Altcoins, or different cryptocurrencies, have turn into a buzzword within the digital foreign money panorama, providing a world past Bitcoin (BTC). This information explores the essence of altcoins, answering the pivotal query: What are altcoins? From the historic rise of altcoins to the thrilling phenomenon of altcoin season, we delve into the intricacies that outline this dynamic market.

What Are Altcoins? Understanding The Fundamentals

Altcoins, quick for “different cash,” embody a various vary of cryptocurrencies which have emerged following the success of Bitcoin. They don’t seem to be merely imitations of Bitcoin however symbolize a broad spectrum of digital currencies with distinctive attributes, functions, and technological improvements.

Traits Of Altcoins

Every altcoin is distinguished by its distinctive blockchain know-how and consensus mechanism. As an example, Ethereum, one of the outstanding altcoins, makes use of a Proof-of-Stake (PoS) consensus mechanism, which is much less energy-intensive in comparison with Bitcoin’s Proof-of-Work (PoW) system.

XRP operates on a consensus protocol referred to as the Ripple Protocol Consensus Algorithm, designed for high-speed and energy-efficient transactions. Cardano employs the Ouroboros PoS algorithm, acclaimed for its safety and scalability. These various consensus mechanisms replicate the varied targets and technological developments of altcoins, starting from enhancing transaction effectivity to making sure higher safety and sustainability.

Altcoins additionally range considerably of their market capitalization, liquidity, group assist, and real-world purposes. For instance, Litecoin, sometimes called the silver to Bitcoin’s gold, presents quicker transaction affirmation instances, making it appropriate for smaller, on a regular basis transactions. In the meantime, Binance Coin (BNB) is intricately linked to the Binance alternate ecosystem, offering utility inside that particular platform.

Variations Between Altcoins And Bitcoin

One of many stark contrasts between Bitcoin and lots of altcoins is their improvement and governance construction. Bitcoin, created by the pseudonymous Satoshi Nakamoto, who has since left the mission in December 2010, operates in a decentralized and open-source method with out a government.

In distinction, many altcoins have identifiable founding groups or organizations overseeing their improvement. For instance, Ethereum is backed by the Ethereum Basis, Solana is developed by Solana Labs, and Cardano is spearheaded by IOG (Enter Output World).

One other key distinction lies of their transaction speeds and capabilities. Bitcoin, primarily designed as a digital retailer of worth and medium of alternate, processes transactions roughly each 10 minutes. In distinction, altcoins like Ripple’s XRP have a much-shorter block time and may course of transactions in seconds, making it a most popular alternative for cross-border cash transfers. Ethereum, with its sensible contract performance, permits a variety of decentralized purposes (dapps) past easy financial transactions.

Moreover, whereas Bitcoin’s most provide is capped at 21 million cash, altcoins have various approaches to produce. For instance, Ethereum initially had no cap. With the introduction of EIP-1559, Ethereum builders have launched a mechanism that burns a portion of the availability with every transaction, doubtlessly making its provide deflationary over time. XRP – like many different altcoins – was premined and has a capped complete provide of 100 billion XRP.

The Rise Of Altcoins: A Historical past

The historical past of altcoins is a charming narrative of innovation, market dynamics, and the continual pursuit of refining digital foreign money know-how. Because the inception of Bitcoin, the primary decentralized cryptocurrency, there was a surge within the creation of other cryptocurrencies, every searching for to handle perceived limitations of Bitcoin or to introduce new options and use circumstances.

The First Altcoins Gaining Traction

The journey of altcoins started quickly after the institution of Bitcoin, with the creation of Namecoin in April 2011. Namecoin aimed to decentralize domain-name registration, making web censorship harder.Following Namecoin, Litecoin was launched in October 2011, envisioned because the “silver” to Bitcoin’s “gold.” Litecoin supplied quicker transaction affirmation instances and a special hashing algorithm (Scrypt).

Following these, one other notable early altcoin included Peercoin, launched in 2012, which was the primary to implement a Proof-of-Stake/Proof-of-Work hybrid system. One other important early participant was XRP which was created in 2012. The XRP Ledger was launched in June 2012 by the founders of Ripple Labs, together with Chris Larsen and Jed McCaleb. Shortly after that, Dogecoin was launched in December 2013, initially created as a light-hearted tackle cryptocurrency.

Remarkably, not all early altcoins sustained their momentum. Many, like Feathercoin and Terracoin, which gained consideration initially, noticed their affect wane through the years. These cash, whereas progressive of their time, couldn’t sustain with the quickly evolving cryptocurrency market or construct a long-lasting group and improvement ecosystem.

