Digital

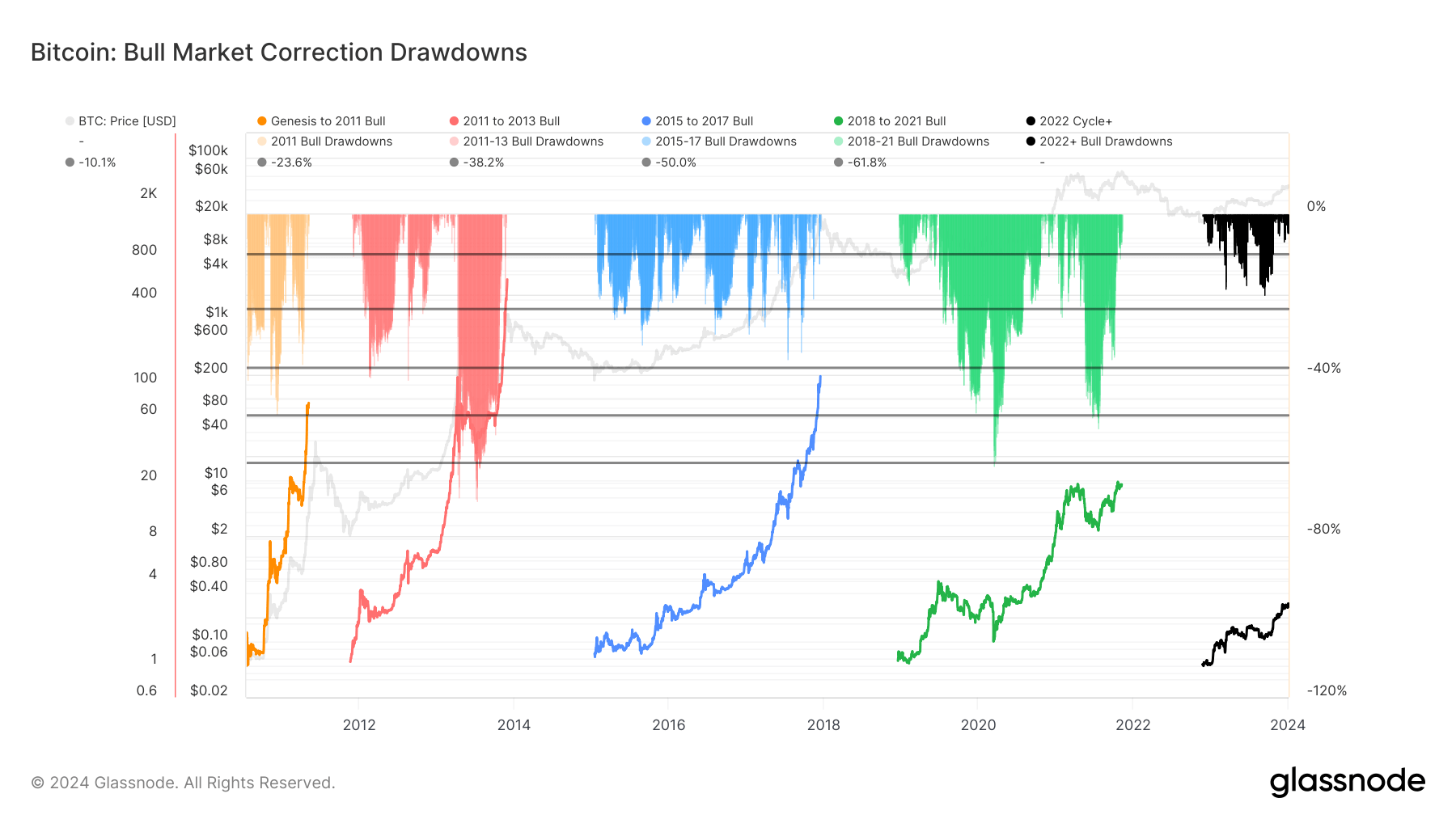

asset funding merchandise noticed $2.25 billion of inflows in 2023, marking it as

the third largest 12 months for inflows since 2017, based on the most recent report by

CoinShares. The inflows represented a dramatic turnaround from 2022 once they

totaled simply $831 million.

Their

seen acceleration because the 12 months’s second half exhibits the trade’s keen

anticipation for introducing the first-ever Wall Avenue BTC spot ETF.

Belongings

below administration (AuM) ended 2023 at $51 billion, the very best degree since March

2022. Bitcoin was the prime beneficiary of the resurgence in curiosity,

attracting $1.9 billion inflows, or 87% of the entire. This dominance of

flows was the most important on document.

A lot of the

rebound got here within the fourth quarter, because it grew to become clear the US Securities and

Change Fee (SEC) was warming as much as approving Bitcoin spot ETFs. The

market is at the moment eagerly awaiting the approval of the primary software,

which has pushed the value of BTC this week to its highest ranges since April

2022.

