Ethereum’s staking pool dynamics have undergone a major transformation amidst the excitement surrounding Binance and CZ’s authorized challenges and the heightened regulatory scrutiny on centralized exchanges.

Over the previous few weeks, there was a discernible shift within the dynamics of the Ethereum staking pool that signifies a major slowdown within the price of validator progress. On account of this alteration, there was a lower within the every day issuance of Ethereum (ETH), which was a direct results of the amount of ETH that was actively staking within the pool.

Ethereum Validator Exodus: What’s Going On?

In line with Glassnode’s evaluation, there was a excessive degree of about 1,018 validator exits on daily basis since early October, which has coincided with a rise in spot costs for cryptocurrencies. With this motion, Ethereum’s Proof-of-Stake (PoS) consensus mechanism has skilled its first decline in Complete Efficient Steadiness for the reason that replace.

Over the past eight weeks, the overwhelming majority of the departing validators have willingly withdrawn. Which means that somewhat than slicing, which is the punishment meted out to validators that break protocol, the stakers freely select to go away the staking pool.

There have solely been two instances of slashing all through that point, one among which was essential and concerned the slashing of 100 validators who had newly joined and have been fined for signing two separate blocks throughout the community on the similar time.

ETH market cap at the moment at $244 billion on the every day chart: TradingView.com

Inspecting The Voluntary Exits

It takes a minimal of 32 ETH to stake with a purpose to act as a validator on the Ethereum community. The variety of distinctive addresses holding this a lot ETH has been steadily declining for the reason that begin of the October rise.

Nearly all of exits reported in the course of the earlier eight weeks, in response to Glassnode, have been voluntary. When validators independently select to go away the ETH 2.0 staking pool, it’s thought-about that they’ve left the community freely.

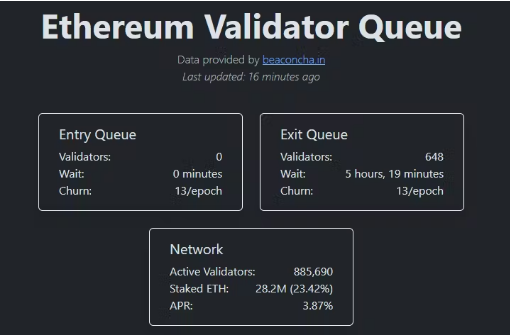

Supply: Validator Queue

Roughly 125,189 addresses held a minimum of 32 ETH as of this writing, a 1% lower from October 1st.

Even with these departures, Kraken and Coinbase, amongst others, noticed a restoration of their balances following Zhao’s resignation, suggesting that customers nonetheless think about these companies.

Moreover, the rise within the every day burning of ETH charges by way of EIP1559 coincides with the change within the situation of ETH. The London improve in 2021 set off this fee-burning mechanism, which brought on the ETH provide to turn out to be deflationary as soon as extra.

Because the Ethereum community adapts to post-upgrade circumstances, it’s going by way of a dynamic part. The departures of validators and the shift in staked capital are indicative of how the cryptocurrency markets are altering and the way traders are adapting their technique to make the most of new potentialities and developments out there.

Featured picture from Freepik