Bitcoin, Bitcoin… Is there something new to say about this cryptocurrency at this level? Even individuals who have zero curiosity within the trade have heard its title. Because the primary cryptocurrency, it enjoys unimaginably excessive costs (as much as $60K), plenty of consideration, and, after all, a lot scrutiny.

Bitcoin, alongside the remainder of the cryptocurrency market, is understood for its potential to beat any challenges and have robust comebacks regardless of everybody writing it off. Numerous monetary specialists have been predicting that the Bitcoin bubble will pop “within the close to future” each month with out fail for the previous eight or so years. And but, the coin nonetheless stays on prime, and BTC buyers get pleasure from excessive income, patiently ready for yet one more meteoric BTC value rise.

Nevertheless, the crypto trade is quickly altering, and a few crypto fanatics are beginning to doubt whether or not Bitcoin continues to be price investing in.

Please notice that that is our long-term Bitcoin value prediction. This text doesn’t represent monetary recommendation, and we’re not funding advisors.

Bitcoin Overview

Bitcoin Worth

$52,096.81

Bitcoin Worth Change 24h

0.8%

Bitcoin Worth Change 7d

8.6%

Bitcoin Market cap

$1,022,765,942,455.75

Bitcoin Circulating Provide

19,632,025 BTC

Bitcoin Buying and selling Quantity

$19,437,270,629.85

Bitcoin All time excessive

$68,789.63

Bitcoin All time low

$0.05

Bitcoin Worth Prediction 7d

$49,366 (-5.1)

Bitcoin Worry-Greed Index

72 (Greed)

Bitcoin Sentiment

Impartial

Bitcoin Volatility

8.56%

Bitcoin Inexperienced Days

20/30 (67%)

Bitcoin 50-Day SMA

$43,692

Bitcoin 200-Day SMA

$35,687

Bitcoin 14-Day RSI

77.98

Our real-time BTC to USD value replace reveals the present Bitcoin value as $52,323.4 USD.

Based on our Bitcoin value prediction, BTC value is predicted to have a -2.17% lower and drop as little as by February 20, 2024.

Our evaluation of the technical indicators means that the present market feeling is Impartial Bearish 26%, with a Worry & Greed Index rating of 72 (Greed).

During the last 30 days, Bitcoin has had 20/30 (67%) inexperienced days and eight.56% value volatility.

Bitcoin (BTC) Technical Overview

When discussing future buying and selling alternatives of digital property, it’s important to concentrate to market sentiments.

Bitcoin Revenue Calculator

Revenue calculation please wait…

Bitcoin (BTC) Worth Prediction For Immediately, Tomorrow and Subsequent 30 Days

Date

Worth

Change

February 19, 2024$52,4190.77%February 20, 2024$51,656-0.7%February 21, 2024$50,893-2.17%February 22, 2024$50,129-3.64%February 23, 2024$49,366-5.1%February 24, 2024$48,603-6.57%February 25, 2024$47,839-8.04%February 26, 2024$47,077-9.5%February 27, 2024$46,314-10.97%February 28, 2024$45,550-12.44%February 29, 2024$44,787-13.91%March 01, 2024$44,024-15.37%March 02, 2024$43,260-16.84%March 03, 2024$42,347-18.6%March 04, 2024$41,281-20.65%March 05, 2024$40,215-22.69%March 06, 2024$39,149-24.74%March 07, 2024$38,083-26.79%March 08, 2024$37,018-28.84%March 09, 2024$35,952-30.89%March 10, 2024$34,887-32.94%March 11, 2024$33,821-34.99%March 12, 2024$32,755-37.04%March 13, 2024$31,690-39.08%March 14, 2024$30,624-41.13%March 15, 2024$29,558-43.18%March 15, 2024$29,262-43.75%March 16, 2024$32,322-37.87%March 17, 2024$35,381-31.99%March 18, 2024$35,492-31.77%

Bitcoin Prediction Desk

Bitcoin Historic

Based on the most recent knowledge gathered, the present value of Bitcoin is $$52,218.20, and BTC is presently ranked No. 1 in the whole crypto ecosystem. The circulation provide of Bitcoin is $1,025,155,753,760.83, with a market cap of 19,632,156 BTC.

Up to now 24 hours, the crypto has elevated by $443.85 in its present worth.

For the final 7 days, BTC has been in an excellent upward development, thus rising by 5.18%. Bitcoin has proven very robust potential currently, and this might be an excellent alternative to dig proper in and make investments.

Over the last month, the worth of BTC has elevated by 25.46%, including a colossal common quantity of $13,294.75 to its present worth. This sudden development implies that the coin can turn into a stable asset now if it continues to develop.