Evolution Of The Altcoin Market

The altcoin market has developed considerably through the years, increasing past easy variations of Bitcoin’s know-how. The introduction of Ethereum in 2015 was a watershed second. Ethereum’s innovation was not simply in creating a brand new cryptocurrency however in introducing a platform for decentralized purposes (dApps) by way of sensible contracts.

This breakthrough opened the doorways for a brand new period of blockchain know-how, the place altcoins may serve numerous functions past mere foreign money, from powering decentralized finance (DeFi) to non-fungible tokens (NFTs). The market noticed an inflow of various altcoins primarily based on Ethereum, every catering to particular niches and use circumstances.

Key Milestones In Altcoin Historical past

A number of key milestones mark the historical past of altcoins. The Preliminary Coin Providing (ICO) growth in 2017 was one such important occasion. ICOs turned a preferred methodology for brand new cryptocurrency initiatives to boost funds, resulting in the launch of hundreds of latest altcoins. Nevertheless, this era additionally noticed elevated regulatory scrutiny and situations of fraud, resulting in a extra cautious market method.

One other main improvement was the rise of DeFi in 2020, the place altcoins performed a central function in enabling decentralized lending, borrowing, and buying and selling, impartial of conventional monetary establishments. This period additionally witnessed the surge in reputation of NFTs, with altcoins like Ethereum being on the forefront of this new digital asset class. These milestones spotlight the dynamic nature of the altcoin market, constantly formed by technological developments and shifting market sentiments.

High Altcoins To Watch

Because the crypto market continues to evolve, quite a few altcoins have risen to prominence, every providing distinctive benefits and improvements. This part highlights a number of the prime altcoins which have captured the market’s consideration resulting from their technological developments, group assist, and potential for future progress.

Overview of High Altcoins

Ethereum (ETH): Usually thought to be the main altcoin, Ethereum is famend for its sensible contract performance, which has paved the way in which for decentralized purposes (dApps) and decentralized finance (DeFi) ecosystems.

Solana (SOL): Solana has gained reputation for its extremely quick and low-cost transactions, leveraging a singular mixture of proof-of-history (PoH) and proof-of-stake (PoS) consensus mechanisms.

XRP: Regardless of authorized challenges in america, Ripple has established itself and the XRP token as a major participant, primarily for its use in quick and environment friendly cross-border cash transfers.

Binance Coin (BNB): Initially created as a utility token for the Binance cryptocurrency alternate, BNB has expanded its use circumstances to incorporate transaction payment reductions, token gross sales, and extra throughout the Binance ecosystem.

Cardano (ADA): Identified for its sturdy deal with sustainability and scientific philosophy, Cardano presents a third-generation blockchain that guarantees extra scalability and safety by way of its distinctive Ouroboros proof-of-stake algorithm.

Polkadot (DOT): Polkadot stands out for its interoperability, enabling totally different blockchains to switch messages and worth in a trust-free style; it’s additionally scalable and customizable.

These are only a few examples of the quite a few altcoins out there, every contributing to the varied panorama of cryptocurrency of their distinctive methods.

Options That Make Altcoins Stand Out

Altcoins distinguish themselves by way of numerous options that cater to particular wants and use circumstances:

Sensible Contract Capabilities: Ethereum’s introduction of sensible contracts revolutionized the blockchain area, enabling the creation of complicated, programmable transactions and purposes.

Scalability And Pace: Altcoins like Solana and Cardano have targeted on fixing scalability points, providing quicker transaction speeds and decrease charges in comparison with older blockchain networks like Bitcoin and Ethereum.

Interoperability: Tasks like Polkadot and Cosmos deal with the difficulty of blockchain interoperability, permitting totally different networks to speak and alternate info seamlessly.

Area of interest Functions: Some altcoins goal particular sectors or use circumstances, akin to Chainlink’s deal with offering real-world information to blockchain networks by way of oracles, or Monero’s emphasis on privateness and anonymity.

What Is Altcoin Season?

Altcoin season or “altseason” is a time period that describes a interval within the crypto market when altcoins considerably outperform Bitcoin. It’s a part the place traders’ urge for food for riskier belongings grows, and capital flows from Bitcoin into altcoins, typically leading to substantial value surges for these different cash. Understanding when an altcoin season is on the horizon might be essential for cryptocurrency merchants and traders seeking to capitalize on market tendencies.

