Bull runs are like wildfires: they want a mix of circumstances to get began.

A wildfire wants an extended interval of no rain, excessive temperatures after which excessive winds on the level of ignition.

Sure – wildfires have been exacerbated by document methane emissions that Bitcoin helps mitigate, however that’s not what this text’s about: this time it’s simply an analogy.

Halvings trigger a drying up of latest provide of Bitcoin (no rain). They draw elevated curiosity in timing Bitcoin market entry (excessive temperature). However additionally they want excessive winds and an ignition occasion.

That prime wind is the winds of change across the Bitcoin ESG narrative.

The ignition occasion would be the first giant ESG Funding Committee backing Bitcoin for ESG causes.

The Downside The Hovering Quantity Of ESG Buyers Have

By 2026, ESG-focused institutional funding may have rocketed to 33.9 trillion {dollars}. That’s greater than greater than $1 for each $5 of property underneath administration in line with a PwC report.

However the extra necessary takeaway from the report that ought to alert Bitcoin hodlers present and future is that proper now ESG buyers have an issue: demand for strong ESG funding outstrips provide. ESG buyers take a very long time to seek out appropriate ESG investments, with a really excessive 30% of buyers saying they wrestle to seek out engaging ESG funding alternatives.

Bitcoin is now in pole place to reply that downside. Right here’s why:

The Alternative For Bitcoin

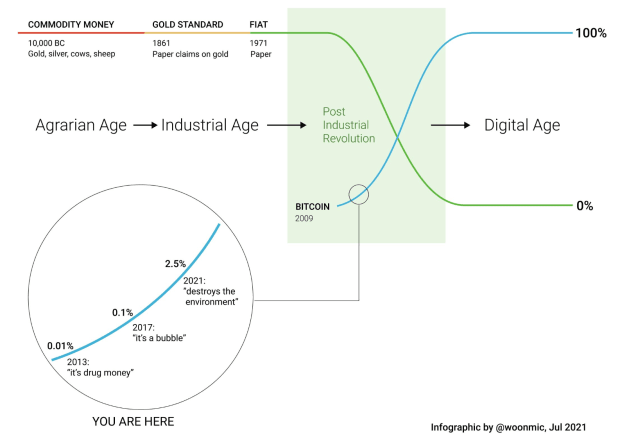

2023 marked the turning of the tide within the ESG narrative round Bitcoin.

In simply 53 halcyon days from Aug 1-Sept 22 this yr, 5 occasions helped flip the Bitcoin ESG narrative. They have been:

1. KPMG Report concludes that Bitcoin helps the ESG crucial (1 Aug)2. Peer reviewed analysis helps thesis Bitcoin will be good for setting (8 Aug)3. Cambridge acknowledges Bitcoin vitality overestimation (30 Aug)4. Bloomberg Intelligence charts present Bitcoin mining main decarbonization (14 Sept)5. Institute of Threat Administration conclude Bitcoin helps renewable transition (22 Sept)

These reviews and papers have been produced independently, from extremely respected researchers and organizations, and reasonably than conclude Bitcoin is “not as unhealthy for the setting as we thought”, they reached the a lot stronger conclusion that Bitcoin was web constructive as an ESG asset.

This wind of change has the potential to accentuate into the excessive wind that Bitcoin wants to finish the set of circumstances wanted for a bull run.

What This Means

Info is energy. Proper now, there may be an data asymmetry. The narrative has modified primarily based on new information. However most ESG buyers don’t have this information. But. Till they get this new information, they’ll hold believing the outdated “Bitcoin is web detrimental for the setting” narrative.

In case we wanted proof of that, right here’s a DM I bought from a fund supervisor simply the opposite day.

Any such ESG investor nonetheless can not deploy a better share into Bitcoin as a result of their ESG data on Bitcoin is a number of years outdated, and are usually not but conscious of the 5 narrative-flipping occasions described above.

Whereas the Bitcoin-views of ESG Funding Committee members are sometimes strongly detrimental, it has been my expertise that in contrast to environmental NGOs, their views are additionally loosely held. Once I was in Sydney just lately, a younger Australian enthusiastically bounded up me and stated “Dan – I used your charts to orange-peel our funding commeettee!”

So what’s going to occur when this data asymmetry is blown away by the excessive winds of the brand new Bitcoin ESG narrative?

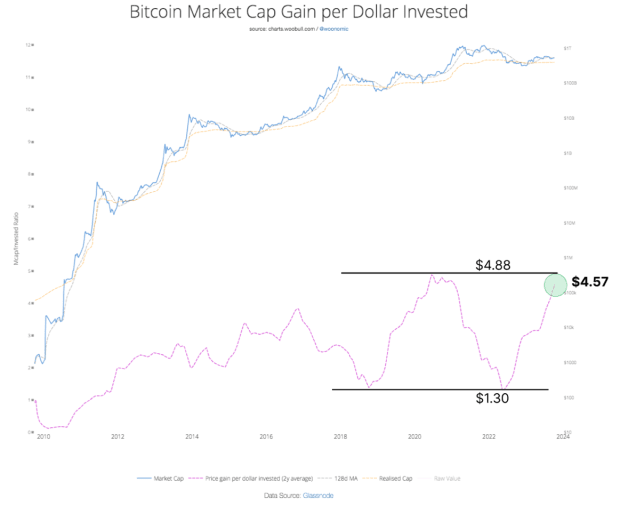

Because of Willy Woo’s evaluation, we will quantify what that may imply to Bitcoin’s market cap inside a spread.