Bitcoin Worth Prediction 2024

Based on the technical evaluation of Bitcoin costs anticipated in 2024, the minimal value of Bitcoin shall be $$29,262. The utmost degree that the BTC value can attain is $$40,840.50. The common buying and selling value is predicted round $$52,419.

BTC Worth Forecast for February 2024

Based mostly on the worth fluctuations of Bitcoin firstly of 2023, crypto specialists anticipate the typical BTC charge of $$48,603 in February 2024. Its minimal and most costs might be anticipated at $$44,787 and at $$52,419, respectively.

March 2024: Bitcoin Worth Forecast

Cryptocurrency specialists are able to announce their forecast for the BTC value in March 2024. The minimal buying and selling value could be $$29,262, whereas the utmost may attain $$44,024 throughout this month. On common, it’s anticipated that the worth of Bitcoin could be round $$36,643.

BTC Worth Forecast for April 2024

Crypto analysts have checked the worth fluctuations of Bitcoin in 2023 and in earlier years, so the typical BTC charge they predict could be round $$43,051.96 in April 2024. It will probably drop to $$40,665.58 at least. The utmost worth could be $$45,438.33.

Might 2024: Bitcoin Worth Forecast

In the course of the 12 months 2023, the BTC value shall be traded at $$44,924.76 on common. Might 2024 may additionally witness a rise within the Bitcoin worth to $$47,242.83. It’s assumed that the worth won’t drop decrease than $$42,606.69 in Might 2024.

BTC Worth Forecast for June 2024

Crypto specialists have analyzed Bitcoin costs in 2023, so they’re prepared to offer their estimated buying and selling common for June 2024 — $$40,269.32. The bottom and peak BTC charges could be $$35,552.40 and $$44,986.23.

July 2024: Bitcoin Worth Forecast

Crypto analysts anticipate that on the finish of summer time 2023, the BTC value shall be round $$36,234.06. In July 2024, the Bitcoin value might drop to a minimal of $$35,540.38. The anticipated peak worth could be $$36,927.73 in July 2024.

BTC Worth Forecast for August 2024

Having analyzed Bitcoin costs, cryptocurrency specialists anticipate that the BTC charge may attain a most of $$36,870.10 in August 2024. It’d, nonetheless, drop to $$35,462.43. For August 2024, the forecasted common of Bitcoin is sort of $$36,166.27.

September 2024: Bitcoin Worth Forecast

In the course of autumn 2023, the Bitcoin value shall be traded on the common degree of $$35,374.29. Crypto analysts anticipate that in September 2024, the BTC value may fluctuate between $$34,439.32 and $$36,309.26.

BTC Worth Forecast for October 2024

Market specialists anticipate that in October 2024, the Bitcoin worth won’t drop under a minimal of $$34,232.40. The utmost peak anticipated this month is $$36,979.53. The estimated common buying and selling worth shall be on the degree of $$35,605.97.

November 2024: Bitcoin Worth Forecast

Cryptocurrency specialists have fastidiously analyzed the vary of BTC costs all through 2023. For November 2024, their forecast is the next: the utmost buying and selling worth of Bitcoin shall be round $$37,324.78, with a chance of dropping to a minimal of $$34,412.97. In November 2024, the typical value shall be $$35,868.88.

BTC Worth Forecast for December 2024

Market analysts predict that Bitcoin won’t fall under $$32,709.78 in December 2024, with an opportunity of peaking at $$37,192.99 in the identical month. The common buying and selling worth is predicted to be $$34,951.39.

Bitcoin Worth Prediction 2025

After the evaluation of the costs of Bitcoin in earlier years, it’s assumed that in 2025, the minimal value of Bitcoin shall be round $$98,874. The utmost anticipated BTC value could also be round $$120,518. On common, the buying and selling value could be $$102,470 in 2025.

Month

Minimal Worth

Common Worth

Most Worth

January 2025

$35,063

$56,589.92

$47,480.29

February 2025

$40,864

$60,760.83

$54,120.08

March 2025

$46,665

$64,931.75

$60,759.88

April 2025

$52,466

$69,102.67

$67,399.67

Might 2025

$58,267

$73,273.58

$74,039.46

June 2025

$64,068

$77,444.50

$80,679.25

July 2025

$69,869

$81,615.42

$87,319.04

August 2025

$75,670

$85,786.33

$93,958.83

September 2025

$81,471

$89,957.25

$100,598.63

October 2025

$87,272

$94,128.17

$107,238.42

November 2025

$93,073

$98,299.08

$113,878.21

December 2025

$98,874

$102,470

$120,518

Bitcoin Worth Prediction 2026

Based mostly on the technical evaluation by cryptocurrency specialists concerning the costs of Bitcoin, in 2026, BTC is predicted to have the next minimal and most costs: about $$139,487 and $$174,208, respectively. The common anticipated buying and selling value is $$144,611.

