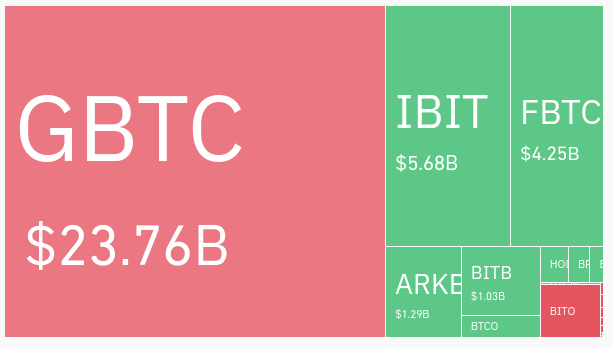

US-based spot Bitcoin ETFs have gathered near $37 billion in belongings beneath administration (AUM) throughout the first 25 days of buying and selling, in keeping with market information.

By the way, the full AUM of Bitcoin ETFs is a sizeable fraction of the general AUM of gold ETFs, in keeping with information shared by Bitcoin Archive.

The $37 billion AUM of spot Bitcoin ETFs is the same as 39.8% of the $93 billion AUM of gold ETFs and 28.5% of each lessons’ mixed $130 billion AUM.

Bitcoin ETFs might outpace gold ETFs

Bloomberg ETF analyst Eric Balchunas commented on the 25-day development of the ETFs, stating:

“There’s been $4b-ish in internet internet flows + rally = on tempo to move gold a lot prior to I estimated.”

Nevertheless, he famous that the Grayscale Bitcoin Belief (GBTC) contained substantial belongings earlier than it was transformed to an ETF, which means that the numbers are “not fairly as spectacular” as they could appear.

Certainly, a lot of the spot Bitcoin ETF AUM is accounted for by GBTC, adopted by BlackRock’s iShares Bitcoin Belief (IBIT) and the Constancy Clever Bitcoin Belief (FBTC).

Balchunas stated {that a} rally within the flagship crypto’s value to new all-time highs may lead these ETFs to overhaul gold-based merchandise in a short time. Nevertheless, he admitted that this end result relies on Bitcoin’s value as a “enormous variable,” and a downward development in value would imply it will take “for much longer.”

Spot Bitcoin ETFs are at the moment outperforming gold ETFs by different metrics.

CryptoSlate evaluation exhibits that gold ETF outflows have seen $3 billion in outflows year-to-date, whereas spot Bitcoin ETFs have seen $4.1 billion in inflows since launch.

It’s unclear whether or not these developments may have a long-lasting impact on AUM.

The put up Spot Bitcoin ETFs attain $37B in AUM, roughly one-third of gold ETF belongings appeared first on CryptoSlate.