The delicate shift in social media conversations. The mentions within the mainstream media: “Bitcoin will now be obtainable for Wall Road traders!”. All of the textual content messages arriving with questions on bitcoin out of your no-coiner mates. Bitcoiners know that that is the sign. The bull market is formally right here earlier than the 2024 halving. It is a letter and a short information with good instruments for all these individuals who have been asking questions on bitcoin within the final couple days.

“Bitcoin… Ought to I purchase it?” “What’s one of the best ways to purchase some?” “When ought to I purchase it?” “How a lot do I purchase?” “What technique do I take advantage of to build up?” “Do I hold it? How lengthy?”

Regularly after which instantly. That bizarre magic web cash you spend your free time researching is all anybody desires to speak about now. Your coworker, often oblivious to something outdoors his rapid area, begins peppering you with questions on exchanges and wallets. Your highschool and faculty mates textual content you asking for recommendation.

The no-coiner texts are greater than only a social phenomenon. They seem to be a barometer of market sentiment, a bellwether signaling the rise of a brand new wave of curiosity. When the questions shift from “What’s Bitcoin?” to “How do I purchase it?” you already know one thing elementary has shifted.

This is not simply FOMO (worry of lacking out). It is recognition. Individuals are beginning to see what we have seen all alongside: a financial revolution unfolding earlier than our eyes. The restrictions of the outdated system, the fragility of fiat currencies, have gotten painfully apparent. And Bitcoin, that beacon of sound cash and particular person sovereignty, shines ever brighter within the rising darkness.

The questions, after all, are diverse. “Ought to I purchase now?” asks the cautious one, nonetheless scarred by previous worth swings. “What trade ought to I take advantage of?” queries the sensible one, looking for a safe path to entry. And the adventurous one, eyes gleaming with gold rush fever, desires to learn about leverage and buying and selling methods.

There is not any one-size-fits-all reply, after all. Every journey into Bitcoin is exclusive, formed by particular person circumstances and danger tolerance. However for these drawn to the flight to high quality, let’s go step-by-step.

“Ought to I Purchase Bitcoin?”

This isn’t funding recommendation. Earlier than investing any cash, I might counsel that you simply make investments time doing your personal analysis about find out how to use the Bitcoin community appropriately. That mentioned, the world’s largest asset supervisor could be very bullish on Bitcoin. In line with a BlackRock paper from 2022, they imagine that an 84.9% bitcoin allocation is the optimum technique.

Moreover, Constancy revealed a paper titled Introduction to Digital Property For Institutional Buyers they usually point out Bitcoin 73 occasions. After that, they revealed a paper titled Bitcoin First: Why traders want to think about Bitcoin individually from different digital belongings.

Once more, that doesn’t imply you must belief them along with your eyes closed. I encourage everybody to do their very own analysis. That is merely a bit of little bit of context about what giants within the asset administration business are saying recently. There are open supply instruments that may enable you to make your personal conclusions. Any individual can entry and perceive find out how to use these instruments for his or her private wealth administration. In truth, you’ll be able to play with the fashions and regulate something if you already know some programming in Python. Lastly, the Bitcoin community has so many distinctive traits that make it like no different asset we have seen earlier than. Bitcoin rocks!

“What Is The Finest Approach To Purchase Some?”

It is dependent upon particular person wants, priorities and commerce offs. On one aspect, you want to select the extent of duty that you simply’re snug with. On one other aspect, you want to resolve on the extent of possession that you simply need to have over your wealth.

For instance, there shall be people that want to surrender absolute possession as a result of they’d fairly have a third-party because the custodian of the bitcoin. Very long time bitcoiners worth absolute possession and subsequently they like to be the custodians of their very own bitcoins even when that suggests extra duty for them. Holding your personal keys is the one approach to actually personal any bitcoin. That is why they are saying: “Not your keys, not your bitcoin”. For those who actually need to be your personal financial institution, you’ll be able to’t delegate the duty of holding your keys to anybody else.

There isn’t a doubt that not everybody prefers the large duty of holding their bitcoin. The identical factor occurred with different belongings like gold. Not everybody feels snug storing gold of their properties they usually ship their gold to third-party custodians which have large gold vaults. In our on-line world there are additionally technicalities that may make some people really feel unable to maintain up with the large duty of holding worth with out the assistance of a third-party.

Ask your self the next questions: Do you worth absolute ownerships? Do you worth privateness? Are you snug with the duty of holding your keys safely? How a lot belief do you might have in a third-party to custody your wealth? Are you a person or institutional investor? In case you are an institutional investor, are there laws stopping you from proudly owning actual bitcoin? The next diagram from River might help you resolve which is one of the best ways so that you can purchase and maintain bitcoin.

