There are a selection of various chart patterns that merchants must be careful for to optimize their buying and selling methods. The bear flag sample is one in all them.

The bear flag is likely one of the most dependable continuation patterns. Typically seen in downtrends, it’s fashioned when there’s a sharp sell-off adopted by a interval of consolidation. The target of buying and selling this sample is to catch the subsequent leg down within the development.

Hello, my identify is Zifa. I’ve been deeply immersed on this planet of crypto, writing and analyzing traits for over three years. In immediately’s dialogue, we’ll delve into the whole lot you could know concerning the bear flag sample — from its look on charts to efficient buying and selling methods using this sample. Be part of me as we discover the intricacies of the bear flag and the way it may be a game-changer in your buying and selling strategy.

What Is a Bearish Flag Sample? Bear Flag That means

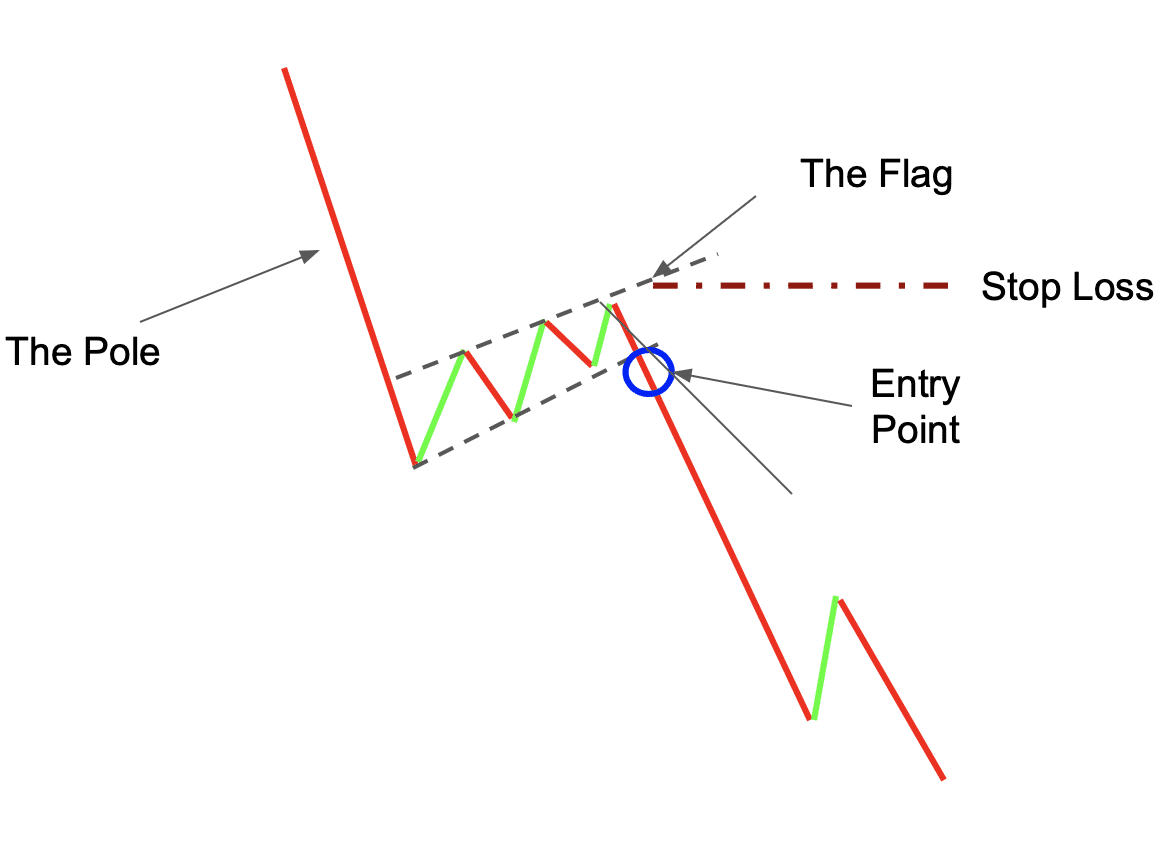

A bear flag is a technical evaluation charting sample used to foretell the continuation of a bearish development. The sample consists of two components: the flag and the flag pole. The flag pole is fashioned by a pointy sell-off that takes place initially of the sample, and the flag is created by the interval of consolidation that follows.

