Market Outlook #247 (twenty eighth November 2023)

Good day, and welcome to the 247th instalment of my Market Outlook.

On this week’s put up, I can be overlaying Bitcoin, Ethereum, Polkadot, Cosmos Hub, Aave, Akash Community, Litentry and Rainicorn.

As ever, when you have any requests for subsequent week, ship them throughout.

Bitcoin:

Weekly:

Each day:

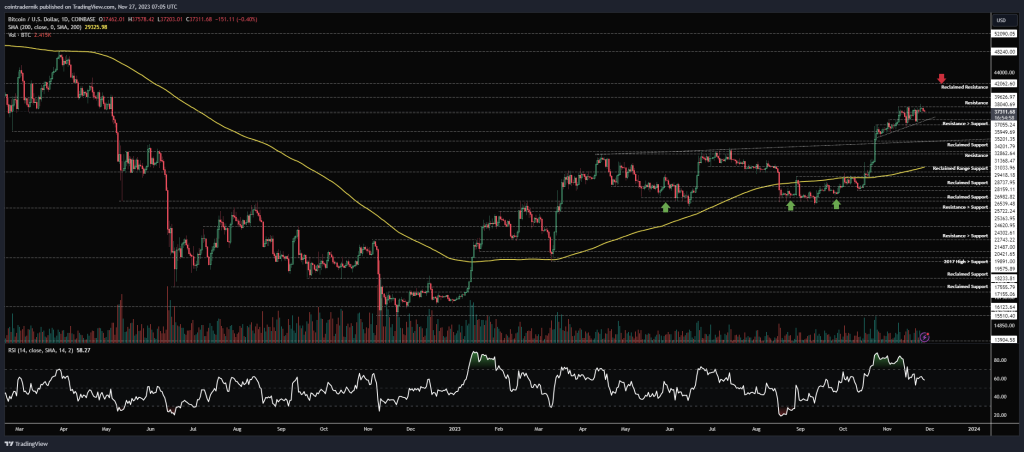

Value: $37,295

Market Cap: $729.275bn

Ideas: If we start by taking a look at BTC/USD on the weekly timeframe, we will see that worth – regardless of wicking decrease earlier within the week – shaped a higher-low above the prior week and closed at marginal new yearly highs on rising quantity. We closed simply above prior assist at $37.1k however stay capped by $38k in the interim. It appears to be like virtually like one thing of an ascending triangle is now forming with $38k because the resistance; and so long as we maintain above $36k as assist this week I believe it’s possible we see an upside decision and push up into $39.6k, adopted by $42k as the foremost degree. Naturally, a weekly shut under $36k would invalidate this construction and we might then take into account a deeper pull-back, however for now all indicators level north, for my part.

Turning to the each day, we will see this ascending triangle formation a bit of extra clearly, with a failed breakout try above resistance a few days in the past however a scarcity of willingness to push any decrease at current. While we proceed to carry this trendline and prior resistance turned assist round $36k, I believe it’s possible we proceed to push increased, notably if $37k now begins to behave as assist because it presently seems to be doing. Anticipating a each day shut firmly by way of $38k to behave because the catalyst for the following leg increased. Nothing a lot else to debate right here for now.

Ethereum:

ETH/USD

Weekly:

Each day:

ETH/BTC

Weekly:

Each day:

Value: $2045 (0.05487 BTC)

Market Cap: $245.906bn

Ideas: One other week goes by for ETH/USD and we stay consolidating proper round that $2037 degree. Final week noticed worth type a higher-low above the prior week’s low however proceed to be capped by $2133 as resistance. While we’re persevering with to cut round at this degree however maintain above prior trendline resistance, very like BTC I anticipate we see upside decision of this vary and any transfer by way of $2170 opens up that $250 vary into the following resistance space at $2426. Dropping into the each day, we will see that worth is now retesting $2037, which might develop into resistance turned assist right here if it holds – if not we’re taking a look at reclaimed resistance and sure one other transfer decrease into $1957 as the following main assist. Nonetheless, we’re additionally testing minor trendline resistance as assist right here too, offering confluence for a potential backside early this week on this space. If that happens and we begin to push increased off this trendline, I believe $2133 will get blown out later this week, after which we’re in search of a weekly shut above $2172 for continuation increased in December.

