Bitcoiners Want The Guillotine

As Scottish economist and thinker David Hume noticed in A Treatise of Human Nature, nothing we find out about what’s true can inform us what should be true and nothing we find out about what should be true can inform us what’s true. The world of goal truth and ethical reality are totally separate. Hume known as this the is/ought drawback and his argument that descriptive and normative reasoning needs to be separated is called Hume’s guillotine.

Hume’s guillotine is a philosophical razor – a rule of thumb for reasoning in regards to the world. It’s a means of reducing aside two strains of reasoning that grow to be entangled once they intertwine. An argument the place one aspect argues about what’s true and the opposite aspect argues about what should be true is a ineffective argument. These persons are speaking previous one another.

Much more importantly, the guillotine is a instrument for lowering bias in our considering. Left unsupervised, our hopes can corrupt our beliefs – main us to imagine that which is true is sweet (naturalistic fallacy) and that which is sweet is true (wishful considering). Within the Bitcoin business there are lots of who let their conviction about what Bitcoin needs to be distort their understanding of what Bitcoin is. They should examine the guillotine.

Decentralization Will By no means Be Low cost

One harsh however easy reality is that actual decentralization is just too costly to be common. Should you consider within the worth of decentralization it’s straightforward to see why you’ll need it to be universally accessible. However if you happen to perceive how decentralization works additionally it is straightforward to see why that can by no means be doable. The mathematics merely doesn’t enable it.

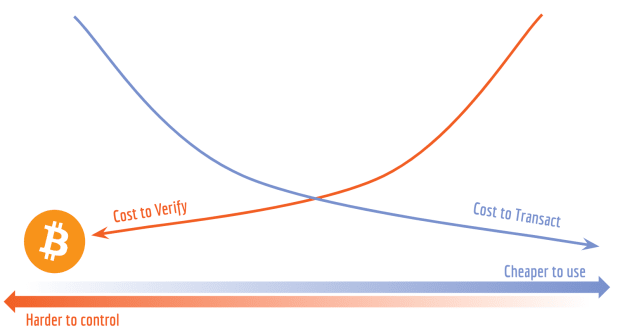

Decentralization is – by definition – dearer than a centralized different. To be decentralized, networks want extra copies of the community historical past (blue squares) and extra connections between nodes (crimson arrows). Coordinating a centralized community is basically cheaper and simpler to do. Relying on the aim of the community, decentralization is perhaps value paying for – however it’s going to by no means be the most affordable possibility.

The expense of operating a community is break up between customers and validators. Networks can both restrict exercise on the community (which makes transactions costly as a result of they’re scarce) or they will demand extra work from validators (which centralizes the community). Bitcoin retains the price of community validation low by limiting the block measurement – however that additionally by definition means transaction house is restricted. Transaction charges on Bitcoin are costly by design.

Including extra capability to the community wouldn’t make it cheaper for particular person customers, anyway. That’s as a result of Bitcoin’s transaction charges aren’t set by the community, they’re set by customers’ willingness to outbid one another within the blockspace public sale. You’ll be able to’t decrease transaction charges by rising capability as a result of rising capability doesn’t change anybody’s willingness to pay. Customers don’t resolve whether or not to pay for a transaction based mostly on how full the blocks are, they resolve based mostly on how excessive the charges are.

Bigger blocks could be excellent news for miners (as a result of there could be room for extra paying prospects) nevertheless it wouldn’t change a lot for customers – transaction charges could be about the identical. The flowery economics time period for this counterintuitive result’s Jevons paradox.

Inventing new Layer2 expertise gained’t make transacting on Bitcoin any cheaper, both. Expertise like Lightning, Liquid, Fedimint and Ark develop the ability and adaptability of what Bitcoin transactions can do – however making transactions extra helpful doesn’t make them cheaper, it makes them extra invaluable. Extra methods to make use of Bitcoin transactions means extra demand for the restricted accessible blockspace. We should always count on Layer 2s to make L1 Bitcoin transactions dearer, not cheaper.

That’s okay, as a result of Bitcoin will not be purported to be low cost. It’s purported to be Free.

Free As In Freedom

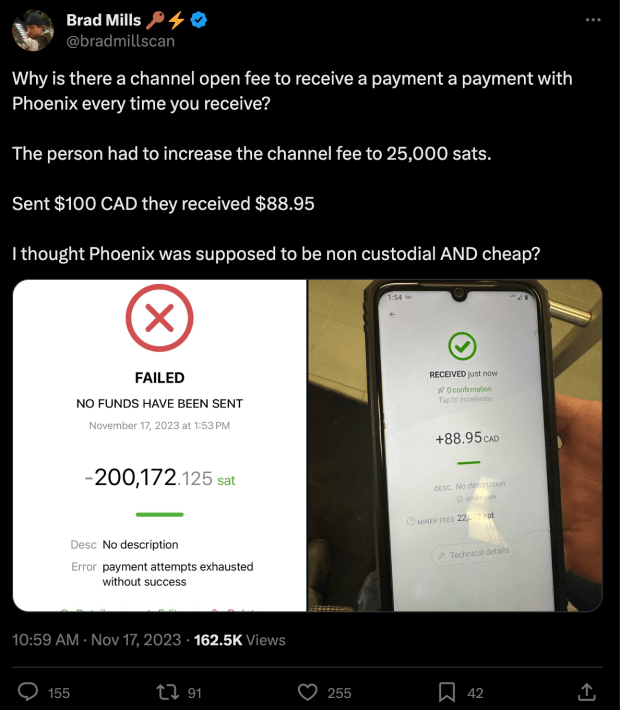

The lure of low cost decentralized transactions is robust. It was the center of the blocksize wars and it’s the central worth proposition of most altcoin networks in the present day. It’s additionally the driving power behind the widespread however misplaced perception that the Lightning community will enable Bitcoin scale to common adoption. The fact is extra nuanced: Lightning lowers the price of utilizing Bitcoin. That’s not the identical factor as making Bitcoin low cost to make use of.

