Bitcoin has noticed a pointy rally past the $47,000 degree as information reveals shopping for strain on Coinbase has displayed no indicators of letting off.

Bitcoin Has Surged Extra Than 4% In Final 24 Hours As ETF Deadline Nears

After the asset’s indecisiveness over the previous couple of days, the cryptocurrency has appeared to have picked its route within the final 24 hours, as its worth has elevated sharply.

On the peak of this surge, the coin had crossed past the $47,300 mark, however since then, the coin has registered some pullback because it’s now right down to $46,500. The beneath chart reveals how Bitcoin has carried out throughout the previous couple of days.

Seems just like the asset’s worth has blasted off up to now day | Supply: BTCUSD on TradingView

With this surge, the coin is up over 4% within the final 24 hours. The one cryptocurrencies within the high 20 market cap listing which have attained higher returns throughout this era are Solana (SOL) and Bitcoin Money (BCH).

This newest rally to ranges not visited since March 2022 has come for the cryptocurrency because the US SEC deadline for a choice on BTC spot ETFs is approaching quick.

With the expectation out there extensively being that the ETFs would get permitted, it’s not stunning that consumers could also be leaping in, anticipating the asset to rally additional after the ETFs begin buying and selling.

Knowledge of an indicator might additionally level in direction of giant entities being concerned in accumulation on this leadup to the day of resolution.