Turning to ETH/BTC, extra consolidation adopted final week under that 200wMA and vary low at 0.055, however worth held as soon as once more above 0.0533 as assist. While we’re on this vary, there truthfully is just not much more so as to add to final week’s evaluation: weekly shut again above that 200wMA and backside is probably going in, a minimum of for a push into trendline resistance; however shut under 0.0533 and I believe we take out 0.051 into 0.0487. Let’s see if we get any actual motion this week…

Polkadot:

DOT/USD

Weekly:

Each day:

DOT/BTC

Weekly:

Each day:

Value: $5.25 (14,077 satoshis)

Market Cap: $6.825bn

Ideas: Starting with DOT/USD, we will see that worth has been consolidating after its robust transfer off the lows and thru trendline resistance, rejecting under prior assist at $6 however holding now above $5 as reclaimed assist. This $5-6 vary may be very a lot simply consolidation post-trendline breakout, so so long as we now maintain above $4.40 I believe we’re taking a look at a transfer into $7.08 sooner somewhat than later, the place there’s stronger resistance. Weekly shut by way of that’s what bulls need to see for the following giant vary to open up, with $10-11 the resistance space I’d anticipate to see examined as soon as $7 turns into assist. Dropping into the each day, we will see how the 200dMA is now performing as assist round $5.27, aligning with reclaimed assist in that space; we’re successfully bull-flagging into that degree as assist, which is promising. Both a higher-low above it or a sweep of that degree with some divergence can be the proper setup for a protracted entry, with a view to carry for a breakout above $6, taking a look at $7 as the first goal.

Turning now to DOT/BTC, we will see that worth rejected at prior assist ~15.6k satoshis and is now forming a higher-low above the October lows and all-time low at 11.8k satoshis. We’re nonetheless very a lot in a bear pattern right here, with bearish market construction on the weekly, however, if we drop into the each day, we will see indicators of a shift right here, as worth reclaimed assist at 13.5k satoshis and has shaped a higher-low there. Nonetheless, while that is under under the 200dMA (because it has been for nicely over 18 months) and 16.4k satoshis, it’s safer to imagine the downtrend persists, however given how the broader market appears to be like at current I’d not be stunned to see that confluence of resistance cleared in December, turning market construction bullish on the upper timeframes. If we see that, we will have a look at lengthy publicity on DOT in mid-Dec-January for some catch-up strikes.

Cosmos Hub:

ATOM/USD

Weekly:

Each day:

ATOM/BTC

Weekly:

Each day:

Value: $9.45 (25,352 satoshis)

Market Cap: $2.765bn

Ideas: Starting with ATOM/USD, we will see from the weekly that worth rallied final week after wicking under assist at $9 to shut at weekly highs simply shy of $10. We are actually capped by prior assist however this push off assist into weekly highs signifies increased costs from right here to me, with a transfer above $10.30 this week opening an enormous vary to play longs inside: we then have solely trendline resistance barring the best way to the 200wMA up at $13.40, the place there a variety of confluence for resistance and thus possible a sensible space to hedge lengthy publicity within the coming weeks and months. If we reject $10.30 and begin to shut again under $9, nonetheless, then we will have a look at a return to $7.30, the place I’d search for longs above that degree forming a higher-low. Briefly wanting on the each day, we will see that worth bounced off the 200dMA as assist and reclaimed $9 subsequently, having reset momentum indicators and thus now wanting primed for continuation by way of $10. Let’s see what the week brings to Cosmos…

Turning to ATOM/BTC, we’ve a very nice formation right here following a deviation under multi-year assist at 24k satoshis, with worth since consolidating again above the extent after a pointy reversal and final week wicking again under the extent solely to shut above 26k satoshis. So long as this assist continues to carry now, it’s possible the underside is in and we will anticipate any transfer by way of 27k satoshis to result in a a lot sharper rally into that trendline from the September 2022 highs. Under 24k, nonetheless, the downtrend resumes, and we will have a look at 17.8k under as main assist. If we have a look at the each day, we will see the pair continues to be capped by the 200dMA, so acceptance by way of that may additionally look very a lot constructive for a longer-term reversal.

