Wyckoff Evaluation (WA) goals to know why costs of shares and different market gadgets transfer resulting from provide and demand dynamics. It sometimes is utilized to any freely traded market the place bigger or institutional merchants function (commodities, bonds, currencies, and many others.). On this article we are going to apply WA to the cryptocurrency Storj ($STORJ) to make a forecast for approximate future occasions.

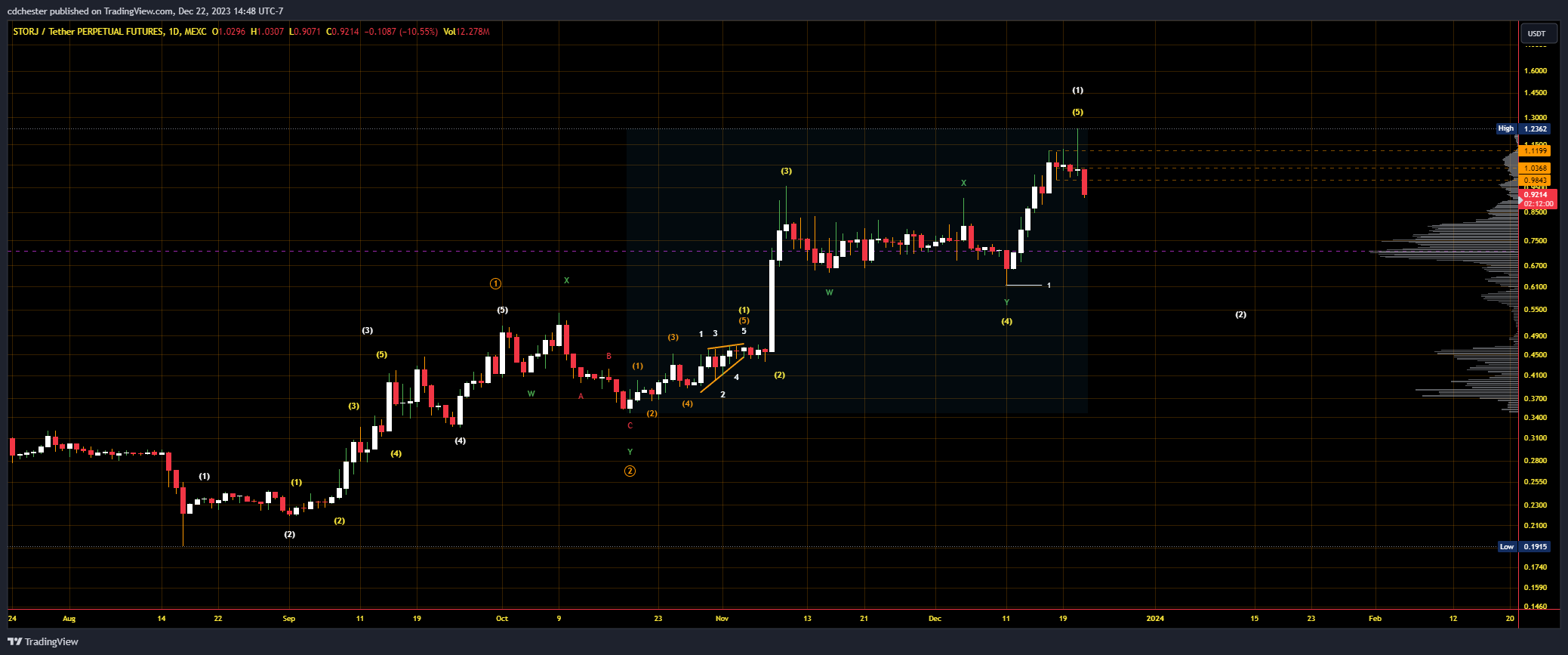

Hyperlink to the uncooked picture: https://www.tradingview.com/x/BGsOkzGM

Storj is presently in Part E of a Wyckoff Distribution Schematic #1. StockCharts says this about Part E of their article on the Wyckoff Methodology:

Part E depicts the unfolding of the downtrend; the inventory leaves the TR and provide is in management. As soon as TR assist is damaged on a serious SOW, this breakdown is usually examined with a rally that fails at or close to assist. This additionally represents a high-probability alternative to promote quick. Subsequent rallies through the markdown are often feeble. Merchants who’ve taken quick positions can path their stops as worth declines. After a major down-move, climactic motion might sign the start of a re-distribution TR or of accumulation.

The buying and selling vary for Storj was $1 – $1.12 and it has concretely fallen under that. From the image under a serious SOW has occurred, extra so pointing to a Distribution occurring. This additionally coincides with our analyst’s Elliott Wave (EWT) view on Storj. They predict a small rally as Storj continues to fall in its Wave 2. Nearly all of the liquidity (per its related Quantity Profile) is between the 38.2% and 61.8% LFR at $0.56 and $0.76 respectively. A liquidity cluster is usually anticipated between these LFRs in EWT main us to the suppose a Wave 2 correction is going on. Moreover, the cluster is within the worth vary of the subwave 4, an EWT guideline.

Storj Value Knowledge from MEXC Futures | Supply: STORJUSDT.P on tradingview.com.

