Fast Take

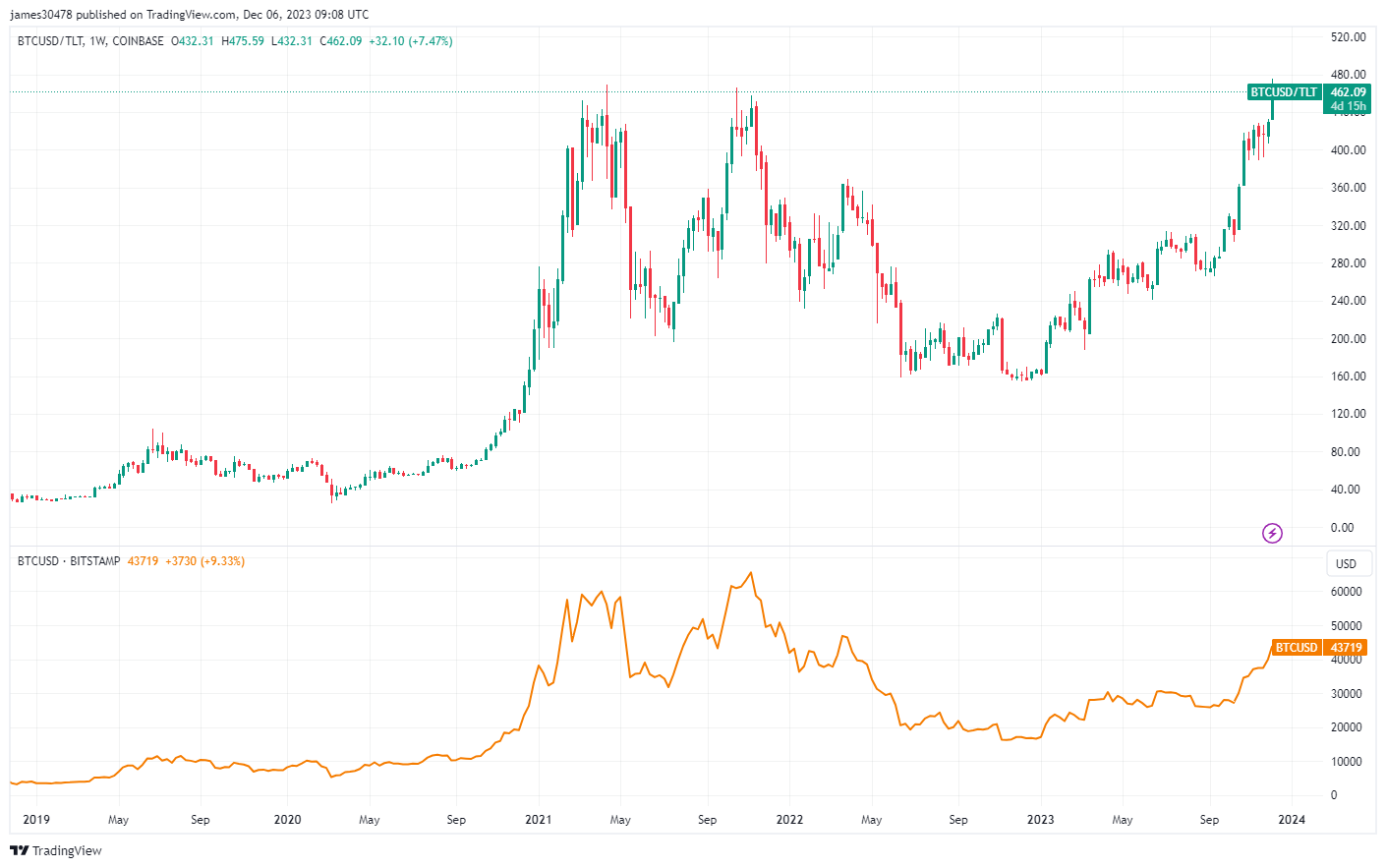

As Bitcoin was catapulted into the ninth place within the world asset rank yesterday, notably forward of Meta, its efficiency is juxtaposed with TLT, the US lengthy bond ETF. Presently, Bitcoin stands at 36% wanting its all-time excessive, whereas TLT, buying and selling roughly at $95, is 49% away from its peak.

Nevertheless, a deeper dive into the connection between Bitcoin and TLT reveals an attention-grabbing pattern. After we contemplate the variety of TLT models required for a single Bitcoin, so BTC denominated in TLT, the determine stands at 462, placing us at a triple high degree beforehand seen in March and November 2021.

Intriguingly, throughout these intervals, Bitcoin was buying and selling at larger values of $57,000 and $65,000, respectively. This means that, at the moment, it takes extra TLT models to amass the identical quantity of Bitcoin, hinting at a possible ongoing pattern the place Bitcoin begins to engulf asset premiums throughout the board.

The submit Bitcoin to US lengthy bond ratio matches ATH final seen in 2021 appeared first on CryptoSlate.