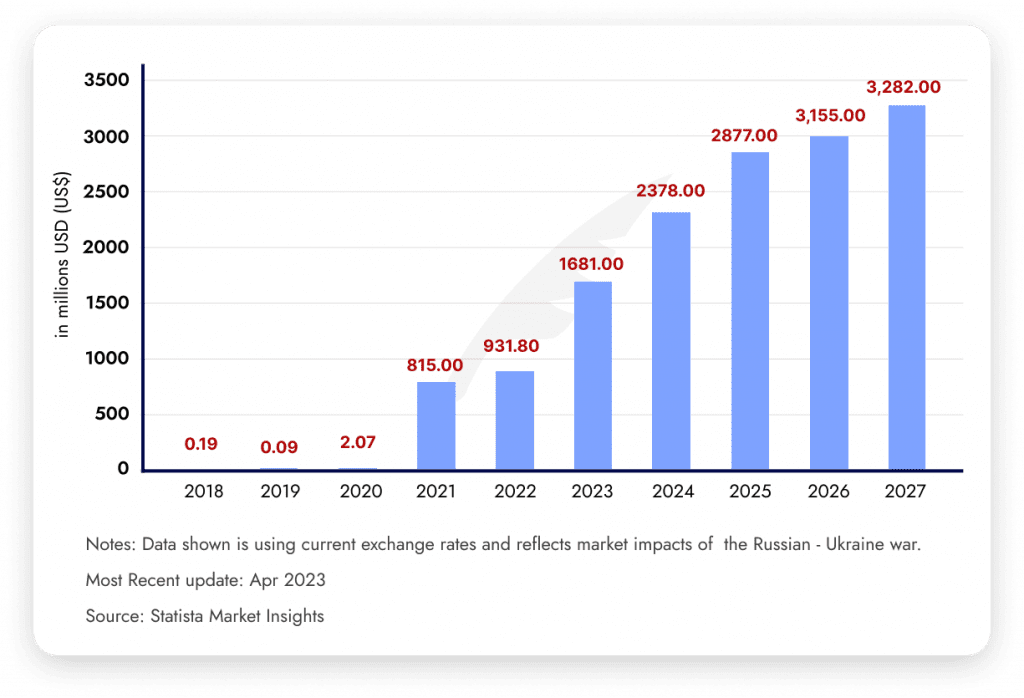

Based on statista.com projections, the non-fungible token (NFT) market is predicted to expertise vital progress when it comes to each income and consumer engagement.

The NFT market is anticipated to generate roughly US$2,378.00 million in income by 2024. With a predicted annual progress charge (CAGR) of 11.34% between 2024 and 2027, this rising development is predicted to proceed, leading to a projected complete income of US$3,282.00 million by 2027.

The US is projected to dominate the NFT market in 2024, with common income per consumer reaching US$140 and complete gross sales hitting over US$1 billion. Regardless of its explosive progress, NFT participation stays area of interest, with solely 0.2% of the worldwide inhabitants anticipated to be concerned by 2027. Nonetheless, the burgeoning rise of the NFT market doesn’t come with out its challenges.

Nonetheless, the whopping rise doesn’t imply NFTs are freed from points. NFTs are constructed on sensible contracts which might be susceptible to exploitation and hacking. Based on Bitcoin Information, 25% of all sensible contracts have important bugs. Other than these, different contracts are additionally more likely to comprise bugs of assorted varieties and severity ranges. Builders, usually working in a rush or due to a lack of understanding, could create defective contracts, which could trigger the lack of thousands and thousands of {dollars} to the undertaking promoters.

Safety issues in NFTs may also end result from sensible contract vulnerabilities. They encompass front-running, reentry, and DoS assaults. Moreover, the trade’s insufficient identification verification practices have led to the sale of counterfeit art work.

NFT Safety Points And Risks

Market Dangers:- Through the use of a market to buy and retailer digital artwork, you might be giving third events entry to your NFT safety. Safety flaws in NFT Marketplaces are exploited by unhealthy actors to steal cash or get hold of unauthorized entry to your property. Examples embody the Lympo sizzling pockets safety breach, the Full Ship Metacarrd, and the OpenSea low-price exploit.

Rugpulls:- A rug pull within the NFT world is a rip-off the place the creators of an NFT undertaking hype it up, promote NFTs for cryptocurrency, after which all of a sudden withdraw all of the funds and disappear, leaving buyers with nugatory NFTs.