Aave:

AAVE/USD

Weekly:

Each day:

AAVE/BTC

Weekly:

Each day:

Value: $95.60 (0.00256 BTC)

Market Cap: $1.396bn

Ideas: If we start with AAVE/USD, we will see that the pair has been range-bound for 567 days, with assist at $49 and vary resistance round $113, all of this price-action having additionally occurred under the 200wMA. AAVE was additionally one of many first tokens to peak in 2021, and thus it has been virtually three years since these all-time highs shaped towards the Greenback. We are actually urgent up towards the high quality as soon as once more, with resistance at $90 now performing as minor assist and worth sandwiched between there and $113. Now, given how this space of the vary has acted as resistance for 18 months, I’d not personally search for contemporary lengthy publicity round right here; somewhat, I’d search for a weekly shut above $113 after which look to enter on a retest of vary resistance as assist, if that chance presents itself, with invalidation under $90 and in search of $167 as a primary goal, adopted by the 23.6% fib retracement of the bear market at $207. If we lose $90 right here earlier than a breakout, I’d search for any alternative to get lengthy near $62.

Turning to AAVE/BTC, we will see that worth is consolidating inside a major historic vary, with assist at 22.5k satoshis and resistance on the 2018 cycle highs of 28.5k satoshis. We’re additionally seeing worth capped by trendline resistance from October 2021. What bulls need to see from AAVE right here is kind of clear: a weekly shut by way of each trendline resistance and 28.5k, accepting above each and flipping them into assist. If we see that happen, I’d be assured {that a} backside has shaped for this cycle and we’d be wanting on the subsequent bull cycle for AAVE, with the 47-55k space as the primary main goal for upside.

Akash Community:

AKT/USD

Weekly:

Each day:

AKT/BTC

Weekly:

Each day:

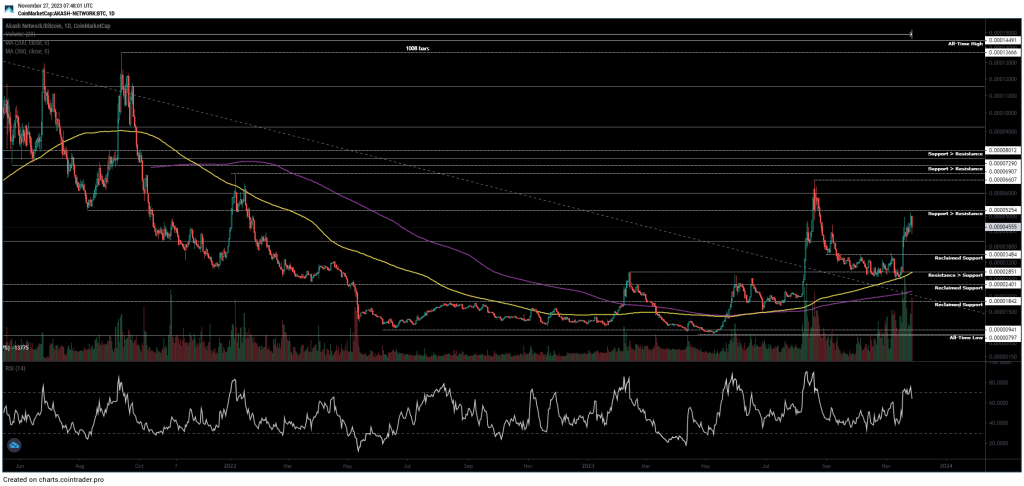

Value: $1.64 (4385 satoshis)

