The anticipation round a possible approval of a Spot Bitcoin ETF continues to be excessive amongst crypto buyers. This anticipation has been one of many foremost drivers of the worth rally that has been witnessed during the last two months.

Regardless of the USA Securities and Trade Fee (SEC) suspending its choice on a number of spot ETF filings, business consultants stay very optimistic that the regulator is on the verge of approving the primary Spot Bitcoin ETF.

Bitcoin Spot ETF Coming In January 2024

Many consultants have revised their expectations for if and when the SEC would approve a Spot Bitcoin ETF. At first, expectations had been low. However as time has gone on, the expectations have risen rapidly and analysts at Matrixport are a part of the camp that believes a Spot Bitcoin ETF is on its approach.

In a report launched on Monday, December 18, Matrixport Head of Analysis Markus Thielen reveals a 95% probability {that a} Spot BTC ETF will likely be permitted in January 2024. January carries the deadline dates for a lot of the 13 filings to date, and Thielen expects that the SEC will approve a spot ETF on January 10.

The report factors to the truth that BlackRock, the most important asset supervisor on the planet, reviewed its S-1 submitting with the SEC. Right here, the regulator had given the asset supervisor directions which included monitoring uncommon worth actions, storing all non-public keys in chilly storage, and having procedures within the occasion there are Bitcoin forks.

Moreover, the SEC additionally responded to Franklin-Templeton’s submitting in November regardless of having till January to take action. This transfer, the analyst says, “appeared that the SEC is lining all issuers as much as get approval by January 10, 2024.”

Thielen explains the significance of the assembly the regulator had with BlackRock, saying, “The SEC has by no means actively engaged with potential ETF points and seems to have given all ETF issuers with whom it had discussions the identical directions.”

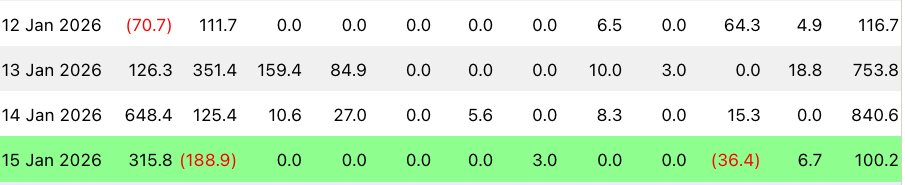

BTC worth exhibits excessive degree of volatility | Supply: BTCUSD on Tradingview.com

BTC Value Expectations After Approvals

On condition that Matrixport expects approvals to come back in January, the analyst additionally gave their expectation for worth when this occurs. Thielen expects that Bitcoin will go on one other rally as soon as this occurs and the worth might rise as excessive as $50,000 within the first quarter of the yr 2024 in consequence.

“We anticipate this correction to modify again into one other leg increased in Bitcoin costs after Christmas as buyers reap the benefits of the current correction and place themselves for the probably Bitcoin Spot ETF approval interval – January 8 to January 10, 2024,” the analyst stated, alluding to the decline in worth that Bitcoin has recorded during the last week.

As for Grayscale, the analyst doesn’t consider that the SEC would enable for a conversion of the Bitcoin belief right into a Spot ETF on January 10. Nevertheless, they do anticipate 20% of treasured steel demand to modify to Spot Bitcoin ETFs following the approvals.

Featured picture from Atlantic Council, chart from Tradingview.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.