Indicators Of An Upcoming Altcoin Season

A key indicator of an impending altcoin season might be the Bitcoin Dominance (BTC.D) chart, which tracks the share of the whole cryptocurrency market capitalization contributed by Bitcoin. Technical analysts scrutinize this chart for indicators of lowering dominance, which can recommend that altcoins are beginning to take up a bigger share of the market.

Help and resistance ranges on this chart can point out potential shifts in market dynamics. As an example, a sustained fall beneath a serious assist degree may sign the start of altcoin season.

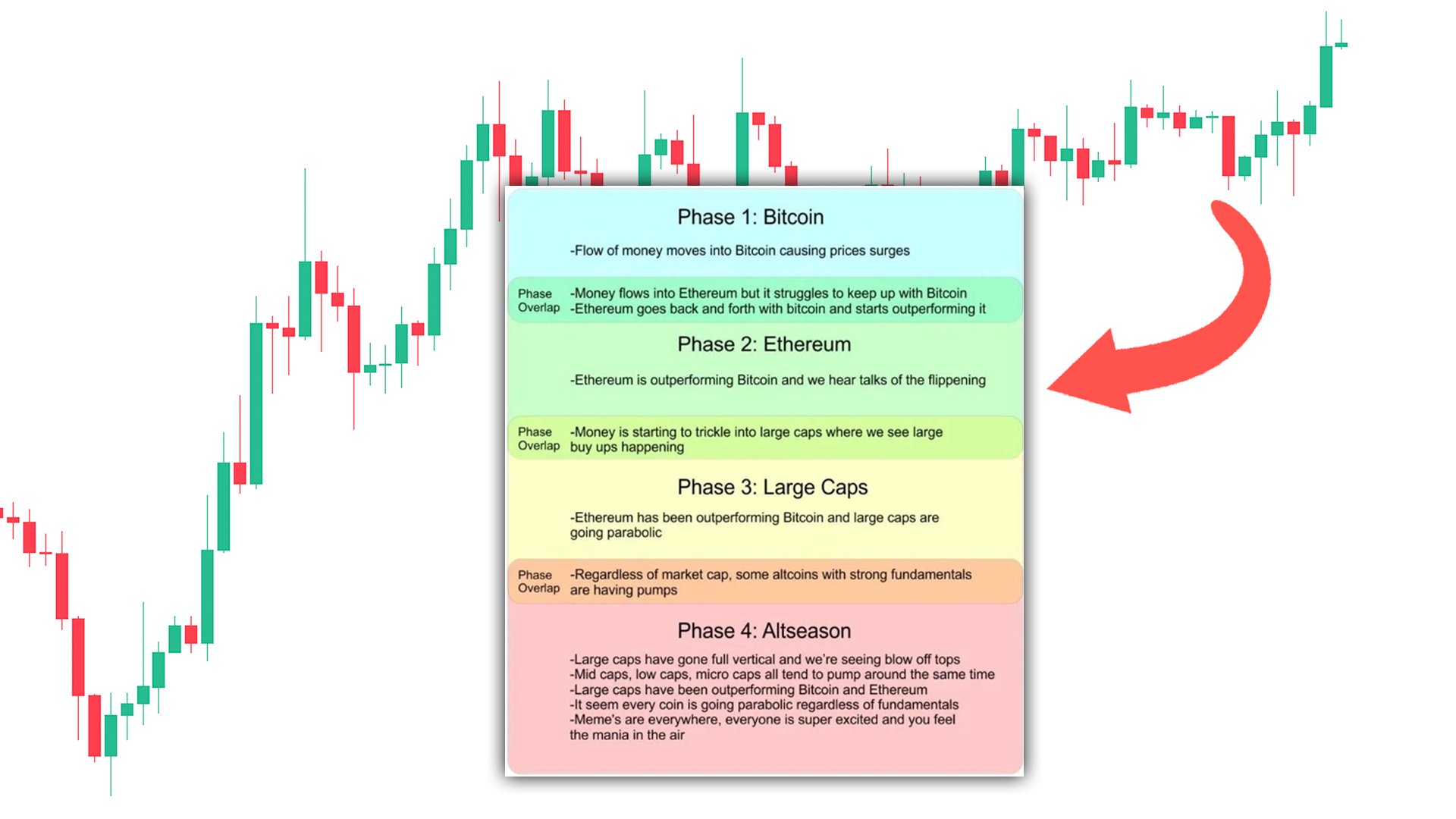

Remarkably, the market typically strikes in cycles which might be damaged down into 4 distinct phases, as illustrated within the picture supplied by crypto analyst Ted (@tedtalksmacro):

Section 1: Bitcoin – The cycle typically begins with Bitcoin’s value surging as cash flows into Bitcoin, inflicting important value will increase.