Hyperlink to the uncooked picture: https://www.tradingview.com/x/dD8hv9Aj

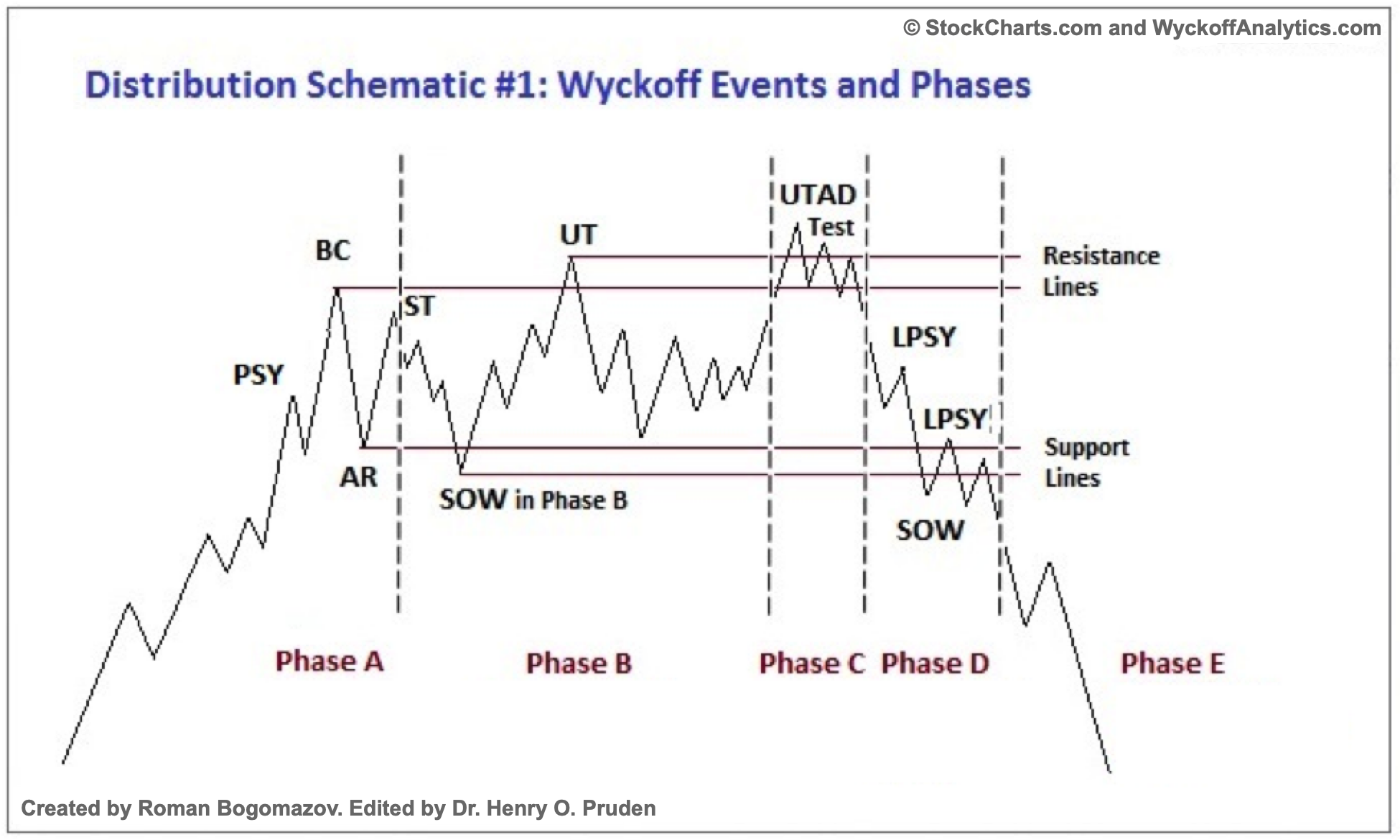

Beneath is the everyday schematic for a Wyckoff Distribution Schematic #1.

Wyckoff Distribution Schematic #1 | Supply: StockCharts.com

Glossary

All quotes are from the primary hyperlink in Supplemental Studying.

Preliminary Provide (PSY) – “the place massive pursuits start to unload shares in amount after a pronounced up-move”

Shopping for Climax (BC) – massive operators promoting their shares whereas the general public buys them at a premium throughout a interval of big demand

Computerized Response (AR) – “With intense shopping for considerably diminished after the BC and heavy provide persevering with, an AR takes place”

Secondary Check (ST) – when “worth revisits the realm of the SC to check the provision/demand steadiness at these ranges”

Upthrust After Distribution (UTAD) – “a definitive take a look at of latest demand after a breakout above TR resistance”

Check – the place bigger merchants “take a look at the marketplace for provide all through a TR”

Signal of Weak point (SoW) – “a down-move to (or barely previous) the decrease boundary of the TR, often occurring on elevated unfold and quantity”

Final Level of Provide (LPSY) – “exhaustion of demand and the final waves of enormous operators’ distribution earlier than markdown begins in earnest”

Elliott Wave Concept (EWT)

“A idea in technical evaluation that attributes wave-like worth patterns, recognized at varied scales, to dealer psychology and investor sentiment.”

Supply: “Elliott Wave Concept: What It Is and Methods to Use It” by James Chen (2023)

Logarithmic Fibonacci Retracement (LFR) – A measured correction at sure Fibonacci ratios on a semi-log scale.

Logarithmic Fibonacci Extensions (LFE) – A measured rally at sure Fibonacci ratios on a semi-log scale.

Supplemental Studying

“The Wyckoff Methodology: A Tutorial” by Bogomazov & Lipsett

“Reaccumulation Evaluate” by Bruce Fraser (2018)

“Leaping the Creek: A Evaluate” by Bruce Fraser (2018)

“Distribution Evaluate” by Bruce Fraser (2018)

“Introduction to Level & Determine Charts” from StockCharts

“P&F Value Targets: Horizontal Counts” from StockCharts

“The Wyckoff Methodology in Depth” by Rubén Villahermosa (2019)

“Wyckoff 2.0: Constructions, Quantity Profile and Order Circulation” by Rubén Villahermosa (2021)

“Elliott Wave Precept – Key To Market Habits” by Frost & Prechter (2022)

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual threat.