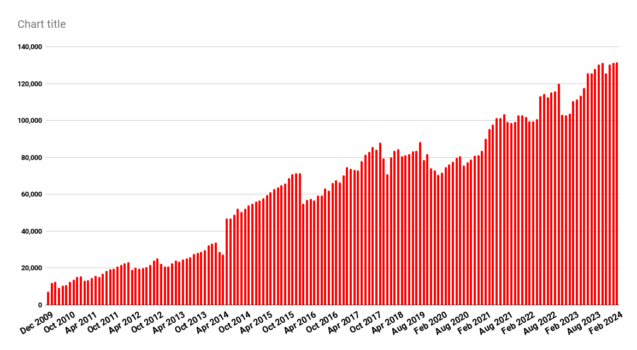

Bitcoin has been on an absolute tear, surpassing $52,000 for the primary time since December 2021. The main digital asset has already climbed over 23% in 2024, and a serious driver of this meteoric rise has been the inflow of institutional cash coming into the house by way of spot Bitcoin ETFs.

Bitcoin’s mainstream credibility amongst conventional traders has been rising for the reason that starting of February, with ETFs registering between $400 million and $650 million in each day inflows previously week. On the similar time, BTC name choices have seen a large rise.

This bullish sentiment has prompted traders to start anticipating the second when BTC would obtain a brand new all-time excessive. In accordance with analysts at QCP Capital, a crypto asset buying and selling agency, Bitcoin is ready to succeed in a new all-time excessive earlier than the tip of March 2024.

Prime Agency Predicts Bitcoin Can Attain New All-Time Excessive Earlier than April

Bitcoin’s present all-time excessive of $69,044 has seemed like an insurmountable mountain for the previous two years, particularly through the extended bear market in 2022, which noticed BTC buying and selling beneath $17,000. Nevertheless, issues have modified since that point, and present metrics level to the worth of Bitcoin blasting previous this worth level within the coming months.

This transformation in sentiment can primarily be attributed to the eye round spot Bitcoin ETFs. Though Bitcoin appeared to wrestle behind a sell-the-news occasion for weeks after these ETFs hit the market, the scenario has since turned constructive.

In accordance with information from BitMEX Analysis, Bitcoin ETFs have witnessed huge inflows led by BlackRock’s ETFs previously week. On the similar time, outflows from Grayscale’s GBTC have slowed down. Consequently, the ETFs have acquired a gradual $400 million to $650 million in each day inflows, which works out to eight,000 to 12,000 BTC purchased each day.

Notably, buying and selling hit historic highs on February 14th, with the highest 9 ETFs hitting $1.5 billion in buying and selling quantity.

What’s Driving The BTC Value Rally?

QCP Capital credit this rising institutional funding in Bitcoin as a important driver of future development. Analysts count on this influx to proceed as BTC turns into more and more in style amongst conventional traders and international liquidity rotates into the spot ETFs, permitting it to interrupt previous its all-time excessive earlier than April.

The analysts additionally seemed on the huge purchases of BTC name choices, noting how $10 million was spent previously week on premiums for $60,000 to $80,000 strikes expiring from April to December. This worth level is thrilling, because it signifies many traders are already trying ahead to Bitcoin breaking previous $69,000 within the coming months.

Predictions will be hit and miss, however Bitcoin appears poised to proceed its meteoric rise in worth. It’s additionally essential to notice that the following Bitcoin halving, slated for April 2024, is steadily approaching.

Cowl picture from Dall-E, Chart from Tradingview

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual danger.