An instance is the “Advanced Apes” case, the place the creator vanished with about $2.7 million, and the promised options of the undertaking had been by no means delivered. This illustrates the dangers within the speculative and largely unregulated NFT market. 2022 was filled with scamming initiatives, reminiscent of AniMoon, Frosties, Boren Bunnty, and Huge Daddy Ape Membership. These scams have led to thousands and thousands in stolen worth. Most often, founders run off with customers’ property. Whereas rug pulls should not technically hacks, they end in unintended losses. Thus, you higher discover ways to keep away from them.

Good Contract Vulnerability:- NFTs on Ethereum use a algorithm referred to as ERC-721, together with ERC-998 and ERC-875, with related requirements like BEP-721 on BNB Good Chain and TRC-721 on Tron. These digital contracts have a threat of flaws since they’re public, permitting hackers to search out and exploit weaknesses to steal tokens.

These vulnerabilities usually stem from coding errors in languages like Solidity, Vyper, or Rust, and since these contracts run in a simulated atmosphere just like the Ethereum Digital Machine, any coding mistake can disrupt your entire contract. Moreover, since these contracts continuously work together with one another, a single error may cause not only one utility to fail, but additionally have an effect on different interconnected providers.

Most Widespread Good Contract Points

Reentrancy

Arithmetic Overflows and Underflows

Default Visibilities

Race Situations

Denial of Service (DOS)

Constructors with Care

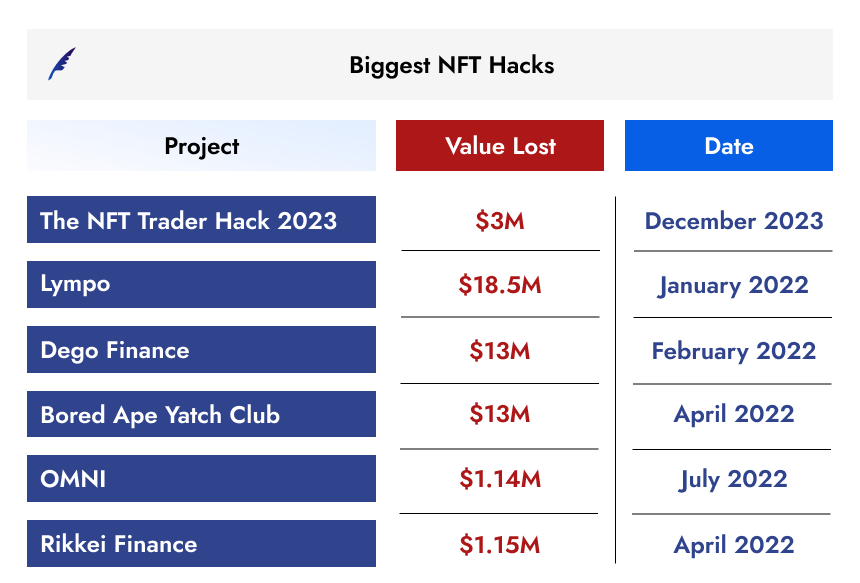

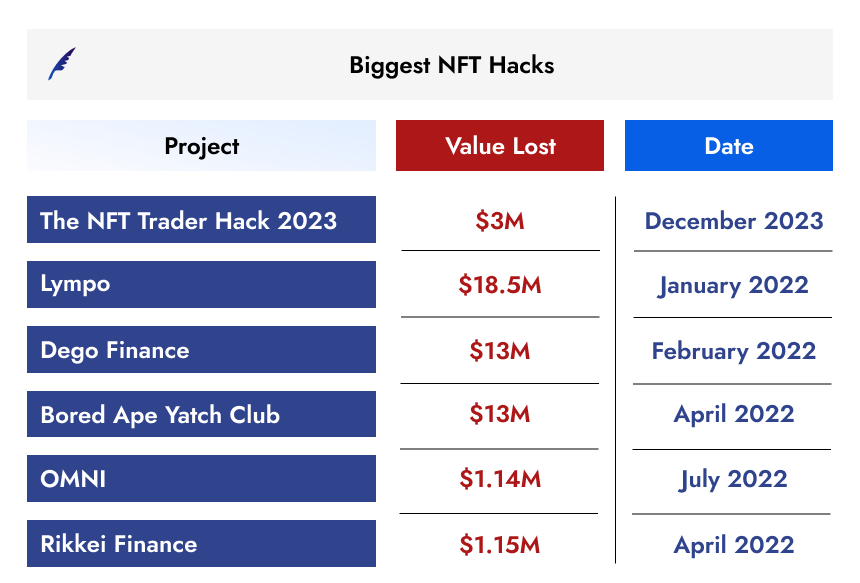

Allow us to throw mild on some in style NFT initiatives that skilled deadly outcomes as a consequence of bugs and mischievous tweaks:

The NFT Dealer Hack 2023

NFT Dealer fell sufferer to a hack in December 2023. The attacker took benefit of weaknesses within the sensible contracts of the undertaking to steal precious NFTs valued at roughly $3 million.

