Whether or not you’re a newcomer or an skilled crypto dealer, prioritizing utilizing trusted platforms is crucial to keep away from falling prey to scams. The cryptocurrency world, ever-expanding, introduces new tendencies—some helpful, others doubtlessly dangerous.

One such development is the emergence of nested exchanges, also called “immediate exchanges.” These platforms act as intermediaries between customers and different service suppliers.

Whereas decentralization within the crypto house usually goals to reinforce anonymity, it shouldn’t come at the price of compromising safety, which is paramount for safeguarding customers’ crypto belongings. Sadly, when coping with nested exchanges, there’s no assure of the security of your funds.

Within the following sections, we talk about what nested exchanges are, how they perform, and the potential dangers related to utilizing these platforms.

How Nested Exchanges Work

A nested alternate is operated by an “agent” who possesses a number of accounts with a trusted and controlled alternate. These accounts are utilized to execute buying and selling actions on behalf of events. Primarily, nested exchanges act as intermediaries between customers and crypto buying and selling service suppliers, whether or not the supplier is conscious of this middleman position or not.

Right here’s a simplified rationalization of how nested exchanges perform:

All the course of is designed for fast execution and occurs with out the person interacting with the trusted alternate instantly. Some nested exchanges even facilitate in-person crypto transactions utilizing money funds.

Whereas this course of could appear handy for customers, as they will commerce with out registering or present process KYC processes, it introduces sure dangers. Understanding these dangers is essential for customers navigating the cryptocurrency buying and selling panorama. One must be cautious concerning the anonymity supplied by nested exchanges, as it might entice illicit actions and compromise the integrity of the crypto ecosystem.

Risks of Utilizing Nested Exchanges

Using nested exchanges comes with numerous dangers that customers ought to rigorously contemplate. Within the fast-paced cryptocurrency house, impatience with Know Your Buyer (KYC) and Anti-Cash Laundering (AML) processes may drive people in direction of nested exchanges. These platforms function discreetly, providing swift buying and selling with minimal or no registration necessities. Nonetheless, the convenience of entry presents potential dangers that customers have to be cautious about.

The next are some highlighted risks of utilizing a nested alternate:

Potential for Manipulation or Fraud

Nested exchanges usually lack transparency and auditing capabilities, making it difficult for customers to find out if the buying and selling course of is honest and dependable.

The shortage of transparency within the operation of nested exchanges makes monitoring and confirming trades throughout a number of platforms difficult for customers. This opacity raises issues about potential manipulation or fraudulent actions that customers might not be capable to detect.

Lack of Safety Ensures

Nested exchanges don’t supply ensures of fund safety throughout transactions. Customers entrust their funds to unfamiliar accounts, making a state of affairs the place the restoration of funds isn’t assured.

The shortage of safety ensures in nested exchanges makes them enticing targets for scammers and fraudsters. Unsuspecting customers might fall sufferer to malicious actions with out being conscious of the hazards.

Safety Vulnerabilities

Nested exchanges introduce further factors of vulnerability, growing the possibilities of safety breaches. Every added alternate within the nested system represents a possible weak spot. If any platform within the chain is compromised, it places all related exchanges and person funds in danger.

Privateness Dangers

Utilizing a nested alternate means sharing private data, buying and selling historical past, and account particulars throughout a number of platforms. This will increase the chance of information breaches or unauthorized entry and threatens person privateness.

Contemplating these risks, customers ought to train warning and prioritize safety when participating with nested exchanges. Persistence in adhering to correct KYC and AML processes on respected platforms is crucial to make sure the security of funds and defend towards potential dangers within the crypto buying and selling panorama.