Quantifying How ESG = NGU

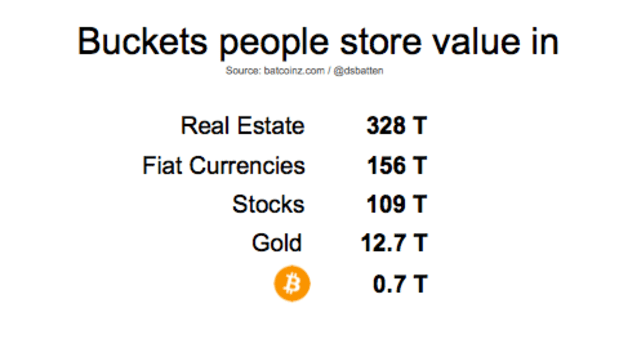

ESG adoption of Bitcoin may be very bullish for Bitcoin’s comparatively thimble-sized market of $713Bln on the time of writing. Woo argues that Bitcoin wants to remain above 1 Tr earlier than the establishments that maintain the wealth of nation states and/or retirement funds really feel comfy investing in it en masse.

What then would occur to Bitcoin’s market cap if ESG buyers deployed 1% of their 2026 AUM (Property Beneath Administration) into Bitcoin?”

At as we speak’s market-cap-increase-per-dollar-invested ratio – Bitcoin’s market cap would improve to a wholesome $2.26 Trillion. That’s greater than triple what it’s as we speak.

If 2.5% of ESG funds AUM was deployed into Bitcoin, it could improve market cap to $3.87 Trillion. That’s greater than 5 occasions as we speak’s market cap. This places it squarely on the roadmap for institutional buyers, which results in extra capital deployment, which in flip creates a really bullish constructive suggestions loop.

Even with out this suggestions loop although, a 2.5% ESG deployment may catalyze a Bitcoin value of round $193,000 throughout a potential 2026 bear market.

This isn’t a prediction however a simulation. I’m saying if ESG ICs deployed 1-2.5% of AUM, then the consequence for Bitcoin’s market cap might be 2-5x.

That stated, Bitcoin has the distinctive potential of turning into the world’s first Greenhouse Adverse business with out offsets: one thing that might require Bitcoin mining methane mitigation on simply 35 mid-sized venting landfills. Ought to that happen by the aggressive but potential timeframe of 2026, I’d be shocked if Bitcoin didn’t obtain a 2.5% deployment of ESG investor AUM or larger.

Ignition

As if we wanted extra affirmation that the winds of ESG narrative change are swirling, just lately I spoke on the 2023 Plan₿ Discussion board in Lugano on the subject “Bitcoin is the World’s finest ESG Asset”. I had the concept of utilizing a declare each Michael Saylor and Baseload have beforehand made, and making it right into a keynote backed up with supporting information.

The recording is presently essentially the most watched discuss from the 2023 convention on Youtube not due to any nice notoriety on my half (there have been significantly better recognized audio system) however as a result of as Victor Hugo as soon as remarked “Nothing is extra highly effective than an thought whose time has come.”

Bitcoin as an ESG asset is an thought whose time has come. Bitcoin has now demonstrated its capacity to extend renewable vitality capability and scale back methane emissions at a time when the world urgently wants options to each. In contrast, now Ethereum has migrated to Proof of Stake, it might not help with both of those pressing wants.

In early 2022, most Bitcoiners have been nonetheless making an attempt to “defend” Bitcoin towards ESG assaults by means of me-tooism resembling “However Tumble Dryers use extra vitality than us”. However by 2023, Bitcoiners began taking the sport into the opponent’s half, with constant success. The technique of sharing fact-based reviews and provoking tales concerning the constructive ESG case for Bitcoin is working: This yr each The Hill and Bloomberg started publishing constructive press on Bitcoin mining. Constructive mainstream information protection outnumbered detrimental accounts 4:1. After which after all there have been these 53 days of narrative flips.

Each 4 years, a brand new false-narrative is hatched. Nevertheless, each 4 years, it’s additionally “tick tock, subsequent false-narrative for the chopping block.”

The story that Bitcoin “destroys the setting” if not lifeless, is no less than a Almost Headless Nick.

The approaching halving will additional dry up Bitcoin provide whereas concurrently heating up investor curiosity. All of the whereas, the winds of change within the ESG narrative are choosing up knots. The circumstances are actually excellent for the inevitable igniting spark of huge ESG fund deployment into Bitcoin.

ESG = NGU.Daniel Batten is founding father of CH4Capital, who supplies infrastructure financing to Bitcoin mining firms who’re powered by vented methane from landfills.

It is a visitor submit by Daniel Batten. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.