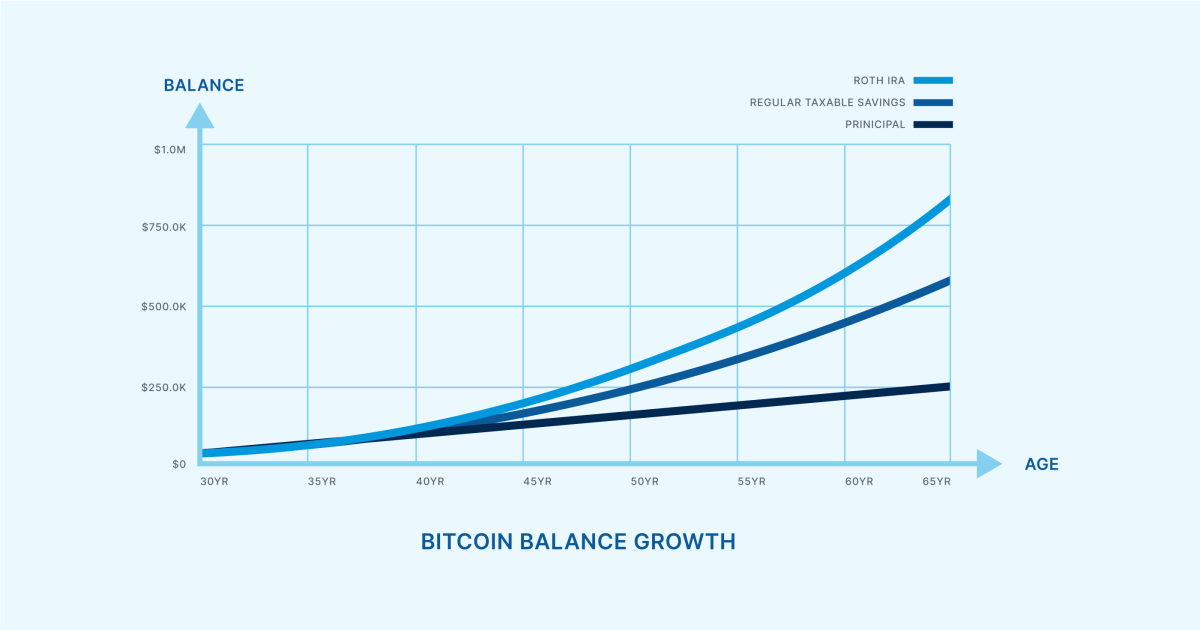

On the time of writing, the full crypto market cap is valued at $2.52 trillion, following a 4.23% decline within the final day. In the meantime, Bitcoin, the market chief, now trades at $66,275.63 attributable to an ongoing worth correction.

Complete crypto market valued at $2.428 trillion on the day by day chart | Supply: TOTAL chart on Tradingview.com

Featured picture from The Guardian, chart from Tradingview.