With SEC’s approval confirmed, spot Bitcoin ETFs are formally set to launch, marking what some commentators consider is a turning level in Bitcoin’s historical past. No matter occasions unfold from right here, it’s price contemplating why now could be the appropriate time for ETFs to get the inexperienced mild, and the way Bitcoin and the broader crypto business could also be affected from right here.

Why Are ETFs Occurring Now?

The primary ever software for a bitcoin ETF was from the Winklevoss brothers, again in 2013 when BTC was buying and selling under $100, and subsequent to that, there have been a number of additional makes an attempt, from the likes of Gemini (based by the Winklevoss brothers), Ark Make investments and Grayscale. None have been accepted, and the SEC appeared intransigent.

What’s extra, the SEC’s refusal to budge got here as Bitcoin futures ETFs gained approval, and whereas spot Bitcoin ETFs have been launched in different international locations, together with Canada and Australia.

All of which could lead one to ask what occurred over the previous 12 months to trigger BlackRock, some of the influential monetary corporations on the planet, to consider it was price transferring forwards with Bitcoin ETF plans, and why BlackRock and its Chairman and CEO, Larry Fink, instantly displayed such enthusiasm for crypto anyway, after years of indifference.

Preserve Studying

Flashback to six years in the past: That is what an ETF rejection regarded like.#BTC #ETF #CryptoHistory #Throwback #BitcoinETF pic.twitter.com/PJSYOiiMvI

— Crypto Patel (@CryptoPatel) December 29, 2023

Did the Courts Pressure the SEC to Alter Course?

Within the SEC’s case in opposition to Grayscale, the courts decided, final August, that the regulator had acted in an “arbitrary and capricious” manner in denying Grayscale’s software to transform its Bitcoin Belief right into a spot Bitcoin ETF, with the regulator beforehand having accepted different, futures-based Bitcoin merchandise.

This seems to have been a crucial resolution, apparently leaving the SEC with the choice of opening the gates for a number of spot ETFs, or reversing course on futures ETFs and alluring authorized motion, within the data that authorized choices have been already not going its manner.

Moreover, whereas circuitously associated to ETFs, the SEC confronted authorized setbacks in opposition to Ripple thrice in 2023. These setbacks included rulings that XRP, as traded on secondary markets, just isn’t a safety, the Fee being denied an interlocutory enchantment, and all fees being dropped in opposition to Brad Garlinghouse, Ripple’s CEO, and Chris Larsen, the Co-Founding father of Ripple. When these fees have been dropped, Ripple’s CLO, Stuart Alderoty, even characterised it as “a give up by the SEC.”

Then in mid-December, there was a revealing quote from the SEC’s Chair, Gary Gensler, when he said in a CNBC interview, referring to identify BTC ETF functions: “We had prior to now denied a lot of these functions, however the courts right here within the District of Columbia weighed in on that. And so we’re taking a brand new take a look at this based mostly upon these courtroom rulings.”

Though Gensler didn’t immediately reference Grayscale, that case was heard within the District of Columbia Court docket of Appeals. It seems to be as if it’s the courts which can be forcing the SEC to change its strategy, and so in the end, it’s the crypto corporations keen to tackle the SEC in courtroom (Ripple and Grayscale, notably) which have pressured the SEC’s hand.

Has Bitcoin Grown Too Giant to Ignore?

Bitcoin has grown, within the area of fifteen years, from a digital experiment that traded nearly free of charge, to an asset whose cash are at present valued at over $45,000 every, with a market cap of just about $840 billion. And what’s extra, that is regardless of being sidelined by conventional finance and requiring new adopters to make uncommon efforts to accumulate the asset.

A number of declarations from legacy media commentators through the years to the impact that Bitcoin has run its course or is lastly useless have been repeatedly inaccurate, and no matter impediment or initiator of market concern has been positioned in its path (from Chinese language bans to Tesla offloading half its holdings), Bitcoin has marched on regardless. Or as long-term holders with outstanding conviction prefer to put it: tick tock, subsequent block.

Born to Bitcoin. 🧡 pic.twitter.com/qYI3bmZDvC

— VanEck (@vaneck_us) December 29, 2023

Is a Generational Shift Occurring?

Including to the sense that Bitcoin and crypto are right here to remain, there could also be a generational shift happening; a change which comes with an attendant switch of wealth. This proposed prevalence, defined intimately by Cerulli Associates in 2022, means $84 trillion is anticipated to go from the Child Boomer and Silent generations, to youthful generations, and in addition charities, by 2045.

And, this relates on to Bitcoin and different cryptocurrencies as a result of it’s youthful generations, primarily, which can be main the adoption of crypto, suggesting that conventional monetary establishments will probably be more and more motivated to pivot in the direction of digital belongings, and can accomplish that naturally as youthful generations exert higher affect over company resolution making.

