Lloyds Financial institution has issued a stark warning as crypto scams spike by 23% this 12 months, revealing that victims are dropping a median of £10,741. The report highlights the alarming pattern of two-thirds of those scams originating on social media platforms.

The information underscores the pressing want for elevated consciousness and regulatory measures within the cryptocurrency area, the place the promise of revenue intersects with the rising risk of deception, posing a big problem for traders navigating this evolving monetary panorama.

Crypto Scams: Younger People On The Crosshair

Lloyds has revealed that people falling throughout the 25 to 34 age bracket represent the commonest demographic focused by crypto scams.

In line with the financial institution, potential crypto traders usually discover themselves making a median of three funds earlier than realizing they’ve fallen prey to scams.

Alarmingly, it takes roughly 100 days from the preliminary transaction for victims to report the fraudulent exercise to their financial institution, shedding gentle on the persistence and class of those misleading schemes.

Complete crypto market cap at $1.37 trillion on the every day chart: TradingView.com

An evaluation highlights that 66% of funding scams provoke on social media, primarily by Instagram and Fb. These scams contain pretend adverts, movie star endorsements, and focused messages. Traders are suggested to confirm the legitimacy of alternatives to keep away from falling prey to those misleading techniques.

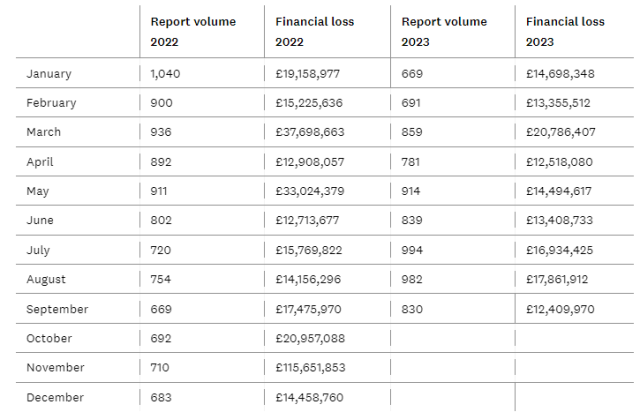

A separate report obtained knowledge from Metropolis of London Police, revealing 9,709 reviews of cryptocurrency scams and a £329,199,179 loss in 2022. In 2023, 7,559 reviews resulted in a £136,468,004 loss. These figures probably underestimate the issue, as Motion Fraud depends on self-reporting, and Police Scotland’s knowledge is excluded.

Supply: Metropolis of London Police

Supply: Metropolis of London Police

Liz Ziegler, the director of fraud prevention at Lloyds Financial institution, emphasised that cryptocurrency is a “notably high-risk asset class” with restricted regulation, making it an “interesting goal for fraudsters.”

Many banks within the UK have blocked transactions to bitcoin buying and selling platforms as a result of widespread drawback of cryptocurrency scams. The latest financial institution to tell customers that they might now not purchase cryptocurrency belongings utilizing their Chase debit card or with a financial institution switch was Chase by JPMorgan in September.

The Lloyds Financial institution report, which helps Coinbase’s outcomes, says that youthful Individuals are extra receptive to unorthodox monetary choices like cryptocurrencies, which leaves them extra prone to fraud.

This group aggressively seems to be for brand spanking new enterprise ventures and views cryptocurrency and different new expertise as devices for upgrading the monetary system and reimagining the so-called “American Dream.”

Featured picture from NoName_13/Pixabay