The United States Securities and Exchange Commission (SEC) is set to re-evaluate Grayscale’s request for a Bitcoin ETF, prompted by a recent directive from the U.S. Court of Appeals, signaling a potential shift in the SEC’s approach to cryptocurrency investments.

Trading volumes for Grayscale’s GBTC and ProShares’ BITO have experienced notable increases, piquing the interest of major corporations. The central question at hand is whether the SEC will grant exclusive approval to Grayscale, or if all applicants will receive simultaneous authorization.

Regarding the upcoming meeting, the SEC has arranged a confidential session, convening high-ranking officials, including Commissioners, legal experts, and recording secretaries. The agenda will cover crucial subjects like settlement claims, administrative proceedings, litigation resolutions, and matters related to examinations and enforcement procedures. This emphasizes the SEC’s dedication to conducting a thorough assessment of Grayscale’s ETF proposal.

This recent development stems from a substantial court order in late August, which endorsed the conversion of the Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF. The passing of the October 13 deadline has now established a clear timeline for the approval process of what could potentially be the inaugural U.S. Bitcoin ETF.

Various perspectives are being closely observed by market observers. Some anticipate the SEC may issue collective approvals for existing ETF applications. Grayscale’s application, supported by a favorable court order, stands out due to its timely submission and regulatory disposition. Mike Novogratz, CEO of Galaxy Digital, is optimistic and envisions that the Bitcoin ETF could secure SEC endorsement this year.

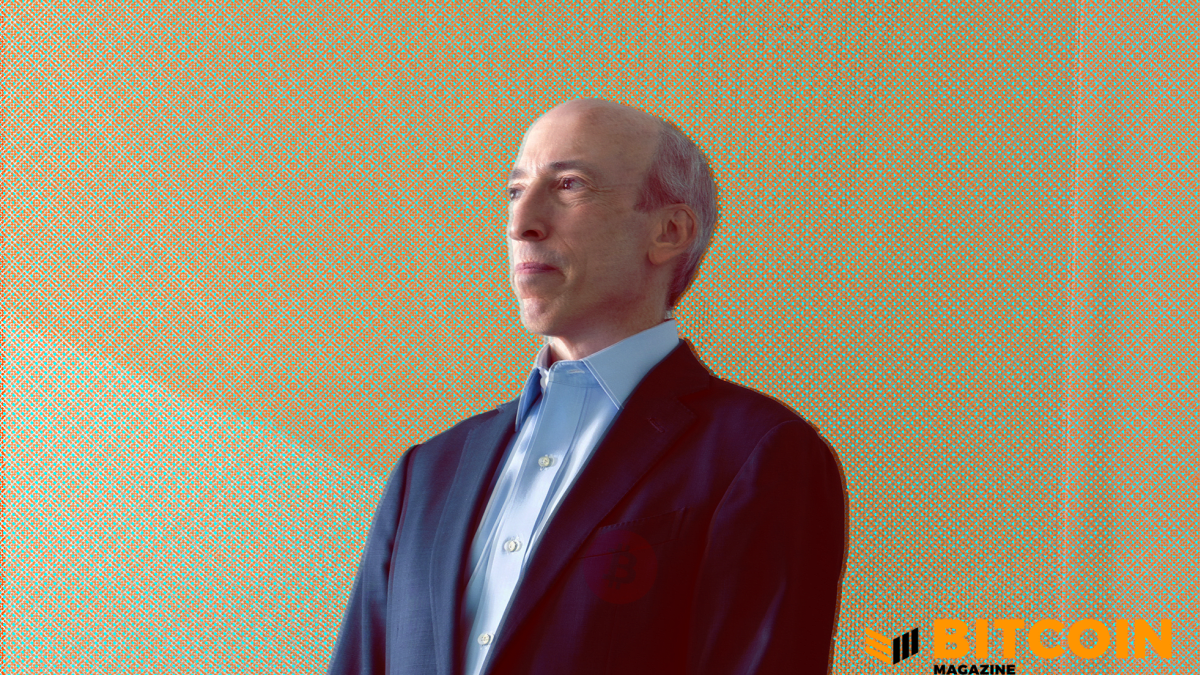

However, there are concerns voiced by figures like Dave Nadig, suggesting that SEC Chair Gary Gensler may unexpectedly reverse his position, an action characterized as a “Gensler semi-comedic rug-pull.” Bloomberg’s ETF analysts also view such a reversal as “remarkably capricious.”

![What is Bitcoin Dominance? A Complete Guide [2023]](https://bitpay.com/blog/content/images/2023/10/what-is-btc-dominance-bitpay.jpg)