Market Cap: $363.597mn

Ideas: Starting with AKT/USD, we will see from the weekly that worth is in a robust uptrend, turning prior resistance into assist on rising quantity and now discovering some resistance on the 23.6% fib degree and prior assist at $2. That is textbook price-action to this point since bottoming, and I’d anticipate to see reclaimed assist at $1.37 now maintain as a better low and worth then proceed to push into $2.67 as the following resistance. I’m personally not trying to promote any of my AKT till we get nearer to $4, nonetheless, with a view to carry a minimum of 20% of my unique place for contemporary all-time highs above $8. Nothing else so as to add right here as that is very clear market construction.

Turning now to AKT/BTC, we will see how worth rejected 6640 on the primary try again in August and closed under 5200 satoshis on that try, then retracing into 2850 to type a better low after which reversing on rising quantity off that degree. Value is now as soon as once more sat proper under 5200 satoshis, so we’re in search of a weekly shut above this degree to open up the following leg of the cycle, with a retest of 6640 the primary degree of curiosity right here, given the confluence of resistance in that space. Above 8000 satoshis, there’s successfully zero resistance again in the direction of the all-time highs, in order that’s the place I believe we’ll see worth speed up (as market cycles usually do). Onwards and upwards in 2024…

Litentry:

LIT/USD

Weekly:

Each day:

LIT/BTC

Weekly:

Each day:

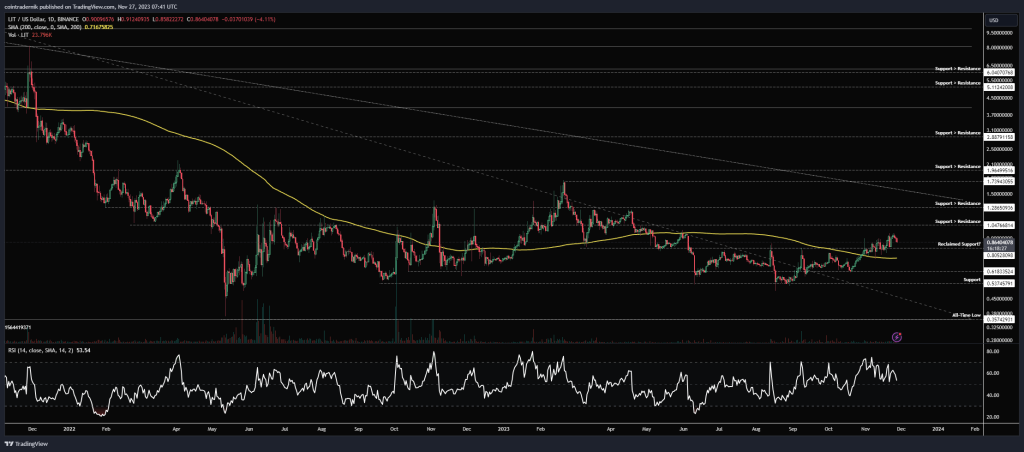

Value: $0.87 (2329 satoshis)

Market Cap: $40.644mn

Ideas: Starting with LIT/USD, we will see that worth has been in a downtrend since incept, buying and selling decrease for over 1000 days at this level, however having spent the previous yr consolidating above all-time lows and above assist at $0.54. Now we have not too long ago turned weekly construction bullish by closing above $0.80 and I’ve added to my spot bag right here round $0.86. I wish to see the pair now push on and shut above $1.30 after which overcome that trendline resistance from the all-time excessive, after which I believe we’ll see a disbelief rally kick in and LIT’s first bull cycle start. I’m trying to maintain this in the course of that first market cycle, with contemporary all-time highs above $16 the expectation within the subsequent 12-18 months, however with a view to promote partials at $6 and at $12.50.

