Sotheby’s injected a modest however much-needed dose of stability into New York’s autumn public sale season Wednesday evening (8 November) with its devoted sale of works from the gathering of the deceased Whitney Museum of American Artwork patron Emily Fisher Landau.

Other than establishing new public sale highs for 2 blue-chip “artist’s artists” within the $10m to $20m bracket, the public sale will maybe greatest be remembered for doing precisely what it wanted to do. The public sale home delivered a hammer complete of $351.6m ($406.4m with charges), throughout the pre-sale estimate vary of $344.5m to $430.1m (calculated with out charges).

Pablo Picasso’s Femme à la montre (1932) Courtesy of Sotheby’s.

Roughly one third of that sum got here courtesy of Pablo Picasso’s 1932 portrait of Marie-Thérèse Walter, Femme à la montre, which auctioneer Oliver Barker knocked down at $121m ($139.4m with charges), satisfying its unpublished pre-sale goal “in extra of” $120m. Not like the connection between Picasso and Walter, this affair was over in lower than three minutes, with Barker spending one minute coaxing the successful bidder into providing the ultimate $1m, and one other minute deciding there have been no extra will increase on this crowd.

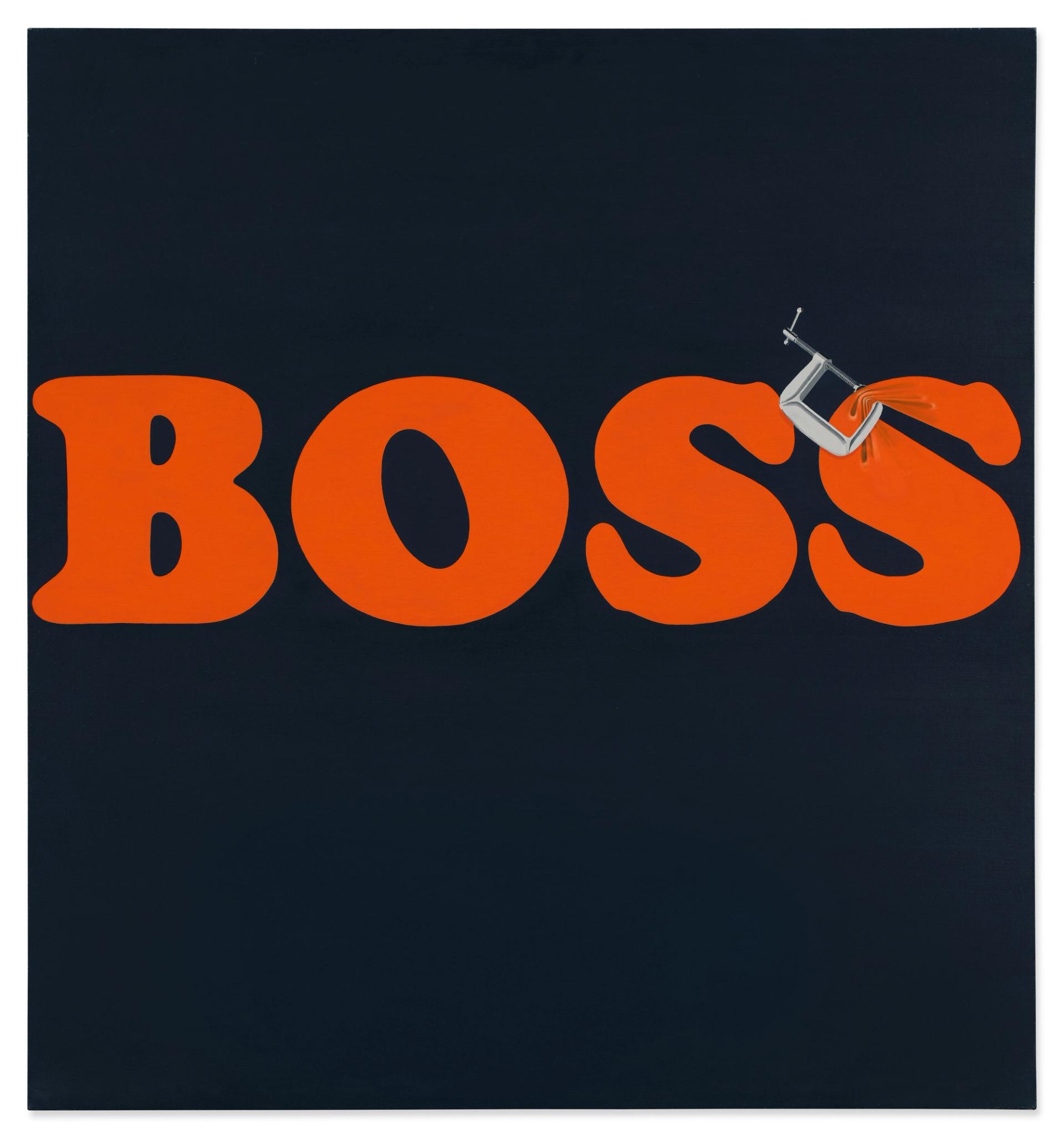

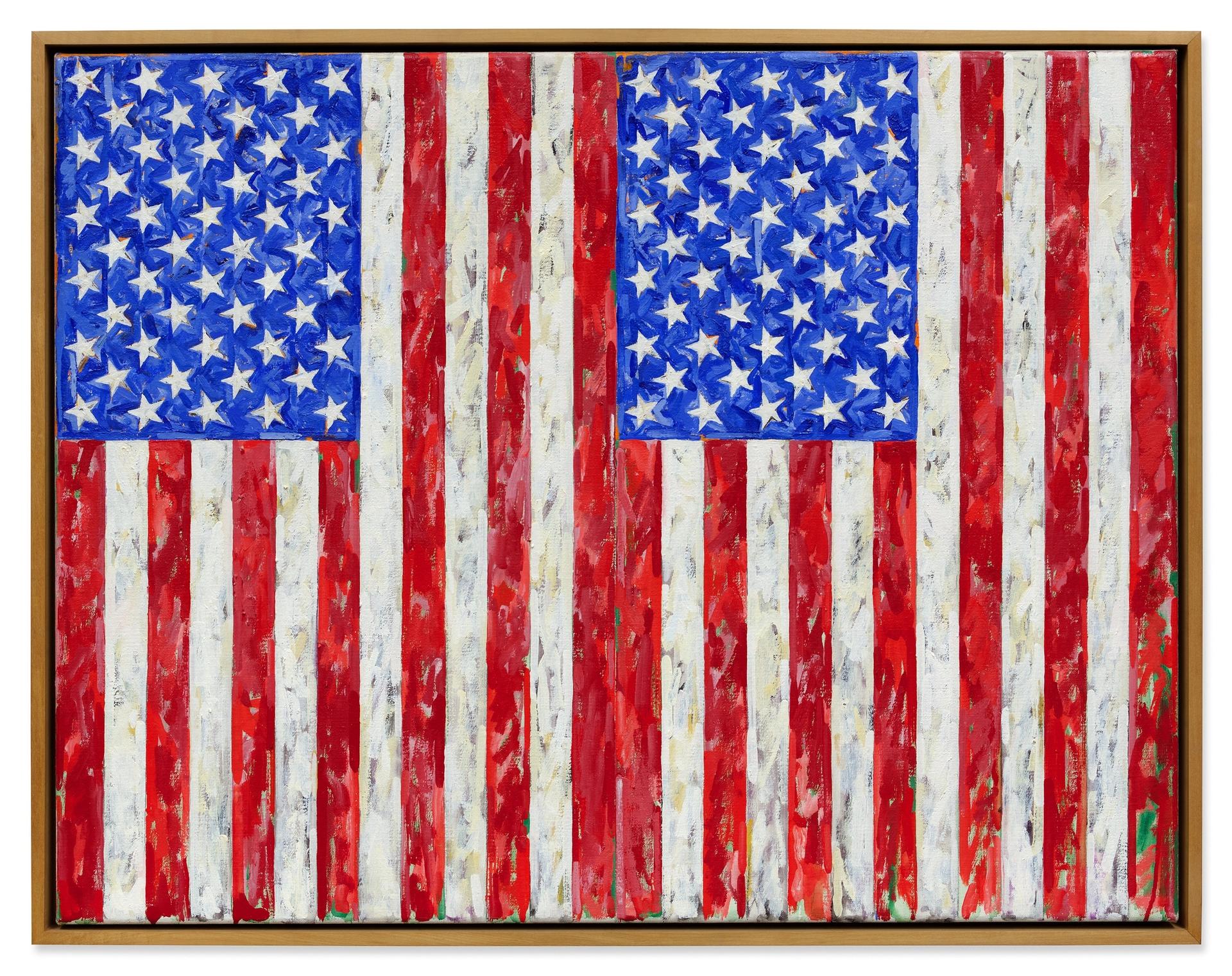

9 of the 31 heaps on provide discovered consumers at costs of $10m or extra. Three works, together with the Picasso, vaulted over the $30m threshold even with out the booster pack of the client’s premium. The gavel fell for the primary, Jasper Johns’s Flags (1986), at a within-estimate $37m ($41m with charges) after lower than two minutes of bidding; Ed Ruscha’s cheeky 1964 phrase portray, Securing the Final Letter (Boss), made $34m ($39.4m with charges), however hammered simply beneath its $35m low estimate.