Hold Studying

The ultimate week of 2023 noticed US$243m of inflows into digital asset ETPs, bringing 2023 whole flows to US$2.2bn. pic.twitter.com/EtdHQWlu2K

— James Butterfill (@jbutterfill) January 3, 2024

For

Bitcoin, it is a important interval because it simply celebrated its fifteenth

anniversary of mining the first-ever BTC block, often called the “Genesis block.”

The most recent report from the Bitget trade for 2023 confirms the expansion in Bitcoin market exercise, which mentions a rise of 12 million in customers and

a bounce of 94% in spot volumes.

Whereas

Bitcoin roared again, Ethereum (ETH) lagged regardless of a restoration of inflows to $78

million. Its share of whole AuM remained muted at 0.7%. Solana was a vibrant

spot amongst altcoins, benefitting from Ethereum’s woes to notch $167 million in

inflows.

Germany, Canada and

Switzerland on Crypto Lead

By area,

Germany noticed the most important inflows as a proportion of AuM at 22%, adopted by

Canada and Switzerland at 15% and 13%, respectively. The US noticed probably the most

nominal inflows at $792 million, however its share of AuM was solely 2%.

Fairness

funding into blockchain firms moreover rebounded in 2023, with property

doubling from 2022 ranges.

CoinShares

publishes its stories on flows into cryptocurrency funds each month. The

newest report summarized your entire 12 months of 2023 and signaled renewed investor

enthusiasm for the crypto asset class, pushed overwhelmingly by Bitcoin. With

the prospect of a spot Bitcoin ETF in 2024, one other 12 months of sturdy inflows might

be forward.

In accordance

to the newest data, Goldman Sachs additionally desires a chunk of the Bitcoin ETF

pie, reportedly contemplating a partnership with BlackRock and Grayscale, who

have utilized to introduce such an instrument.

Digital

asset funding merchandise noticed $2.25 billion of inflows in 2023, marking it as

the third largest 12 months for inflows since 2017, based on the most recent report by

CoinShares. The inflows represented a dramatic turnaround from 2022 once they

totaled simply $831 million.

Their

seen acceleration because the 12 months’s second half exhibits the trade’s keen

anticipation for introducing the first-ever Wall Avenue BTC spot ETF.

Belongings

below administration (AuM) ended 2023 at $51 billion, the very best degree since March

2022. Bitcoin was the prime beneficiary of the resurgence in curiosity,

attracting $1.9 billion inflows, or 87% of the entire. This dominance of

flows was the most important on document.

A lot of the

rebound got here within the fourth quarter, because it grew to become clear the US Securities and

Change Fee (SEC) was warming as much as approving Bitcoin spot ETFs. The

market is at the moment eagerly awaiting the approval of the primary software,

which has pushed the value of BTC this week to its highest ranges since April

2022.

Hold Studying

The ultimate week of 2023 noticed US$243m of inflows into digital asset ETPs, bringing 2023 whole flows to US$2.2bn. pic.twitter.com/EtdHQWlu2K

— James Butterfill (@jbutterfill) January 3, 2024

For

Bitcoin, it is a important interval because it simply celebrated its fifteenth

anniversary of mining the first-ever BTC block, often called the “Genesis block.”

The most recent report from the Bitget trade for 2023 confirms the expansion in Bitcoin market exercise, which mentions a rise of 12 million in customers and

a bounce of 94% in spot volumes.

Whereas

Bitcoin roared again, Ethereum (ETH) lagged regardless of a restoration of inflows to $78

million. Its share of whole AuM remained muted at 0.7%. Solana was a vibrant

spot amongst altcoins, benefitting from Ethereum’s woes to notch $167 million in

inflows.

Germany, Canada and

Switzerland on Crypto Lead

By area,

Germany noticed the most important inflows as a proportion of AuM at 22%, adopted by

Canada and Switzerland at 15% and 13%, respectively. The US noticed probably the most

nominal inflows at $792 million, however its share of AuM was solely 2%.

Fairness

funding into blockchain firms moreover rebounded in 2023, with property

doubling from 2022 ranges.

CoinShares

publishes its stories on flows into cryptocurrency funds each month. The

newest report summarized your entire 12 months of 2023 and signaled renewed investor

enthusiasm for the crypto asset class, pushed overwhelmingly by Bitcoin. With

the prospect of a spot Bitcoin ETF in 2024, one other 12 months of sturdy inflows might

be forward.

In accordance

to the newest data, Goldman Sachs additionally desires a chunk of the Bitcoin ETF

pie, reportedly contemplating a partnership with BlackRock and Grayscale, who

have utilized to introduce such an instrument.