The Suex Nested Trade Occasion

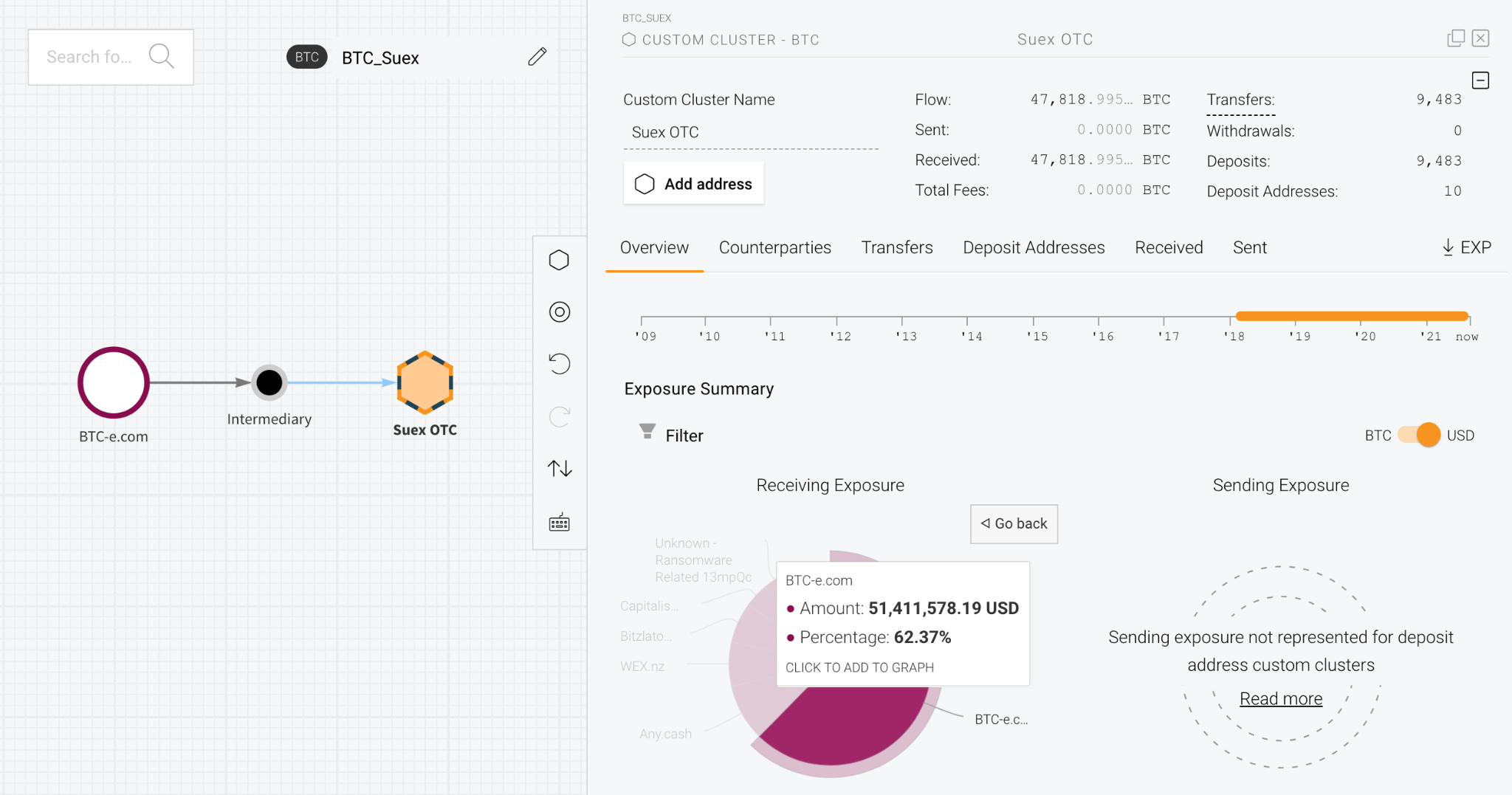

As an example the true issues related to nested crypto exchanges, let’s look at a concrete case. On September 21, 2021, the Suex crypto alternate, based mostly within the Czech Republic however working exterior Russia, confronted sanctions from the U.S. Workplace of Overseas Belongings Management (OFAC).