Month

Minimal Worth

Common Worth

Most Worth

January 2026

$102,258.42

$105,981.75

$124,992.17

February 2026

$105,642.83

$109,493.50

$129,466.33

March 2026

$109,027.25

$113,005.25

$133,940.50

April 2026

$112,411.67

$116,517

$138,414.67

Might 2026

$115,796.08

$120,028.75

$142,888.83

June 2026

$119,180.50

$123,540.50

$147,363

July 2026

$122,564.92

$127,052.25

$151,837.17

August 2026

$125,949.33

$130,564

$156,311.33

September 2026

$129,333.75

$134,075.75

$160,785.50

October 2026

$132,718.17

$137,587.50

$165,259.67

November 2026

$136,102.58

$141,099.25

$169,733.83

December 2026

$139,487

$144,611

$174,208

Bitcoin Worth Prediction 2027

The specialists within the subject of cryptocurrency have analyzed the costs of Bitcoin and their fluctuations in the course of the earlier years. It’s assumed that in 2027, the minimal BTC value may drop to $$202,875, whereas its most can attain $$244,102. On common, the buying and selling value shall be round $$210,105.

Month

Minimal Worth

Common Worth

Most Worth

January 2027

$144,769.33

$150,068.83

$180,032.50

February 2027

$150,051.67

$155,526.67

$185,857

March 2027

$155,334

$160,984.50

$191,681.50

April 2027

$160,616.33

$166,442.33

$197,506

Might 2027

$165,898.67

$171,900.17

$203,330.50

June 2027

$171,181

$177,358

$209,155

July 2027

$176,463.33

$182,815.83

$214,979.50

August 2027

$181,745.67

$188,273.67

$220,804

September 2027

$187,028

$193,731.50

$226,628.50

October 2027

$192,310.33

$199,189.33

$232,453

November 2027

$197,592.67

$204,647.17

$238,277.50

December 2027

$202,875

$210,105

$244,102

Bitcoin Worth Prediction 2028

Based mostly on the evaluation of the prices of Bitcoin by crypto specialists, the next most and minimal BTC costs are anticipated in 2028: $$360,910 and $$302,901. On common, will probably be traded at $$311,305.

Month

Minimal Worth

Common Worth

Most Worth

January 2028

$211,210.50

$218,538.33

$253,836

February 2028

$219,546

$226,971.67

$263,570

March 2028

$227,881.50

$235,405

$273,304

April 2028

$236,217

$243,838.33

$283,038

Might 2028

$244,552.50

$252,271.67

$292,772

June 2028

$252,888

$260,705

$302,506

July 2028

$261,223.50

$269,138.33

$312,240

August 2028

$269,559

$277,571.67

$321,974

September 2028

$277,894.50

$286,005

$331,708

October 2028

$286,230

$294,438.33

$341,442

November 2028

$294,565.50

$302,871.67

$351,176

December 2028

$302,901

$311,305

$360,910

Bitcoin Worth Prediction 2029

Crypto specialists are continually analyzing the fluctuations of Bitcoin. Based mostly on their predictions, the estimated common BTC value shall be round $$470,249. It’d drop to a minimal of $$457,797, but it surely nonetheless may attain $$527,670 all through 2029.

Month

Minimal Worth

Common Worth

Most Worth

January 2029

$315,809

$324,550.33

$374,806.67

February 2029

$328,717

$337,795.67

$388,703.33

March 2029

$341,625

$351,041

$402,600

April 2029

$354,533

$364,286.33

$416,496.67

Might 2029

$367,441

$377,531.67

$430,393.33

June 2029

$380,349

$390,777

$444,290

July 2029

$393,257

$404,022.33

$458,186.67

August 2029

$406,165

$417,267.67

$472,083.33

September 2029

$419,073

$430,513

$485,980

October 2029

$431,981

$443,758.33

$499,876.67

November 2029

$444,889

$457,003.67

$513,773.33

December 2029

$457,797

$470,249

$527,670

Bitcoin Worth Prediction 2030

Yearly, cryptocurrency specialists put together forecasts for the worth of Bitcoin. It’s estimated that BTC shall be traded between $$693,732 and $$820,623 in 2030. Its common value is predicted at round $$717,243 in the course of the 12 months.

