Binance Sensible Chain (BSC) has demonstrated notable progress in key metrics in the course of the fourth quarter (This fall) of 2023, as highlighted in a complete report by Messari.

Because the third-largest Layer-1 protocol by market capitalization, BSC skilled constructive progress throughout its monetary indicators, signaling a productive quarter for the blockchain ecosystem.

Binance Sensible Chain File-Breaking Transactions

The report reveals that BSC’s market capitalization witnessed a 48% quarter-over-quarter (QoQ) surge. This surge displays renewed curiosity in BNB (Binance Coin), the native asset of BSC, following two consecutive quarters of decline.

Furthermore, BSC’s income measured in USD skilled a major QoQ progress of 27%. This income surge, amounting to over $39 million in This fall, signifies elevated exercise on the protocol and the implementation of assorted initiatives all year long.

Fuel charges burned in BNB, a metric reflecting community exercise, additionally noticed a notable QoQ improve of 21%. The rising variety of transactions and sensible contract interactions contributed to elevated fuel charges burned, additional reinforcing the Binance Sensible Chain ecosystem.

Along with monetary metrics, BSC showcased spectacular enhancements in different areas. The variety of lively validators elevated by 25% QoQ, highlighting rising belief and participation in securing the community. BSC’s dedication to decentralization was evident because the protocol skilled a 54% YoY improve in lively validators.

In response to Messari, all through 2023, BSC demonstrated its capacity to deal with heightened exercise whereas concurrently lowering prices for customers. Day by day transactions on the community witnessed a 35% year-over-year (YoY) improve and a 30% QoQ surge, averaging round 4.6 million transactions per day in This fall.

These spikes in transaction quantity had been attributed to inscription-related exercise, with BSC processing a record-breaking 32 million transactions on December 7, 2023.

BSC’s DeFi Ecosystem Reaches $4.6 Billion TVL

Regardless of a decline in each day common lively addresses and new distinctive addresses, primarily attributable to customers exploring different chains like opBNB, BSC’s on-chain exercise remained sturdy.

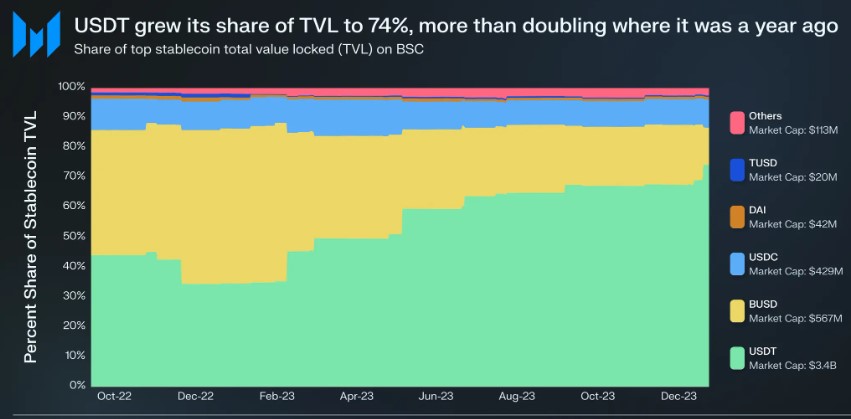

The protocol’s ecosystem of stablecoins, dominated by Tether’s USDT, reached a complete worth locked (TVL) of $4.6 billion in This fall, showcasing a 33% QoQ improve in Decentralized Finance (DeFi) TVL.

Whereas Non-Fungible Token (NFT)- associated metrics declined in This fall, Binance Sensible Chain and Ethereum (ETH) witnessed a resurgence in exercise towards the top of the quarter, indicating a possible upward development within the subsequent market cycle.

Along with BSC’s progress, BNB additionally skilled notable worth actions. After a pointy drop, BNB surged from $238 to achieve the $338 degree. Nonetheless, it later retraced to $287 following a correction.

Prior to now 24 hours, BNB has recorded a progress of three.7%, pushing its present buying and selling worth above $302.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site totally at your personal danger.