Section 2: Ethereum – Cash begins to circulation into Ethereum, which could battle to maintain up initially however then begins to outperform Bitcoin, resulting in discussions about ‘the flippening’ (the place Ethereum’s market cap may surpass Bitcoin’s).

Section 3: Giant Caps – As Ethereum begins outperforming Bitcoin, traders start to enterprise into large-cap altcoins, which then begin to see massive buy-ups and value will increase.

Section 4: “Altseason” – On this closing part, enthusiasm spreads throughout the market; massive caps have gone full vertical, and a spotlight turns to mid and small-cap altcoins. All classes, no matter fundamentals, are likely to pump across the similar time, resulting in a parabolic enhance in altcoin costs. This part is marked by excessive ranges of pleasure and media consideration.

Methods to Purchase Altcoins: A Step-by-Step Information

Buying altcoins can appear daunting for newcomers to the cryptocurrency area, however by following a transparent step-by-step course of, it may be easy and safe. Right here’s a simplified information that can assist you by way of the method:Analysis: Earlier than the rest, conduct thorough analysis to find out which altcoins align together with your funding targets and danger tolerance.

Select A Pockets: Choose a digital pockets that helps the altcoin you want to buy. Wallets might be software-based (like cellular or desktop purposes) or hardware-based for added safety.

Choose A Cryptocurrency Change: Select an altcoin alternate that lists the altcoin you’re excited by and is thought for its reliability, safety, and ease of use.

Register And Safe Your Account: Create an account on the chosen alternate and arrange sturdy authentication measures, together with two-factor authentication (2FA).

Fund Your Account: Deposit funds into your alternate account. This could typically be carried out by way of financial institution switch, bank card, or by depositing different cryptocurrencies.

Place An Order: Navigate to the market or buying and selling pair to your chosen altcoin and place a purchase order. You’ll be able to go for a market order for an instantaneous buy at present costs or a restrict order to specify a value at which you’re prepared to purchase.

Retailer Your Altcoins Securely: After the acquisition, switch your altcoins to your private pockets for safekeeping, particularly if you happen to’re planning on holding them for the long run.

The place to Purchase Altcoins

You should buy altcoins on quite a lot of platforms, every providing its personal set of options, charges, and safety measures. Listed here are a number of the most typical locations the place you should purchase altcoins:

Centralized Exchanges: These are the commonest platforms for getting altcoins and embody well-known exchanges like Binance, Coinbase, and Kraken. They provide a variety of altcoins and are usually user-friendly.

Decentralized Exchanges (DEXs): DEXs like Uniswap and SushiSwap permit for peer-to-peer transactions with out the necessity for an middleman. They provide the next diploma of privateness and direct wallet-to-wallet trades.

Cryptocurrency Brokers: Platforms like eToro and Robinhood act as brokers, providing a simple entry level for getting cryptocurrencies. Nevertheless, they might have a extra restricted collection of altcoins in comparison with devoted exchanges.

Peer-to-Peer (P2P) Platforms: Web sites like OKX P2P or Remitano join patrons and sellers immediately. Whereas they provide flexibility in cost strategies, they require the next diploma of belief between events.

When selecting the place to purchase altcoins, contemplate components akin to safety, charges, the number of obtainable altcoins, and the person expertise of the platform. At all times make sure that the platform you select complies with the regulatory requirements in your jurisdiction.

Are Altcoins A Good Funding?

The query of whether or not altcoins are a great funding is dependent upon numerous components, together with market circumstances, the precise altcoin’s potential for progress, and the investor’s danger tolerance and funding technique.

Execs Of Investing In Altcoins:

Excessive Progress Potential: Some altcoins have proven the capability for top returns on funding, outperforming conventional belongings of their greatest intervals.

Diversification: Altcoins can diversify an funding portfolio, doubtlessly lowering danger by spreading publicity throughout totally different asset courses.

Innovation: Investing in altcoins could be a technique to assist and be a part of progressive blockchain initiatives which will rework numerous industries.

Cons Of Investing In Altcoins:

Volatility: Altcoins might be extremely risky, with the potential for important value swings that may result in substantial good points or losses.

Market Maturity: In comparison with extra established markets, the cryptocurrency market is comparatively younger and might be unpredictable.