Month

Minimal Worth

Common Worth

Most Worth

January 2030

$477,458.25

$490,831.83

$552,082.75

February 2030

$497,119.50

$511,414.67

$576,495.50

March 2030

$516,780.75

$531,997.50

$600,908.25

April 2030

$536,442

$552,580.33

$625,321

Might 2030

$556,103.25

$573,163.17

$649,733.75

June 2030

$575,764.50

$593,746

$674,146.50

July 2030

$595,425.75

$614,328.83

$698,559.25

August 2030

$615,087

$634,911.67

$722,972

September 2030

$634,748.25

$655,494.50

$747,384.75

October 2030

$654,409.50

$676,077.33

$771,797.50

November 2030

$674,070.75

$696,660.17

$796,210.25

December 2030

$693,732

$717,243

$820,623

Bitcoin Worth Prediction 2031

Cryptocurrency analysts are able to announce their estimations of the Bitcoin’s value. The 12 months 2031 shall be decided by the utmost BTC value of $$1,201,355. Nevertheless, its charge may drop to round $$964,153. So, the anticipated common buying and selling value is $$992,842.

Month

Minimal Worth

Common Worth

Most Worth

January 2031

$716,267.08

$740,209.58

$852,350.67

February 2031

$738,802.17

$763,176.17

$884,078.33

March 2031

$761,337.25

$786,142.75

$915,806

April 2031

$783,872.33

$809,109.33

$947,533.67

Might 2031

$806,407.42

$832,075.92

$979,261.33

June 2031

$828,942.50

$855,042.50

$1,010,989

July 2031

$851,477.58

$878,009.08

$1,042,716.67

August 2031

$874,012.67

$900,975.67

$1,074,444.33

September 2031

$896,547.75

$923,942.25

$1,106,172

October 2031

$919,082.83

$946,908.83

$1,137,899.67

November 2031

$941,617.92

$969,875.42

$1,169,627.33

December 2031

$964,153

$992,842

$1,201,355

Bitcoin Worth Prediction 2032

After years of research of the Bitcoin value, crypto specialists are prepared to offer their BTC value estimation for 2032. It will likely be traded for not less than $$1,445,488, with the doable most peaks at $$1,674,847. Subsequently, on common, you may anticipate the BTC value to be round $$1,485,201 in 2032.

Month

Minimal Worth

Common Worth

Most Worth

January 2032

$1,004,264.25

$1,033,871.92

$1,240,812.67

February 2032

$1,044,375.50

$1,074,901.83

$1,280,270.33

March 2032

$1,084,486.75

$1,115,931.75

$1,319,728

April 2032

$1,124,598

$1,156,961.67

$1,359,185.67

Might 2032

$1,164,709.25

$1,197,991.58

$1,398,643.33

June 2032

$1,204,820.50

$1,239,021.50

$1,438,101

July 2032

$1,244,931.75

$1,280,051.42

$1,477,558.67

August 2032

$1,285,043

$1,321,081.33

$1,517,016.33

September 2032

$1,325,154.25

$1,362,111.25

$1,556,474

October 2032

$1,365,265.50

$1,403,141.17

$1,595,931.67

November 2032

$1,405,376.75

$1,444,171.08

$1,635,389.33

December 2032

$1,445,488

$1,485,201

$1,674,847

Bitcoin Worth Prediction 2033

Cryptocurrency analysts are able to announce their estimations of the Bitcoin’s value. The 12 months 2033 shall be decided by the utmost BTC value of $$2,430,580. Nevertheless, its charge may drop to round $$1,961,474. So, the anticipated common buying and selling value is $$2,035,733.

Month

Minimal Worth

Common Worth

Most Worth

January 2033

$1,488,486.83

$1,531,078.67

$1,737,824.75

February 2033

$1,531,485.67

$1,576,956.33

$1,800,802.50

March 2033

$1,574,484.50

$1,622,834

$1,863,780.25

April 2033

$1,617,483.33

$1,668,711.67

$1,926,758

Might 2033

$1,660,482.17

$1,714,589.33

$1,989,735.75

June 2033

$1,703,481

$1,760,467

$2,052,713.50

July 2033

$1,746,479.83

$1,806,344.67

$2,115,691.25

August 2033

$1,789,478.67

$1,852,222.33

$2,178,669

September 2033

$1,832,477.50

$1,898,100

$2,241,646.75

October 2033

$1,875,476.33

$1,943,977.67

$2,304,624.50

November 2033

$1,918,475.17

$1,989,855.33

$2,367,602.25

December 2033

$1,961,474

$2,035,733

$2,430,580

Bitcoin Worth Prediction 2040

Based on the technical evaluation of Bitcoin costs anticipated in 2040, the minimal value of Bitcoin shall be $$2,870,385. The utmost degree that the BTC value can attain is $$3,338,603. The common buying and selling value is predicted round $$3,053,601.