The bear flag formation indicators the continuation of a value decline.

The Anatomy of a Flag Formation

Flag formations play a vital function in technical evaluation, aiding within the interpretation of inventory value conduct. These patterns emerge when a big value surge is succeeded by a consolidation section, forming a recognizable flag-like form on the chart. Understanding flag formations is essential for merchants to detect potential development continuations or reversals.

Recognizing a Downtrend

In technical evaluation, figuring out a downtrend entails analyzing particular indicators like shifting averages, trendlines, and chart patterns. A downtrend is obvious when the chart shows a sequence of decrease peaks and troughs, signifying a shift from assist to resistance ranges. Instruments like downward-trending shifting averages and trendlines that hyperlink decrease peaks present affirmation of a downtrend. Chart patterns, corresponding to head and shoulders or descending triangles, may also sign a downtrend. Merchants usually make use of short-selling methods in these eventualities to revenue from the anticipated downward motion of costs.

Understanding the Flagpole

The flagpole is a key element of the flag formation, representing a fast and steep value motion on a buying and selling chart. This motion is commonly seen after a big breakout. The flagpole’s predominant traits are its marked size and the sturdy momentum it demonstrates, which may differ relying on the chart’s timeframe. Merchants use the flagpole to gauge potential commerce entry and exit factors, in search of a consolidation section, known as the “flag,” that follows. This section suggests a short lived pause in momentum, offering a setup for both a bullish or bearish continuation.

Find out how to Determine a Bear Flag Sample?

Buying and selling the bear flag: methods to implement flag associated methods?

First issues first, what does a bear flag appear like? Effectively, check out the image under — right here’s a typical bearish flag sample.

There are some things you could search for when making an attempt to establish this sample:

– First, you could see a pointy sell-off in value. This sell-off ought to be accompanied by excessive quantity. A notable improve in quantity through the bearish flagpole formation indicators sturdy promoting strain, indicative of a bearish development. Conversely, through the flag’s upward consolidation section, a lower in quantity usually happens, suggesting an absence of bullish momentum and a attainable weakening of the upward motion. Because the bearish development resumes with the flag sample completion, a rise in commerce quantity usually follows, affirming the bearish strain. For merchants, this development has a fantastic which means as a result of it helps choices like initiating brief positions or exiting lengthy positions.

– After the sell-off, the worth will enter a interval of consolidation. That is usually marked by decrease quantity and tighter buying and selling vary.

– Upon getting recognized these two components of the sample, you possibly can then search for a breakout to the draw back from the consolidation section. That is usually signaled by a transfer under assist or a forming bearish candlestick sample.

50-Interval MA: Key to Bear Flag Detection

The 50-Interval Shifting Common (MA) is a helpful instrument for merchants to establish the bear flag sample, because it gives a transparent view of the market’s intermediate-term development and helps affirm the sample’s validity. Right here’s the way it assists in figuring out a bear flag:

Pattern Affirmation: The 50-period MA helps merchants decide the general development route. Within the context of bear flag value patterns, the worth is usually under the 50-period MA, indicating a bearish development. This alignment confirms that the market surroundings is appropriate for a bear flag formation.Resistance Stage: Through the formation of a bear flag, the 50-period MA can act as a dynamic resistance degree. As the worth consolidates or bounces barely upwards through the flag portion of the sample, it usually encounters resistance on the 50-period MA. Failure to breach this shifting common reinforces the bearish sentiment and means that the downtrend is prone to proceed.Sample Validation: The consistency of the worth staying under the 50-period MA through the flag formation provides validity to the bear flag sample. A break above this shifting common may query the sample’s reliability, indicating a possible change in development or weakening of the bearish momentum.Breakout Affirmation: When the worth ultimately breaks under the decrease boundary of the flag sample, the place of this breakout in relation to the 50-period MA might be an extra affirmation. If the breakout happens with the worth nonetheless under the 50-period MA, it provides confidence to the bearish outlook and the potential continuation of the downtrend.Smoothing Worth Fluctuations: The 50-period MA smooths out short-term value fluctuations, making it simpler to establish the true development and lowering the chance of being misled by momentary value spikes or drops which may happen throughout the consolidation section of the bear flag.