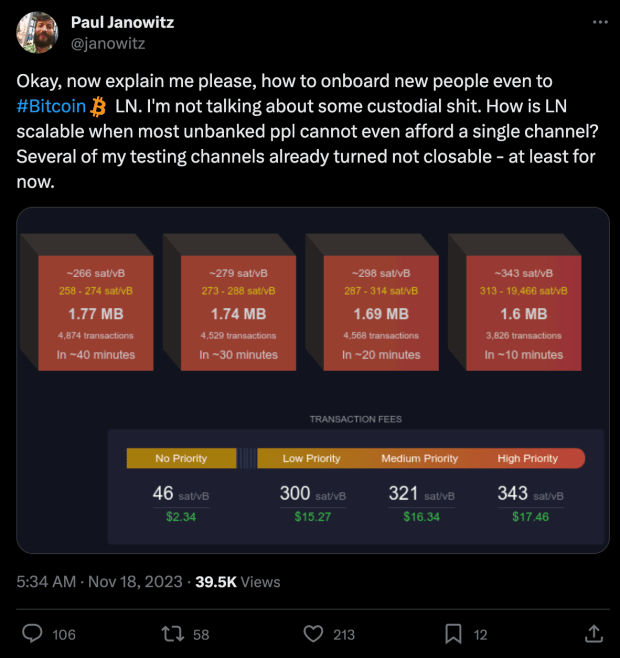

The reality is that Lightning channels require Bitcoin transactions and Bitcoin transactions will inevitably be costly. Bitcoin confirms ~0.4M transactions/day. That’s one transaction/individual each ~55 years, assuming nobody is born or dies whereas ready. The long run value of a bitcoin transaction is troublesome to foretell, nevertheless it isn’t troublesome to foretell they are going to be uncommon: both as a result of most individuals can’t afford them or as a result of most individuals don’t need them within the first place.

There are proposals to make channel administration cheaper (e.g. channel factories) however since each proposal in the end is dependent upon some on-chain anchor transaction, each channel will have to be bought/leased in some way from somebody who can afford the unique transaction. Anthony Cities did some attention-grabbing evaluation and estimated that there was room for roughly ~50,000 entities to transact immediately on-chain. Everybody else would want to lease custodial providers from a type of on-chain entities. You need to use a replica of this spreadsheet to tweak the assumptions and run your individual estimates.

Even when we ignore opening/closing prices totally, channels themselves will not be cost-free to take care of. Customers want a web based presence to obtain funds / supervise their counterparties for misbehavior. They should both completely steadiness their despatched/acquired funds or periodically pay a liquidity supplier to rebalance their channels. Most significantly, any bitcoin getting used to create Lightning channel capability is essentially on-line and never in chilly storage.

The marginal value of particular person Lightning transactions may be very small, however the whole value of making, utilizing and sustaining a Lightning channel is definitely fairly excessive — as a result of it’s denominated in bitcoin and bitcoin is the scarcest useful resource in historical past. Telling retail customers to open Lightning channels to make low cost transactions is like telling them to launch their very own satellites for cheaper cellular web.

To be clear, I’m a believer within the worth of the Lightning Community – I simply don’t assume it’s going to financial institution the unbanked. The Lightning Community makes Bitcoin transactions extra highly effective, not cheaper. Fee channels will solely make sense for individuals who make sufficient funds to justify paying to streamline them. For most individuals even proudly owning a single on-chain UTXO shall be a privilege of serious luxurious. I’m not attempting to defend that end result nearly as good. It merely is. It exists on the opposite aspect of Hume’s guillotine.

Bitcoin Is For Saving, Not For Spending

The big measurement and continued progress of the stablecoin market is proof there may be loads of demand for low-cost, disintermediated retail funds. However Bitcoin will not be a panacea – simply because low-cost funds are helpful doesn’t imply that Bitcoin is a helpful method to make low-cost funds. Bitcoin will not be designed to be low cost – it’s designed to be sturdy. These aren’t the identical objectives they usually most likely gained’t be achieved by the identical system.

Even in a world the place Bitcoin transactions have been in some way value free we should always nonetheless count on stablecoins to dominate funds. Why would anybody who thinks bitcoin is treasured wish to spend it? Why would anybody who doesn’t assume bitcoin is treasured have any to spend? Bitcoin is emergency cash, not comfort cash. Nobody needs to be spending it on espresso.

Decentralized networks don’t make good retail cost instruments – they’re costly, gradual and unforgiving. Utilizing Bitcoin to make a retail buy is like driving to the mall in a M4 Sherman tank. It is perhaps cool, nevertheless it isn’t sensible – and it’ll by no means be regular.

It is a visitor submit by knifefight. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.