How Does a Spot BTC ETF Change the Crypto Panorama?

A spot BTC ETF, notably when managed by a agency as giant and respected as BlackRock, legitimizes BTC for conventional traders, and acts as an institutional stamp of approval. This shift is enhanced by incoming adjustments to FASB truthful worth accounting guidelines for companies, which can make it extra viable for companies to carry BTC on their steadiness sheets.

ETFs present an avenue for traders who will not be inclined to delve into the technical, financial and even philosophical discussions surrounding Bitcoin. They will not be concerned with studying about self-custody, however merely acknowledge Bitcoin as a useful addition to a various portfolio. These traders search publicity with as little friction as potential.

What’s extra, from a buying and selling psychology perspective, an ETF removes unit bias: markets aren’t completely rational, and holding a number of shares in an ETF could seem extra interesting than holding a fraction of a bitcoin.

How Is the ETF Being Acquired by Crypto Natives?

Inside crypto, there’s a agency perception within the mechanism referred to tongue-in-cheek as the worth will increase. This implies, very merely, that nothing attracts individuals to Bitcoin greater than the sight of the value rising. So, if you happen to’re an advocate of the transformative energy of crypto, then you definitely welcome newcomers even when they’re solely visiting within the hope of short-term good points, since some proportion of them will deepen their crypto data and select to stay round for the long-term.

By that token, if an ETF results in elevated investments and a sustained rise in worth over the long run, then it needs to be welcomed. A counter argument is that by eradicating the self-custody components of BTC, an ETF reduces the probability of what may be known as true adoption. However, the advantages, equivalent to legitimizing crypto, and elevated funding, are prone to outweigh any considerations about straying from the founding ideas.

Nonetheless, spot BTC ETFs are removed from a silver bullet for the entire crypto business, as from a growth and adoption perspective, the US would nonetheless profit from new crypto laws and higher regulatory certainty. That stated although, the approval of the ETF alerts a possible landmark shift in attitudes in the direction of Bitcoin.

With SEC’s approval confirmed, spot Bitcoin ETFs are formally set to launch, marking what some commentators consider is a turning level in Bitcoin’s historical past. No matter occasions unfold from right here, it’s price contemplating why now could be the appropriate time for ETFs to get the inexperienced mild, and the way Bitcoin and the broader crypto business could also be affected from right here.

Why Are ETFs Occurring Now?

The primary ever software for a bitcoin ETF was from the Winklevoss brothers, again in 2013 when BTC was buying and selling under $100, and subsequent to that, there have been a number of additional makes an attempt, from the likes of Gemini (based by the Winklevoss brothers), Ark Make investments and Grayscale. None have been accepted, and the SEC appeared intransigent.

What’s extra, the SEC’s refusal to budge got here as Bitcoin futures ETFs gained approval, and whereas spot Bitcoin ETFs have been launched in different international locations, together with Canada and Australia.

All of which could lead one to ask what occurred over the previous 12 months to trigger BlackRock, some of the influential monetary corporations on the planet, to consider it was price transferring forwards with Bitcoin ETF plans, and why BlackRock and its Chairman and CEO, Larry Fink, instantly displayed such enthusiasm for crypto anyway, after years of indifference.

Preserve Studying

Flashback to six years in the past: That is what an ETF rejection regarded like.#BTC #ETF #CryptoHistory #Throwback #BitcoinETF pic.twitter.com/PJSYOiiMvI

— Crypto Patel (@CryptoPatel) December 29, 2023

Did the Courts Pressure the SEC to Alter Course?

Within the SEC’s case in opposition to Grayscale, the courts decided, final August, that the regulator had acted in an “arbitrary and capricious” manner in denying Grayscale’s software to transform its Bitcoin Belief right into a spot Bitcoin ETF, with the regulator beforehand having accepted different, futures-based Bitcoin merchandise.

This seems to have been a crucial resolution, apparently leaving the SEC with the choice of opening the gates for a number of spot ETFs, or reversing course on futures ETFs and alluring authorized motion, within the data that authorized choices have been already not going its manner.

Moreover, whereas circuitously associated to ETFs, the SEC confronted authorized setbacks in opposition to Ripple thrice in 2023. These setbacks included rulings that XRP, as traded on secondary markets, just isn’t a safety, the Fee being denied an interlocutory enchantment, and all fees being dropped in opposition to Brad Garlinghouse, Ripple’s CEO, and Chris Larsen, the Co-Founding father of Ripple. When these fees have been dropped, Ripple’s CLO, Stuart Alderoty, even characterised it as “a give up by the SEC.”