In conclusion, there are three completely different options relying on particular person wants. First, proudly owning actual bitcoin with a {hardware} pockets that you simply personal the keys to. Second, shopping for paper bitcoin and having a third-party do the custody for you. Third, shopping for a Bitcoin ETF and having your dealer hold it for you. In spite of everything, you need to use a mixture of completely different methods both to diversify your publicity or make investments from completely different platforms.

“When Ought to I Purchase It?”

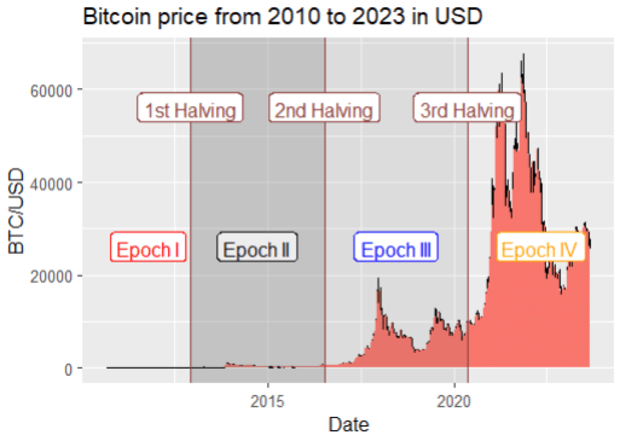

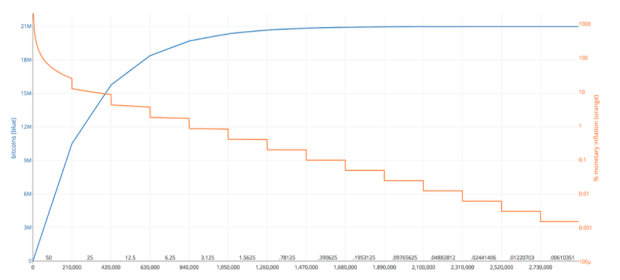

Roughly each 4 years there may be an occasion known as the Halving. A halving implies that the quantity of bitcoins put into circulation is minimize into half. This is called the Block Reward or Block Subsidy. In 2023, the Block Reward was equal to six.25 Bitcoin cash. The Block Reward refers back to the variety of cash issued each 10 minutes. Which means 900 bitcoins have been created every day.

In 2010, the Block Reward was 50 cash. Throughout a Halving, the Block Reward is halved, marking vital epochs within the lifetime of the Bitcoin community. We’re at present within the 4th epoch (Epoch IV), which started in 2020 and can finish in 2024.

Due to this fact, with the Halving in 2024, the financial issuance will lower to three.125 cash each 10 minutes. This halving is anticipated to happen round April and in different phrases, a halving causes an anticipated lower within the development fee of the financial base. The halving and the Epoch are essential issues for these desirous about investing in Bitcoin. Within the following graph you’ll be able to visualize this:

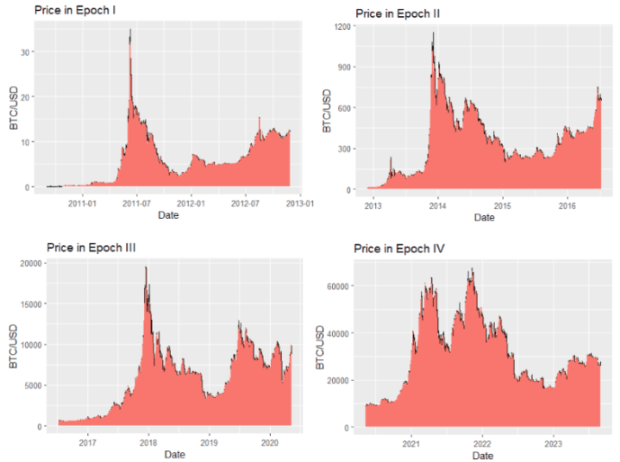

The next charts comprise Bitcoin worth knowledge for every epoch individually (from Epoch I to Epoch IV, respectively). What’s intriguing about these 4 charts is that they assist us visualize a transparent sample that repeats in every epoch. These charts may be worthwhile to anybody desirous about investing in Bitcoin, as they help us in visualizing a really distinct cycle that repeats each 4 years.

You will need to point out that we have no idea if the 4 yr cycle will proceed ceaselessly. In the previous few years there have been new conversations that counsel that the 4 yr cycle is not going to at all times be like that. A preferred argument is that the halving shall be priced in with anticipation for future epochs when folks turn into extra conscious of this phenomenon.

There are at present 19.7 billion bitcoins in circulation out of the 21 million that there’ll ever exist. Which means 93% of the whole bitcoins exist already and there may be lower than 7% of them to be mined. Nonetheless, the final bitcoins shall be mined across the yr 2140 and miners will dwell off of transaction charges after that.