Regulatory Uncertainty: Altcoins face regulatory challenges that may influence their worth and legality.Buyers contemplating altcoins ought to conduct thorough analysis, perceive the dangers concerned, and contemplate talking with a monetary advisor. Funding choices ought to be primarily based on a person’s monetary scenario, funding targets, and danger tolerance.

Are Altcoins Useless Or Thriving?

The altcoin market is a various ecosystem with a variety of initiatives boasting numerous ranges of innovation, utility, and group assist. Just like the early days of the web which led to the Dot-Com bubble, the cryptocurrency area is experiencing its personal type of pure choice the place not all initiatives will survive in the long run.

The Actuality Of Altcoin Longevity:

Oversaturation: The market has seen an explosion of altcoins, with hundreds presently in existence. Many of those cash serve comparable features or goal to resolve the identical issues, resulting in an oversaturated market the place solely the strongest or most original can survive.

Consumer And Firm Adoption: For an altcoin to thrive, it should achieve widespread adoption amongst customers and companies. Nevertheless, with so many choices obtainable, not each altcoin will obtain the mandatory adoption price to maintain its community.

Innovation And Steady Improvement: The know-how underlying altcoins is quickly evolving. Tasks that fail to innovate or adapt to new developments are more likely to fall behind and ultimately turn into out of date.

Survival Of The Fittest:

The ‘Amazon’ Of Altcoins: There might be altcoins that handle to carve out a distinct segment for themselves and turn into integral to the crypto economic system, very like Amazon did for e-commerce. These initiatives usually have sturdy fundamentals, clear use circumstances, energetic improvement groups, and sturdy group assist.

The ‘Pets.com’ Of Altcoins: Conversely, some altcoins will fade into obscurity, much like the destiny of Pets.com and different failed Dot-Com ventures. Causes for this embody poor administration, lack of clear use circumstances, failure to ship on guarantees, or just the lack to compete with extra profitable initiatives.

Market Dynamics And Hypothesis:

Speculative Bubbles: The altcoin market just isn’t resistant to hype and hypothesis, which may result in bubbles. Tasks that rise quickly on hypothesis slightly than strong fundamentals are susceptible to crashing simply as shortly.

Regulatory Challenges: Authorities are nonetheless defining the regulatory panorama for cryptocurrencies. Altcoins that fall foul of future rules or fail to navigate the complicated authorized setting could face challenges that would impede their progress or result in their demise.

In conclusion, whereas the altcoin market as a complete exhibits indicators of thriving, with steady innovation and rising integration into the broader monetary system, it’s clear that not each altcoin will survive the check of time. Buyers ought to be discerning, specializing in initiatives with strong fundamentals, energetic improvement, and real-world utility to determine these with the potential to reach the long run.

FAQ

What Are Altcoins?

Altcoins, quick for “different cash,” are cryptocurrencies aside from Bitcoin.

Who Is Altcoin Day by day?

Twin brothers Aaron and Austin Arnold based Altcoin Day by day, a outstanding cryptocurrency YouTube channel. With over 1.34 million followers, it covers every day updates on Bitcoin, altcoins, NFTs, and extra.

What Is Altcoin Alert?

Altcoin Alert refers to a software program and repair that tracks and analyzes sentiment on a big scale within the cryptocurrency market. It predicts coin costs primarily based on in depth information.

How Many Altcoins Are There?

Are Altcoins Price Investing In?

Altcoins might be price investing in, however they carry their very own units of dangers and potential rewards. Their price as an funding will rely on particular person danger tolerance, market analysis, and funding targets.

Can You Brief Altcoins?

Sure, it’s potential to quick altcoins on many cryptocurrency exchanges. In brief promoting, an investor borrows a cryptocurrency and sells it available on the market, anticipating a lower in its value.

How Do Altcoins Work?

Altcoins work utilizing blockchain know-how, which is a decentralized ledger that data all transactions throughout a community of computer systems. Many various cryptocurrencies have totally different options and function on numerous consensus mechanisms, akin to Proof of Work, Proof of Stake, or others.

How Are Altcoins Created?

Creating altcoins typically includes forking from an current blockchain or creating a brand new blockchain and its underlying know-how from scratch. The method contains designing the coin’s protocol, creating its blockchain, and launching it for public use.

What Is An Altcoin?

An altcoin is any cryptocurrency aside from Bitcoin. The time period “altcoin” encompasses a broad vary of cryptocurrencies with numerous features and underlying applied sciences.

Featured picture from Shutterstock