Ed Ruscha’s Securing the Final Letter (Boss), 1964. Courtesy of Sotheby’s.

Sotheby’s assured a minimal value for all 31 objects within the public sale, that means it was positive to be a sold-out sale no matter bidding exercise. Much more noteworthy, 25 of the 31 heaps had been backed by third events by the point they crossed the block. The low estimates of these 25 works totalled $297.3m, or 86.3% by worth of the mixture pre-sale low estimate of $344.5m.

“Mainly, there was a lot in danger that they left no danger,” New York-based adviser Wendy Cromwell stated of the home’s assure technique after the sale’s conclusion.

The general outcomes had been definitely a triumph of expectation-setting. Two-thirds of the works on provide within the sale hammered inside their pre-sale estimate ranges. (The particular complete is both 20 or 21, relying on how one interprets the $121m Picasso’s relationship to its estimate “in extra of” $120m.)

This arguably constituted a shift from New York’s spring public sale cycle, after which there was chatter throughout the commerce that a few of the season’s disappointments had been a consequence of the three main public sale homes pushing estimates too far past natural demand in an effort to win over collectors. On this telling, overpromising to safe consignments too usually led to under-delivering when bidding started.

“We at all times attempt to set estimates neatly and strategically. It’s a balancing act between reflecting the market and reflecting the precedents, however oftentimes we’re going through objects so unimaginable that they don’t have a precedent,” says David Galperin, Sotheby’s head of latest artwork within the Americas. “So you employ a bit little bit of market intel but additionally a bit little bit of intestine in making your selections.”

Two of the unprecedented works Galperin referenced set new public sale data for the blue-chip artists behind them: $11.8m (with charges) for Mark Tansey’s Triumph Over Mastery II (1987), which hammered at $10m; and $18.7m (with charges) for Agnes Martin’s early grid portray Gray Stone II (1961), which hammered at $16m. Each works had been on the centre of bidding wars that lasted between 5 and ten minutes every.

However the lack of precedent generally labored towards the home, too.

Though the public sale certified as a “white glove” sale, with 100% of the heaps on provide discovering consumers, there have been at the least two cases the place Sotheby’s and the consignors agreed to promote at costs considerably under the degrees one would count on based mostly on the printed estimate ranges. (Reserve costs, the minimal quantities at which heaps are allowed to commerce, are usually identified solely by the events straight concerned within the offers.)

Mark Rothko’s untitled (1958).Courtesy of Sotheby’s.

Mark Rothko’s untitled 1958 color area portray from his Seagram mural collection—the primary canvas from this physique of labor ever to be supplied at public sale—modified palms at a hammer value of simply $19m ($22.2m with charges), lower than two-thirds the $30m low estimate. An early Robert Rauschenberg silkscreen portray, Sundog (1962), hammered at $4m ($4.9m with charges), half the low goal of $8m.

“It’s what I name an actual market,” says Galperin. “You noticed works tonight that soared well past estimates, and also you noticed a number of works tonight that offered under estimates. In any market pushed by actual collectors, there’s at all times a spread.”

Jasper Johns’s Flags (1986) Courtesy of Sotheby’s.

“Based mostly on this spherical of gross sales, estimates have been a superb barometer of the place works truly traded,” says Cromwell, suggesting that possibly the much-discussed market correction might already be serving to to rein in presale targets nearer to consumers’ true limits.

That stated, she and different market professionals agree that it’s nonetheless too quickly to say for sure. Extra knowledge will emerge within the coming days, beginning with Christie’s twentieth century night sale on Thursday (9 November); that public sale home’s sale of Twenty first-century artwork on Tuesday (7 November) produced decidedly blended outcomes.

“We really feel actually good about the place we’re [after making] $400m for 31 objects in a single night sale,” Galperin provides in regard to Sotheby’s place heading into its Fashionable, up to date and The Now night gross sales subsequent week. “However as we’ve seen over the previous a number of years, we’re coping with a really sensible and selective market.”