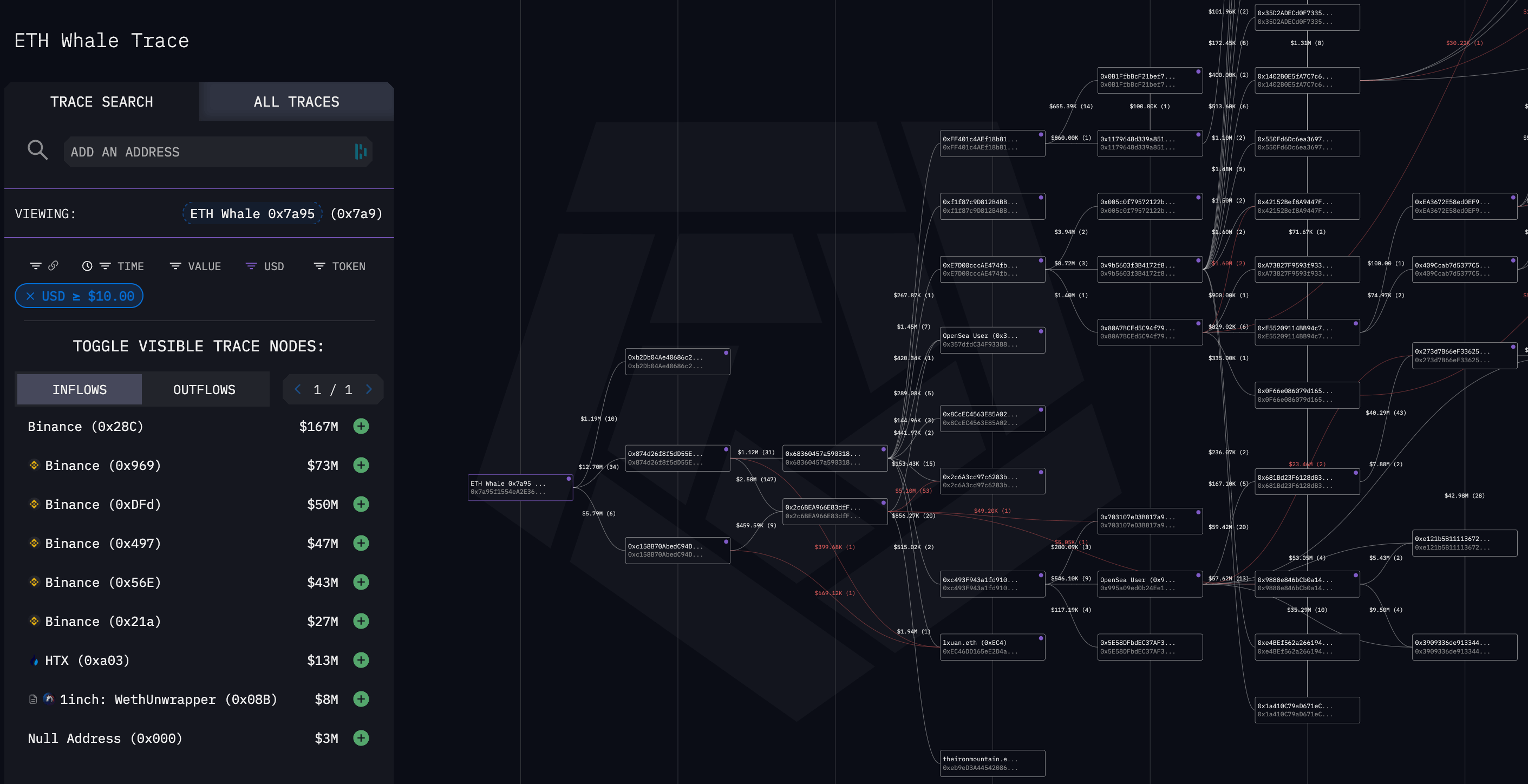

An unknown Ethereum whale has been accumulating ETH at a fast tempo for the reason that begin of February. Over the previous 23 days, pockets 0x7a95c has acquired $411 million price of ETH and stETH, principally from Binance.

Information shared with CryptoSlate from Spotonchain traces the ETH inflows into the pockets all through the month, displaying persistent purchases of between 3,000 and 34,000 ETH.

CryptoSlate evaluation tracing inflows and outflows from the pockets reveals connections with a number of totally different exchanges and DEXs. Virtually all funds into the pockets got here from Binance with $21 million HTX and 1inch. Nevertheless, when it comes to outflows, a variety of addresses are linked, together with Wintermute, Uniswap, 1inch, AlphaLab Capital, Native Pool, and Paraswap, amongst others.

Digging into the transaction particulars on Spotonchain, the whale transferred a considerable quantity of seven,915 ETH, valued at roughly $23.52 million, from Binance to their pockets. This transaction, recorded on Feb. 22 at 16:38, signifies the continuation of a notable sample of accumulation by this entity. The transaction particulars point out a deliberate technique by the whale to extend their holdings in Ethereum.

Over the previous 4 days, the whale has reportedly bought a complete of 112,923 ETH by Binance and 1inch, with a mean acquisition value of $2,892 per ETH, amounting to an funding of $326.5 million. Following these transactions, the whale’s Ethereum holdings now stand at 132,585 ETH, alongside 5,485 STETH, cumulatively valued at $411 million. This portfolio at the moment reveals an unrealized revenue of $21.13 million, highlighting the monetary positive aspects ensuing from these strategic strikes.

The sample of accumulation contains a number of different important transactions. Notably, 17,198 ETH had been withdrawn from Binance in a previous transaction, contributing to the whale’s rising Ethereum reserves.

Moreover, the whale’s actions prolong past Ethereum purchases, as evidenced by a withdrawal of 40 million USDT from Binance. This means a broader technique that doubtlessly contains leveraging stablecoin reserves to additional enhance Ethereum holdings. The whale’s transactions and holdings, notably the strategic use of each ETH and STETH, replicate a complicated method to digital property funding, emphasizing diversification and timing to capitalize on market actions.

Rumors of a possible spot Ethereum ETF being authorised by the SEC have helped push Ethereum again over the $3,000 mark on two events this month. Considerations over theoretical points with the centralization of staked Ethereum amid a spot ETF have been raised, although at current any potential approval is unclear.

Unconfirmed rumors of Justin Solar relationship

Earlier within the month, Lookonchain urged the whale could also be Justin Solar based mostly on an evaluation of comparable transactions with a suspected pockets belonging to the investor. Nevertheless, all info seems to be circumstantial, and the pockets has no equal lively deal with on the Tron blockchain. Nonetheless, curiously, the 0x7a95 pockets has by no means interacted with USDC and solely seems to make use of USDT for stablecoin transactions. Circle acknowledged that Justin Solar has no accounts with them in a 2023 letter to Senator Elizabeth Warren, but wallets recognized by Arkham Intelligence to belong to Solar transacted with USDC as lately as Feb. 22.

The one connection to Justin Solar that may very well be recognized by CryptoSlate was a 1inch Settlement contract with two tangentially associated wallets. Addresses 0x874d and 0x158B obtained $21 million from 0x7a95, and each transferred funds to the 1inch Settlement contract 0xA888. A Justin Solar-tagged pockets, 0x1387, obtained $58 million from the identical 1inch contract a 12 months in the past. Nevertheless, all transactions from 0x7a95 occurred far more lately.

CryptoSlate is monitoring the pockets and associated addresses ought to additional info grow to be obvious.