Turning to LIT/BTC, we will see that the pair has been consolidating between assist at 2000 satoshis and resistance at 2850 for six months now, holding above all-time lows within the meantime. This diminishing volatility and consolidation vary above all-time lows is strictly what I search for in a bottoming formation, offering confluence for including to my spot bag right here. For these with rather less threat urge for food, you might await a robust shut above 2850 and turning that degree into reclaimed assist earlier than entry, making it a better chance that we see continuation increased from there, with 6200 satoshis as the primary main resistance above. Little else to debate for LIT.

Rainicorn:

RAINI/USD

Weekly:

Each day:

RAINI/BTC

Weekly:

Each day:

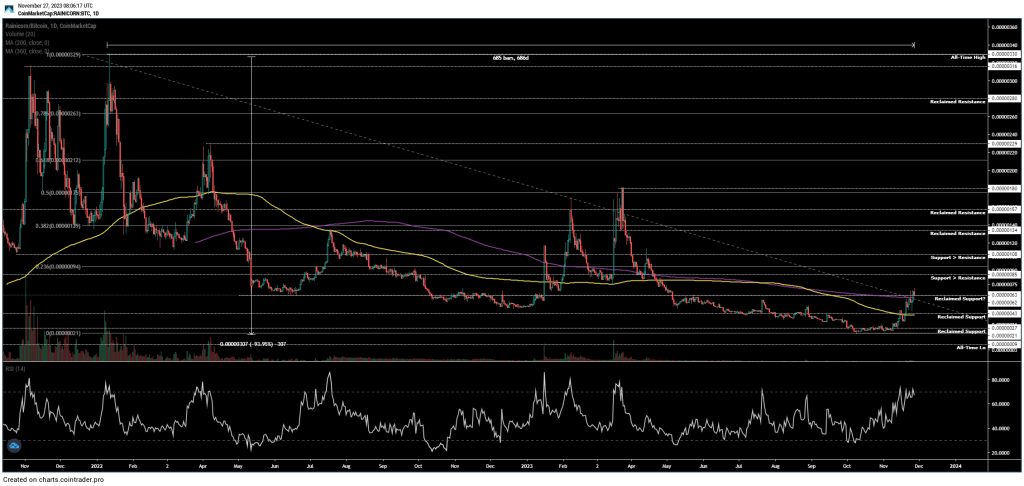

Value: $0.0244 (65 satoshis)

Market Cap: $11.857mn

Ideas: Starting with RAINI/USD, we will see from the weekly that the pair has been reversing sharply for the previous few weeks and is now sat in no man’s land between reclaimed assist at $0.016 and assist turned resistance at $0.04, above which the 2023 excessive can also be sat at $0.05. I anticipate this momentum – and the momentum within the broader marketplace for the BEAM ecosystem – to proceed, taking this into $0.04 with haste. What we then need to see is the formation of a higher-low after which a weekly shut by way of the 2023 highs and the 23.6% fib retracement at $0.05. That’ll be the catalyst for the following part of RAINI’s bull cycle, as we emerge from disbelief. I’m anticipating to see $0.088 hit later this yr after which worth to speed up in the direction of contemporary all-time highs later in 2024 after some type of longer consolidation interval.

Turning to RAINI/BTC, we will see how the pair has turned weekly construction bullish and has reclaimed assist at 62 satoshis, with 43 satoshis performing as reclaimed assist final week. There’s air between right here at 85 satoshis, which is then subsequent degree I anticipate to see hit within the subsequent week or two, however actually I don’t see a lot by means of main resistance till 108 satoshis. That’s the place I’d anticipate the pair to take a breather earlier than making a transfer for that 38.2% retracement degree and historic resistance at 134 satoshis. If you happen to’re in search of an entry, I’m undecided we get a pointy pull-back down right here however clearly 43 satoshis can be golden, or something near that. Wanting forward into 2024, I’m anticipating any acceptance above the 2023 highs at 180 to start the parabolic part of its bull cycle, with 280 as main resistance above that (the place I’ll possible promote some RAINI) and contemporary all-time highs past that at 330.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be happy to go away any feedback or questions under, or e-mail me instantly at nik@altcointradershandbook.com.