In response to a current report from Web3 market technique consulting agency DeSpread report, the Korean crypto area can be populated by roughly 6 million traders, comprising greater than 10% of your complete inhabitants.

Centralized Exchanges (CEX) look like the selection for many of those lovers, in keeping with the report. This huge inflow of traders signifies a rising belief and curiosity in crypto, making South Korea a vital participant in world digital finance.

Dominance Of Korean Crypto-Centralized Exchanges

Towards the backdrop of a worldwide droop in crypto buying and selling volumes, Korean Centralized Exchanges (CEXs) inform a distinct story. 4 pivotal gamers, Upbit, Bithumb, Coinone, and Korbit, appear to be driving this momentum, collectively accounting for 10% of the worldwide buying and selling quantity.

This feat locations them forward of Coinbase, the second-largest trade globally, in buying and selling volumes. Upbit, specifically, leads the pack, registering a buying and selling quantity of $36 billion in February alone and securing 80% of the Korean market.

Following Upbit is Bithumb, capturing between 15% to twenty%, whereas Coinone and Korbit path with market shares of 3-5% and decrease than 1%, respectively.

A Dive Into Altcoin Preferences

Funding traits typically function a window into investor psychology. A more in-depth have a look at Korean CEXs reveals a particular penchant for altcoins. As disclosed within the report, the funding area within the South Korean market stands in sharp distinction to platforms like Coinbase, which institutional traders predominantly affect. The report famous:

Not like Upbit, the place particular person traders dominate, Coinbase’s buying and selling quantity is pushed by institutional traders.

Additional citing Coinbase’s Q2 shareholder letter, DeSpread famous:

Institutional traders account for roughly 85% of Coinbase’s whole buying and selling quantity. They have an inclination to pursue portfolio stability, which is why buying and selling in BTC and ETH, which boast the best market capitalization amongst cryptocurrencies, occupies a comparatively excessive proportion.

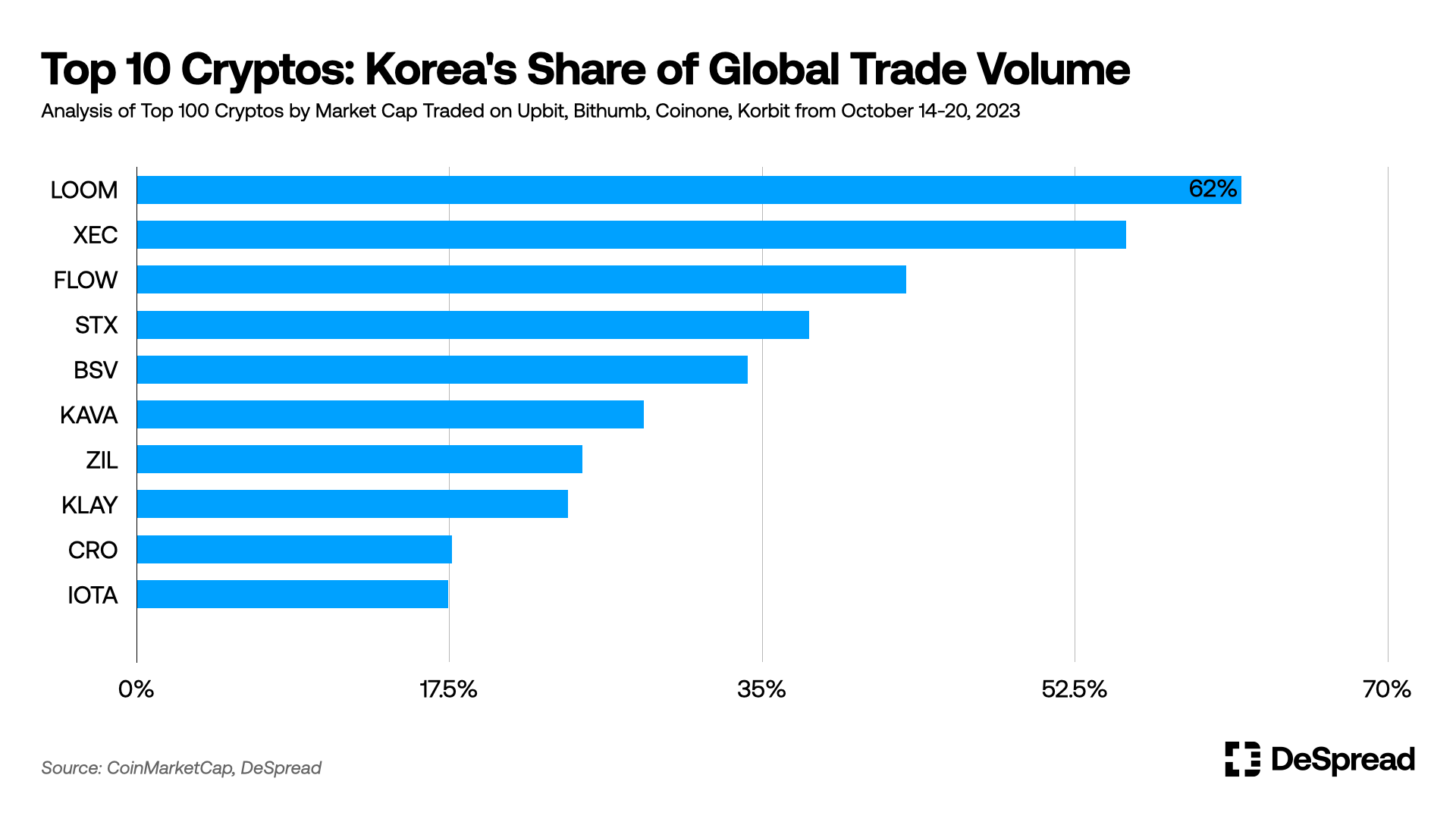

Information extracted from market experiences additional underlines this pattern, highlighting Loom Community ($LOOM) with a buying and selling dominance of 62%.

Following carefully are eCash ($XEC) at 55% and Movement ($FLOW) at 43%. Different notable mentions embody Stacks ($STX) and Bitcoin SV ($BSV), which additionally take pleasure in appreciable consideration with buying and selling ratios of 37% and 34%, respectively.

Notably, whereas Bitcoin is the highest crypto with the biggest market capitalization, it’s evident that the asset shouldn’t be fascinating to South Korean traders. Regardless, Bitcoin has continued to thrive, recording almost 20% prior to now week.

Nonetheless, Bitcoin has seen fairly a retracement from its earlier features that introduced the asset to commerce as excessive as $35,000. On the time of writing, Bitcoin trades for $35,027 with no important motion prior to now 24 hours.

Featured picture from Unsplash, Chart from TradingView