Month

Minimal Worth

Common Worth

Most Worth

January 2040

$2,037,216.58

$2,120,555.33

$2,506,248.58

February 2040

$2,112,959.17

$2,205,377.67

$2,581,917.17

March 2040

$2,188,701.75

$2,290,200

$2,657,585.75

April 2040

$2,264,444.33

$2,375,022.33

$2,733,254.33

Might 2040

$2,340,186.92

$2,459,844.67

$2,808,922.92

June 2040

$2,415,929.50

$2,544,667

$2,884,591.50

July 2040

$2,491,672.08

$2,629,489.33

$2,960,260.08

August 2040

$2,567,414.67

$2,714,311.67

$3,035,928.67

September 2040

$2,643,157.25

$2,799,134

$3,111,597.25

October 2040

$2,718,899.83

$2,883,956.33

$3,187,265.83

November 2040

$2,794,642.42

$2,968,778.67

$3,262,934.42

December 2040

$2,870,385

$3,053,601

$3,338,603

Bitcoin Worth Prediction 2050

After the evaluation of the costs of Bitcoin in earlier years, it’s assumed that in 2050, the minimal value of Bitcoin shall be round $$3,725,392. The utmost anticipated BTC value could also be round $$4,193,612. On common, the buying and selling value could be $$3,969,681 in 2050.

Month

Minimal Worth

Common Worth

Most Worth

January 2050

$2,941,635.58

$3,129,941

$3,409,853.75

February 2050

$3,012,886.17

$3,206,281

$3,481,104.50

March 2050

$3,084,136.75

$3,282,621

$3,552,355.25

April 2050

$3,155,387.33

$3,358,961

$3,623,606

Might 2050

$3,226,637.92

$3,435,301

$3,694,856.75

June 2050

$3,297,888.50

$3,511,641

$3,766,107.50

July 2050

$3,369,139.08

$3,587,981

$3,837,358.25

August 2050

$3,440,389.67

$3,664,321

$3,908,609

September 2050

$3,511,640.25

$3,740,661

$3,979,859.75

October 2050

$3,582,890.83

$3,817,001

$4,051,110.50

November 2050

$3,654,141.42

$3,893,341

$4,122,361.25

December 2050

$3,725,392

$3,969,681

$4,193,612

Based on the most recent knowledge gathered, the present value of Bitcoin is $$52,156.27, and BTC is presently ranked No. 1 in the whole crypto ecosystem. The circulation provide of Bitcoin is $1,023,940,118,714.24, with a market cap of 19,632,156 BTC.

Up to now 24 hours, the crypto has elevated by $370.31 in its present worth.

For the final 7 days, BTC has been in an excellent upward development, thus rising by 5.24%. Bitcoin has proven very robust potential currently, and this might be an excellent alternative to dig proper in and make investments.

Over the last month, the worth of BTC has elevated by 25.33%, including a colossal common quantity of $13,211.18 to its present worth. This sudden development implies that the coin can turn into a stable asset now if it continues to develop.

What Is Bitcoin (BTC)?

Bitcoin is the primary cryptocurrency that was created again in 2009. It’s a decentralized digital forex that makes use of blockchain expertise to facilitate trustless peer-to-peer transactions. BTC has the proof-of-work consensus mechanism, which implies it depends on Bitcoin miners to safe its community.

In recent times, Bitcoin has been probably the most standard property for funding: not solely can it’s extraordinarily worthwhile as a result of excessive volatility of the cryptocurrency market, however additionally it is very simple to spend money on. All one must get Bitcoin is an Web connection.

What Impacts the Worth of Bitcoin?

There are plenty of various factors that may have an effect on the worth of Bitcoin. Not like most altcoins, its value actions don’t rely as closely on the remainder of the crypto market and often finally ends up being the one to set the development. Nevertheless, BTC continues to be aware of the overall elements that have an effect on all markets like rising rates of interest or enormous crypto information, particularly ones that both concern the trade as an entire or different massive cash like Ethereum or Shiba Inu.

Bitcoin’s value additionally will get affected by non-crypto information — an awesome instance of that might be its value motion within the spring of 2020. That’s why it is best to keep watch over inventory forecasts if you wish to have a greater understanding of the present Bitcoin value. One other information sector that those that invested in Bitcoin or are planning to take action ought to look out for is ecology.