In abstract, on the subject of distinguishing real bear flag formations from false indicators, the significance of the 50-period Shifting Common can’t be overestimated.

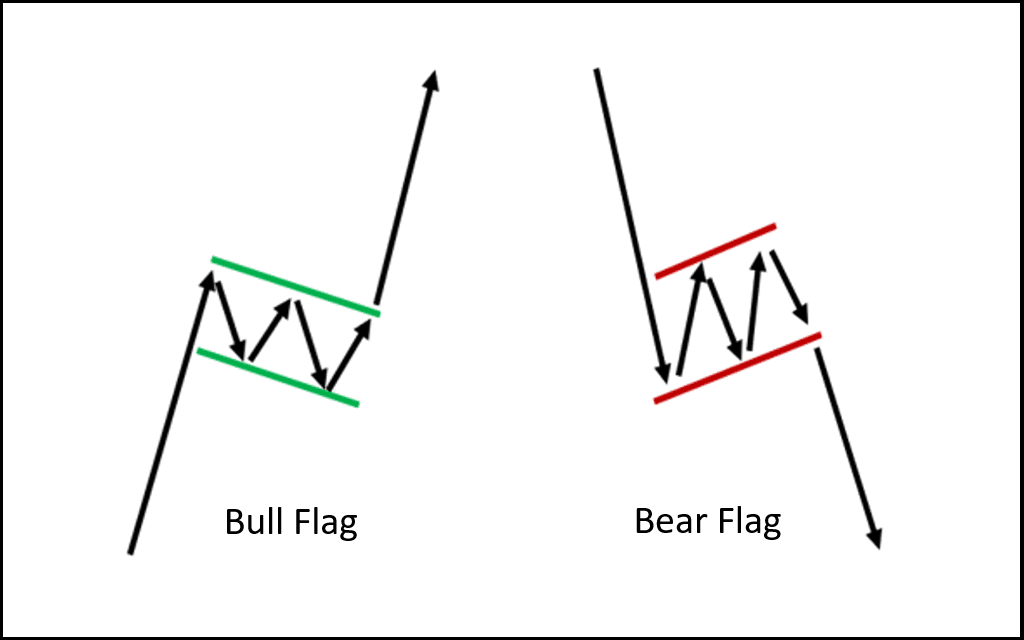

Bull Flag & Bear Flag Patterns

This bearish chart sample additionally has a bullish counterpart — the bull flag sample (a.okay.a. downward flag sample or bullish flag sample). It has an analogous construction however a special route: bull flags sign a continuation of an increase in worth as a substitute.

