Bitcoin regained the psychologically necessary $40,000 stage throughout the weekend after spending final week struggling to surpass $39,500. As of press time, it stands at simply above $42,000, displaying strong resilience at this stage. This restoration positively affected the broader crypto market and the efficiency of public Bitcoin mining corporations.

Regardless of being listed and traded on inventory exchanges like Nasdaq, public Bitcoin mining corporations are inclined to modifications in Bitcoin’s spot worth and different developments within the crypto market. As most TradFi buyers concerned with the shares see them as a proxy for buying and selling and proudly owning Bitcoin, will increase in Bitcoin’s worth robotically translate into will increase within the inventory worth of those corporations. Conversely, a lower within the worth of BTC results in a discount in revenues, adversely affecting their inventory efficiency.

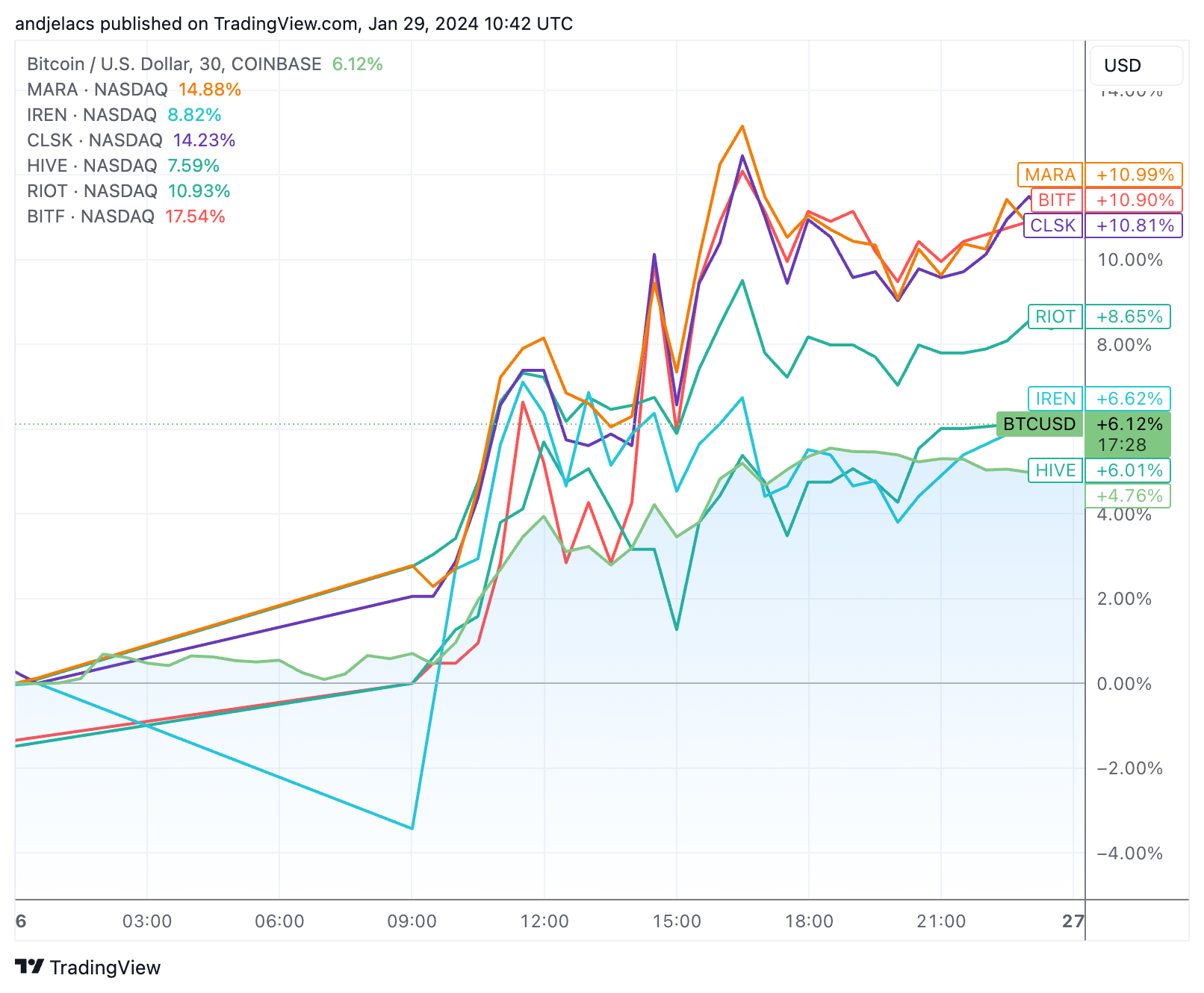

After experiencing a pointy droop within the first two weeks of January, public miners appear to have recovered most of their losses. Between Jan. 22 and Jan. 29, CleanSpark (CLSK) led the pack with a 23% improve, with Bitfarms (BITF) shut behind with 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew by 17.29%, 14.71%, and seven.26%, respectively, with Iris Power (IREN) posting the slightest progress of three.93% throughout the interval.

This upward pattern was extraordinarily pronounced on Friday, Jan. 26, when nearly the entire talked about shares outperformed Bitcoin’s progress of 6.12%, with MARA, BITF, and CLSK all displaying will increase of over 10.80%.

On Jan. 29, as of press time, there was a scarcity of response from Bitcoin mining shares to Bitcoin’s worth motion. This lag is as a result of completely different buying and selling hours between the crypto market, which operates 24/7, and conventional inventory exchanges like Nasdaq, which operates solely on weekdays and the place a lot of the mining shares are listed. This discrepancy typically ends in a delayed response in mining inventory costs to Bitcoin’s weekend worth actions. Given Bitcoin’s rise previous $42,000 over the weekend, we might see additional progress in mining shares because the market opens on Jan. 29 and adjusts to the event within the coming week. Shares resembling RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, to this point in pre-market buying and selling.

The efficiency of those shares additionally displays the marginally elevated miner income, which was unstable final week however confirmed an general constructive uptrend. In keeping with knowledge from Glassnode, the overall every day USD income paid to miners fluctuated between $39 million and $47 million, following Bitcoin’s worth volatility. Miner income is a important benchmark for assessing the well being and efficiency of mining shares, and income will increase are probably the most vital elements pushing inventory costs up.

The put up Regardless of ETF rotation fears, mining shares get well as Bitcoin crosses $42K appeared first on CryptoSlate.