Identical to some other asset, Bitcoin will get affected by information associated to it, be it about Bitcoin itself, crypto exchanges, or blockchain expertise. Crypto costs often go up when there’s a piece of stories associated to mass adoption, new technological breakthroughs, and so forth. Alternatively, any uncertainty may cause its worth to plummet.

Historical past of Bitcoin

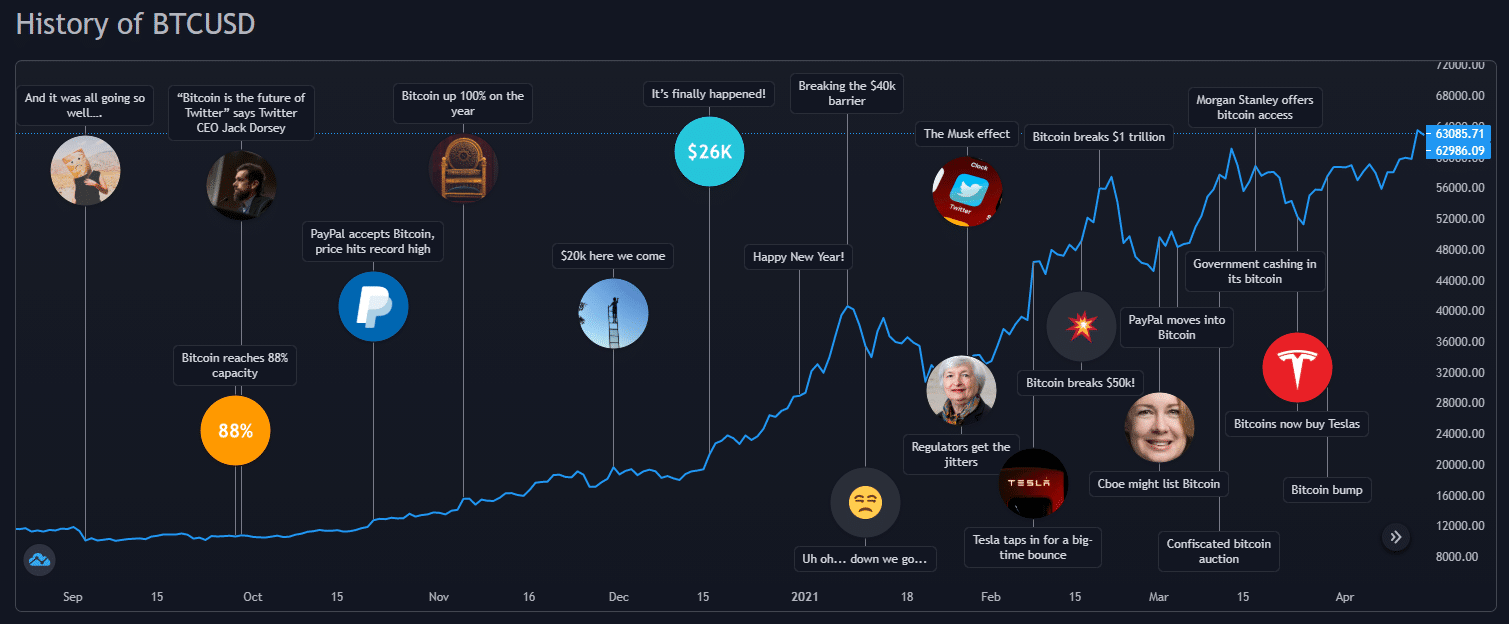

Bitcoin’s value historical past is understood to most crypto fanatics. From being finally almost nugatory, this coin has grown to turn into one of many greatest property on the earth. At its top, Bitcoin’s market cap was even increased than that of a number of established companies.

Let’s take a quick take a look at the Bitcoin value chart.

Upon this chart, one factor that instantly turns into obvious is that Bitcoin’s value cycles carry on shortening. Moreover, regardless of the coin frequently shedding worth, the typical worth of Bitcoin retains rising. This reveals a constructive development for the long run.

“Will Bitcoin return up?” is an evergreen query within the crypto market. The reality is, irrespective of how onerous we examine BTC value historical past and developments, we might not have the ability to predict this precisely. Nevertheless, we are able to nonetheless contemplate these elements in addition to right now’s Bitcoin information to make a tentative prediction.

Bitcoin’s crypto market cap continues to be the very best within the trade, and it nonetheless has probably the most recognition. Its circulating provide is slowly approaching its whole provide however there’s nonetheless an extended solution to go until we attain some extent the place there shall be no new Bitcoins launched.

General, Bitcoin value historical past reveals us that there’s nonetheless room for this asset to develop even when there’s a bear market.