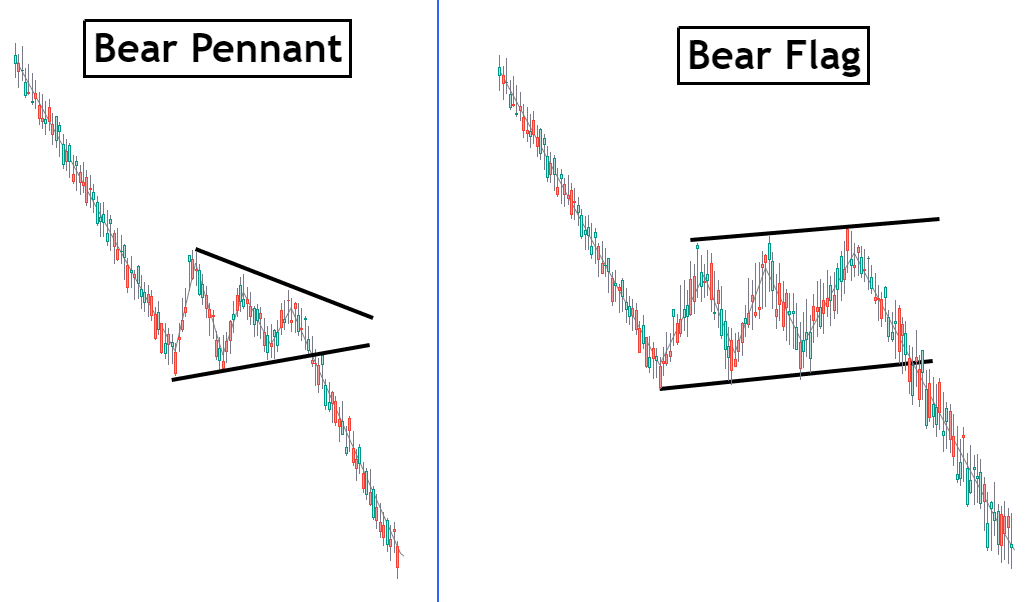

Bear flag vs Bear pennant

The bear flag and the bear pennant are chart patterns used to establish bear markets. They each seem as downward-sloping traits which are adopted by a quick interval of consolidation earlier than the worth continues its decline. The primary distinction between these two patterns is that the bear flag is characterised by a pointy drop in value that’s rapidly adopted by a interval of consolidation, whereas the bear pennant has an prolonged interval of sideways buying and selling earlier than persevering with its downward development. Each patterns point out bearish exercise and can be utilized to anticipate potential reversals and put together for brief positions.

Learn additionally: Reversal candlestick patterns.

Find out how to Commerce Crypto With a Bear Flag Sample

There are a selection of various buying and selling methods that you should use when buying and selling bear flag sample. One widespread technique is to attend for a breakout from the consolidation section after which enter a brief place. Another choice is to purchase places or promote name choices when the worth breaks under assist.

No matter which technique you persist with, it is very important remember that this sample is greatest utilized in downtrends. Which means you must search for bearish indicators earlier than coming into any commerce.

Keep in mind to make use of a mix of various technical indicators and market evaluation strategies to verify your commerce indicators earlier than coming into any positions. Additionally, at all times use danger administration instruments corresponding to stop-loss orders to guard your capital.

Let’s discover a number of the hottest bear flag buying and selling methods.

Wanna see extra content material like this? Subscribe to Changelly’s e-newsletter to get weekly crypto information round-ups, value predictions, and knowledge on the most recent traits immediately in your inbox!

Bear Flag Sample Technique

Buying and selling with bear flags entails figuring out this bearish sample and making use of strategic approaches to capitalize on potential downward actions. Listed here are three efficient methods:

Technique №1: Bear Flag Breakout Draw back

This technique focuses on coming into a commerce through the breakout section of a bear flag. Watch for the worth to interrupt under the flag’s decrease boundary, which indicators a continuation of the preliminary downtrend. This breakout is commonly accompanied by elevated buying and selling quantity, which confirms the bearish momentum.

Let’s check out an instance of the way you may commerce a bear flag sample utilizing this technique.

Since bull and bear flag patterns characterize that an asset is overbought or oversold, respectively, they’re usually mixed with varied technical indicators, just like the RSI.

To establish a bearish flag sample, we first want to acknowledge the flagpole — the preliminary sharp sell-off. On the similar time, we’ve got to keep watch over the quantity — it must be excessive — and the RSI, which ought to be under 30.Subsequent, we’ve got to attend for the breakout from the consolidation section. That signifies that you must place your brief order because the “flag” zone of this chart sample ends.Most merchants often place their trades on the candle that goes immediately after the one which confirms the break of the sample. The sample is often thought of damaged when the worth goes under the assist degree — the flag’s decrease border.Place a cease loss at a degree that’s snug for you. Most merchants often set it on the resistance degree of the flag — its higher border.

Technique №2: The Bear Flag Sample and Fibonacci Retracements

On this strategy, use Fibonacci retracement ranges to establish potential reversal factors throughout the flag sample. After the preliminary downward transfer (flag pole), apply Fibonacci ranges to the rebound. Merchants usually search for retracement ranges like 38.2%, 50%, or 61.8% as potential areas the place the worth may resume its downtrend. Enter a brief place if the worth reverses from one in all these Fibonacci ranges.

Technique №3: The Bear Flag and Assist Breakout

This technique entails ready for a value drop under a big assist degree throughout the flag sample. A bear flag forming close to or at a key assist degree can strengthen the chance of a bearish continuation. As soon as the worth breaks this assist, it may possibly set off a sharper decline, providing a strategic entry level for a brief place.