Suex OTC utilized the nested crypto alternate service supplied by main platforms corresponding to Binance for its clients. Notably, Suex maintained lenient Know Your Buyer (KYC) processes, even permitting face-to-face money transactions for buying crypto.

Chainalysis, a outstanding blockchain evaluation firm, reported Suex’s involvement in laundering funds from hacks and ransomware assaults. In response, Binance deactivated all identified accounts related to Suex. Moreover, the OFAC blacklisted over 30 wallets holding Bitcoin, Ethereum, and Tether.

Everybody concerned with Suex was uncovered to damning authorized dangers.

Chatex, a crypto financial institution related to Suex, was affected by this; OFAC imposed sanctions on Chatex. Subsequently, Suex and Chatex took down their web sites.

Easy methods to Spot a Nested Trade

Newcomers to the crypto house could also be inclined to potential pitfalls related to nested exchanges. Listed below are some methods to identify a nested alternate:

Lack of Emphasis on AML and KYC.

Nested exchanges usually prioritize swift account setup, with minimal give attention to Anti-Cash Laundering (AML) and Know Your Buyer (KYC) necessities. Importantly, this accelerated setup doesn’t impose any quick limitations on how you should utilize the account.

Unfriendly Consumer Interface

The person interface (UI) of the nested alternate’s web site or cell app is probably not user-friendly, making it difficult to find the buying and selling sections. Respectable exchanges usually spend money on intuitive UI design for person comfort.

Unclear Dealing with of Trades:

A nested alternate might not present a transparent assertion about whether or not they instantly deal with cryptocurrency trades. Respectable exchanges explicitly point out that buying and selling happens on their platform, guaranteeing transparency and constructing belief with customers.

Different Charges for Transactions

Nested exchanges usually current customers with a number of charges to select from for transactions. This complexity arises from using nested accounts inside completely different exchanges, every providing distinct charges for buying and selling. This follow could be a purple flag indicating potential dangers.

For those who suspect your cryptocurrency alternate could also be a nested one, utilizing a blockchain explorer can present readability. In instances involving a nested alternate, your cryptocurrency will usually go by means of an extra pockets linked to a unique alternate, separate out of your major one. Verifying this by means of a blockchain explorer will help verify the presence of a nested construction.

Variations between Decentralized Exchanges and Nested Exchanges

Whereas there are some preliminary similarities between nested exchanges and decentralized exchanges, significantly of their strategy to Know Your Buyer (KYC) procedures, they considerably differ of their transaction strategies.

The important thing distinction lies within the transaction strategies and custody of cryptocurrency, with DEX emphasizing decentralization and person management, whereas nested exchanges contain a extra centralized strategy.

In abstract, decentralized exchanges prioritize direct peer-to-peer transactions facilitated by good contracts, sustaining person privateness. In distinction, nested exchanges act as intermediaries, managing customers’ crypto belongings instantly and counting on the providers of one other platform to execute transactions.

In Conclusion,

Nested exchanges can simply function within the cryptocurrency house as a result of it’s nonetheless rising and open for all. Nonetheless, it’s as much as buyers to take ample care in guaranteeing the security of their funds.

Nested crypto exchanges are greatest averted, even when they promise engaging charges and returns. When an alternate permits quick entry to all its options with out not less than verifying your tackle, it ought to elevate purple flags. It’s an important sign to train warning.

Lastly, it’s strongly advisable to stay with well-established and trusted cryptocurrency exchanges to defend your funds from potential dangers of theft or misappropriation. Your safety and peace of thoughts ought to at all times be prime priorities within the cryptocurrency house.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you want to learn extra articles (information reviews, market analyses) like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Nested Exchanges: What Are They and What Are Their Potential Dangers? appeared first on DeFi Planet.