*Supply: https://medium.com/swlh/the-mathematics-of-bitcoin-89e7ab59edc

“How A lot Do I Purchase?”

Upon getting determined to purchase bitcoin, the following step is to ask your self how a lot you need to make investments. Keep in mind the recommendation from that Blackrock publication? You do not have to be that aggressive and make investments 84% of your portfolio in bitcoins. You possibly can start little by little. On this part, I’ll use a beautiful open-source instrument created by Raphael Zagury (Chief Funding Officer of Swan Bitcoin) and I might counsel everybody to play with the fashions within the platform by your self. You’ll find this dashboard at https://nakamotoportfolio.com/.

Within the Nakamoto Portfolio web site, you’ll be able to personalize a portfolio to satisfy your wants or you’ll be able to try default portfolios templates which are already there so that you can analyze. Let’s try a quite simple and conventional portfolio:

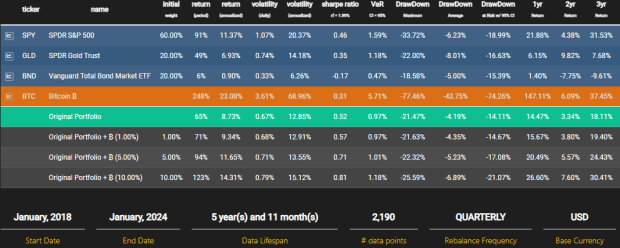

This portfolio has 60% of its wealth invested within the S&P 500 Index (SPY), 20% in a daily gold belief (GLD), and the opposite 20% in a Vanguard Bond Market ETF (BND). The time-frame used to research this portfolio is between January 2018 and January 2024. The inexperienced line exhibits us the precise outcomes that this portfolio would`ve had throughout that point span. The outcomes inform us that this portfolio would have had an annual return of 8.73%. The overall return for the six yr interval is 65%. The day by day volatility of this portfolio is 0.67% and the annualized volatility is 12.85%.

Now let’s concentrate on the three strains under the inexperienced line that represents the unique portfolio. These strains give us the outcomes of the unique portfolio if they’d have had 1%, 5% and 10% of the portfolio in Bitcoin for these six years. Simply by having 1% in Bitcoin, the whole returns of the portfolio would go from 65% to 71%. The annualized volatility would solely enhance to 12.91%. A place of 5% in Bitcoin would enhance the returns all the way in which to 94% with the volatility at 13.55%. Lastly, a place of 10% in Bitcoin would take the returns all the way in which to 123% and the volatility would solely enhance to fifteen.12%. This train illustrates completely why publicity to Bitcoin (even minimal publicity) is right for any portfolio.

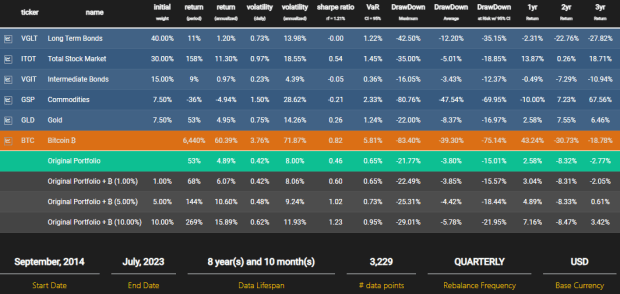

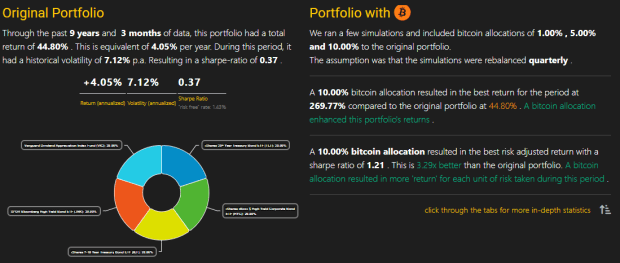

Ray Dalio, the well-known investor from Bridgewater Associates, created a portfolio designed to carry out properly throughout completely different financial circumstances. This funding technique is called the All Climate Portfolio. This portfolio template is offered on the Nakamoto Portfolio web site to research the outcomes of Bitcoin publicity. The next picture demonstrates the advantages of including Bitcoin to a portfolio like this one.

One other fascinating portfolio to take a look at is the Diversified Bond Portfolio. It is a conservative funding technique for risk-averse people. This portfolio consists of a mixture of Treasury with Excessive Yield ETFs. In line with Mr. Zagury, “a Bitcoin allocation is the right implementation of a bond portfolio. Even at small quantities, it has the potential to extend risk-adjusted returns.” The next picture incorporates a short abstract of the impression that Bitcoin publicity can have on the Diversified Bond Portfolio. I counsel for everybody to check out the Nakamoto Portfolio by themselves to play with completely different numbers, portfolios, methods, and so forth. There are YouTube tutorials and Twitter Threads to assist anybody that’s desirous about utilizing this glorious instrument.