BTC Coinbase Premium Hole Has Been Constructive For Extra Than A Week Now

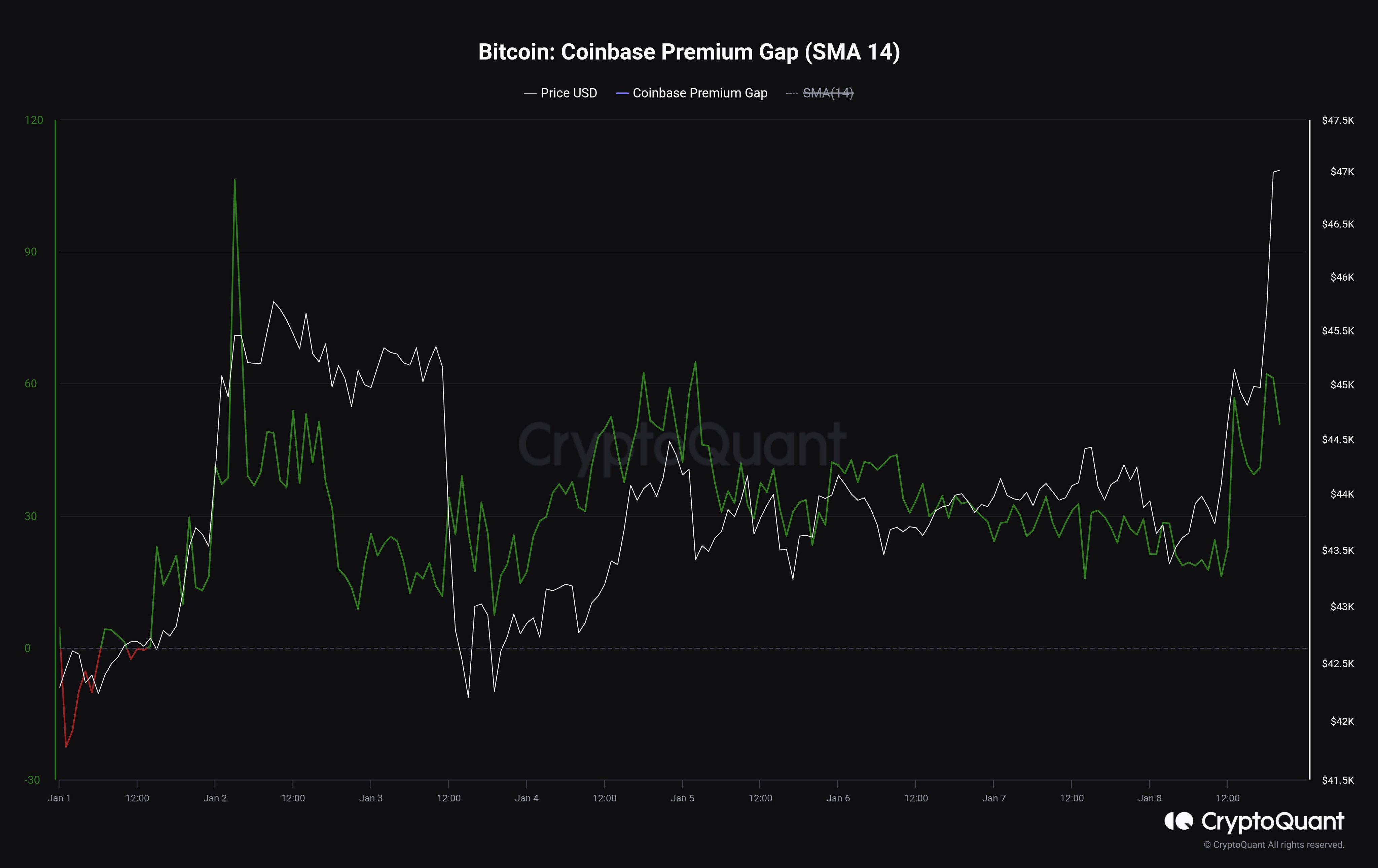

As CryptoQuant Netherlands group supervisor Maartunn identified in a publish on X, the Bitcoin Coinbase Premium Hole has been constructive for a number of consecutive days.

The “Coinbase Premium Hole” refers to a metric that retains observe of the distinction between the Bitcoin costs listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

This indicator’s worth tells us concerning the distinction within the shopping for (or promoting) behaviors on the 2 largest platforms within the sector. Under is a chart displaying the current pattern on this metric’s 14-day easy shifting common (SMA).

The worth of the metric appears to have been inexperienced since some time now | Supply: @JA_Maartun on X

As displayed within the above graph, the Bitcoin Coinbase Premium Hole has been constructive for nearly 2024, with just one dip within the metric approaching the primary day of the yr.

This means that the shopping for strain on Coinbase has been better than on Binance for over per week now. US-based institutional buyers extensively use the previous, whereas the latter hosts extra international site visitors.

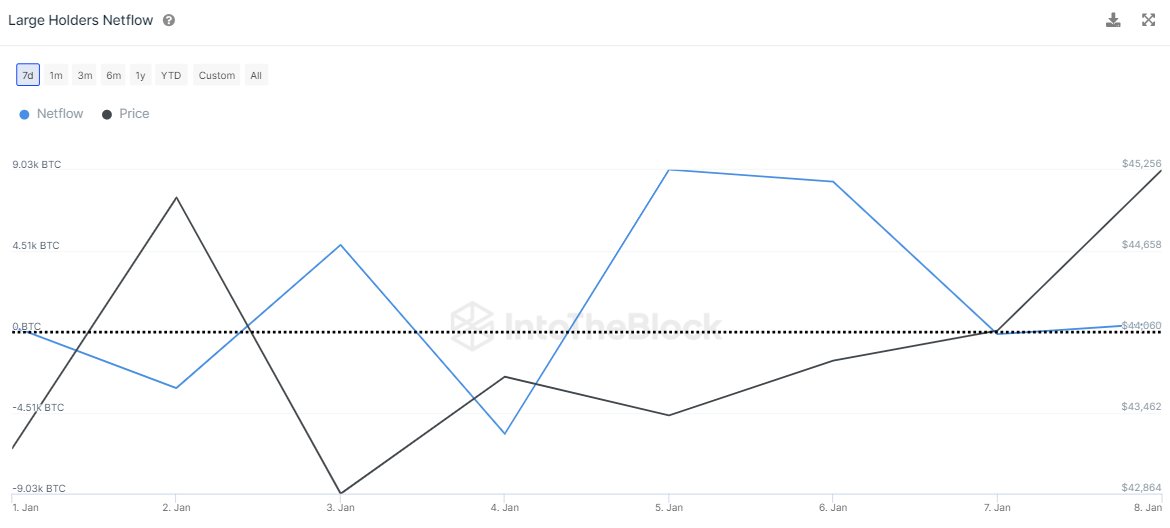

Thus, this means that enormous institutional merchants have presumably been going purchasing just lately. One other indicator that means accumulation from the whales is the “giant holders netflow” metric from IntoTheBlock, which has displayed constructive spikes just lately.

The information for the BTC giant holders netflow because the begin of the yr | Supply: IntoTheBlock on X

“Massive holders purchased the dip! Bitcoin holders holding >1% of the availability collected greater than 14k BTC over the previous week as costs dipped beneath $43k,” explains IntoTheBlock.

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com, IntoTheBlock.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.