Entry Methods

For coming into trades, take into account the next:

Within the breakout draw back technique, enter a commerce when the worth closes under the flag’s decrease boundary.With Fibonacci retracements, enter when the worth reverses from a key Fibonacci degree.Within the assist breakout technique, enter after the worth decisively breaks under a big assist degree throughout the flag.

Cease Loss Placement

Place cease losses to handle danger successfully:

For breakout trades, set a cease loss simply above the flag’s higher boundary.When utilizing Fibonacci ranges, place it above the newest swing excessive throughout the flag sample.In assist breakout trades, set the cease loss simply above the damaged assist degree, now performing as resistance.

Revenue Targets

Setting revenue targets entails measuring the preliminary flagpole’s size and projecting it downward from the breakout level. This methodology ensures that your revenue targets are in step with the sample’s historic momentum and presents a practical expectation of the worth motion. For a extra conservative strategy, you can even set revenue targets at key assist ranges under your entry level.

In abstract, buying and selling with bear flags requires a eager eye for sample recognition and strategic execution. No matter instruments you might be utilizing — breakout indicators, Fibonacci retracements, or assist degree methods — entry factors, cease loss placement, and revenue targets are essential parts for profitable buying and selling in bearish market situations.

Is Bear Flag a Dependable Indicator?

A bear flag sample is a dependable indicator for predicting the continuation of a bearish development. Nonetheless, it’s essential to keep in mind that this sample is greatest utilized in downtrends. Which means you must search for bearish indicators earlier than coming into any commerce. Additionally, make sure you place your cease loss above resistance in an effort to defend your capital if the commerce goes in opposition to you.

Moreover, bear flag patterns ought to at all times be confirmed utilizing different indicators, just like the RSI.

Execs and Cons of the Bear Flag Sample

Execs:

– A bear flag sample is a dependable indicator for predicting the continuation of a bearish development.

– It’s helpful for making worthwhile brief trades.

Cons:

– Identical to every other indicator, the bear flag might be unreliable.

– Buyers who’d slightly keep away from dangerous trades can have restricted alternatives to make an enormous revenue when utilizing this chart sample.

Learn additionally: Chart patterns cheat sheet.

What Is a Failed Bear Flag?

A failed bear flag, usually a false sign in bear flag buying and selling methods, happens when the anticipated bearish continuation of a bear flag sample reverses right into a bullish development. To establish this on a value chart, search for these key options:

Steady Assist Stage: The worth doesn’t break under the flag’s decrease assist, a vital aspect in confirming a bearish sample. This stability suggests a possible shift in market sentiment.Average Quantity Fluctuations: In contrast to a typical bear flag the place quantity drops considerably, in a failed bear flag, quantity decreases modestly. This means weaker bearish momentum, miserable the validity of the bearish sample.Bullish Breakout: Opposite to bear flag expectations, the worth breaks above the higher resistance line. This breakout on the worth chart indicators a bullish reversal that challenges the preliminary bearish assumption.Quantity Improve on Retests: When earlier value ranges are retested with a rise in quantity, it usually factors to a strengthening bullish development, diverging from the anticipated bearish consequence.

In bear flag buying and selling methods, to acknowledge a failed bear flag is to mitigate potential losses — an completely helpful ability. By figuring out these indicators on a value chart, merchants can adapt their methods to align with the brand new market route, seizing alternatives or avoiding missteps in a shifting market.

Remaining Ideas

The bear flag sample is likely one of the hottest value motion patterns. It’s used to foretell the continuation of a bearish development. It’s a highly effective instrument, however similar to every other aspect of technical evaluation, it shouldn’t be utilized in isolation.

Cryptocurrency costs are unpredictable, and merchants ought to at all times be aware of maximum volatility when analyzing crypto market traits. Watch out and acutely aware of the market state of affairs, and don’t get caught up in FOMO. And, after all, don’t overlook to DYOR!

Bearish Flag Chart Sample: FAQ

Is the bear flag bullish?

No, the bear flag sample is a bearish continuation sample.

Is the bear flag bearish?