“What Technique Do I Use To Accumulate?”

Upon getting determined that you simply need to purchase some bitcoin and you’ve got selected the quantity of publicity that you really want, the following step is to resolve the way you need to method this accumulation part. What technique do you need to purchase bitcoin? On one hand, you should buy it abruptly. However, you should buy little by little.

There are two most important methods for bitcoin accumulation: Lump-sum Investing and Greenback Price Averaging (DCA). A lump-sum technique implies investing all obtainable funds directly. The DCA technique allocates funds over common intervals. For instance, somebody that decides to purchase $100 value of bitcoin every week (irrespective of the worth) is following a DCA technique. It is a well-liked technique amongst bitcoiners that need to stack sats constantly. Every technique has its personal execs and cons. Nonetheless, the perfect technique is dependent upon the actual wants and preferences of every particular person.

The Nakamoto Portfolio web site additionally has a instrument the place anybody can run the numbers and examine which technique works higher for his or her explicit state of affairs. Take a look at the BTC Price Averaging Simulator. In line with Swan´s Nakamoto Portfolio, “lump-sum investing has traditionally outperformed DCA methods. That is primarily as a consequence of Bitcoin’s explosive upward worth actions. However DCA can result in vital outperformance throughout bear markets. As an example, traders who purchased at all-time highs however employed DCA afterward have been capable of break even considerably faster. Whereas DCA has potential drawbacks, resembling lowered returns in constantly rising markets, it stays a preferred technique for managing danger and selling disciplined investing.” In spite of everything, most individuals use a mixture of each of those methods and that is perhaps one of the best ways to go.

“Do I Hold Tt? For How Lengthy?”

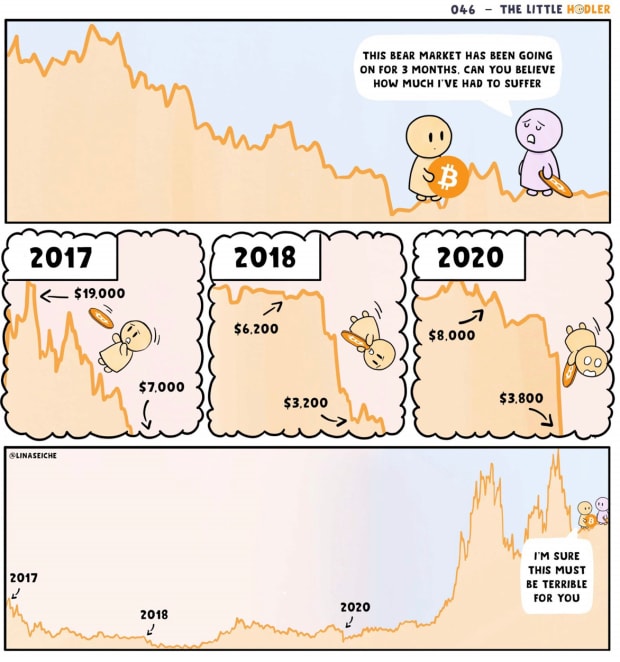

Once more, that comes all the way down to particular person wants, priorities, data, and so forth. Nonetheless, this asset must be thought of a long-term funding technique. Which means holding your bitcoin for a really very long time, no matter worth fluctuations. Many Bitcoin fans imagine that bitcoin will ultimately turn into a worldwide reserve forex, and subsequently, they’re prepared to carry it by means of the ups and downs of the market. There’s a well-liked saying amongst bitcoiners that adjustments “maintain” into “HODL” (Maintain On For Pricey Life!). Check out superior bitcoin comics that may additionally provide you with some recommendation…

Different traders want buying and selling their bitcoin on a frequent foundation. This technique includes shopping for bitcoin through the dips and promoting through the highs. It sounds too cool however in actuality this decentralized market could be very tough to foretell. Very not often do merchants get to outsmart the market. Time out there is extra vital than timing the market.

I encourage readers to take the following step, whether or not it is researching Bitcoin on their very own, beginning a Bitcoin funding plan, or becoming a member of the Bitcoin group. Begin your Bitcoin journey right now! Dive into the assets, discover the Nakamoto Portfolio, and do not hesitate to ask questions. Bitcoin awaits those that dare to step into the long run. As Bitcoin continues its ascent, how will the world adapt to this new paradigm of sound cash and particular person sovereignty? Solely time will inform, however one factor is for certain: the long run is orange.

It is a visitor put up by Santiago Varela. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.