Then in mid-December, there was a revealing quote from the SEC’s Chair, Gary Gensler, when he said in a CNBC interview, referring to identify BTC ETF functions: “We had prior to now denied a lot of these functions, however the courts right here within the District of Columbia weighed in on that. And so we’re taking a brand new take a look at this based mostly upon these courtroom rulings.”

Though Gensler didn’t immediately reference Grayscale, that case was heard within the District of Columbia Court docket of Appeals. It seems to be as if it’s the courts which can be forcing the SEC to change its strategy, and so in the end, it’s the crypto corporations keen to tackle the SEC in courtroom (Ripple and Grayscale, notably) which have pressured the SEC’s hand.

Has Bitcoin Grown Too Giant to Ignore?

Bitcoin has grown, within the area of fifteen years, from a digital experiment that traded nearly free of charge, to an asset whose cash are at present valued at over $45,000 every, with a market cap of just about $840 billion. And what’s extra, that is regardless of being sidelined by conventional finance and requiring new adopters to make uncommon efforts to accumulate the asset.

A number of declarations from legacy media commentators through the years to the impact that Bitcoin has run its course or is lastly useless have been repeatedly inaccurate, and no matter impediment or initiator of market concern has been positioned in its path (from Chinese language bans to Tesla offloading half its holdings), Bitcoin has marched on regardless. Or as long-term holders with outstanding conviction prefer to put it: tick tock, subsequent block.

Born to Bitcoin. 🧡 pic.twitter.com/qYI3bmZDvC

— VanEck (@vaneck_us) December 29, 2023

Is a Generational Shift Occurring?

Including to the sense that Bitcoin and crypto are right here to remain, there could also be a generational shift happening; a change which comes with an attendant switch of wealth. This proposed prevalence, defined intimately by Cerulli Associates in 2022, means $84 trillion is anticipated to go from the Child Boomer and Silent generations, to youthful generations, and in addition charities, by 2045.

And, this relates on to Bitcoin and different cryptocurrencies as a result of it’s youthful generations, primarily, which can be main the adoption of crypto, suggesting that conventional monetary establishments will probably be more and more motivated to pivot in the direction of digital belongings, and can accomplish that naturally as youthful generations exert higher affect over company resolution making.

How Does a Spot BTC ETF Change the Crypto Panorama?

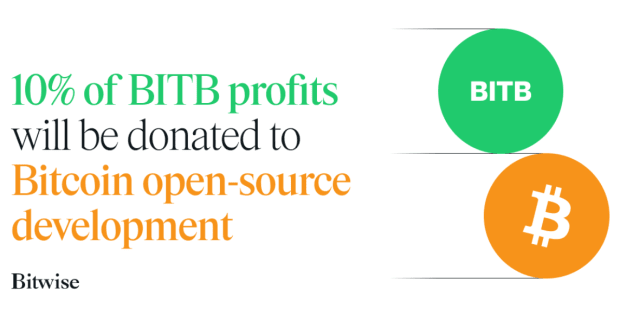

A spot BTC ETF, notably when managed by a agency as giant and respected as BlackRock, legitimizes BTC for conventional traders, and acts as an institutional stamp of approval. This shift is enhanced by incoming adjustments to FASB truthful worth accounting guidelines for companies, which can make it extra viable for companies to carry BTC on their steadiness sheets.

ETFs present an avenue for traders who will not be inclined to delve into the technical, financial and even philosophical discussions surrounding Bitcoin. They will not be concerned with studying about self-custody, however merely acknowledge Bitcoin as a useful addition to a various portfolio. These traders search publicity with as little friction as potential.

What’s extra, from a buying and selling psychology perspective, an ETF removes unit bias: markets aren’t completely rational, and holding a number of shares in an ETF could seem extra interesting than holding a fraction of a bitcoin.

How Is the ETF Being Acquired by Crypto Natives?

Inside crypto, there’s a agency perception within the mechanism referred to tongue-in-cheek as the worth will increase. This implies, very merely, that nothing attracts individuals to Bitcoin greater than the sight of the value rising. So, if you happen to’re an advocate of the transformative energy of crypto, then you definitely welcome newcomers even when they’re solely visiting within the hope of short-term good points, since some proportion of them will deepen their crypto data and select to stay round for the long-term.

By that token, if an ETF results in elevated investments and a sustained rise in worth over the long run, then it needs to be welcomed. A counter argument is that by eradicating the self-custody components of BTC, an ETF reduces the probability of what may be known as true adoption. However, the advantages, equivalent to legitimizing crypto, and elevated funding, are prone to outweigh any considerations about straying from the founding ideas.

Nonetheless, spot BTC ETFs are removed from a silver bullet for the entire crypto business, as from a growth and adoption perspective, the US would nonetheless profit from new crypto laws and higher regulatory certainty. That stated although, the approval of the ETF alerts a possible landmark shift in attitudes in the direction of Bitcoin.