Please notice that this doesn’t represent funding recommendation.

Will Bitcoin Go Again Up?

The longer term trajectory of Bitcoin’s value, influenced by numerous macroeconomic elements and key occasions, is a topic of widespread curiosity within the cryptocurrency trade.

The anticipated discount in rates of interest by the US Federal Reserve is predicted to ease strain on the cryptocurrency market, probably fostering widespread adoption of Bitcoin. Moreover, potential laws within the US aiming for clearer crypto funding laws may scale back investor uncertainty. This, coupled with Bitcoin’s present standing as a regulated commodity within the US, might encourage institutional adoption, attracting new buyers to the cryptocurrency.

One other vital occasion is the Bitcoin block reward halving scheduled for 2024, traditionally related to a surge in Bitcoin’s value and indicative of bullish momentum. This occasion is eagerly awaited, because it has beforehand signaled the beginning of a bullish market development. Bitcoin’s strong efficiency, highlighted by a record-breaking transaction quantity and a robust hash charge, has additional strengthened investor confidence and positively impacted its market worth.

Regardless of these constructive developments, the long-term viability of the crypto market faces scrutiny. The rising introduction of crypto-related services contrasts with the skepticism of specialists, pushed by stringent world laws and public apprehension about new applied sciences, usually attributed to misunderstanding or worry.

Bitcoin is a digital forex, simple and unambiguous in its essence. Nevertheless, its sluggish adaptability and reliance on an environmentally unfriendly proof-of-work (PoW) consensus algorithm might problem its attractiveness as an funding in comparison with extra various cryptocurrency ecosystems.

In gentle of those dynamics, the query stays: Can Bitcoin get well and reclaim its earlier highs? Its historical past of resilience suggests the potential for rebound. All that stated, we stand with the analysts who imagine within the nearing rise of BTC. Now, let’s check out what numbers BTC is predicted to hit in a short while.

Bitcoin Worth Predictions by Specialists

The approval of the Bitcoin exchange-traded fund (ETF) marks an essential milestone in mainstreaming Bitcoin investments, probably increasing its investor base, particularly amongst establishments. Regardless of Bitcoin buying and selling under $45,000 post-approval, investor sentiment is mostly bullish, suggesting an optimistic outlook for future value will increase.

Anthony Scaramucci of SkyBridge Capital predicts a $100,000 peak inside a 12 months, drawing parallels to the 2004 spot gold ETF approval and highlighting the historic value motion of such property. Technopedia forecasts a excessive of $98,000 in 2024, with an early low of round $21,500 and a median of $65,000, indicating potential value appreciation.

MicroStrategy’s Michael Saylor anticipates a “provide shock” from the Bitcoin halving, lowering miner-available BTC, which might gas bullish value motion. Tim Draper of Draper Associates speculates a few rise to $250,000 by July. Figures like Marshall Beard of Gemini and Paolo Ardoino of Tether anticipate a retest of the $69,000 excessive.

Tom Lee of Fundstrat World Advisors sees a possible rise to $150,000 short-term, with long-term potential at $500,000, influenced by altering financial coverage and market dynamics. Ark Make investments’s Cathie Wooden has an much more formidable projection of $600,000 in her base case and $1.5 million by 2030 in her bull case, reflecting a robust perception in Bitcoin’s potential for a lot development.

Digital Coin Worth predicts a gradual improve to just about $140K in three years, with a median value of $90,733 in 2024, $99,421.76 in 2025, and $153,537.15 in 2026.

Nevertheless, extra conservative forecasts, like Pockets Investor, counsel a possible drop to $10,000, demonstrating the variety of opinions out there.

These bullish predictions are underpinned by Bitcoin’s finite provide and independence from exterior financial elements. Its rising acceptance and technological developments, regardless of the evolving regulatory landscapes, bolster its funding enchantment.

The Bearish State of affairs

On the time of writing, the cryptocurrency trade largely maintains a constructive view on Bitcoin, making it difficult to search out notable bearish projections. Nevertheless, two main issues might negatively affect Bitcoin’s value.

Firstly, Bitcoin’s substantial vitality consumption continues to attract criticism, posing a possible risk to its market worth. Secondly, the evolving regulatory panorama, notably regarding anti-money laundering (AML) and Know Your Buyer (KYC) legal guidelines, presents vital challenges that hassle buyers.

If Bitcoin’s value crashes, then the values of different cryptocurrencies are prone to observe swimsuit.

Is Bitcoin a Good Funding?

Regardless of if it’s in a down- or uptrend, Bitcoin is sort of at all times predicted to maintain rising sooner or later. So, it may be an excellent funding. Nevertheless, please DYOR and thoroughly contemplate the dangers earlier than investing in BTC or some other cryptocurrency.

