Fast Take

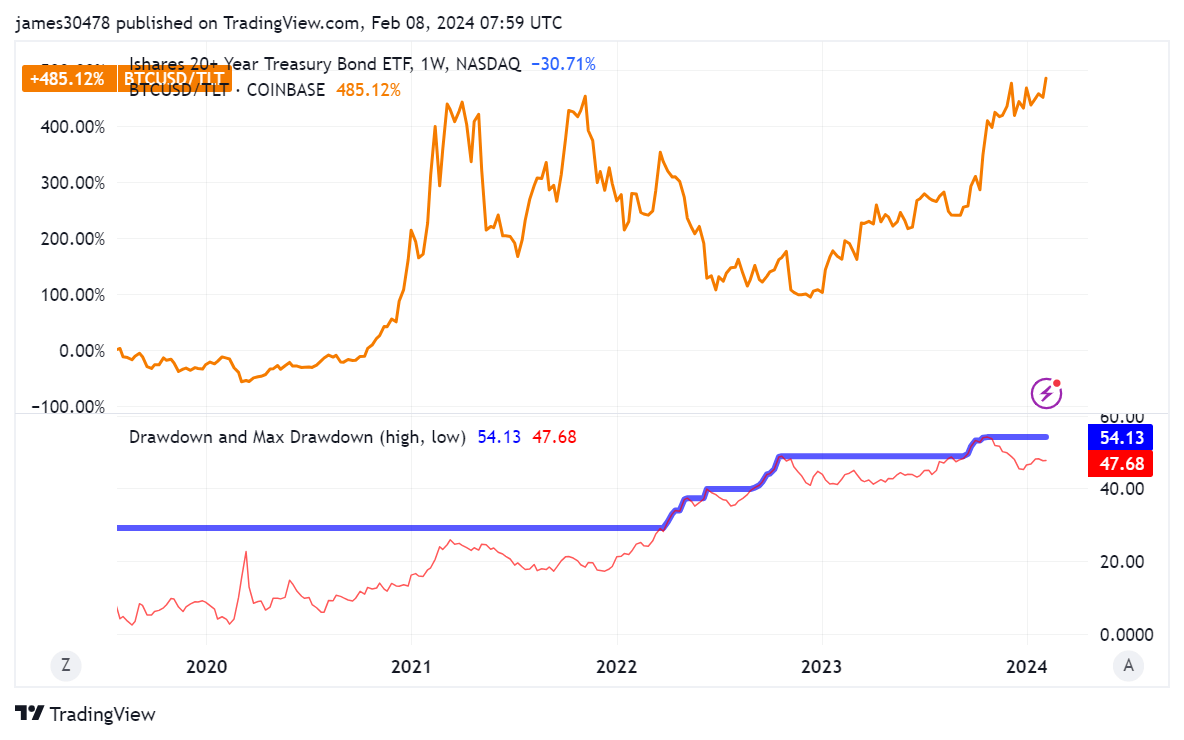

A development emerged between Bitcoin and TLT, the U.S. lengthy bond ETF, in early December as BTC denominated in TLT hit a triple high stage beforehand seen in 2021.

Bitcoin simply rallied above $44,200 and is 36% off its all-time excessive of $69,000; it has showcased a big dominance in relation to TLT, which is presently buying and selling round $94 and stands 48% off its peak. This divergence is additional highlighted because it presently requires 471 TLT to buy one Bitcoin, surpassing earlier highs of roughly 420 and 440 in March and November 2021, respectively, when Bitcoin was buying and selling properly above $50,000.

This development suggests an fascinating side of the monetary markets, as Bitcoin, historically considered as a dangerous asset, shows resilience in comparison with TLT, a world benchmark for comparatively secure property. Notably, BTC ETFs are experiencing substantial inflows, doubtlessly providing tailwinds to Bitcoin’s worth.

Contrarily, market forecasts might dampen TLT’s prospects; the CME fed watch software is presently projecting an 82% probability of a pause by March 2024, opposite to the optimism that prompted TLT to rally in latest weeks.

Compounded by challenges within the banking sector, for instance, New York Group Financial institution inventory is almost down 70% year-to-date, in line with The Kobeissi Letter; these developments current a compelling narrative of potential shifts in asset dynamics, worthy of shut consideration.

The put up Bitcoin breakout towards US bonds sees it hit new all-time excessive appeared first on CryptoSlate.