The reentrancy vulnerabilities current in a lot of the undertaking’s older sensible contracts supplied the NFT Dealer attackers with a gap. A safety gap in a wise contract’s inside state monitoring when it calls different, untrusted sensible contracts is called a reentrancy vulnerability.

When a withdrawal perform is applied, as an illustration, the sensible contract would possibly confirm {that a} withdrawal request is reputable, give the caller entry to the property, after which replace its information to indicate that the withdrawal was accomplished efficiently.

This management circulation is problematic as a result of a wise contract can execute its personal code upon receiving a switch. This characteristic permits a malicious sensible contract to re-enter the vulnerable withdrawal perform earlier than it has had an opportunity to replace its inside state. The attacker would be capable to take out the identical property greater than as soon as due to this.

OMNI Actual-Property Token Exploit

In January 2023, the Omni Actual Property token on the BNB Good Chain was compromised as a consequence of coding flaws in its sensible contract. The problems concerned integer overflow/underflow, the place numbers exceed or drop beneath the storage restrict, resulting in incorrect values.

Moreover, there was improper argument validation, which means the contract didn’t adequately verify the inputs it obtained. These vulnerabilities allowed unauthorized actions throughout the sensible contract, underscoring the necessity for rigorous safety measures in cryptocurrency growth.

OpenSea Low-Value Exploit (January 2022)

OpenSea, a significant on-line market for NFTs (Non-Fungible Tokens), confronted a critical safety challenge when hackers discovered a technique to steal precious NFTs, together with in style ones like Bored Apes, at very low costs. The theft was cleverly finished utilizing a flaw in OpenSea’s system that dealt with itemizing cancellations. Hackers exploited a back-end vulnerability and bought NFTs at decrease costs.

They resold them for greater than 300 ETH, over $700K. The previous itemizing was nonetheless accessible by means of OpenSea API. The breach highlighted a giant safety downside within the quickly rising NFT market, exhibiting the dangers of utilizing new and unproven digital contracts. OpenSea shortly fastened the difficulty, however the harm to its status was already finished.

The Significance of Good Contract Examination in an NFT Undertaking

Any blockchain undertaking should carry out a wise contract audit as a way to discover and repair any code vulnerabilities that may end in asset loss or reputational hurt. An audit of this sort examines the codebase for a variety of attainable issues, reminiscent of reentrancy assaults, gasoline restrict issues, and logical and numerical errors. It additionally evaluates the safety of random quantity era and protects in opposition to vulnerabilities that might trigger a denial of service.

After conducting an intensive vulnerability evaluation, auditors rank safety vulnerabilities in accordance with their degree of severity. This leads to a complete report that not solely identifies points that should be fastened straight away but additionally makes suggestions for enhancements that may enhance the sensible contract’s effectivity and safety.

QuillAudits stands on the forefront of sensible contract safety, providing an NFT Due Diligence Service that’s unmatched in its thoroughness and reliability. Harness the facility of our experience to preempt the plethora of NFT assault vectors, together with sensible contract vulnerabilities, market bugs, and the more and more subtle threats posed by social engineering techniques.

How can customers decrease their threat publicity?

Use reliable NFT marketplaces solely, and maintain your cash secure in a safe pockets.

Be looking out for NFT scams and ensure the legitimacy of any provides earlier than sending cash or NFTs.

When it’s possible, use multi-factor authentication.

Previous to signing any transaction utilizing NFTs by means of their wallets, overview the transaction particulars.

Conclusion

In abstract, regardless of the fast progress of the NFT market, safety vulnerabilities persist. The NFT market is projected to achieve a income of US$3,282.00 million by 2027. Notable safety breaches just like the NFT Dealer Hack of 2023 and the OpenSea Low-Value Exploit function proof of those vulnerabilities. These breaches usually stem from sensible contract flaws, resulting in substantial monetary losses. Widespread sensible contract vulnerabilities embody reentrancy, arithmetic overflows, and denial of service assaults.

Particular person customers can mitigate threat within the NFT area by using reliable marketplaces, safeguarding their funds in safe wallets, staying vigilant in opposition to scams, and diligently verifying transaction particulars earlier than confirming. To make sure the NFT market’s progress and safety, proactive safety measures, reminiscent of sensible contract audits, are important. Builders and buyers should keep knowledgeable about evolving safety threats because the market evolves.

41 Views

.gif?format=1500w)

.gif?format=1500w)