Our Bitcoin value prediction is relatively conservative and doesn’t bear in mind any random media hype or surprising laws that will occur within the close to future — these elements are too unpredictable. Nevertheless, in the event you’re contemplating investing in Bitcoin, it’s good to be sure you’re prepared for its value to fluctuate wildly.

Bitcoin is much less dangerous than different cryptocurrencies, however it’s nonetheless pretty unstable and unpredictable compared to conventional funding avenues just like the inventory market.

Bitcoin vs Fiat Currencies

In comparison with cryptocurrencies, fiat currencies are a relatively low-risk funding, particularly ones just like the US greenback. Nevertheless, they will nonetheless positively be thought of dangerous property.

Institutional buyers have tentatively began placing their belief in Bitcoin and different cryptocurrencies. Nonetheless, digital property positively shouldn’t have the identical relevancy as fiat cash just like the euro or the US greenback — not less than, not but.

Bitcoin is the next danger, increased reward funding different to fiat cash and different asset courses that positive aspects further worth in the event you imagine in its price as a forex of the long run.

Is it too late to purchase Bitcoin?

Historical past reveals that it’s by no means too late to purchase Bitcoin. The Bitcoin value right now continues to be decrease than its ATH, which implies it might rise and go for a full-scale bull run once more sooner or later.

FAQ

Is Bitcoin an excellent funding?

The forecast for Bitcoin value is sort of constructive. It’s anticipated that BTC value may meet a bull development within the nearest future. We kindly remind you to at all times do your individual analysis earlier than investing in any asset.

Can Bitcoin rise?

In a five-year plan perspective, the cryptocurrency might in all probability rise as much as $143,779.60. As a result of value fluctuations in the marketplace, please at all times do your analysis earlier than investing cash in any challenge, community, asset, and so on.

How a lot will Bitcoin be price 2023?

BTC minimal and most costs may hit $33,016.25 and $39,784.65 accordingly.

How a lot will Bitcoin be price 2025?

The Bitcoin community is creating quickly. BTC value forecast for 2025 is relatively constructive. The BTC common value is predicted to achieve minimal and most costs of $67,625.22 and $83,868.30 respectively.

How a lot will Bitcoin be price 2030?

BTC is supplied with appropriate surroundings to achieve new heights when it comes to value. BTC value prediction is sort of constructive. Enterprise analysts predict that BTC may attain the utmost value of $505,014.84 by 2030.

Will Bitcoin ever hit $100K?

Contemplating the truth that Bitcoin’s value has already doubled its worth a number of instances up to now, it’s doable. Nevertheless, it will require one other market-wide value surge and not less than one journey to the moon.

Will Bitcoin return right down to $10K?

It’s doable. In any case, the cryptocurrency market is extremely risky, and the query of crypto regulation stays unsure.

Is Bitcoin an excellent funding in 2023?

Whether or not Bitcoin is an efficient funding or not relies on your portfolio and danger urge for food. It’s nonetheless going robust, and regardless of all the web doomposting coming from numerous inventory market specialists, the crypto market “bubble” nonetheless hasn’t popped. If it suits into your portfolio, and also you imagine in it as an asset, Bitcoin can certainly be an excellent funding in 2023.

How excessive can Bitcoin go in 10 years?

In 10 years, Bitcoin can attain $100K and even hit $200K. So long as there aren’t any threats to it when it comes to competitors and regulation, its finite provide and rising reputation ought to be certain that it retains on reaching new value highs.

Why can there solely ever be 21 million Bitcoins?

The easy reply to this query is “as a result of it was designed that manner.” Nicely, however why can’t this restrict be prolonged? Amongst different issues, BTC’s finite provide acts as a deflationary measure and is among the the reason why Bitcoin’s value is as excessive as it’s. As for why this actual determine was chosen, there are a number of theories about it. One states that it’s as a result of the whole worth of all bodily cash on the earth when BTC was developed was equal to $21 trillion. Because of this, if Bitcoin had been then to utterly substitute fiat, 1 BTC would have been price $1M, and one satoshi — $0.01.

Is Bitcoin a secure long-term funding?

Bitcoin is a comparatively secure funding in comparison with different cryptocurrencies. Nevertheless, it’s nonetheless a high-risk, high-reward sort of asset and shouldn’t be seen as a dependable long-term retailer of worth.

What occurred to Bitcoin’s value?

Bitcoin hasn’t been capable of attain its earlier highs currently, but it surely could be slowly beginning to bounce again.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.