Sure, the bear flag sample is a bearish continuation sample.

How do you commerce a bear flag sample?

One of the simplest ways to commerce a bear flag sample is to search for bearish indicators in downtrends. You possibly can enter a brief place when the worth breaks under assist or purchase places/promote calls when the worth varieties a bearish candlestick sample.

What’s an instance of a bear flag chart sample?

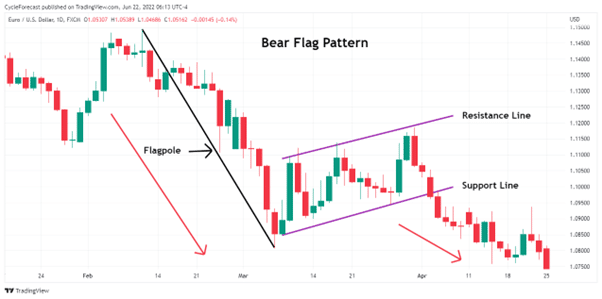

Examples of this value sample might be seen in all monetary markets. Right here’s one from International Alternate (Foreign exchange):

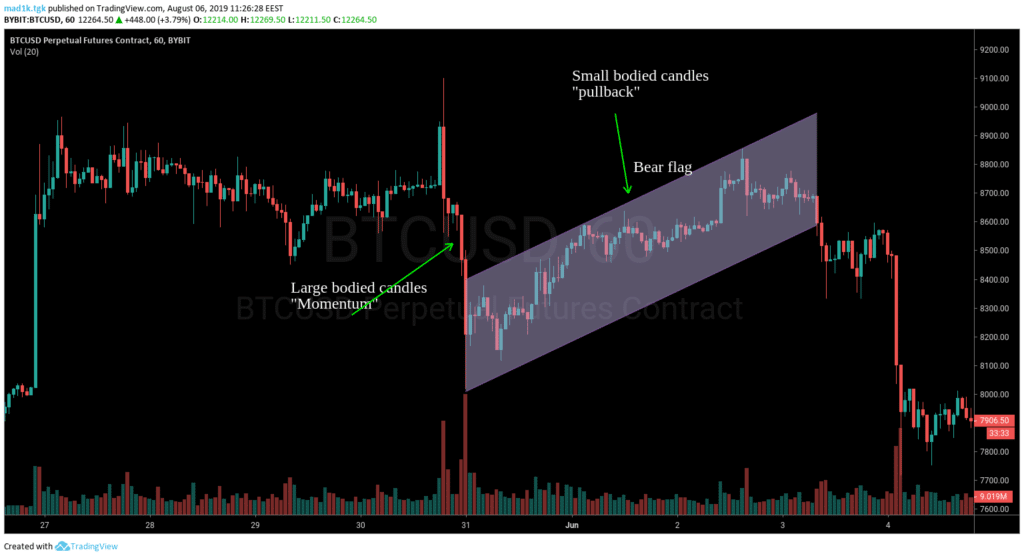

And right here’s one other instance from the crypto sphere — fashioned on the BTC/USD candle chart.

How dependable are bear flags?

A bear flag sample is a dependable indicator for predicting the continuation of a bearish development. Nonetheless, it isn’t completely correct and might typically be deceptive, so it ought to be utilized in mixture with different buying and selling indicators.

How lengthy does a bear flag final?

Bear flag patterns can final for days and even weeks. Nonetheless, it’s price noting that the longer the consolidation section lasts, the much less dependable the sample turns into. Subsequently, it’s best to enter trades when the consolidation section is comparatively brief.

What invalidates the bear flag?

The bear flag signifies that the present value development could also be coming to an finish and the worth goal is reversing itself.

Nonetheless, it doesn’t assure development reversal: the sample might be simply invalidated by market situations or different elements. For instance, if the worth fails to interrupt the bottom level of the flag sample or if costs transfer out of the bear vary (outdoors of what could be anticipated for flag continuation), then this invalidates the sample. Moreover, if there are volumes which are bigger than regular, this might additionally invalidate the potential bear flag.

It can be crucial to not depend on chart patterns alone when making buying and selling choices however to mix them with different technical indicators in addition to basic evaluation.v

Disclaimer: Please be aware that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.